Predicted E&P spending increase in 2001 to exceed 30%

Although recent survey results indicate that planned capital spending for exploration and production in 2001 will increase by 20% over 2000 spending, Raymond James & Associates Inc. (RJA) predicts that actual spending will be closer to 30-35%.

A number of factors will contribute to this added increment, including:

- The industry's desire to use 2000 cash flows to explore a wealth of tabled projects.

- Continuing substantially higher energy prices to fund the E&P projects.

- Service-industry costs that are burgeoning due to full rig utilization and a shortage of service personnel.

Understated budgets

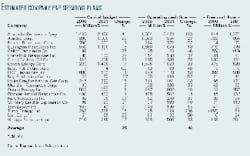

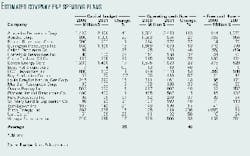

RJA derived the 20% estimate from data secured in a recently conducted survey of energy companies' proposed E&P spending (see table).

But the financial analyst said that the record prices for crude oil and natural gas in 2000 have resulted in larger-than-normal cash flows that should enable most of these companies to spend even more this year for E&P than their original "bullish" projections indicated.

RJA believes, for a couple of reasons, that most of the companies understated their estimates of actual 2001 E&P spending increases by as much as one third.

E&P companies are exercising caution regarding the sustainability of higher energy prices and the consequent continuing cash inflow. RJA, however, expects that higher commodity prices will generate a 40%-plus increase in 2001 E&P operating cash flow.

As the sustainability of the current pricing environment becomes more visible and allows more projects to clear the necessary hurdle rates of return, capital budgets will likely increase sharply during the year, just as they did from May to December of last year.

In addition, RJA says, companies will have to increase current budgets to accommodate service industry costs that are rising due to limited service company infrastructure. RJA expects that companies will also drill more wells in 2001 than they did last year, and the consequent higher service industry costs will cause E&P costs to "explode."

E&P caution

It is understandable that E&P companies are cautious, RJA says. Although, traditionally, they have tried to increase production volumes by spending to their level of earnings (and sometimes more), in the past 2 years, these companies have exercised more discipline. They are beginning to trade volume growth-at often-marginal returns-for a stronger concentration on project economics and internal rates of return.

"Depending on expectations for commodity prices, today's drilling portfolios are likely to be constrained by the number of projects that clear a given rate of return hurdle," RJA analysts said. Most E&P companies currently place that hurdle height at about $20/bbl for West Texas Intermediate crude oil and $3/MMbtu for Henry Hub natural gas.

If current prices remain viable, more E&P projects will clear that hurdle and result in increased capital spending.

In addition, if E&P companies are really shaping a 20% increase in costs, they could be severely underestimating actual costs in their 2001 budgets, RJA says, because of likely "explosively high drilling costs this year."

Service cost increases exceeding 20% would take up much of the planned spending increases, as the service industry is constrained by an almost 100% current rig utilization, thus skyrocketing costs in that budget column.The sharply increasing drilling costs, which could double before the end of 2001, will reduce the number of projects that can clear current hurdle rates for many E&P companies, RJA says.

Spending will also have to increase by more than 20% if operators increase the number of wells drilled this year. "The net result will likely be an increase in 2001 E&P capital spending of 30-35% over 2000 levels, which is well short of the expected 40%-plus increase in operating cash flow, RJA said.

Limited plowback

Although commodity prices and capital budgets plummeted in 1998-99, E&P companies continued to generate prospects, building up a rich inventory of quality projects.

The increase in cash flow during 2000 should have enabled a fast track for these drilling programs, but the inventory of drillable prospects likely will now exceed the industry's service capacity and E&P companies' ability to actually do the work.

Within the past 3 years, the industry has severely trimmed its workforce to more effectively survive the lean years. Consequently, this dearth in personnel to perform the work will also squeeze spending budgets. "The end result is a ceiling on capital spending that will likely fall well short of cash flow in 2001," said RJA.

"E&P plowback ratiosellipseare likely to fall from the 75%-plus range to the sub-40% range, if commodities maintain their current levels," RJA said. The infrastructure just is not in place to enable that higher amount of spending any time soon.

Therefore, capital budgets should fall well short of anticipated cash flow, allowing most E&P companies to "strengthen their balance sheets, buy back stock, and/or buy other companies."