OGJ Newsletter

Market Movement

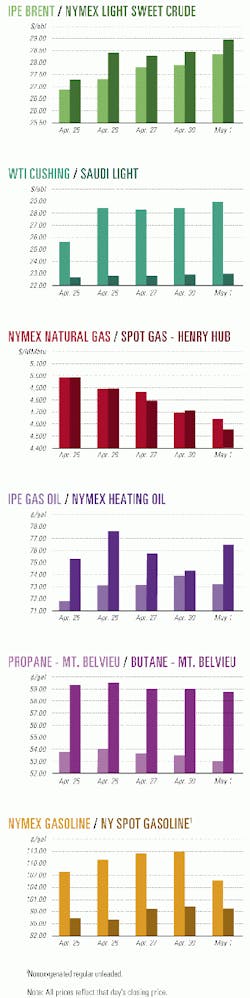

Oil prices on the upswing

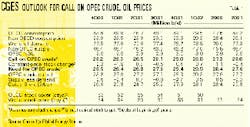

Oil prices are surging again, so the market focus again has fallen on how well OPEC will micromanage oil supply to sustain its unofficial $25/bbl target price.

That was brought to light with oil prices rising by more than $1.50 shortly after a comment late last month by Saudi oil minister Ali al-Naimi that OPEC is unlikely to increase production at the group's ministerial meeting in June.

As UBS Warburg put it, "The surprise, perhaps, is that such a comment would surprise the market.

"The stock overhang already in place and likely to exist by early June makes it unlikely that there will be a strong enough price signal for OPEC to raise quotas. And without such a signal, don't expect higher quotas."

In fact, Merrill Lynch contends that, if OPEC hopes to sustain its official price band target of $22-28/bbl (which equates to $25-31/bbl for WTI), the group needs to tighten the screws on quota-busting (see table).

Meantime, IEA projected global oil demand this year would rise by only 1.8%, or 1.3 million b/d, and non-OPEC supply would increase by 1.4%, or 620,000 b/d. Merrill Lynch's own forecasts are more conservative, at 1.2 million b/d and 500,000 b/d, respectively.

Crude, gasoline stock data

Crude, gasoline stock data The newest data from the US EIA show that US gasoline stocks in mid-April were 6% below the same level a year ago, which the London-based Centre for Global Energy Studies suggests sets the stage for a possible repeat of the $35/bbl [dated Brent] oil price spike seen last fall. As CGES notes: "Certainly, if we were to transpose this year's gasoline stock position into last year's market, we would be justified in expecting a price explosion [and $35/bbl might even seem a modest price].

"However, the crude oil price spike in third quarter 2000 was the result of intense competition for oil between refiners in Asia and those in the Atlantic [Basin]-this may not be such a problem this year."

The London think tank blames "excessive" oil buying in fall 2000 for last fall's spike in oil prices and contends that Asian buying will again increase over the next few months, once stocks have been drawn down enough to reduce the current stock overhang. This, in turn, will support oil prices.

AAA seeks to avert US Gasoline shortages

American Automobile Association says the US government should take immediate action to avert the "the most potentially serious threat to adequate gasoline supplies since the early 1980s."

It also said the US should move to a single national gasoline, rather than separate fuels for different areas.

AAA said that, for a second consecutive year, some areas of the US are already paying record-high gasoline prices and are bracing for prices in excess of $2/gal.

To help deal with record gasoline prices, AAA said Congress immediately should consider the Bush administration's energy policy proposals this month.

AAA said, "To be successful, the strategy must include access to adequate supplies of domestic and foreign-produced crude oil, increased capacity in the nation's gasoline refining and distribution infrastructure, the maintenance of gasoline inventories sufficient to meet the needs of motorists during a national emergency, increased use of alternative energy sources, and vigorous government oversight of the energy industry's production and pricing practices."

AAA also urged the immediate adoption of reasonable gasoline conservation measures to ease the strain on low stocks, especially in areas required to use reformulated gasoline.

