Personnel quality key to selection of engineering contractors

Owners of downstream petroleum and chemical companies rank quality of key personnel as their number one consideration in choosing engineering contractors, says a recent industry study. These owners also cite concerns about the ability of engineering firms to handle a multitude of small jobs on the horizon and to adapt to global customers.

These are some of the conclusions of a biennial survey on the global downstream engineering, procurement, and construction (EPC) industry by Transmar Consult Inc., Houston.

Between September 2000 and January 2001, Transmar interviewed 99 owners in the US and Europe. European interviews took place in Belgium, France, Germany, Italy, the Netherlands, and the UK.

Most interviewees were managers in the engineering, construction, and project management departments of major petroleum and chemical companies. Others were planning and procurement executives or senior corporate executives.

Investment outlook

Owners are cautiously optimistic that capital spending will trend upward in the refining and heavy chemicals industry.

Both in the US and Europe, capital investments in refining will be driven by regulatory authorities in the next few years. Refiners do not expect a return on these projects but consider them the cost to stay in business.

Despite flat commodity chemical prices and meager spending budgets, heavy chemical suppliers also expect higher capital spending in 2-3 years.

Said the vice-president of refining of a major American company, "We are making good money now in the refining business. However, there are not going to be any major expansions in the US or...European refining industry. Spending is going to be driven by environmental regulations....You have to spend it only to stay in business not make a profit."

The vice-president of projects in a major European integrated major said, "We have a lot of small projects to complete in our refineries over the next 5 years. Most will have a total installed cost of less than $50 million. Most are required to meet the European Economic Community rules regarding sulfur. These are environmental and not economic investments. I see at least 20-30 such projects in our pipeline during the next 3 years."

EPC contractor selection

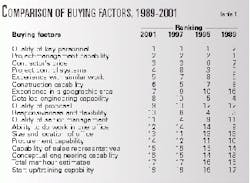

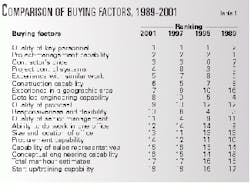

Owners rank quality of key personnel as the number one consideration for choosing EPC contractors for a project. The next assessment factors, respectively, were project-management capability and contractor's price.

Table 1 lists the assessment factors in order of importance to owners. Compared to responses in 1997, owners are more carefully considering "hard" buying factors such as project-control systems used by the contractor, the contractor's experience with similar work, and the contractor's experience in the same geographic area.

"An understanding of local conditions is more important than ever when you are trying to build a chemical plant. Given the regulatory pressures in Europe and the US you cannot afford to goof up. It can tie-up the project and cost you a wheel barrel of money. That is why we place more emphasis and care on assuring ourselves that a contractor has the requisite local capabilities," a senior project manager of a chemical company said.

The buying factor labeled "quality of senior management" plummeted from 4th place in 1997 to 11th place in this year's ranking.

Again, this suggests that owners are placing a greater emphasis on hard factors on their selection than behavioral soft factors. Owners are more concerned today than 2 years ago about improving project performance and keeping costs low.

Unsustainable operations by certain medium-size engineering firms, such as Stone & Webster Inc., KTI, Raytheon Engineers & Constructors, resulted in a rash of recent takeovers, said Transmar. These corporate changes have hurt some owners and changed their thinking regarding contractor selection.

To illustrate a smaller emphasis on soft factors, one project engineer in a major European chemical company blamed the failure of his project on personal relationships: "The engineering contractors made a total mess of our petrochemical project. A number of the management people on our side and within the contractors had strong personal relationships....We should have looked closer at the project team they put together and their track record."

Like previous surveys, owners expressed concern that the engineering contractors are set up to do greater than $100 million projects and are incapable of smaller ones that now dominate the market.

The survey quoted a senior project executive at a major integrated European Petroleum Co.: "It is rare that a major engineering contractor can provide what is needed for revamps of say $25 million to $50 million. We have been very disappointed with some of the people our major contractors are putting on our refinery revamps. Many just lack the ability and experience to do small type jobs..."

Best contractors

Transmar used three measurements to rank quantitatively EPC contractor performance: market recognition, uptick-downtick index, and rating of contractors.

Market recognition measures the percentage of owner interviewees able intelligently to recognize a specific contractor. Out of 25 engineering companies, the seven firms with the highest level of recognition by owners, in no particular order, are ABB Lummus Global, Bechtel Corp., Fluor Corp., Foster Wheeler Corp., Kellogg Brown & Root, Shaw Group's Stone & Webster Inc., and Technip.

The recognition level in the 2001 study is significantly higher than those of the 1995 or 1997 studies. The average recognition level of the top 13 global engineering contractors today is 63%. In 1997, it was 34%.

The reason for this higher recognition, suggests the consultant, is that engineering contractors are in a rapidly consolidating industry.

The uptick-downtick measure represents whether owners thought certain engineering contractors were on an "uptick," that is, improving, or on a "downtick."

The seven global engineering contractors with the highest "uptick" scores, in no particular order, are ABB Lummus, Bechtel, Fluor, JGC Corp., Lurgi AG, Snamprogetti SPA, and Technip.

The third benchmarking exercise asked owners to rate those engineering contractors with which they have had experience in the past 5 years. Of 25 firms, only 13 received a sufficient number of evaluations for meaningful statistics.

These companies were ABB Lummus, Bechtel, Fluor, Foster Wheeler, Jacobs, JGC, Kellogg Brown & Root, Lurgi, Parsons Corp., Stone & Webster, Snamprogetti, Technip, and Washington Group.

Table 2 summarizes the average ratings of these 13 engineering contractors without naming them. There are broad differences in the perceived capabilities of these companies, differences which are wide and growing.

Strategic issues

In the course of the survey, owners identified some strategic issues and trends that the EPC contractor industry needs to consider to survive.

- The process-plant-engineering contractor industry will continue its trend to bifurcate into global players and regional or niche players. This trend imitates that of the petroleum and chemical industries.

One senior executive commented that engineering contractors will have to consolidate to meet the global interests of major petroleum and chemical companies. Mid-size players, he predicted, will not have the revenue to follow global clients around the world.

- The right size for petroleum and engineering contractor firms will be relatively small or very big. The medium size company is the wrong size strategically and financially for an engineering company serving global clientele.

- Engineering firms today will require constant corporate organizational reconfiguration to meet changing global conditions.

- Engineering contractors need to develop new models on how their companies and industry should operate. The models should have ideas and assumptions of how the business should be run and structured to succeed. They should identify customers, competitors, and technology.

- The long-term trend toward lumpsum contracting for global capital projects will continue. This is a disadvantage to most American contractors that are organized to do cost plus reimbursable projects.

A French oil executive noted that this trend will give European engineering contractors an advantage in Europe, the Middle East, Asia, and Africa, where authorities prefer knowing the price from the beginning.

- Many owners perceive that senior management at EPC companies are unable to anticipate changes and make necessary decisions.

- Owners are trying to understand the impact of information technology and e-commerce on themselves and on engineering contractors.

Most owners think better standards between owners and suppliers are needed to make progress in implementing e-commerce and in using the Internet. They think the use of modern information technology for purposes of revising internal business processes and organizations will be more important than purchasing using e-commerce.