Record capacity increase occurs amidst growing ethylene demand

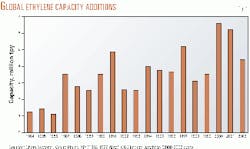

A net 6.6 million tonnes/year (tpy) world wide ethylene production capacity came on stream in 2000, more incremental capacity than any other year in history (Fig. 1).

Capacity as of Jan. 1, 2000, was 94.0 million tpy.

This year's ethylene survey reflects worldwide capacity commissioned as of Apr. 1, 2001, a total of 101.5 million tpy. A new ethylene unit in Bahia Blanca, Argentina, a new unit in Yanbu, Saudi Arabia, and a shutdown of a Japanese refinery since the beginning of this year, contributed another 944,000 tpy to worldwide ethylene production capacity in 2001.

Rising NGL prices occurred in the US throughout 2000. Slower rising ethylene prices, however, created hardships for many North American operators whose crackers process NGL as feedstock.

Ethylene prices reflected the additional supply placed in the market in the past year and lower demand for ethylene. By yearend 2000, US ethylene plant shutdowns and reduced operations pulled operating rates below 90%.1

Operating rates in western Europe also dropped (to 90%) but for other reasons.

Operating problems and plant outages, combined with limited new capacity, created an import market of 710,000 tonnes of ethylene in 2000. Previously, western Europe has rarely imported more than 150,000 tpy on a net basis.2

New units

Egypt completed its first ever refinery in 2000 with a capacity of 300,000 tpy. The operator is Sidi Kerir Petro chemicals Co., a subsidiary of Egyptian Petro chemicals Co. Saudi Arabia had two significant expansions in 2000 and one in 2001. Arabian Petrochemical Co., a wholly owned subsidiary of Saudi Basic Industries Corp. (SABIC), added an 800,000-tpy ethylene unit to its Jubail plant (Petrokemya). Al Jubail Petrochemical Co. (Kemya), a 50/50 joint venture (JV) between SABIC and ExxonMobil Corp., added a grassroots 700,000-tpy steam cracker to its polyethylene plant in November 2000.

In February 2001, Yanbu Petrochemical Co., a 50/50 JV between SABIC and ExxonMobil, added a new 800,000-tpy unit.

In October 2000, Nova Chemicals Corp. completed a third ethylene unit at Joffre, Alta. The 55/45 JV with Dow Chemical Co. (formerly a JV with Union Carbide Corp.) has a nameplate capacity of 1.3 million tpy, almost doubling the capacity of the existing site (OGJ, July 3, 2000, p. 45). The Joffre site uses ethane feedstock from Alberta natural gas.

The largest Asian-Pacific project this past year, Taiwan's Formosa Petrochemical Corp., started operations of a 900,000-tpy naphtha cracker in Mailiao, Taiwan. The new unit triples the existing ethylene capacity at Mailiao.

This complements an existing cracker, commissioned in 1999.

India contributed 720,000 tpy to worldwide ethylene capacity this year. Indian Petrochemicals Corp. Ltd. started a new 300,000-tpy plant in Gandhar, Gujarat, in 2000. Haldia Petrochemicals Ltd. commissioned a 420,000-tpy naphtha cracker in April 2000 in Haldia, West Bengal.

In South America, projects led by Copesul and Dow Chemical Co. contributed to most of the continent's ethylene capacity expansion. Copesul brought its new 450,000-tpy naphtha cracker online in Brazil in March 2000 (OGJ, Apr. 3, 2000, p. 60).

In first quarter 2001, Dow Chemical Co.'s JV with Repsol-YPF completed construction of a 420,000-tpy ethane cracker in Bahia Blanca, Argentina. This is the second unit to be built at that site. Dow will provide feed for this cracker from the new natural gas fractionator it completed in fourth quarter 2000.

Regional review

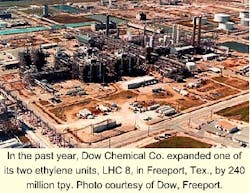

Nova's huge 1.3 million-tpy Joffre expansion project makes it the largest producer of ethylene from any one complex. Table 1 shows rankings of the 10 largest ethylene production complexes in the world. Note worthy is that 6 of these 10 complexes are on the Gulf Coast, 5 in Texas.

