OGJ Newsletter

Market Movement

Tight gasoline markets ahead

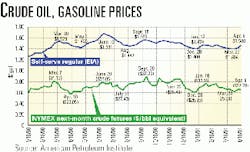

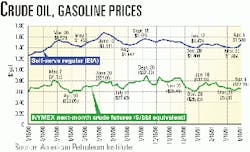

It's "déjà vu all over again" for gasoline markets in the US, as the patterns established during last year's driving season are manifesting themselves again.

And that means an unpleasant summer "rerun" for motorists, albeit strong margins for refiners. NYMEX futures prices for wholesale gasoline have topped $1/gal for the first time this year and have settled at their highest level since last June.

Much of this gain can be attributed to the rebound in crude oil prices. After falling or remaining relatively flat since mid-February, gasoline futures prices had risen 4 weeks in a row as of last week.

According to US EIA data, regular, self-serve gasoline at the pump, including taxes, averaged $1.50/gal across the US for the week ended Apr. 6 (see chart). That tracks, to some extent, the recent rise in crude oil prices stemming from two agreements by OPEC to cut oil production by a combined 2.5 million b/d in anticipation of the seasonally slack second quarter's demand decline. The first of those cuts was to kick in as of Feb. 1, the second as of Apr. 1.

US gasoline supply woes

But on a per-gallon basis, the recent rise in gasoline prices has actually outpaced that of crude oil (see chart). And the big spike in average gasoline prices last summer did not follow a comparable rise in crude oil prices.

Last summer's huge jump in gasoline prices owed more to the infrastructure and regulatory problems affecting the US gasoline supply system. New rules governing the specifications for fuels have spawned a "balkanization" of the US gasoline markets, reducing the system's flexibility to handle the transition to new fuels. So when a supply outage occurs-as was the case in the US Midwest last summer, with refinery and pipeline outages in the market most vulnerable because of its "boutique" nature-the price effects are amplified (see Editorial, p. 21). Nothing has changed on that score for this year.

Natural gas supplies in temporary surplus

While many forecasters are concerned about a natural gas shortfall, Raymond James & Associates estimates there is about 5 bcfd more available on the market right now than at this time 1 year ago.

RJA attributes the temporary surplus to a combination of lower demand and more supply. The analyst estimated demand is down about 3 bcfd as a result of fuel switching and 1 bcfd from lower industrial demand.

"Regardless of the origin of the extra gas, it is clear that there is substantially more gas available to inject today than there was at the same time last year," RJA said.

The short-term oversupply is projected to push prices down through May and possibly June to below $4/Mcf. But as gas-fed electric power generation gets fired up to meet summer power demand, RJA then expects prices to shoot up to $6/Mcf and remain "relatively" strong at $5/Mcf thereafter.

RJA expects this summer's peak electric demand to be 5-10 bcfd higher than last summer, based on the assumption that about 40,000 Mw of new gas-fired generation will be added to the grid this summer. Annualized, this equals about 4 bcfd of additional consumption. RJA cautions the number is somewhat misleading, because about 2 bcfd of additional consumption will be used in baseload generation, while the balance will be consumed in peaking units used for short periods of time-an extra 5-10 bcfd during peak summer use.

Possible market alternatives

RJA points to two possible alternatives for the market to play out in the next month. Storage operators may inject large amounts of gas over the next few months. While this would support cash prices, high gas injection rates could cause the current 303 bcf year-to-year storage differential to disappear "in a matter of 5-6 weeks," the analyst says.

Such a large boost in storage numbers would cause the futures market to weaken. By late July, however, RJA says, traders will grow less comfortable as electric generation siphons gas from storage and drives prices back up.

Alternately, storage operators may inject less gas than is available to the market, and cash prices will drive the futures market down. Under this scenario, storage operators will spread modestly higher injections throughout the entire storage season.

In any case, RJA says, it seems clear that gas prices are in for another wild ride this summer.

null

null

null

Industry Trends

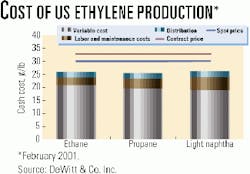

RECENT ETHYLENE CAPACITY ADDITIONS IN THE MIDDLE EAST HAVE ASIAN AND EUROPEAN PRODUCERS WORRIED, consulting company DeWitt & Co. said at its World Petrochemical Review in Houston last month.

