Mexico's New Energy Era: Pemex development tracking fiscal, technological strategies

As presidential candidate, and president-elect, Vicente Fox emphasized the need for greater participation by private industry in the energy sector of Mexico.

Since assuming office on Dec. 1, the government has named executives from Dupont México, Turbinas Solar SA de CV (Solar Turbines Inc.'s Mexican unit), and the giant Mexican glassmaker Vitro SA de CV to key energy posts. Changes in energy policy are pending.

In November 1995, then-President Ernesto Zedillo gave a new policy orientation to govern the natural gas industry: private investment was to be encouraged in gas transportation, storage, and distribution.

However, 5 years later, that policy change has resulted only in investments in gas distribution. There have been no investments in gas pipeline infrastructure in markets where Petroleos Mexicanos (Pemex) operates and no investment-by Pemex or others-in gas storage.

As gas prices rose in second half 2000, Mexico's Energy Regulatory Commission (CRE), facing political pressure from industry groups, called for a public consultation on measures to increase the efficiency of the natural gas industry.

On Mar. 6, 2001, CRE published on its web site (www.cre.gob.mx) the executive summaries of 50 proposals received from trade associations, individual companies, and even academic centers and government agencies, including the Mexican Chemical Association (ANIQ), the Mexican state-owned national power utility (CFE), Sempra Energy, and the University of Houston's College of Business Administration Energy Center.

"The basic question facing the government is how to finance the energy sector in the next 20 years," observed Javier Estrada, a CRE commissioner.

"In the state-owned oil sector, the greatest challenge is transparency. How [can Mexico] attract private investment capital to an operating environment where business transparency has not always been the rule?"

CIPM proposal

There is some support from within Mexico's petroleum industry for a further opening of Mexico's petroleum sector to private investment, but even this support skirts the politically controversial notion of allowing private companies to participate in upstream activity.

The College of Mexican Petroleum Engineers (CIPM), is preparing its own proposals to the Fox government concerning hydrocarbon policy for the next 6 years. This initiative was unveiled at EXITEP 2001, the Pemex upstream technology conference held in Mexico City in early February this year.

"Mexico is a net importer of refined products, petrochemicals, and now, natural gas. Pemex faces demand forecasts for natural gas that far exceed current production," said Teódulo Gutiérrez Acosta, an officer of CIPM and a member of Pemex Exploration & Production's Technology Office, assessing current trends in the oil sector, both from the side of demand for petroleum products and from the side of probable financing.

"Pemex has initiated a special gas E&P program, but success is not guaranteed.

"Further, there is little likelihood that the government will be willing to provide the necessary budgetary support for the needed investments in refining, natural gas gathering and processing, or petrochemicals," he said.

"For this set of reasons," he concluded, "the CIPM will propose to the government that a further opening be authorized in the oil sector for private investment in gas, refining, and petrochemicals."

Gutiérrez Acosta added that the CIPM did not propose any opening of the upstream, "as we respect the constitution."

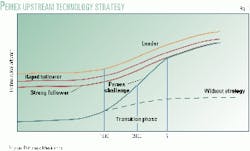

CIPM's recommendations excluded an upstream opening even though the logic of analysis clearly pointed in that direction. Nevertheless, the Fox government issued an official communique to CIPM that it would welcome CIPM advice and collaboration.Meanwhile, Pemex E&P's Guillermo Domínguez, in a paper presented at EXITEP 2001, described his department's efforts to articulate an upstream technology strategy in which Pemex would take the role of a "strong follower," one that was just a step or two behind the leading technology companies.

The strategy requires the coordination of complex elements, including technology transfer, professional training, and strategic relationships (Fig. 1).

Exploration prospects

Any investment, private or state, in Mexico's upstream certainly does not lack for opportunities.

According to Pemex E&P's planning manager, Horacio Guevara, the company has exploration propects ranging from the Colorado River Delta in Baja California to the "donut holes" in the Gulf of Mexico (Fig. 2).

"Pemex has enough known prospects to keep 30 companies busy for the next 5 years," commented one observer at the February conference.

Pedro Silva, director of Pemex's Strategic Gas Program (PEG), outlined an ambitious project being undertaken to discover and develop new dry gas fields onshore and light oil fields with a high gas-oil ratio offshore in the Southeast Zone as well as in other offshore, shallow-water locations.

At at a meeting of the American Chamber of Commerce of Mexico in Mexico City on Mar. 16, Pemex CEO Raúl Muñoz Leos was the keynote speaker. One of the points he emphasized was that Pemex would seek the collaboration of international companies in the exploration and development of dry gas fields.