Table 2 ranks ethylene production capacity by region, and Table 3 ranks it by country. North America led the world with the largest absolute increase, followed by the Middle East/Africa and Asia-Pacific regions.

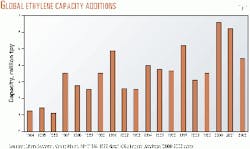

After Canada, the US accounted for the remaining capacity increases in North America, mainly projects in Dow's Freeport, Tex., plant and Shell Chemicals Ltd.'s Norco, La., plant.

Saudia Arabia accounted for most of the change in regional Middle East/Africa capacity. The country expanded its Petrokemya ethylene complex and added an ethylene unit to its Kemya polyethylene plant in 2000.

For the first time, Nigeria responded to OGJ's survey. Although this is not an increase in capacity, it is reflected in this year's survey.

Projects in India and Taiwan, previously mentioned, contributed the most to ethylene capacity expansion in the Asia-Pacific region in the past year.

Closed plants

In January, Mitsubishi Chemical Corp., Tokyo, shut down its 276,000-tpy ethylene production facility in Yokkaichi, Japan, the smallest of its three plants in Japan. The company also shut down its ethylene glycol (EG) and ethylene oxide (EO) operations in the Yokkaichi plant.

Mitsubishi's Kashima and Mizushima plants are providing ethylene and propylene to Yokkaichi operations, and Kashima is providing EG and EO to Yokkaichi.

The company cited competition with large-scale production plants in Saudi Arabia, Taiwan, and Singapore and expected large cuts in import tariffs on major petroleum products in 2004 as deciding factors in closing down the Yokkaichi plant.

Showa Denko KK scrapped its 230,000-tpy No. 1 steam cracker in Oita in August 2000. In combination, it expanded its No. 2 cracker from 524,000 tpy to 600,000 tpy.

In November 2000, Sunoco Inc. shut down ethylene and ethylene oxide units at its Brandenburg, Ky., facility. These units will be dismantled in the next 2 years.

Mergers

Andrew B. Swanson, director of Chem Systems's petrochemical practice, at the company's annual US Chemical Conference in Houston, said that US petrochemicals mergers have better positioned companies for a downturn.

Fig. 2a shows that the number of US ethylene, low linear density polyethylene, and benzene companies have decreased since 1995. Although these mergers have not led to a major concentration of companies, said Swanson, they have achieved scale and other fixed cost savings (Fig. 2b).

On Feb. 6, 2001, Union Carbide Corp. became a wholly owned subsidiary of Dow Chemical Co. The new Dow tops the chart for the leading supplier of ethylene in the world. Even without the merger, Dow would have ranked first among ethylene suppliers.

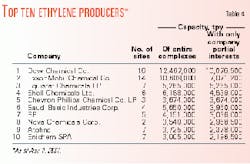

Table 4 lists the top ten owners of ethylene capacity in the world. Second to Dow's 10.1 million-tpy capacity is ExxonMobil's 7.1 million-tpy capacity.

In Fig. 3, CMAI (Chemical Market Association Inc.) shows the difference between the top five shareholders of North American ethylene capacity between 1995 and 2005. Fewer companies are taking a larger share of the total ethylene market.

Chevron Phillips Chemical Co. LP, based in Houston, now ranks fifth among worldwide ethylene producers. All its plants are in Texas. Basell NV is a new company formed by the merger of Elenac GMBH, Elenac SA, Montell NV, and Targor. Of these companies, only Elenac manufactured ethylene at a plant in Wesseling, Germany. Basell is a 50/50 JV between BASF AG and Shell Petroleum NV.

In response to European and US restructuring, Mitsui Chemicals Inc. and Sumitomo Chemical Co. Ltd. agreed at the end of last year to consolidate their businesses in October 2003 to enhance economies of scale. Initially, the two companies will consolidate their polyolefins businesses by October 2001.

At present, the two companies jointly own a 700,000-tpy ethylene plant operated by Keiyo Ethylene Co. Ltd. in Chiba, Japan. Sumitomo solely operates another 415,000-tpy plant in Chiba.