It said the White House should seek suspension of restrictive local gasoline rules, if there is a likelihood of fuel shortages in any area. AAA also called for a presidential commission to study the feasibility of devising a single, cleaner-burning fuel standard.

null

null

null

Industry Trends

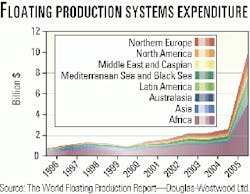

THE FLOATER MARKET WILL GROW TO $42.5 BILLION BY 2005, SAYS A TOP OFFSHORE ANALYST.

Demand for floating production, storage, and offloading vessels off Africa could drive a newbuild floater market forecast to grow to more than $42.5 billion in all for the next 5 years, according to a report from UK-based analysts Douglas-Westwood Ltd. and data specialists Infield Systems UK (see chart).

A total 123 newbuild floating production systems of various types could be brought on stream between now and 2005 as the market for floaters rises from an estimated $5.9 billion this year to $10.9 billion in 2005.

FPSOs are foreseen to account for 80% of future spending in the floater market, with demand off Africa growing to a total value of $11.6 billion over the next 5 years, followed by Brazil, where the market should grow to $7.9 billion.

Infield Systems said, "Over [the next 5 years,] a total of 153 field prospects are under consideration for development using an FPS by 48 oil and gas companies. Just five companies total...52% of the prospects."

THE INTERNATIONAL MARITIME ORGANIZATION HAS ENDORSEDD A TOTAL PHASE OUT OF SINGLE HULLED TANKERS BY 2015.

IMO said it has approved a global timetable that would phase out all single-hull crude tankers within 15 years starting from September 2002 (OGJ, Apr. 30, 2001, Newsletter, p. 7).

Following a week-long meeting of the IMO's Environment Protection Committee last month, delegates from the organization's 158 member states agreed to the fast-track program, which will be included in a revised chapter in the MARPOL convention on the prevention of marine pollution.

The timetable, which the IMO called a "landmark for the cause of safer shipping and cleaner oceans," was one of a package of measures put forth by the organization after the Erika tanker sank off France in December 1999.

The current MARPOL regulation, adopted in 1992, had legislated for the phasing-out of single-hull tankers but over a "more protracted period."

The IMO noted that although the new phaseout timetable sets 2015 as the cut-off date for single-hull tankers, a nation "could allow some newer single-hull ships registered in its country that conform to certain technical specifications to continue trading until the 25th anniversary of their delivery."

Government Developments

FRANCE'S GOVERNMENT OPTED TO DELAY DEREGULATION OF THE COUNTRY'S GAS MARKET.

Due to internal politics, the French government has decided that it's not an appropriate time to change the EU directive on deregulating the gas market.

The delay coincides with recent regional election polls that show the left wing parties in power losing ground within the electorate-1 year before the presidential elections. Prime Minister Lionel Jospin said it's better to avoid such controversy at this time and that nothing will probably happen before yearend 2002.

The change in Gaz de France's status was to take place in June, when parliament was scheduled to transcribe into French law the EU gas deregulation directive. No such debate is currently scheduled.

Loyola de Palacio, European Commission vice-president of energy and transport, described France as "the most backward" in this area. Through the updated directive- called Gas Directive II-de Palacio wants to accelerate the "full opening" of the gas and electricity markets within 4 years.

CHINA PLANS TO BUILD EMERGENCY OIL STOCKS OVER 5 YEARS.

IEA has applauded a Beijing decision last month to build emergency oil stocks over 5 years, saying it would help strengthen global energy supply security.

China's declaration was at a joint IEA-China workshop in Paris on emergency stock issues. Other subjects discussed at the workshop included the experience of IEA members with the building, maintenance, and use of strategic oil stocks. They also discussed legislation, financing, and procedures for international cooperation in an oil emergency.

The country's ambassador to France, Wu Jianmin, said China's new 5-year development plan should consider the "experiences of other countries on this subject" and build strategic oil stocks.

THE TEXAS NATURAL RESOURCE CONSERVATION COMMISSION CONTINUES TO COME UNDER FIRE BY ACTIVISTS WHO CLAIM INADEQUATE ENVIRONMENTAL POLICING OF OIL COMPANIES IN THE STATE.

