OGJ Newsletter

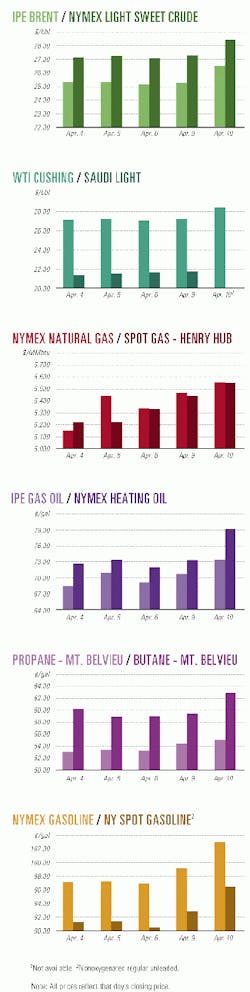

Market Movement

Natural gas demand continues downward spiral

Studies undertaken for the 3,700-km Alliance Pipeline to quantify the effects of sunlight on fusion-bonded epoxy (FBE) coating on stockpiled line pipe indicated that the coating under full sunlight exposure showed a reduction in thickness and flexibility and a loss of gloss with chalking as a result of degradation by ultra-violet (UV) radiation.

Gas demand has scarcely risen in recent weeks, despite a fairly sharp falloff from stratospheric prices seen last December.

The reason for the decline in demand is the incentive that higher prices in 2000 gave consumers to conserve, switch to other fuels, or curtail operations. Driscoll estimates that this price-induced slump in nonheating demand was an average 2-3 bcfd in fourth quarter 2000 vs. a high of 8-10 bcfd in late December (see chart).

"When natural gas prices fell sharply in mid-January, we expected natural gas demand to recover quickly-but we now believe that we have regained only a small share of the demand lost in late December and early January," Driscoll said.

Natural gas storage status

With demand down, natural gas injection is certain to be stepped up, according to this scenario. Driscoll contends that injection levels could exceed those of a year ago by 6-9 bcfd in April and May.

This situation is like looking at a negative of the market a year ago, he observes.

"The winter of 1999-2000 was among the warmest on record, yet storage withdrawal rates were normal. Normal withdrawal rates, despite extraordinarily low winter heating demand a year ago, implied that the market was extremely tight.

"However, market prices for natural gas failed to reflect this tightness until the feeble natural gas storage refill rates of last April and May made it clear to all that the market was much tighter than it had been in previous years."

That situation yielded a rise in natural gas prices that traveled from $2.50/MMbtu in first quarter 2000 to $3.00/MMbtu in April-May and $4.25-4.50/MMbtu in June-July. So the stage was set for an even sharper spike in price when heating demand jumped, on the back of a string of record cold waves sweeping the US last year. The difference in heating demand for natural this past winter vs. the previous one is about 923 bcf, Driscoll estimates.

"However, the industry has met that demand without increased storage withdrawals [and without increased supplies, in our opinion], as other gas users have reduced their consumption," he said.

Continued demand patterns

As the year-to-year storage deficit fades and as recent demand patterns continue, gas inventories are likely to start the next heating season at close to the traditional level deemed appropriate, 3 tcf. But storage is not likely to exceed this level by much, Driscoll notes, as gas demand is likely to recover in a climate of reduced prices.

"Although hot summer days could undoubtedly lead to localized natural gas price spikes, we do not expect sustained high prices this summer as a result of power demand increases," he said. "We speculate that increased natural gas consumption to generate power this summer will add no more than 2-4 bcfd to gas demand [and perhaps much less, depending on the weather and the state of the economy]; this is far less than the 8-10 bcfd of demand that appears to be missing currently."

Power expectations

In the past 6 years, gas consumed by power generators-including nonutility generators-has risen about 750 MMcfd/year. During this time, natural gas fed about 28% of all incremental power demand. "Had natural gas provided all of the incremental electric demand growth, we estimate that the incremental gas load for power generation would have been 2.5 bcfd," Driscoll said. "This was a period during which GDP growth exceeded 4%. Even a bullish scenario for gas consumption would likely reflect slowing GDP growth and thus slowing electric consumption growth."