Construction

Of the 9 million tpy of expected capacity from major expansions to be completed in 2000, 7.2 million tpy came to fruition. Completions of BASF-Atofina's 860,000-tpy olefins unit in Port Arthur, Tex., ExxonMobil's 800,000-tpy unit in Pulau Ayer Chawan, Singapore, and Uzbekneft egaz's 140,000-tpy expansion in Shurtan, Uzbekistan, have been postponed until the second quarter or second half of 2001.

Yanbu Petrochemical Co.'s 800,000-tpy unit, expected in 2000, postponed its start-up from 2000 until early February 2001. It will also contribute significantly to the 2001 total.

According to OGJ's construction survey, 6.2 million tpy of new capacity will come on stream in 2001 (Table 5). Besides the previously mentioned postponed projects, Formosa Plastic Corp.'s 850,000-tpy project in Point Comfort, Tex., is the next largest project expected to come on stream before yearend. Also significant are Optimal Olefins's planned 600,000-tpy unit in Kertih, Malaysia, and Dow's 600,000-tpy ethylene expansion in Terneuzen, The Netherlands, both planned for completion before yearend 2001.

Click here to view Ethylene expansions, 2001-2005

This survey is in PDF format and will open in a new window

Worldwide capacity will grow an average of 4.5%/year between now and 2005. Fig. 1 illustrates the comparatively huge capacity additions planned to come on stream in 2000 and 2001.

Global market

Worldwide supply of ethylene exceeds worldwide demand. Worldwide demand was 91 million tonnes in 2000, 9.6 million tonnes less than worldwide capacity on Jan. 1, 2001.

Fig. 4 breaks down this demand by end use. Polyethylene is the most common derivative from ethylene. It contributed to 57% of demand in 2000 and will make up 60% in 2015.

At the annual Gas Processors Association Convention in San Antonio in March, Mark Eramo, business director of light olefins for CMAI, based in Houston, said all new olefin complexes are being built with polyethylene units.

Fig. 5 reflects ethylene demand growth expected by 2006 and 2012. CMAI expects total consumption to reach 100 million tonnes in 2002. A significant portion of new demand will come from Asia. CMAI said Asia needs 50 million tonnes more capacity by 2020, or 44% of global additions.

Abdullah S. Nojaidi, executive vice-president of planning and investment at Saudi Basic Industries Corp., in a speech earlier this year, said he expects global ethylene demand in Africa and the Middle East to grow by 13% and global demand in Asia to grow by 8.6% in the next 5 years. The US and Western Europe, however, will experience lower growth, 1.7% and 3.3%, respectively.

North American market

In the short term, high natural gas prices have diverted NGLs from ethylene feedstock. Gas processors have found it more profitable to keep NGL in the natural gas stream. Combined with weak demand for ethylene, North American petrochemical profitability is suffering.

Earlier this year, ethylene operating rates in the US dropped into the low 80% range while crackers dropped to breakeven economics, said Swanson. North American ethylene demand was 31 million tonnes in 2000. OGJ surveyed 33.7 million tonnes of capacity in 2000. A surplus capacity in excess of 4.5% of total demand results in weak market conditions, according to CMAI (Fig. 6).

According with the figure, recovery will occur when the surplus narrows in 2004, said Eramo. By that year, current capacity additions will not meet domestic demand, and North American producers should consider investment in additional capacity. Fig. 7 shows this expected US recovery in 2004.

Canadian and US competitive advantage has been built upon abundant and relatively cheap supplies of natural gas. In the long run, according to the Federal Reserve Bank of Dallas, natural gas prices threaten this advantage when they are high compared to crude oil prices. The report says that US natural gas at $3-4/Mcf is just competitive with oil prices at $17-22.1

References

- Eramo, Mark A., Gilmer, Robert W., and Teleki, Arved, "Petrochemicals and Natural Gas Prices: Short-Term Pain, Long-Term Concern," Houston Business, Federal Reserve Bank of Dallas, Houston Branch, January 2001.

- Jordan, Peter, "Ethylene and Propylene Contrasting Outlooks in Europe and the Middle East," DeWitt & Co. Inc. World Petrochemical Review, Houston, Mar. 27-29, 2001.