It said that in North America, the strength of natural gas prices has cut into margins, making producers rethink their decisions and strategies for expanding cracker capacity.

Peter Jordan, DeWitt senior vice-president, said no one is pretending that the buildup in Middle East ethylene capacity is for anything but the Asian market, mainly China.

Saudi Arabia started three crackers with a total nameplate capacity of 2.3 million tonnes/year in the past few months and has announced two more world-scale plants for 2004 and 2005.

US ethylene is now noncompetitive in the world market, said Earl Armstrong, managing director of DeWitt.

He said the past few months witnessed an unprecedented change in natural gas pricing relative to crude oil. Historically, the discount of gas prices relative to crude gave US petrochemical producers a significant advantage over world markets.

Because roughly 60% of ethylene is produced from light feedstocks recovered from gas, ethylene producers suffered negative margins in January and small positive margins in February (see chart).

THE INTERNATIONAL MARITIME ORGANIZATION IS CONSIDERING A FASTER PHASEOUT OF SINGE-HULL TANKERS.

The IMO's marine environment protection committee plans to adopt a global timetable to phase out the use of single-hull crude tankers on a faster schedule.

The committee was expected to consider revised legislation during its week-long conference last week that would have a "major impact" on curbing serious oil spills from tankers by pushing plans to scrap single-hull vessels before 2017, "several years earlier" than originally agreed.

The plan to accelerate the elimination of single-hull tankers is contained in a revised regulation 13G of Annex I to MARPOL 73/78-the international convention that deals with pollution from vessels. The proposed changes to legislation were approved by the committee in October.

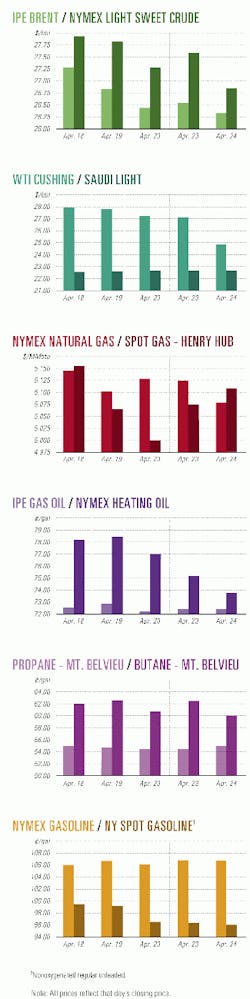

OFFSHORE RIG MARKETS CONTINUE TO STRENGTHEN.

Global Marine reports its worldwide Summary of Current Offshore Rig Economics (SCORE) for March increased 4.1% over February-the 19th consecutive month of increases in the rating.

Bob Rose, president and CEO of Global Marine, said, "While every major offshore rig market showed improvement in March, the real strength was in the international area. Here we are seeing the impact of higher spending by the major oil companies and accelerating project approvals by foreign governments."

SCORE compares the profitability of current mobile offshore drilling rig rates with the profitability of rates at the 1980-81 offshore drilling cycle peak, when speculative rig construction was common.

Government Developments

USE ENERGY PROBLEMS WON'T BE SOLVED OVERNIGHT, US Vice-President Dick Cheney contends.

"We won't offer a quick fix, because there is none," Cheney told the Northern Virginia Technology Council earlier this month. "In fact, narrow, short-term thinking is what got the country into an energy crisis in the first place."

That doesn't mean today's problems can't be solved, he stressed. The White House's energy strategy will be comprehensive in approach and long-term in outlook, he said. Yet no one should expect a dramatic cure-all, Cheney cautioned.

Cheney leads an interagency task force that will offer recommendations to Congress in mid-May. The oil industry expects the White House to expand public lands and waters available for exploration, including areas now restricted or off-limits to drilling.

The administration also is expected to recommend the lifting of economic sanctions that block oil companies from investing in certain nations.