Offsetting this scenario to some degree is the continuing collapse of hydropower supply in the US West this spring and summer, which could add another 1 bcfd to gas demand for 6 months. Still, it won't be enough to offset the plunge in nonheating demand for gas stemming from high prices and a slumping economy, according to Driscoll.

The analyst slips in a qualifier, however, that may well prove to be a bigger problem for his bearish forecast than he acknowledges now: such a forecast assumes the absence of major spikes in oil prices.

null

null

null

Industry Trends

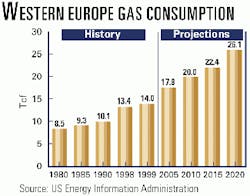

EIA PREDICTS THAT NATURAL GAS WILL GRAB THE FASTEST-GROWING SHARE OF THE GLOBAL POWER MARKET. Natural gas's share of the global electric power generation market will grow to 35.2% in 2005, up from 27.9% in 1999, US government forecasters predict.

With gas becoming the fuel of choice for new electric generation globally, EIA has projected the gas share of the power market will rise to 41.7% in 2010, 51% in 2015, and 59.7% in 2020.

EIA forecasters attributed the rise of gas to a desire in Western Europe to move away from relying on coal and nuclear; uncertainty about national and international policies, such as the Kyoto Protocol, that could affect coal use; an expected decline in nuclear power capacity in the US; increasing substitution of gas for coal in Eastern Europe and the former Soviet Union; and fuel diversification to cut dependence on hydroelectricity among developing countries in South America.

The most rapid growth of gas demand by the power industry among industrialized nations is expected in Western Europe. In 1975, a European Union directive restricted gas use in new power plants, and gas's share of the market declined to 5% in 1981, where it remained for most of the decade.

In 1999, natural gas held a 14% share of the market in Western Europe. EIA predicted this will rise to 28% by 2020 (see chart).

AUSTRALIA HAS BECOME DANGEROUSLY COMPLACENT ABOUT ITS ENERGY SUPPLY, contends Barry Jones, executive director of the Australian Petroleum Production & Exploration Association.

Speaking at APPEA's annual conference in Sydney last week, Jones said Australian politicians have yet to provide significant encouragement for exploration. He said that, despite industry warnings, the government has not streamlined development permitting or access to acreage, reformed the tax system, or funded oil reserves studies.

"Buying petrol from Asia does not solve any of the issues that all governments need to address. Political leaders need to ask themselves: 'What Australian assets will be sold to buy petrol from overseas when domestic production falls in the next few years?'"

Jones notes that encouraging frontier exploration would require reform in the approvals system and the fiscal regime. And promoting existing gas resources means more LNG plants, GTL facilities, and a comprehensive gas supply infrastructure.

Jones said Australian oil production is 600,000 b/d but will drop to as low as 313,000 b/d in 10 years and possibly as low as 132,000 b/d, unless more discoveries are made.

Government Developments

US lawmakers say THAT the "roadless" rule is hurtING national energy security.

A last-minute decision by the Clinton administration to restrict 58.5 million acres of federal land from development was "short-sighted" in light of tight energy supplies that have driven up fuel prices, Republicans from oil-producing states complained at a congressional hearing.

"The previous administration felt OPEC couldn't set the price of crude oil like they did in the '70s and '80s, so why should they concern themselves about import dependence?" noted Rep. Barbara Cubin, chairman of the House Subcommittee on Energy and Mineral Resources. Cubin held a joint oversight hearing with the Subcommittee on Forests and Forest Health on the energy effects of the "roadless" rule.

According to a Republican staff briefing paper, "Due to the roads initiative, some badly needed energy resources within our national forests will no longer be available for development."

Existing leases, which account for about 6 million acres in the national forest system, are not "materially" affected by the regulation, the US Forest Service testified. That includes about 759,000 acres of inventoried roadless areas considered to have high oil and gas potential.

In a US DOE funded-study completed last year, researchers from Arlington, Va.-based Advanced Resources International said an estimated (mean) 11.3 tcf of natural gas and 550 million bbl of oil could potentially underlie inventoried roadless areas.