Activist groups last week alleged ExxonMobil's 508,000 b/d Baytown, Tex., refinery-the largest in the US-has a history of persistent pollution problems, including repeated violations of state and federal law.

ExxonMobil disputed those claims. It said, "Our environmental record is a good one, and we continue to make improvements." It added that the report appeared to contain a number of misrepresentations about how the plant operates and its history.

The study, commissioned by the Sustainable Energy & Economic Development (SEED) coalition and released by the Lone Star Chapter of the Sierra Club and Public Citizen's Texas office, also claimed the TNRCC had failed to address the alleged problems.

"This is bad news for Texans who want clean air," said Peter Altman, SEED executive director. "What this report makes clear is that major polluters can repeatedly violate our clean air laws, neglect to fix persistent problems, under-report or fail to report vital information-and the TNRCC will sit back and let them do it."

ExxonMobil said at their request, it allowed SEED members to tour the refinery and review its operations in February. It said SEED did not allow it to comment on the allegations before the report was released.

Quick Takes

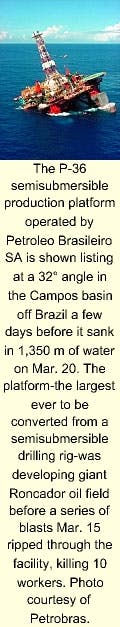

THE AFTERMATH OF PETROBRAS's P-36 PLATFORM DISASTER CONTINUES TO UNFOLD.

Ibama, Brazil's federal environmental agency, fined Petrobras $10 million for oil spills from two platforms in the Campos basin.

The P-36 sank Mar. 20 as a result of damage sustained in explosions and a fire on Mar. 15. In a separate incident, oil spilled from the P-7 platform Apr. 13.

The P-36, the world's largest semisubmersible platform, spilled 1.2 million l. of diesel and 300,000 l. of crude after it sank.

The P-7 spilled 26,000 l. of crude, and the spill was blamed on defective valves.

A Petrobras inquiry commission Apr. 23 said a gas accumulation might have helped trigger explosions that damaged the P-36 platform. Carlos Heleno Neto Barbosa, the commission's coordinator, said misalignment of venting ducts might have contributed to the blasts, and that the flooding of the platform was caused by the rupture of ducts in the interior of the column.

The commission will release a final report June 15 (see related story, p. 22). Due to the loss of the platform, Petrobras said its crude production would average 1.39 million b/d this year instead of the 1.42 million projected earlier.

In other production news, Southern Pacific Petroleum and Central Pacific Minerals said they plan to produce 200,000 b/d of shale oil products from their Queensland deposits by 2012. That would include 85,000 b/d of production from the fully developed Stuart Project Stage 3 by 2009 and the expectation of production from either the Condor or Rundle deposits by the end of the decade. Managing Director Jim McFarland told the companies' annual meeting in Brisbane that the prediction was predicated on continuing progress with the Stuart Stage 1 project, including reaching a break-even point of 1,600 b/d during the fourth quarter. He said the companies would decide whether to proceed to Stage 2 by the end of 2001. Goal is to begin Stage 2 construction in 2003 and start production late in 2005.

Shell E&P said the Brutus TLP cost 17% less than the Mars TLP and will take a shorter time to complete. The structure, being assembled at Gulf Marine Fabricators' yard in Ingleside, Tex., will have taken 3.25 months to complete from the arrival of the 13,500-ton hull from South Korea in late January. The production platform should be complete May 10 and be towed out to position-on Green Canyon Block 158 in 2,985 ft of water in the Gulf of Mexico-May 20. Installation should be complete this summer, with production start-up anticipated in the third quarter (OGJ Online, Jan. 29, 2001). Exact figures for the TLPs were not disclosed, but the entire Brutus project will cost less than $760 million, including pipelines but excluding lease costs.