Key to the White House energy strategy will be an emphasis on expanding domestic E&P and the pipelines and transmission facilities to deliver energy to consumers.

"Our strategy will insist on protecting and enhancing the environment, showing careful regard for the air and natural lands and watersheds of this country," Cheney said.

He blamed the Clinton administration for "ill-considered policies [that] have kept new [electric power] plants from being built, so that in generating capacity, what we have is way below what we need."

PROPOSED TEXAS LEGISLATION COULD CREATE A NEW ENERGY POLICY COUNCIL.

Texas Sen. David Sibley (R-Waco) filed a bill in the legislature last week that would create a Texas Energy Policy Council charged with formulating a state energy policy.

Senate Bill 1825 would create a nine-member panel that would meet at least once quarterly to develop a statewide policy for the legislature to consider by Dec. 1, 2002.

"It is important for Texas to develop an energy policy so we can avoid the spiraling fuel costs and energy shortages now plaguing other states such as California," Sibley said. Texas is on the eve of a statewide electricity competition pilot program that starts June 1.

Most observers believe that, in the short-term, Texas will escape the most flagrant problem that has dogged California-a shortage of generation.

But other problems, such as the exercise of market power by large utilities and their affiliates or a few large marketers, could emerge to adversely impact prices in the newly opened market.

If the bill becomes law, the council will make recommendations to the state and industry regarding energy use, encourage a portfolio of clean and reasonably priced energy sources, develop policies to ensure against interrupted supplies and infrastructure failure, and recommend ways to increase public awareness for conservation.

Quick Takes

BP AND PARTNERS WILL PROCEED WITH THE SECOND PHASE DEVELOPMENT OF AL RAYYAN OIL FIELD OFF QUATAR, said Gulfstream Resources Canada.

BP operates the field with 27.5%, Gulfstream owns 65%, and Preussag Energie GMBH owns 7.5%.

The partners will install platform processing facilities and plan to double production to 25,000-35,000 b/d following completion of detailed reservoir simulations in a few months.

Up to eight new horizontal wells and two reentered wells are planned before start-up of the platform. There are eight horizontal wells now producing in the field.

The existing production platform will be replaced with a refurbished jack up production facility. Drilling activities are expected to begin in July, and start-up is expected in third quarter 2002.

In other development news, owners of Corrib natural gas field off western Ireland have withdrawn an application to jointly market their production, due to the European Commission's concerns about competition. The EC said it "welcomes the decision of the Corrib owners to market the gas individually, which will give gas consumers in Ireland a wider choice between gas suppliers." Enterprise Energy Ireland, operator of Corrib, opened the 25 billion cu m field in 1996 on Block 18/20. The £500 million (Irish) development will use seven subsea wells in more than 1,100 ft of water, tied back to a central gathering manifold. A pipeline will move the gas to an onshore facility (OGJ Online, Feb. 26, 2001). Development work will begin this year and be completed by 2003.

Gulfstream Resources Oman has begun drilling at the Hafar natural gas development project in Oman. In January 1999, Gulfstream signed an agreement to develop Hafar Block 30 and sell 84 MMcfd to Oman for 25 years. The Hafar Block 30 area includes Hafar, Al Sahwa, and Nadir gas fields. Development plans include the drilling of four wells to supplement the three existing ones, a 125 MMcfd processing facility, and a 16-km pipeline to tie into a main gas transmission line.

Conoco said the latest development well in Rang Dong field off Viet Nam was completed with a flow rate of 10,000 b/d. The 15P well on Block 15-2 boosted field output to 55,000 b/d, a production milestone. Block 15-2 is in 165 ft of water in the Cuu Long basin, 120 miles southeast of Ho Chi Minh City. The block covers 400,000 acres and is near Bach Ho and Ruby fields.

SOUTH AMERICAN PROJECTS COMMAND CENTER STAGE THIS WEEK IN EXPLORATION NEWS.

Harken Energy said it diversified its international operations by signing a technical evaluation agreement (TEA) with Perupetro, the state oil company, for Area III in Peru's Marañon basin between the Ucayali River and the Brazilian border (see map).