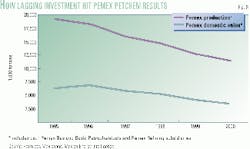

PEG has a 6-year budget of $5.6 billion to achieve an increase in gas production equivalent to 3 bcfd--a tall order for a company whose gas production figures have been declining slightly since 1999. At the end of 6 years, a supply deficit of 1.9 bcfd is forecast.

The Chicago-based Gas Technology Institute recently published an analysis (www.gri.org/baseline) that gave estimates of recoverable gas in the Burgos basin that ran substantially higher than those Pemex had reported (see related article, p. 70).

Raúl González, a former Pemex exploration manager in the Reynosa District responded to the report's findings: "It's faulty methodology to extrapolate from the Texas side of the basin," he said. "But if there is as much in Burgos as they say, we'd like to know where it is."

Upstream participation

Currently, there is no upstream regulatory authority in Mexico, but it is likely that such an authority will be created during the Fox administration's tenure. One approach under consideration is Norway's model, where private concession-holders operate simultaneously with the government's state oil company Statoil SA, whose CEO visited Pemex headquarters on Mar. 1. "The Norwegian model offers transparency," said CRE's Estrada.

If no operators are allowed yet, at least some foreign service companies have breached the wall erected to block participation in Mexico's upstream sector.

On Mar. 13, 2001, the results were made public of a public tender to drill and complete some 240 wells in the northeastern Burgos basin (OGJ Online, Mar. 13, 2001).

Winning the tender were Precision Drilling Corp., Calgary, and BJ Services Co., Houston.

More contracts of this sort may be expected during the coming years. "The contract will be for shallow wellsellipse[of] 1,500-2,000 m. Where Pemex would not have looked at such gas fields in the past, in today's gas market, Pemex needs to evaluate the potential of such production horizons," Pemex E&P Director José Antonio Ceballos said at a special briefing Mar. 17.

Meanwhile, Pemex's thinking is advancing about how to include additional services from upstream companies.

One idea is to ask exploration service companies to carry out prospect evaluation studies of given areas, with the requirement that full data interpretation be provided as part of the contract.

"Pemex geologists and engineers would, of course, verify these interpretations prior to any development effort," Ceballos noted.

When asked about Norway's interest in Mexico, given that Statoil's CEO and energy ministers had recently visited Mexico, Ceballos replied that Statoil had achieved outstanding field recovery levels-as much as 70%-and that Pemex was interested in achieving the same results.

"We are looking for innovative ways to motivate international companies to collaborate with Pemex in the upstream," he said.

At present, no one is discussing in public a change to Article 6 of the Petroleum Law of 1958, which forbids indexing payments to the results of an exploration and development project.

Some international observers wonder if the attempt to reinvent Pemex as "Pemex SA" [Pemex Inc.] might be a way to give Pemex the flexibility it needs to contract for services from international companies in a manner similar to they way it is carried out in Venezuela and other countries where upstream service contracts are the norm. (The range of upstream models in use in Latin America was discussed in a paper by energy lawyer Nicolás Borda, president of the Mexican Academy for Energy Law [AMDE] in a conference on energy policy held Oct. 12-13, 2000, at the Mexico City campus of the Mexico Technological Institute.)

Offshore nitrogen project

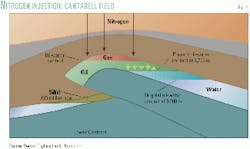

Pemex certainly turned to foreign private companies for assistance when it set in motion a megaproject to boost oil production in the Cantarell giant fields complex in the Bay of Campeche to 1.8 million b/d from 1.0 million b/d in 6 years.

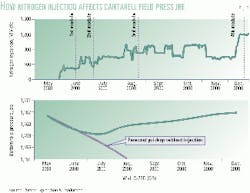

In November 1998, industry skepticism was directed at the feasibility of constructing a 1.2 bcfd nitrogen injection facility as a repressurization strategy for the Cantarell complex. One comment was that it might take several years for Pemex to know whether the strategy was working or not.

With the assistance of Bechtel Corp. acting as project manager, Pemex held a tender for the nitrogen injection project-including development of the world's largest nitrogen plant-which was won by an international consortium led by the BOC Gases unit of UK-based BOC Group.

Pemex commenced nitrogen injection May 19, 2000, with positive results only 6 months later that showed a reversal in the decline of wellhead pressure (Fig. 3).

At EXITEP 2001, Antonio Acuña, director of the multifaceted Cantarell project, reported that full nitrogen capacity was achieved on Dec. 11, 2000, with the nitrogen component reaching 18% of the total Cantarell project (OGJ, Mar. 12, 2001, p. 41). The goal of the project is to increase effective reserves by some 2.5 billion boe (Fig. 4).