Triton Energy reported that it is negotiating to replace the floating, production, storage, and offloading vessel producing La Ceiba field off Equatorial Guinea with a similar sister ship with expanded processing facilities. Triton was finalizing arrangements to replace the Sendje Berge FPSO with a vessel that could meet its previously announced aim of vastly expanding Block G production by early next year. The upgraded vessel would have an onboard liquids-processing capacity of 160,000 b/d rather the current 60,000 b/d, as well as water-injection facilities designed to inject up to 135,000 b/d to maintain field pressure and optimize oil recovery at the field. Second-phase La Ceiba development plans also call for 14 wells to be drilled and completed at the field-10 producers and 4 water injectors by early 2002. Current production via five wells at La Ceiba is 50,000 b/d.

TOPPING DEVELOPMENT NEWS THIS WEEK, the Bongkot consortium plans to start the next development stage of Thailand's largest natural gas field by midyear.

Initially estimated to cost $40-50 million, Phase 3C will help the Thai-European development group sustain gas and condensate output at 635 MMcfd and 15,000-16,000 b/d from Bongkot, about 600 km south of Bangkok in the Gulf of Thailand.

With more than 30% of total reserves estimated at 3.7 tcf already produced and about 10% of remaining reserves being depleted each year, the field's gas production potential is falling by 1 MMcfd/year, said PTT E&P, the field operator.

The development phase calls for installation of an additional wellhead platform and a new gas processing platform to treat sour gas. Phase 3B development, involving drilling 47 wells and installing two additional wellhead platforms, is scheduled for completion in August 2002.

In other development action, PetroChina has started to develop an oil field in the Junggar basin of northwestern China's Xinjiang province. The company plans to drill 261 wells at Luliang field this year to establish a production capacity of 10,800 b/d by Dec. 31, expandable in 3 years to 20,000 b/d. Discovered last year, the field has estimated original oil in place of 847 million bbl, of which 58% is recoverable.

ATLANTIC LNG HAS AWARDED A DESIGN CONTRACT OF A FOURTH PORCESS TRAIN AT ITS TRINIDAD AND TOBAGO PLANT.

Equity holders of Atlantic LNG have awarded a contract to Bechtel Overseas to perform front-end engineering and design work for a proposed fourth process train at its LNG plant in Point Fortin, Trinidad and Tobago.

The proposed train would have nominal design production capacity of 4.8 million tonnes/year.

Atlantic LNG said the study would incorporate the latest design from Bechtel-Phillips, yielding 50% greater capacity and increased efficiencies over the other Atlantic LNG trains. The study should be complete in 8 months.

Atlantic LNG's first liquefaction train came on stream in 1999, and it is building a two-train expansion that will triple LNG export capacity to 9.6 million tonnes/year when the trains come on stream in 2002 and 2003, respectively (OGJ Online, Feb. 14, 2001).

Rounding out gas processing news, Shell Gas, involved in negotiations to sell its seven LPG facilities in China, expects to divest the last one by June 30. The final deal involves an LPG terminal and storage tanks in southern China's Shenzhen. Shell Gas said its seven China LPG facilities were built during 1987-97 at a cost of $70 million. The assets, built as JV with Chinese entities, included LPG terminals, storage facilities, and bottling plants. They were in the cities of Shenzhen, Shunde, Shantou, Suzhou, Hainan, Qingdao, and Zhangjiagang.

ENERGY COMPANIES CONTINUE TO KEEP PACE WITH RISING NARUTAL GAS DEMAND THOUGH PIPELINE EXPANSIONS.

Southern Natural Gas has entered into long-term firm transportation agreements with various shippers for 267 MMcfd.

It said substantially all of that gas would be used to supply new power generation plants in the southeastern US.

SNG is preparing to apply to FERC for an expansion of its mainline, which will include the construction of both pipeline looping and compression to support the added demand in Alabama, Georgia, and South Carolina. The expected in-service date for the expansion is June 2003.

Earlier, SNG announced two other mainline expansions. The three projects would increase SNG's capacity by 635 MMcfd during 2002-03 at an estimated capital cost of $350 million.