Area III is east of the Pacaya Samiria national reserve, now a protected area, where Amoco found oil with the Bretaña exploration well in late 1974.

Harken has the option to convert the TEA to a 7-year exploration contract, with a 22-year production period. The acreage is on trend with producing structures extending from the Oriente region of Ecuador and continuing into Peruvian territory.

The TEA allows Harken to conduct a study that will include the reprocessing of seismic data and evaluation of previous well data.

Also, Occidental Petroleum is resuming talks with Perupetro on a possible exploration contract for Block 22 in the Ucayali basin or a TEA in the same area.

Meanwhile, a joint venture of four companies headed by Petrobras began drilling exploratory well 1-SCS-10 on Block BS-3 in the Santos basin off Brazil.

The well is being drilled in 200 m of water about 100 miles east of Itajai in southern Brazil. It is to be drilled to 5,200 m TD at a cost of $15 million. Its objectives in the lower Guaruja formation are the same type of reservoirs that are producing in nearby Caravela field, as well as in the Coral and Estrela-do-Mar fields that are to be developed by the group.

Rounding out exploration news, Santos has made its third field discovery this year in the Victorian sector of the Otway basin. The Croft-1 wildcat on exploration permit 154 was drilled to 2,529 m TD. It found a 60-m gross natural gas column in Cretaceous Waarre at 2,025-2,085 m. The company is evaluating logs but said indications are that the net gas pay is 34 m. Croft-1 will be cased and suspended as a future gas producer. It will likely produce 9.3-14 MMcfd, estimates Santos.

Mera Petroleums plans to invest up to $4 million (Can.) over the next few months on exploration and drilling work in Saskatchewan. Mera has begun a six-well program with the drilling and casing of two wells in the Leader area 95 km northeast of Medicine Hat. Mera is testing the deeper well. It plans to spud and test one deep well and three more shallow wells within the next few weeks. This summer, Mera plans a 24-well shallow gas program in the area.

Bitech Petroleum announced an agreement with Dashk LLC to jointly explore the Djimdan license block on Russia's Sakhalin Island. Dashk owned 100% of the license, and Bitech is acquiring 52% of Dashk for $1.7 million. Bitech will operate the license block, 5 km north of the town of Nogliki. The block, covering 114 sq km, is south of Mongi field. Mongi has been in production since the 1970s and is operated by Sakhalinmorneftegaz. Two prospects have been identified on the Djimdan license: South Mongi and Ust Veni. The South Mongi prospect is on trend with Mongi field, which had peak production of 25,000 b/d. The Ust Veni prospect is downdip and on the same migration path. Bitech speculates the two identified structures could hold as much as 49-177 million bbl of recoverable oil. Bitech plans to shoot 3D seismic this winter and drill a wildcat in 2002.

SANDIA NATIONAL LABORATORIES HAS DEVELOPED AN INEXPENSIVE DISPOSABLE FIBER OPTICS TELEMETRY SYSTEM TO RELAY REAL-TIME INFORMATION ABOUT THE DRILLING PROCESS.

David Holcomb, the researcher who devised the technique, said, "Information is instantaneously sent to the surface about temperatures, pressure, chemistry, and rock formation-all obtained without stopping the drilling operation."

Using fiber optics telemetry has been expensive for the oil industry because a bulky armor was needed to protect the delicate optical fiber and deploying the cable interfered with drilling.

Holcomb's technique uses unarmored fiber protected only by a plastic coating, similar to that found in guidance systems that can deploy miles of fiber from a small spool at guided-missile speeds.

The disposable fiber optics system was tested last September at Gas Technology Institute's test facility at Catoosa, Okla.

ECORP HAS PROPOSED A NEW YOUR GAS LINE TO SERVE NATURAL GAS-FIRED GENERATORS.

eCORP Holding has disclosed details on the proposed Pipeline of New York (PONY) Express project to serve gas-fired electric power generation in New York state and New England.

The project would link storage and other gas pipeline assets in central New York and Pennsylvania with gas markets in the New York City metropolitan region and points east. The pipeline would connect with the Stagecoach natural gas storage project near Oswego, NY, that eCORP and affiliates are building.

