OGJ Newsletter

Market Movement

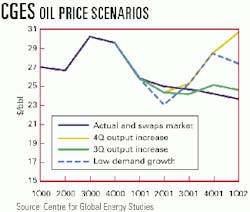

OPEC accord ensures another oil price spike on the horizon

Another hefty oil price spike is headed this way, judging from an emerging consensus among analysts.

Amid all the entrail-divining going on in the wake of OPEC's agreement to cut production again-this time by 1 million b/d-in order to stave off a price slump in the second half, the only disagreement about a price spike is the timing.

Generally, the post-OPEC meeting view of oil markets in 2001 is that a price spike could come in May or June, if US gasoline demand remains strong in the face of higher prices. Or it could come in the fall, when refiners must begin rebuilding heating oil stocks.

London think tank Centre for Global Energy Studies, in analyzing Saudi Arabia's budget, suggests that one factor in this shift in Saudi policy "may be the kingdom's need for higher prices to meet its spending plans and retire some of the country's soaring debt."

Whatever the Saudis' rationale, CGES contends that OPEC has made a misstep: "Atlantic Basin deliveries will fall as a result of the latest output cut just when refinery demand increases by around 1-1.5 million b/d, as plants come out of turnaround and refiners seek to build product stocks ahead of the summer."

If prices don't rebound as OPEC expects, the group is likely to undertake still a further cut in production. While that would help OPEC sustain $25/bbl in the short term, it would also cause prices to spike dramatically later this year, CGES contends.

Global economy outlook

All of the projections of oil prices must be considered against the short-term economic outlook.

Optimists see a brief dip in the US economy, followed by a swift recovery with limited ripple effects on Asia or Europe. In this case, CGES expects global oil demand to increase by 1.3 million b/d this year.

Pessimists see a longer recession in the US, followed by a slowdown in Asia as that region's export markets contract. In this case, CGES sees the year's rise in oil demand as less than 1 million b/d.

"A $25/bbl oil price will do nothing to stimulate oil demand growth," CGES said. "If the global economy follows the more-pessimistic path, then OPEC will need to keep cutting output to maintain a price of $25/bbl.

"The longer oil prices remain high, though, the more likely it becomes that the global economy will indeed enter a prolonged period of slowdown.

"OPEC, with its fixation on $25/bbl oil, appears to be intent on undermining the market for its own oil and with it the economies of its members."

Supply, demand, and price forecast

In the short term, it looks as if OPEC has done the right thing by cutting production. CGES estimates that a cut in actual production (vs. just the nominal quota reductions) of 700,000 b/d to 27.2 million b/d should yield a Brent price of $24.40/bbl in the second quarter-which equates to an OPEC marker basket price within the price band target but a bit short of $25/bbl.

But if OPEC maintains output at 27.2 million b/d over the summer, then Brent would climb back up to about $25/bbl.

"However, refiners will be unable to replenish gasoline stocks in advance of the driving season and will have to maximize gasoline production over the summer at the expense of heating oil."

That would leave dated Brent averaging $28.70/bbl in the fourth quarter (which implies a repeat of last year's price spikes over $30/bbl) and averaging more than $30/bbl in first quarter 2002 (see chart).

If OPEC were to instead boost output by 1 million b/d early in third quarter 2001, however, that would put Brent at $24-25/bbl in the second half. Another hike, of 1 million b/d, would be needed at the start of 2002 in order to prolong this "stability" into first quarter 2002, CGES predicts.

If OPEC cuts output again in the face of weakening demand, it will need to make a further big cut in output-perhaps 1.4 million b/d in early May-in order to sustain $25/bbl.

"However, a huge, 4 million b/d output increase would then be required to prevent prices from rising almost uncontrollably in the final quarter of the year."

null

null

null

Industry Trends

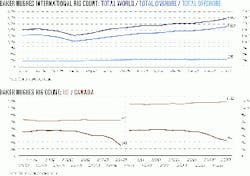

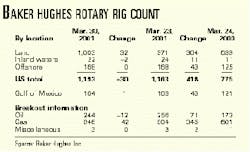

THE US ROTARY RIG COUNT HAS HIT ITS HIGHEST LEVEL IN OVER 10 YEARS.