The US "energy picture does not look good," Interior Sec. Gale Norton warns.

Norton spoke at an MMS event earlier this month honoring oil companies for safety and minerals reporting achievements. She said, "In the next 20 years, according to calculations by EIA, our nation's demand for oil is expected to jump 30% and natural gas by more than 50%.

"The reality is that our domestic production is declining. We now produce nearly 40% less oil than we did in 1970. Unless policies are changed, production will continue to decline. The projection is just over 5 million b/d by 2020, down from a high of 9.4 million b/d 30 years ago. Failure to meet this challenge may harm our prosperity, damage our national security, and may affect the way we live our daily lives."

Norton said a new spirit of cooperation could bring the nation "production of energy in a way that is environmentally safe from a steady supply of domestic sources."

She contends industry and environmentalists have much in common: "They all want to protect the environment. They all want to secure supplies of energy for America. They all want to keep our economy moving.

"America's offshore oil and gas production has an excellent safety and environmental record. Oil spills today are rare. I've been told 150 times as much oil seeps naturally from our oceans as comes about from leaks from our oil production facilities. That's despite the fact that nearly a quarter of our oil and gas production is from offshore."

Quick Takes

THE WORLD'S LARGEST FLOATING PRODUCTION, STORAGE, AND OFFLOADING UNIT IS EN ROUTE TO ANGOLA WHERE IT IS EXPECTED TO ARRIVE AT GIRASSOL FIELD IN EARLY JULY, contractors said.

Mar Profundo Girassol, a JV between Bouygues Offshore and Stolt Offshore, constructed the FPSO under a $700 million engineering, procurement, construction, and installation contract with TotalFinalElf (OGJ, July 20, 1998, p. 42). The partners completed construction of the topsides in 21 months.

The 50,000-tonne hull supports 24,000 tonnes of topsides. The Girassol FPSO will be moored in 1,400 m of water. First oil is slated to flow by the end of 2001. The FPSO has a production capacity of 200,000 b/d and a 2 million bbl storage capacity.

In other production news, Enterprise Oil said it plans to award FMC-Modec-a tie-up between FMC Corp.'s FMC Energy Systems unit and Modec International-the key $270 million contract to build the FPSO for the UK independent's Bijupirá-Salema development off Brazil. FMC-Modec has been issued a letter of intent covering delivery of an FPSO with production capacity for 70,000 b/d of oil and storage for 1 million bbl, as well as subsea equipment, for the Campos basin field complex. Under the deal, the contractor will deliver a subsea package associated with the 15 wells to be tied back to the floater, including christmas trees, risers, and umbilicals. The Bijupirá and Salema fields are located side by side 90 km off Cabo de São Tomé in water depths of 480-880 m. Enterprise expects Bijupirá-Salema, thought to hold more than 150 million boe combined, to flow at around 65,000 b/d.

Devon Energy has begun production from its North July field in the Gulf of Suez off Egypt. North July No. 1 flowed 5,500 b/d of oil and 3 MMcfd of natural gas from Rudeis at 9,790-894 ft. The well is 5 miles offshore in 169 ft of water. It is producing to a three-slot platform.

TOPPING DEVELOPMENT NEWS THIS WEEK, Shell E&P chose subsea power and umbilical cable specialist Nexans to supply and install a 135 km umbilical connecting six platforms on the oil company's $1.26 billion deepwater Na Kika development in the US Gulf of Mexico. The umbilicals, which will convey fluids, electricity, and telecommunication signals, will be laid at the Mississippi Canyon development in water depths of 2,300 m, claimed to be a record for this type of installation.

The equipment will be manufactured in Nexans' subsea cable plant in Norway, with installation work scheduled for completion early in 2003.

Shell E&P announced plans last September to develop Na Kika as a subsea complex of five independent fields-Kepler, Ariel, Fourier, Herschel, and East Anstey-tied back to a centrally located, permanently moored semisubmersible production host facility. Estimated ultimate recovery at Na Kika is more than 300 million boe.

