Gulf sale draws fervent interest

Royalty relief incentives to drill for deep gas in shallow waters, along with the continuing attraction of deepwater Gulf of Mexico exploration, were the drivers in a strong central gulf lease sale Mar. 28.

Apparent high bids in the sale totaled $505,468,501. Ninety companies filed 780 bids exposing $663,406,963 for 547 tracts. The government offered 4,390 blocks in the central gulf planning area off Louisiana, Mississippi, and Alabama.

The US Minerals Management Service held the sale in New Orleans, La. The sale was billed as Part 1 of Sale 178. Part 2 will be held concurrently with western gulf Sale 180 in August. It will contain some of the blocks in the central gulf portion of the "Western Gap," an area subject to a recent US-Mexico boundary agreement.

The Mar. 28 sale drew 60% more bids than the central gulf sale a year ago, No. 175, which netted $292,771,205 in high bids. That sale drew 469 bids from 63 companies on 344 blocks (OGJ, Mar. 20, 2000, p. 34).

Smaller companies bid heavily.

The top ten bidders of the sale were (in order): Exxon Asset Management Co. at $89 million, Kerr-McGee Oil & Gas Corp. $59 million, Samedan Oil Corp. $40 million, Murphy Exploration & Production Co. $39 million, BP Exploration & Production Inc. $36 million, Anadarko Petroleum Corp. $33 million, Dominion Exploration & Production Inc. $32 million, Spinnaker Exploration Co. LLC $32 million, Shell Offshore Inc. $28 million, and Chevron USA Inc. $27 million.

Acting MMS Director Tom Kitsos said, "We are very pleased with this sale. Strong bidding by the independent oil and gas companies was a major part of the sale, and we are particularly pleased with the high interest shown in the shallow water area where deep gas deposits may be present."

Kitsos noted that 11 companies in the sale were first-time bidders.

High bids

Exxon submitted the highest bid for a single tract: $26,115,000 for Mississippi Canyon Block 912. This block also received the highest per acre bid at $4,533.85.

The block, which is in more than 1,600 m of water, also drew three other bids, from Amerada Hess Corp., Nexen Petroleum Offshore USA Inc. (formerly Canadian Occidental Petroleum Ltd.), and BP.

Kerr-McGee submitted the second highest bid in the sale: $18,378,000 for Green Canyon Block 680. Exxon had the third highest bid in the sale with $18,315,000 for Mississippi Canyon Block 956. That tract also drew the most bids, six.

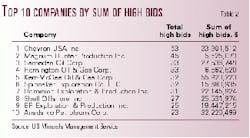

Chevron had the most high bids for tracts, 53, totaling $23.9 million. Magnum Hunter Production Inc. was second with 45 high bids totaling $5.5 million. Third was Samedan with 33 high bids totaling $27.5 million.

Bid strategies

The shallow water gulf-acreage in less than 200 m of water-drew the highest amount of total bids, $227,653,997.

But, not surprisingly, companies paid heavily for deepwater acreage as well. Blocks in more than 800 m to 1,599 m of water drew $195,355,512 in total bids, while ultradeepwater tracts, in depths greater than 1,600 m, fetched bids totaling $171,911,962.

The deepest block receiving a bid was Walker Ridge Block 146 in 2,365 m of water. Chevron USA Inc. bid for that block.

David Pursell, an analyst with Simmons & Co. International, Houston, said the consulting firm was watching whether the MMS's royalty relief for deep gas from shallow water acreage would be enough of an incentive to draw majors and the larger independents closer toward the gulf coast.

An anticipated mantra of the sale might have been "shallow water, drill deep," he said.

Among the more interesting things about this most recent central gulf sale, Pursell said, was that the deepwater blocks' winning bids drew the highest dollar amount per acre.

Pursell said in the 1998 central gulf lease sale, deepwater tracts receiving winning bids averaged $191/acre. In Sale 178, those blocks' winning bid was $281/acre.

Spinnaker said it and partners Murphy Oil Corp. and Dominion submitted 10 apparent high bids near its Front Runner discovery in the Green Canyon area (see p. 43).

Independents elated

Independents said they were pleased with the tracts they won, subject to award.

Luke R. Corbett, Kerr-McGee chairman and CEO, said, "As the number one independent leaseholder in the gulf, we have built a solid inventory of deepwater leases in high-potential core areas."

Kerr-McGee was high bidder on 32 leases. If all are awarded, the company will hold interests in more than 550 leases in the gulf, with 345 of them in deepwater.

Anadarko Petroleum Corp., Houston, was the apparent high bidder on 23 tracts, 16 of them in deep water. Anadarko is a key operator in the gulf's subsalt play. Anadarko already held 335 gulf leases, including 58 in deep water and 150 subsalt.

Stephen Smith, analyst for Dain Rauscher Wessels in Houston, said the sale was strong compared with those of the last few years although below the record 1997 central gulf sale that brought $824 million in high bids.

"It does suggest the companies are financially healthy and trying to focus on deep water. There also seem to be some companies looking on the shelf for deeper prospects," particularly for gas prospects in shallow water, Smith said.

For instance, Chieftain International Inc., Edmonton, Alta., and its partners submitted apparent high bids for 17 blocks, of which 14 are on the shelf and three are in deep water. Chieftain would hold interests in 169 blocks if all 17 bids are accepted.

Other sale details

Nexen said it bid high on five shallow-water and seven deepwater blocks, the latter near Green Canyon Block 243, where the company is completing the drilling of its Aspen prospect. The shelf blocks are in the Eugene Island and West Cameron areas.

Unocal Corp.'s Gulf Region USA and Deepwater USA business units were apparent high bidders for seven shelf blocks and six deepwater tracts. Before this sale they held 474 leases, including 226 exploratory leases in deep water, 114 exploratory leases on the shelf, and 134 shelf development tracts.

Mariner Energy Inc. was apparent high bidder alone or with a partner on three of four blocks on which it bid. All are in 3,600-4,400 ft of water. Mariner has operated nine deepwater gulf field developments since 1995.

Wiser Oil Co., Dallas, in its gulf debut, said it has an exploration agreement to participate with Remington Oil & Gas Corp. and Magnum Hunter under which six shelf prospects will be drilled this year. The first, on Eugene Island Block 302, was to spud in April.