US drilling activity increased by 30 rigs the week ended Mar. 30, with a total of 1,193 rotary rigs working across the country and in coastal waters, Baker Hughes said (see table).

The tally was the highest US rig count since Nov. 23, 1990, and compares with a tally of 775 rigs operating at this time a year ago. The number of US rigs drilling for oil decreased by 12 to 244. Natural gas is providing the drilling momentum, with 946 rigs drilling gas prospects.

And offshore rig utilization remains robust. The ODS-Petrodata Group last month reported a net increase of one mobile offshore rig under contract worldwide. With 572 rigs under contract out of a total fleet of 649, global offshore rig utilization was 88.1%. That is the highest level since Oct. 2, 1998, when utilization was at 88.7%.

Rig utilization in the US Gulf of Mexico rose by a net one-rig in- crease the week ended Mar. 30. Of the 210 mobile offshore drilling rigs available in the region, 186 had contracts, for a US gulf rig utilization of 88.6%.

European offshore rig utilization remained unchanged for the fourth consecutive week at 92.1%.

WORLD DEMAND FOR POLYOLIFINS IS EXPECTED TO GROW 6-8% YEAR UNTIL 2005 according to Chemical Market Associates Inc. That figure is 1.5-2.5 times world gross domestic product projected for the same period, said CMAI.

The consultant said the polyolefins industry "experienced an extraordinary global transition during the 1998-2000 time period. Impacting the industry were such factors as poor economies in Asia, unexpected plant outages, high energy costs in North America, inventory swings from converter to producer, large new capacity, changing trade patterns, and volatile pricing."

The report also predicts that per capita consumption of polyethylene and poly- propylene resins worldwide is expected to grow for several years. Polyethylene consumption, for example, is expected to grow to 10.6 kg per capita in 2005 from 1999's 8.3 kg.

Per capita polypropylene consumption is expected to reach 6.4 kg in 2005, up from 4.8 kg in 1999.

CMAI said, "Polymer production facilities being built today are significantly larger than they were just a few years ago. The average size of a world-scale plant today ranges from 250,000 to 450,000 [tonnes]/year. New advances in operating and catalyst technology will allow new and existing facilities to be even more productive in the years to come."

Government Developments

THE US HOUSE BUDGET COMMITTEE REMOVED ANWR REVENUES FROM ITS PROPOSED BUDGET.

US lawmakers who endorse the oil industry's urging that the ANWR coastal plain be opened to drilling are seeking to reshape the debate thorough a less confrontational style.

Last month, the House budget committee-recognizing strong congressional opposition to ANWR exploration-approved a fiscal 2002 federal budget that does not include bonuses from a potential ANWR lease sale. Previously, budget outlines had allotted the $1.2 billion that the government expected from such a sale.

Sen. Pete Domenici (R-NM), chairman of the Senate budget committee contends he would not put expected ANWR revenues in the Senate budget bill if any Republican on his committee objected.

However, opponents to ANWR drilling expect the issue will be revived later.

A US SENATOR URGES THE INDUSTRY TO PUSH FOR PUBLIC LANDS EX- PLORATION.

If the oil industry wants to expand drilling on public lands, it needs to do a better job selling itself to those "outside the oil patch," Sen. John Breaux (D-La.) told a National Ocean Industries Association meeting in Washington, DC.

"The story is not being told as much as it should be," Breaux said. The conservative Democrat is seen as a key powerbroker in an evenly divided US Senate. It's not pretty; it's not fun to deal with people that don't know an oil field from a battlefield, but it has to be done," if companies expect to see comprehensive energy legislation pass this year.

One recommendation Congress will never approve is opening the coastal plain of ANWR to drilling, Breaux predicted.