Elsewhere on the development front, Amerada Hess has agreed to farm into Chestnut field on Block 22/2a in the UK North Sea. The agreement follows Br vig Production Services' announcement that it would not be able to fulfill its contract to develop the field, said field partner Bow Valley Energy. The contract was announced last year (OGJ Online, Sept. 13, 2000). That agreement has been canceled, and a day rate services agreement made. Amerada Hess will fund the remaining cost of the first phase of development and assume operatorship of Chestnut in return for 50% equity and a share of oil production revenues. The first phase of development is an extended well test of a newly drilled horizontal producer with subsea completion. The second phase is full development of the field. It is subject to a successful extended well test, regulatory consent, and partner approvals. Production start-up from the first phase is expected in the second quarter.

FALCON GAS STORAGE HAS ACQUIRED THE HILL-LAKE GAS STORAGE FACILITY IN EASTLAND COUNTY, TEX., FROM TXU LONE STAR PIPELINE.

Operating as a single-cycle storage facility since the early 1960s, Hill-Lake has been used mainly to serve the Abilene market during the winter heating season.

Falcon plans to add more compression, retrofit surface facilities, and drill horizontal injection-withdrawal wells to transform the Hill-Lake facility into a high-deliverability, multicycle natural gas storage facility capable of 4-6 annual inventory cycles with peak withdrawal capacity of more than 300,000 MMbtu/day. In addition, Falcon will construct a 16-mile, 20-in. high-pressure pipeline to connect the Hill-Lake facility with TXU Lone Star Pipeline's X line, as well as the North Texas Pipeline jointly owned by TXU Fuels and El Paso Natural Gas.

KOCH'S GUILTY PLEA HAS RESOLVED THE CORPUS CHRISTI REFINERY BENZENE EMISSION LAWSUIT.

Koch Industries and Koch Petroleum Group will plead guilty to one charge and pay $20 million to resolve federal allegations about benzene emission violations at Koch's 297,000 b/d Corpus Christi, Tex., refinery.

Koch Petroleum, which operates the refinery, agreed to plead guilty to concealment of information over a 3-month period in early 1995. It will pay a $10 million fine and $10 million for community service projects in and around Corpus Christi as a condition of probation.

In other refining sector news, SA de la Raffinerie des Antilles awarded Technip the engineering design contract for a major expansion of its 17,000 b/d refinery near Fort-de-France, Martinique. The expansion will bring the refinery's production into compliance with the evolution of the market and applicable 2005 quality standards for refined products. The expansion will include the addition of new units and the revamping of existing units, as well as related work necessary to adapt storage and utilities. The engineering contract covers the first phase of the project.

DUSHANZI PETROCHEMICAL HAS SET ANOTHER EXPANSION FOR ITS POLYETHYLENE PLANT IN CHINA.

Dushanzi Petrochemical will further increase the capacity of its polyethylene plant at Dushanzi, Xinjiang Province, China.

The company will use BP's proprietary Innovene polyethylene technology to increase the linear low density polyethylene and high density polyethylene capacity of the plant by 40,000 tonnes/year to 190,000 tonnes/year in 2002.

An initial increase of the plant's polyethylene capacity to 150,000 tonnes/year, announced in June 2000, is also expected to be completed in 2002 (OGJ Online, June 30, 2000). The plant originally came on stream in 1995 at 120,000 tonnes/year of capacity.

ROUNDING OUT EXPLORATION NEWS THIS WEEK, Transocean Sedco Forex's Transocean Arctic semisub drill rig has spudded an exploration well on Production License 257 in the Haltenbanken area of the Norwegian Sea for Statoil, with a view to proving natural gas and condensate in the northern part of the Erlend structure. The well, 5 km west of the high-pressure, high-temperature Kristin field that straddles Blocks 6506/11 and 6406/2, will be drilled to a TD of some 5,000 m. Drilling is expected to take 76 days, said Statoil. The partners in the licenses being explored are considering developing Kristin via a floating production platform equipped with gas and condensate processing facilities in order to build in maximum flexibility to accommodate potential tiebacks from other reservoirs in the area. Reserves in Erlend, Kristin, and two other adjacent Haltenbanken fields are estimated at 140 billion cu m of gas and 440 million bbl of oil and condensate.