The 2001 Offshore Technology Conference held in Houston last week invited Pemex speakers to give detailed presentations about the results of, and outlook for, the nitrogen project.

Hands-on views

Since assuming the presidency of Mexico, Fox has taken a hands-on stance with regard to the country's upstream oil and gas needs.

Fox and Energy Sec. Ernesto Martens attended Mexico's annual Petroleum Day Mar. 18 at the dock of a Pemex facility in Ciudad del Carmen in the state of Campeche and, afterwards, visited one of the offshore platforms in the Cantarell complex.

It was the first time a president of Mexico had visited the offshore facilities since 1988, when former President Miguel de la Madrid had done so.

Ceballos informed President Fox that Sihil field, located in Cretaceous and Jurassic horizons below the supergiant Akal field, contains some 1.14 billion boe of recoverable hydrocarbons.

Both Pemex CEO Muñoz and President Fox emphasized the twin needs for a better fiscal treatment of Pemex-one that allows it to finance its own development-and for an entrepreneurial vision and management philosophy for the company.

The comments about the need for a business-oriented approach to Pemex management were made in the context of a controversy surrounding the naming on Feb. 13 of four prominent businessmen to Pemex's board of directors.

In an address at the same ceremony, Mexican Oil Union chief Carlos Romero Deschamps, who is also a federal deputy in the Lower House of Congress, sharply questioned the use of foreign contractors in Mexico's oil sector.

"They bring their own people, equipment, and supplies, taking jobs away from Pemex personnel as well as from Mexican contractors," he said.

LNG, LPG

Other areas where investment and marketing opportunities may develop during the Fox administration are in the LNG and LPG businesses.

Since the beginning of this year, officials from the Energy Ministry and Pemex Gas have expressed an interest in sourcing new supplies of natural gas via LNG terminals on the Gulf of Mexico and Pacific Ocean coasts. Sites most frequently mentioned are Altamira and Coatzacoalcos on the gulf and Rosarita, Mazatlán, and Lázaro Cárdenas on the Pacific.

Manuel Betancourt, of the Energy Ministry, said that Pemex is interested in being a partner in one or more LNG terminals. He mentioned both Altamira and Rosarita in Baja California as probable sites for such terminals.

Martens also stressed the potential contribution of LNG to Mexico's energy scene at a recent energy conference in Monterrey.

On Feb. 28, the Energy Studies Program at Monterrey Tech (ITESM, Monterrey Campus), led by Armando Llamas of the electrical engineering department, made its debut as a sponsor on an industry conference on energy policy, markets, and technology. The conference, attended by some 200 industry representatives, was opened by Martens, who, during EXITEP, had been in Norway in meetings with his counterparts.

Martens's mention of LNG was echoed in the paper presented by Pemex Gas Planning Manager Roberto Ramírez Soberón: "In view of what has happened recently in California, with the curtailment of supply, we can no longer rely exclusively on Texas for gas imports."

Meanwhile, Mexico ranks third worldwide in LPG consumption, with more than 80% of homes relying on LPG as the primary fuel for cooking and heating.

Whereas the Zedillo administration accomplished the deregulation of LPG transportation and storage, it stopped short of changing regulations to allow international companies the opportunity to invest in LPG distribution.

In February 2001, a controversy broke out in Mexico over alleged oligopolistic practices of Mexican LPG distributors; According to the press, only five families control 70% of LPG distribution. As a result, prices have increased 400% in 3 years.

A dogfight resulted, with the government ordering a 7% price reduction. There is increasing pressure to deregulate LPG distribution entirely. Given the history of natural gas deregulation, however, the extent to which large-volume customers could be enlisted remains to be seen.

Gas sales, transportation

The prospects for further natural gas deregulation may have dimmed a bit as a result of a recent backlash against spiking gas prices in Mexico.

Pemex Gas received a setback to its revenue projections in January when government authorities intervened in a controversy with Mexican industry over the price of natural gas (OGJ, Jan. 22, 2001, p. 18).

The government ordered Pemex to offer a "Mexico price" of $4.00/MMbtu for 3 years to qualified customers. Some Mexican gas customers-those in Mexicali and Piedras Negras-were excluded from the offered discounted price, as they were not Pemex customers.

The deal was offered to Pemex customers who import their gas, such as the local distribution companies of Luis Vázquez in Cananea, Sonora; KinderMorgan Energy Partners LP in Hermosillo, Sonora; and Angélica Fuentes in Cuidad Juárez. Subsequently, however, the Sonora contracts were questioned by the Finance Ministry under Francisco Gil Díz.