But industry can make the best of a bad situation by lobbying "gettable" people in Congress on the benefits of offshore drilling.

ALASKA GOV. TONEY KNOWES said he expects the state legislature to pass a bill prohibiting construction of an offshore pipeline from Prudhoe Bay via the Beaufort Sea to Canada's Mackenzie Delta.

Knowles said Alaskans want North Slope gas transported to the Lower 48 through a pipeline across Alaska.

Knowles says Senate Bill 164 has overwhelming support in that body. He also expects the Alaska House will approve the measure. The bill would prohibit rights-of-way for a gas line on state-owned submerged land in the Beaufort Sea, effectively blocking a potential pipeline from Prudhoe Bay field to the Mackenzie Delta and connecting with a proposed Mackenzie Valley pipeline.

Quick Takes

TOTALFINAELF HAS BEGUN PRODUCTION FROM ELGIN FIELD IN THE CENTRAL GRABEN AREA OF THE UK NORTH SEA.

First production of 13,500 b/d of condensate and 42 MMcfd of natural gas came 4 years after the Elgin-Franklin gas-condensate field development began.

TotalFinaElf said production would reach 140,000 b/d of condensate and 460 MMcfd of gas following start-up of Franklin field in August.

Cost of the Elgin-Franklin development is £1.65 billion. Each field has its own wellhead platform. Production is processed through a production-utilities-quarters platform installed last summer at Elgin.

TotalFinaElf said the project is the largest high-pressure, high-temperature development in the world (1,100 bar and 200° C.). The fields also are the deepest in the UK North Sea at 5,500 m, the company said.

Elgin is on Blocks 22/30b, 22/30c, and 29/5b, and Franklin is on Block 29/5b. The water on both blocks is about 92 m deep.

In other production news, US DOE said last month a government-industry experiment has revived a central California lease that was shut in during 1986 with 85% OOIP unproduced. It has resulted in the production of more than 1 million bbl of oil once thought unrecoverable. The project was on the Pru Fee lease, part of giant Midway-Sunset field 30 miles southwest of Bakersfield. DOE said the 1 million bbl produced in the last 5 years is more than half as much oil as the property produced in all of its first 80 years of operation. Project sponsors predict that the advanced technologies-involving creation of new 3D reservoir models based on new wells and recalibration of logs-ultimately will result in more than 4 million bbl of recovery. The project was one of several in DOE's Reservoir Class Oil Field Recovery program OGJ, Aug. 8, 1994, p. 73).

The Texas Railroad Commission says that requests for oil and natural gas well records, production reports, geological data, and research information can now be made through the agency's website. TRC said parties can contact the commission at www.rrc.state.tx.us to obtain information on its 132 million pages of documents collected for more than 1 million wells in 68,000 oil and gas fields. In addition to well records and data, parties can request hearing files from 1920 to the present, including new field designations, statewide rules, docketed hearings, field rules, and fluid injection hearings.

NEW LNG TRAINS TOP THIS WEEK'S GAS PROCESSING NEWS.

Participants in the North West Shelf Venture off Australia have approved a long-anticipated fourth train at the LNG plant on the Burrup Peninsula.

The $1.6 billion (Aus.), 4.2 million tonne/year train will be the largest LNG train in the world, said Woodside Petroleum, operator of the venture.

Design work on the $800 million (US) train will be done in Perth. Construction of the train is expected to begin in September 2001. First production is expected to begin in mid-2004.

Meanwhile, Qatar's Ras Laffan LNG Co. II (RasGas II) and a JV have signed an engineering, procurement, and construction contract to build a new LNG train and related onshore facilities at Qatar's RasGas complex. The JV consists of Chiyoda and Mitsui, along with Snamprogetti, the engineering and main contracting arm of ENI. In addition, RasGas and J. Ray McDermott Middle East (Indian Ocean) signed a separate engineering, procurement, and construction contract to build the offshore facilities and a 90-km pipeline. The project consists of offshore production, transportation, and liquefaction facilities to produce 4.7 million tonnes/year for the Indian LNG consortium Petronet LNG under an existing sale and purchase agreement. The agreement involves deliveries of 5 million tonnes/year to a planned import terminal at Dahej, Gujarat, and another 2.5 million tonnes/year to a planned import terminal at Cochin, Kerala. Deliveries to Dahaj are slated to begin in late 2003 using existing LNG trains at the RasGas plant until the RasGas II train is completed. Work has already started on the new train, with production slated to begin in 2004.