In other exploration news, Abraxas Petroleum tested a South Texas well at absolute open flow potential of 16 MMcfd of natural gas from the Wilcox formation. Dimon No. 1, in Muy Bueno field in Goliad County, Tex., was drilled to 10,000 ft TD. It found pay in the Wilcox, Yegua, and Frio formation. The well has been on production since Mar. 1 at a restricted flow rate; it is producing 2 MMcfd of gas and 70 b/d of condensate with 4,000 psi flowing tubing pressure. F Esso Exploration Angola has made a 10th oil find on Block 15 off Angola. Mbulumbumba-1 is in 2,790 ft of water 220 miles northwest of Luanda. It was drilled to 12,400 ft TD. Other details were not disclosed. x Devon Energy had a discovery in the southern Gulf of Suez with a well in the southwest Gebel El-Zeit concession, 6 miles offshore in 86 ft of water. The SWGEZ-2 well flowed at a combined rate of 6,700 b/d of oil and 2.4 MMcfd of natural gas from two intervals in Nubia-Matulla at 7,786-894 ft. The well was drilled to TD of 8,040 ft.

GREENPEACE ACTIVISTS DISEMBARKED FROM A SANTE FE INTERNATIONAL RIG conducting cementing operations for BG at its UK North Sea Blake field last week, after BG obtained an injunction against the environmental group.

BG said the rig has resumed work at the field on Block 13/24 in the Outer Moray Firth. BG has not decided whether to take further legal action against Greenpeace. Six Greenpeace protestors had occupied the rig since Apr. 6. The protest came 5 days after 21 Greenpeace activists waylaid a rig under contract to Conoco in Scotland's Cromarty Firth as it prepared to begin a drilling campaign.

US WEST GAS PIPELINES ARE SCRAMBLING TO BUILD NEW CAPACITY TO ENERGY-STARVED CALIFORNIA.

FERC has authorized a unit of Williams to expand its capacity on the Kern River pipeline.

The $81 million expansion would add 135 MMcfd of limited-term, incremental transportation capacity from Wyoming to California by July 1 to help meet energy demand this summer.

The proposal, filed as a California Emergency Action application with FERC, will increase Kern River capacity by 19%. Kern River's pipeline system was built to provide up to 700 MMcfd of year-round, firm transportation services. Kern River's system extends 900 miles from its Wyoming receipt points through Utah and Nevada to the San Joaquin Valley near Bakersfield.

Meanwhile, Questar Pipeline said it has secured a long-term gas-transportation contract for the entire initial capacity on the eastern zone of its Southern Trails Pipeline project.

The 705-mile pipeline from Blanco, NM, to Long Beach, Calif., is divided into east and west zones. The former has the capacity to transport 78.5 MMcfd from multiple receipt points in the San Juan basin to the California state line.

Questar Pipeline bought Southern Trails Pipeline in 1998 from ARCO Pipe Line (now BP). The line originally moved crude oil but Questar will convert it to move gas.

In other pipeline action, Petronas has signed a 20-year agreement to buy natural gas from Pertamina. Petronas will buy up to 250 MMscfd of gas, or a total of 1.5 tcf over the contract period. Delivery of the gas from Conoco-operated Block B in the West Natuna Sea will begin by mid-2002. The gas, worth $4 billion, will be transported via pipeline to Petronas' Duyong field facilities in Malaysia. The production unit for the block is en route from South Korea (OGJ Online, Mar. 27, 2001).

US GAS SUPPLY CONCERNS ARE REVIVING THE COUNTRY'S LNG BUSINESS.

FERC has approved the request of CMS Trunkline LNG, a unit of CMS Energy, to expand the peak send-out capacity of its LNG terminal at Lake Charles, La. That 700 MMcfd terminal is the largest operating LNG facility in the US, said CMS.

The approval authorizes the terminal to increase send-out capacity to 1 bcfd. CMS is evaluating a further expansion to 1.3 bcfd. CMS expects to begin work immediately and have the peak capacity available by June. Modifications to the CMS Trunkline LNG facility will eliminate operational bottlenecks in the regasification process, said CMS.