The ministry argues that because Pemex customers who import gas are not covered by rules governing first-hand sales-the marketing of gas produced from Pemex basins-they are not entitled to the $4 Mexico price and that Pemex should revoke the contracts.

The offer of the $4 gas price effectively suspended CRE's methodology for a Houston netback price for natural gas in Mexico.

The upside of this decision is that Pemex customers are basically locked into a contract with Pemex for the next 3 years and are keenly motivated to accept the new general terms and conditions on Pemex's pipeline system.

For third-party gas marketers such as Enron Corp., which has an office in Monterrey, the fixed-price mechanism basically removes Mexico from the North American gas market. "Selling gas to Pemex and to no one else in Mexico is not exactly what we expected to be the outcome of Zedillo market liberalization of 1995," commented a frustrated US gas marketer based in Houston.

Pemex Gas intends to build some 800 km of pipelines in the coming years. Some international observers believe that Pemex Gas needs to make an existential decision as to whether its future is going to be as a pipeline company or as a gas marketing company.

"As things stand," observed one pipeline company executive, "Pemex Gas is operating in a pre-[US Federal Energy Regulatory Commission Order]636 environment. Whereas most gas markets are moving toward the 'separation of church and state'--transportation and marketing--Pemex Gas continues to operate a theocratic state where the two functions are run from the same company."

By this reasoning, Pemex should either spin off its entire pipeline system to private operators or sell gas only at the plant or at the wellhead.

Refining

On the downstream side of Mexico's petroleum industry, Pemex faces some major refining investments and the possibility of retail competition.

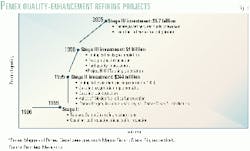

Pemex Refining's current investment plans were outlined in a presentation Feb. 17 to the Energy Section meeting of the Mexican Chamber of the Construction Industry (www.cmic.org). The overall investment requirements for 2001-10 come to some $18 billion (Fig. 5).

One important strategy is to improve product and environmental quality (Fig. 6). Pemex Refining currently is in the process of upgrading its refineries. The project with the biggest potential impact in the Northeast is the Cadereyta project, the center of which is a coking unit that would make it possible to produce some 50,000 b/d of light products in lieu of similar volumes of high-sulfur fuel oil.

The project has been delayed for 4 years, but completion is expected soon. "In this last phase, we have faced difficult negotiations with property owners and municipalities over rights-of-way for our new oil and product pipelines," observed Pemex Refining chief Jaime Mario Willars.

The delay has had an impact on Cemex, the giant cement company, which has a 20-year contract for the coke production from the Cadereyta refinery near Monterrey.

Cemex has built a petroleum coke-fired, circulating fluidized bed-technology, electric power plant some 300 km to the south in the state of San Luis Potosí. The plant awaits its first shipment of coke.

Beyond the refinery gate lies the prospect of legal challenges to Pemex's monopoly over retail refined products sales.

In coming years, motor oil blenders and marketers may have access to Pemex's service station chain, depending on the outcome of an investigation being carried out by the Federal Competition Commission (CFC).

CFC, acting on a complaint by a lube blender, is investigating whether Pemex's 20-year exclusive contract with Mexicana de Lubricantes SA de CV and its parent company--in which Pemex itself holds a 49% interest--violates federal norms that require competition in nonregulated markets.

The position of Mexlub and Pemex Refining is that, at the time the contract was signed, the CFC rules did not exist, so the contract's terms are grandfathered. The matter is now in federal court, which will decided if CFC correctly followed procedure in determining that the contract that excludes motor oil manufactured by third parties constitutes an illegal monopolistic practice.

"The court will decide on procedure, but not on the substance of the complaint," said CFC Pres. Fernando Sánchez Ugarte.

Chemicals

President Fox has again repeated the call for private investment in basic petrochemicals, but determining the right approach still escapes a definite conclusion.

Efforts to sell minority interests in some of Pemex's key basic petrochemicals facilities were launched during the Zedillo administration but faltered because private investors were put off by provisions that required Pemex to maintain a controlling interest in the facilities.

The Oil Union, meanwhile, on Mar. 18 spoke of an "alliance" between Pemex and the union, suggesting to some observers that the government would not try again to issue international tenders for the sale of Pemex chemical units but would limit itself to promoting grassroots projects. One such project is under analysis by the Mexican conglomerate Grupo Serbo.

Motivation for grassroots investments could come from the discounted price of natural gas in Mexico and, possibly, for discounts on other feedstocks.