In other gas processing happenings, Pemex has awarded PYPSA a $5 million engineering, procurement, and construction contract to modernize 10 sour gas treatment plants at the Cactus petrochemical complex in Chiapas, Mexico. PYPSA also announced it has nearly completed a $13 million contract to rehabilitate the No. 7 Pemex compression station at Cempoala, Veracruz. Under the latest contract, PYPSA will integrate 10 coalescing filters in the sweetening units. The total capacity of the units is 1.8 bcfd. It will also rehabilitate five horizontal filters and will change the gas piping of nine heat exchangers. Upgrades to the Cempoala facility are expected to be completed in June, and the Cactus gas treatment units are scheduled to start-up in mid-September.

TOPPING EXPLORATION NEWS THIS WEEK, a successful appraisal well both confirmed earlier commercial expectations of the deepwater Gunnison prospect in the Gulf of Mexico and extended its reservoir boundaries more than a mile to the west of the discovery well, two of the partners in that project said.

The Garden Banks 668 No. 2 well, drilled 1 mile to the west, and a follow-up sidetrack, drilled updip 1.5 miles, confirmed the lateral extent and continuity of reservoirs encountered in the discovery, said officials of both Kerr-McGee and Nexen Petroleum.

Nexen Petroleum parent Nexen Inc. said the wells "confirmed our seismic model of the area, giving us confidence in our original estimate of Gunnison area reserves in the 150-250 million [boe] range."

Elsewhere in the world of exploration, Santos made a gas discovery in the western district of Australia's Victoria state, 15 km northwest of Port Campbell. The Tregony-1 well was drilled to a TD of 1,817 m and penetrated a 55-m gross hydrocarbon column in the Late Cretaceous Waarre sandstone. Wireline logs indicate 42 m of net gas pay over the interval 1,652-1,708 m. The well is expected to go on stream at 10-15 MMcfd of gas at midyear.

NORSK HYDRO HAS RECEIVED APPROVAL TO DEVELOP FRAM WEST AND VALE FIELDS OFF NORWAY.

The Norwegian Ministry of Petroleum last month approved Norsk Hydro's plans for development and operation of Fram West and Vale fields in the North Sea.

Fram West will be developed at a cost of some 4 billion kroner ($440 million) via subsea templates, with four wells tied back to Hydro's nearby Troll C platform for processing. Reserves are 100 million bbl of oil and 8 billion cu m of natural gas. First flow from Fram West is scheduled for October 2003, with production ramping up to a plateau rate surpassing 60,000 b/d, according to Hydro E&P's Lars Christian Alsvik.

The 880 million kroner ($100 million) Vale gas-condensate field will be developed as a subsea satellite tied back to the Heimdal riser platform. Reserves are 2.5 billion cu m of gas and 21 million bbl of condensate. First flow from Vale is set for June 2002.

In other development action, Elf Petroleum Nigeria revealed more details about the company's development plans for Amenam-Kpono field, the largest shallow-water development in the Niger Delta area. Elf expects initial production of 125,000 b/d by mid-2003. The field is located in 40 m of water 30 km off the Nigerian coast. Elf Nigeria said that reserves are more than 1 billion boe and that production would total 500 million bbl over 25 years. Out of the 16.5 million cu m/day of associated gas produced, 15.6 million cu m/day would be reinjected to maintain reservoir pressure, improve energy efficiency, and reduce greenhouse gas emissions. The development plan calls for 31 wells: 18 production, 6 gas injection, 3 deviated water injection, and 4 water production. All the wells would be drilled with two jack ups over 3 years, starting in the first quarter of 2002.