The company also recently announced the Cypress Pipeline project, scheduled to transport gas in southeastern Georgia and in Florida with a capacity of 310 MMcfd (OGJ Online, Apr. 26, 2001).

Meanwhile, ANR Pipeline said it is holding a nonbinding open season in May to determine customer interest in contracting for incremental transportation capacity along ANR's gas pipeline system in south-central Wisconsin. The WestLeg expansion project would provide additional transportation capacity by November 2003 at a level determined by market interest. The proposed expansion is intended primarily to serve incremental growth markets represented by customers including local utilities, electric power developers, and marketers. Proposed facility additions may include the looping of ANR's existing Janesville and Beloit laterals, as well as adding compression at the company's Janesville, Wis., compressor station.

In other pipeline happenings, Georgia Strait Crossing Pipeline (GSCP), a limited partnership formed by Williams of Tulsa applied with FERC to build a natural gas pipeline from Sumas, Wash., to Vancouver Island. The $159 million Georgia Strait Crossing (GSX) project is a joint proposal by BC Hydro and Williams to provide gas transportation from the market hub near Sumas on the US-Canada border to Vancouver, BC. The Williams application focuses on the US mainland and marine segments of the proposed international project. A similar application, focusing on the Canadian portion of the project, was filed with the National Energy Board Apr. 24 by GSCP. The US mainland portion of the GSX pipeline includes 32 miles of 20-in. pipe from Sumas to compression facilities located at Cherry Point, Wash., and 1 mile of 16-in. pipe from Cherry Point to the strait. From the US shore, a 16-in. line will extend 41 miles in waters as deep as 1,050 ft to a landfall near Hatch Point on Vancouver Island. Subject to regulatory approval, the construction is due to begin in late 2002 and be completed in late 2003.

Nigeria aims to revive a long-dormant project to build a natural gas trunkline linking the West African state to Algeria as part of plans to capitalize on gas reserves estimated to be as high as 200 tcf, according to Rilwanu Lukman, the country's presidential advisor on petroleum and energy. Lukman, who recently returned from project meetings in Algeria, said implementation of the pipeline scheme was now at an "advanced stage with plans under way to ensure the expansion and full integration of the project with other countries in the region."

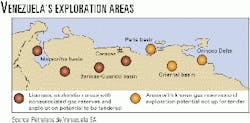

VENEZUELA HAS BEGUN THE TENDER PROCESS FOR 11 GAS-PRONE BLOCKS.

Venezuela's Energy and Mines Ministry on Apr. 23 began a public tender process to grant licenses to private national and foreign companies for the development of 11 areas rich in nonassociated gas reserves.

Investors qualifying for the tender may submit their offers through mid-May. The opening of the bids and announcement of winning companies is planned for June 28-29.

The tender is expected to generate $6-10 billion of investment for developing the 11 areas. The licenses will be valid for 35 years and will be renewable for an additional 30 years. Under the terms of the licenses, companies will pay a 20% royalty on production volumes along with a 34% tax.

Offered in the tender are Norte de Ambrosio in Zulia state, covering 527 sq km; Yucal Placer, two areas in Guarico state covering 900 sq km; seven areas in Guarico, Aragua, and Cojedes states covering 1,200 sq km each; and the Barrancas tract covering 1,970 sq km across Barinas, Portuguesa, and Trujillo states on the western plains.

In other exploration news, operator Petro-Canada says the first wildcat drilled in the Mackenzie Delta in several decades went smoothly. The Kurk M-15 well, 93 miles northwest of Inuvik, encountered a number of sand zones with gas shows. It was drilled to about 10,171 ft, 1,312 ft beyond the original target depth. The well is the first in a multiyear drilling program planned by the company and partner Anderson Exploration. Petro-Canada said that after evaluations are complete, it may test the gas-saturated zones next winter to determine reserve potential and productivity.

BP has a deepwater oil discovery on Green Canyon Block 243 in the Gulf of Mexico. It said a well on the Aspen prospect, in 3,150 ft of water 5 km from its Troika field, found 490 net ft of pay.