Meanwhile, Pemex's Gas and Basic Petrochemicals unit, led by Pemex veteran Armando Leal, despite setbacks, is forging ahead with its own investment program (Fig. 7). An impressive synergy of plants owned by Pemex and private industry is concentrated in Coatzacoalcos (see map).

Mexican chemical imports rose sharply in 2000, while, for many products, production and sales fell owing to constraints in capital investments (Fig. 8).

Outlook for Pemex under Fox

Corporate modifications are the first and most visible change to impact Pemex so far.

Feb. 13, 2001, was expected to have been the day when a new plan would be announced for the restructuring of Pemex at the corporate level. The idea would be to recentralize a number of key management functions such as procurement, project engineering, and finance.

Such a change would represent a return, in some measure, to the management model prior to 1992, when Pemex was divided into four operating units, upon the advice of McKinsey & Co.

McKinsey had actually introduced two ideas, the other being that arms-length transactions could be emulated by a system of transfer-cost accounting. Then, with reliable data, Pemex would be able to benchmark its performance against international standards.

This general approach is being continued under Pemex's new CEO Raúl Muñoz Leos, who hopes to be able to expand the metrics of virtual benchmarking.

What actually happened on Feb. 13, however, was not the Pemex restructuring plan but the announcement that the government had named four private-sector business leaders to the Pemex board of directors, an unprecedented innovation that immediately provoked controversy.

Pemex careerists, meanwhile, are waiting with some trepidation for the other shoe to fall when the restructuring plan is finally announced.

Overall, the expectation is that the pro-business philosophy of the Fox government eventually will make its way down the corridors of the state-owned oil and power companies.

What's next?

A handful of broad conclusions are possible about the oil sector from the vantage point of the 6-month-old Fox presidency.

The Fox administration is still getting its sea legs in energy policy. The item of highest priority is fiscal reform. In line after that is reform of the electric power sector, not scheduled for discussion by the Congress until September 2001.

"Only after that will the Fox people start to articulate their oil policy," observed Borda of the AMDE

Already the Fox government has had setbacks in energy policy, as in the pricing of natural gas for industrial and vehicular users and LPG.

On the other hand, the team in Pemex headed by Muñoz is driven by entrepreneurial standards and goals of excellence. It is expected that the new Pemex board of directors and Muñoz's planned restructuring of Pemex will together provide a framework in which greater private industry participation is possible than was during the Zedillo administration.

In the upstream sector, on the oil side, Pemex E&P is confident that the Cantarell project, especially its nitrogen project, will be an engineering and financial success on a world scale.

On the gas supply side, however, some analysts are less confident. PEG may, or may not, deliver new dry gas volumes as promised. If it does not, the Fox administration may come to have a different view of the role of international oil and gas production companies in Mexico.

Mexico in the coming years will be a growing market for exports of petroleum products, including motor oil, chemicals, and natural gas.

Unless the Fox government or the CFC orders a breakup of Pemex Gas into separate pipeline and gas marketing companies, the status quo is likely to continue, with the Mexican gas market effectively closed to US or Canadian marketers.

The exception might be in relation to investments in LNG terminals; but, even in this area and in the area of natural gas storage, Pemex Gas has voiced an interest in being an equity participant in such a project.

As El Paso Energy Corp. well knows in the case of its Samalayuca pipeline, having Pemex Gas as a partner does not mean having gas customers in Mexico.

Pemex senior E&P management, in its recent thinking about how to involve the participation of international companies in the exploration and development of natural gas fields in Mexico, is giving a good-faith effort to be in a dialog with US President George W. Bush in relation to his stated interest in creating a regional market for gas.

What is still uncertain is whether or not, in 2004, Mexico will be a net exporter or importer of natural gas. With LNG terminals in place, Mexico could easily be a net exporter of gas or its btu-equivalent in electric power.

Absent LNG projects and absent a strong showing of new gas from PEG-at least as much as 1 bcfd-the country will need substantial gas supplies from the US and Canada-as much as 1.9 bcfd, according to Energy Ministry forecasts.

The unanswered question generated by this scenario is "Will Pemex Gas be permitted to maintain what former CRE Pres. Héctor Olea called its 'de facto monopoly' on natural gas transportation?"

The appropriate posture of Mexican and international companies, in relation to the oil policy of the Fox government and the philosophy of corporate governance of Pemex CEO Raúl Muñoz Leos, should be one of due diligence.

The author

George Baker is a petroleum analyst and director of Mexico Energy Intelligence, an industry newsletter service. He is the author of Mexico's Petroleum Sector (PennWell, 1984) articles listed at www.energia.com, and numerous articles for OGJ and its affiliate Spanish-language bimonthly magazine, Oil & Gas Journal Latinoamerica, since 1981.