ROUNDING OUR REFINING NEWS THIS WEEK, BP said investments at its Lavera refining-petrochemical site on the French Riviera will make it one of its "star sites," the other two being Grangemouth,UK, and Texas City, Tex.

BP said the goal is to make the site strategically attractive and competitive, improve its reliability, and make it as environmentally clean as possible. Large investments are taking place for maintenance as well as modernization of both the 210,000 b/d refinery and the petrochemical units. BP recently spent 840 million francs on refining and chemicals improvements. A cracker is getting a debottlenecking to boost capacity to 270,000 tonnes/year from 235,000 tonnes/year, and an amines unit is being expanded to 50,000 tonnes/year from 30,000 tonnes/year. The refinery's sulfur furnace is being modified to reduce emissions. All petrochemicals and refinery units should be back on stream by late May.

Among other refining news, Indian Oil Co. plans to expand and modernize its Digboi refinery, which first came on stream in 1901. The project will cost 17 billion rupees ($360 million). Once work is complete, capacity will increase to 1 million tonnes/year from the current 650,000 tonnes/year. The refinery will get a new hydrotreater that will allow it to make diesel with less than 0.05% sulfur.

The US Trade and Development Association has granted Petroperu $346,000 to finance a feasibility study for upgrading its 62,000 b/d Talara, Peru, refinery to meet fuel standards recommended by the World Bank. Energy and Mines Minister Carlos Herrera has estimated it would cost $315 million to upgrade the refinery to meet these recommendations.

US FERC HAS APPROVED THE FIRST MILESTONE IN THE CENTENNIAL GAS PIPELING CONVERSION.

FERC has given Trunkline Gas, an affiliate of CMS Energy, permission to abandon a gas pipeline, a prelude to its conversion to a petroleum products line.

Trunkline, Marathon Ashland Petroleum, and TEPPCO partners plan to convert the 26-in. line, one of Trunkline's three parallel gas lines, to carry gasoline, diesel, and jet fuel from Gulf Coast refineries to midwestern markets (OGJ Online, Feb. 5, 2001).

The 720-mile line, dubbed Centennial Pipeline, extends from Longville, La., to Bourbon, Ill.

As part of the project, the partners will extend Centennial by building a 74-mile, 24-in. pipeline connecting TEPPCO's facility near Beaumont, Tex., with the start of the existing line.

Centennial Pipeline will intersect TEPPCO's existing mainline in southern Illinois, where a petroleum products storage facility is under construction. The project is expected to be completed by yearend.

In other pipeline news, BC Gas this month will seek expressions of interest in an expansion of its British Columbian South- ern Crossing pipeline. The proposed expansion, dubbed the Inland Pacific Connector project, would extend the existing 303-km system 260 km to Huntingdon, BC. Late last year, the $376 million (Can.) Southern Crossing gas pipeline from Yahk to Oliver came on stream. BC indicated the $460 million (Can.) expansion project will help meet rising demand for gas in southern British Columbia and the US Pacific Northwest. Although further study and regulatory approval is needed, BC Gas said the line could come on stream by late 2003.

J. Ray McDermott will install pipelines for Shell E&P's Crosby field in the deepwater Gulf of Mexico. Under the contract, J. Ray McDermott will install 10 miles of dual 8-in. by 12-in. pipe-in-pipe steel flowlines from Crosby field, on Mississippi Canyon Block 899, to Ursa, a Shell TLP on Mississippi Canyon Block 809. Water depths are 3,802-4,400 ft. Steel catenary risers and topsides equipment will be installed at the Ursa platform as well as a 220-ton subsea manifold at Crosby field. The oil and gas pipelines will be installed this summer.

Correction: In the US rig chart (OGJ, Mar. 19, 2001, Newsletter, p. 7), the years 2000 and 1998 were incorrectly transposed.