Anadarko focusing overseas for double-digit growth atop strong North American foundation

Anadarko Petroleum Corp., Houston, the world's largest independent exploration and production company, isn't shy about venturing overseas to boost its 2 billion boe reserve base.

The company claims a No. 1 ranking for upstream independents both in terms of reserves and market capitalization.

Anadarko is active in 13 countries outside North America, including Tunisia, Egypt, Venezuela, and Australia. And it recently announced plans to return to Algeria, where it will hold a 50% stake in an amended production-sharing agreement with state-owned Sonatrach (OGJ Online, Mar. 26, 2001). Mimicking the majors, the company will increase capital spending for an ambitious exploration program outside North America, increasing its budget for that category to $450 million this year from $240 million in 2000.

Unlike the majors, however, Anadarko's main focus remains North America, where it is the most active driller. And more than any other region, North America is where major obstacles remain, frets Anadarko Chairman and CEO Robert J. Allison Jr. He complains the US government has prevented him from doing business in his own back yard.

"[During previous oil price slumps], prices were so low that industry couldn't afford to drill in this country. Politicians did not adequately balance cost versus benefits in environmental regulations. Now we are reaping the whirlwind," Allison told OGJ Online on the sidelines of the Howard Weil investment conference in New Orleans late last month.

"We are critically short of natural gas, we are importing 60% of our liquid needs, and this is ridiculous. Still, we won't drill off the East Coast, we won't drill off the West Coast, we won't open up 10% of the coastal plain of ANWR [the Arctic National Wildlife Refuge in northeastern Alaska]. We have over 100 million acres in the Rocky Mountains that is off-limits. We have tremendous roadblocks."

Allison, however, makes no secret of his enthusiasm about the change in US presidential administrations.

He said in an interview that he is confident President George W. Bush, a former wildcatter, "will do what he can" for US-based companies seeking increased access to public lands, "but Congress still has a say in all that too."

A vast potential natural gas resource exists in North America-1,258 tcf in the US alone (see related story, p. 22)-but access is still difficult and expensive, Allison says. And the most economical means to achieve large production increases would be to allow access to underexplored offshore areas. Moratorium areas (federal offshore lands where drilling is prohibited) could yield 184 tcf of gas, according to the industry-led Potential Gas Committee report of 1998 cited by Allison in his talk with investors.

"But once exploration begins, reserves could increase by 5-10-fold," Allison said. "And we haven't even figured out yet how much production is trapped by the roadless rule." (Late in the administration of President Bill Clinton, the Forest Service issued a rule blocking road construction on 58.5 million acres in 38 states, or 31% of national forest lands.)

Anadarko wants to expand its holdings in the Rockies, now restricted by the roadless rule. It also wants to acquire federal lands targeted for development, such as the National Petroleum Reserve-Alaska.

Bigger and better

Anadarko will "run with the pack" to maintain shareholder value, Allison said recently in a briefing for analysts and investors. Historically, that has meant adding reserves-and thus shareholder value-with the drillbit. But with industry consolidation changing the dynamics of the E&P sector, Anadarko has followed suit, nearly doubling its reserves in July 2000 through a merger with Union Pacific Resources Inc.

Yet unlike other recent industry mergers, Anadarko says their combination "was about growth, not cutting costs."

To that end, the company says it will devote over half of its 2001 capital budget, about $2.4 billion, to explore for and develop gas in North America (OGJ, Apr. 9, 2001, p. 20). "It's going to be a busy year," said Allison.

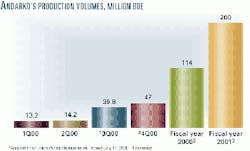

Company-wide, Allison predicts dramatic production increases with 200 million boe targeted this year, up from 114 million boe in 2000 (see chart, this page). Looking ahead to 2002 and 2003, Allison projects "double-digit growth" fueled from plays in the deepwater Gulf of Mexico, East Texas, Algeria, Canada, Venezuela, and the Rocky Mountains.

The company was a major player in the recent federal central Gulf of Mexico lease sale. Anadarko was apparent high bidder on 23 tracts, 16 of them in deep water (OGJ Online, Mar. 28, 2001). Allison also said his company is interested in the controversial federal Lease Sale 181 in the eastern gulf, scheduled for December.

In the nonrestricted central and western gulf, Anadarko plans eight deepwater exploration wells this year. In the gulf subsalt province, it expects to drill seven exploratory wells and one development well.

Onshore, the company's Bossier play, which cuts a 60-mile swath across East Texas, was Anadarko's most active drilling area in 2001, adding 48 bcf/year of gas production. The company plans to aggressively expand its exploration program there, spending $138 million for 36 exploratory wells. "This area has a high ratio of return," Allison noted. "During the past year, some wells paid out in a matter of weeks."

Another big spending item this year is due to Anadarko's recent acquisition of Berkley Petroleum Corp., Calgary (OGJ Online, Feb. 13, 2001). Allison said Anadarko plans to increase capital spending plans for its Canadian operations by 49% to $386 million this year. Anadarko originally set a $259 million budget for Canadian operations this year (OGJ Online, Mar. 27, 2001).

Anadarko is the sixth most active driller in Canada and plans to increase its peak winter activity from 28 rigs in the 2000-01 winter drilling season to as many as 35 rigs next winter.

In addition, Anadarko Canada expects to run 15 rigs this summer in Alberta, British Columbia, and Saskatchewan.

The Berkley acquisition increased Anadarko's Canadian reserves 42% to 312 million boe, of which 65% is gas. It also increased the company's acreage in Canada to 4.7 million acres from 3 million.

Takeover target

Anadarko's vastly expanded portfolio has fueled speculation that it could be a takeover target of a major oil company, given that fellow independent Barrett Resources Corp., Denver, is wrestling with a hostile bid by Royal Dutch/Shell Group.

Allison won't deny a major might be interested, especially given what he sees as the company's "undervalued" stock.

Analysts say companies such as Anadarko, Barrett, and Burlington Resources Inc., Houston, are victims of their own successes. These companies have done too good a job turning around US properties that the majors abandoned 10 years ago, they say.

In Anadarko's case, Allison doesn't argue that his company is an attractive target. Still, he dismisses Wall Street talk that he is trying to get the company ready for sale, although "if it makes sense to the shareholder, we have to listen."

Anadarko is one of several industry players that analysts have said also are reportedly looking at Barrett, which dismissed a $55/share offer last month from Shell. Allison did not express interest in Barrett, but noted Anadarko is "always looking for good opportunities to grow the business."

"[The US is] critically short of natural gas, we are importing 60% of our liquid needs, and this is ridiculous. Still, we won't drill off the East Coast, we won't drill off the West Coast, we won't open up 10% of the coastal plain of ANWR. We have over 100 million acres in the Rocky Mountains that is off-limits. We have tremendous roadblocks."