Tennessee Gas Pipeline has received a FERC permit to expand its 300 Pipeline in northern Pennsylvania and build a lateral to Stagecoach.

Stagecoach, which is being developed in two phases, will initially be capable of delivering up to 500 MMcfd, and ultimately over 1 bcfd, to New York and New England markets.

In other pipeline happenings, Explorer Pipeline said its board approved a plan to expand its main products line between Houston and Chicago by at least 100,000 b/d before late 2002; it also approved additional expansions of up to another 75,000 b/d contingent on volume commitments. The products pipeline moves 560,000 b/d of gasoline, diesel, and jet fuel through a 28-in. line from Houston to Tulsa. It moves 350,000 b/d on to Chicago through a 24-in. line. The company plans to increase throughput on the main line by building 9-15 intermediate pumping stations. No new pipe would be laid.

The North American Natural Gas Pipeline Group (NANGPG), a consortium of ExxonMobil, BP, and Phillips Petroleum, awarded a pipeline conceptual engineering contract to the AlasCan Group. AlasCan consists of Kellogg Brown & Root, Colt Engineering, Natchiq, NANA/Colt Engineering, and Michael Baker Corp. The proposed 1,800-mile natural gas pipeline from near Edmonton to Chicago, would be a continuation of the proposed pipeline from Prudhoe Bay field in northern Alaska to Alberta. The project would consist of a large diameter pipeline with compressor stations and related facilities.

SINOPEC PLANS TO BUILD A CRUDE OIL STORAGE FACILITY AND A PIPELINE IN EASTERN CHINA.

The 40 million tonne tank farm, near the Zhenhai Refining & Chemical complex in Ningbo, Zhejiang, will store crude oil imported from the Middle East.

It will be operable late this year or early next year. Crude will be moved from the tank farm via a 500-600 km, 40 million tonne/year pipeline to four major refineries in Shanghai city and Jiangsu province.

Currently, crude is transported to the refineries by sea or through a pipeline from Shengli oil field in Shandong province. Sinopec will allocate 1.47 billion yuan ($180 million) for construction of the pipeline.

TOPPING GAS PROCESSING NEWS THIS WEEK, AltaGas has proposed to increase processing capacity in its Central Border operating area to 114 MMcfd by expanding its Esther plant by 11 MMcfd. AltaGas constructed the 14 MMcfd Esther plant in February, and it operates at full capacity.

AltaGas has applied to regulatory authorities for the expansion. Subject to approval, the expanded plant would be in service by the end of the second quarter. The Central Border area straddles the Alberta and Saskatchewan border.

In addition, AltaGas is applying to regulatory authorities to increase processing capacity in its Bantry area to 27 MMcfd with a 9 MMcfd expansion of its Bantry sour gas plant and the construction of a 32-km gathering pipeline.

Subject to regulatory approval, the Bantry expansion is expected to be completed in the fourth quarter.

PHILLIPS PETROLEUM HAS STARTED UP A NEW 6,000 B/D UNIT AT ITS BORGER, TEX., REFINERY.

The unit demonstrates Phillips's S Zorb sulfur removal technology (SRT) for lowering sulfur content in gasoline blending streams.

The process uses a regenerative sorbent that chemically attracts sulfur and removes it from blendstocks. Phillip says that the S Zorb SRT lowers sulfur levels in gasoline to 5 ppm for some feedstocks, which exceeds EPA's limit of 30 ppm.

The company is also developing the S Zorb SRT process for diesel fuel. Laboratory test runs on diesel revealed that low sulfur levels can be attained at significantly lower pressures of 275-500 psig vs. conventional hydrotreating process pressures of 500-2,000 psig.

In other refining action, Tosco an-nounced that the coker-processing unit at its 131,000-b/d Los Angeles refining complex was shut down as a result of a fire that also has reduced throughputs from some other processing units. No injuries resulted from the fire. The cause was under investigation last week, along with an evaluation to determine the extent of damage and repair schedule. Tosco's LA complex consists of two refineries, Carson and the nearby Wilmington plant.