OGJ Newsletter

Market Movement

IEA ratchets down demand forecast

Higher oil prices and a slowing economy-a slowdown that those higher oil prices are contributing to-are cutting into oil demand growth.

In its March oil market report, IEA lowered its projection for 2001 world oil demand for the fourth consecutive month, this time by 110,000 b/d. The reasons cited for the latest revision are oil price effects, a milder than anticipated winter, and a sluggish North American economy.

Global oil stocks are key indicators of the market. The latest data show that there was a more modest than average draw on crude stocks in the fourth and first quarters, a time when stocks are usually drawn down to meet peak global demand. But, in spite of weakened demand, OECD industry stocks remain low by historical standards. And they are not being rebuilt (see table). In fact, the number of days of forward stock cover for crude and products in OECD countries is at its lowest point since 1991. This is before the full effects of the February OPEC cuts have hit the market.

Demand typically drops off considerably in the second quarter. A few days after IEA's latest oil market report was released, OPEC agreed to further quota cuts effective in April (see related story, p. 28). This ensures that, with prices remaining relatively high and days of forward stock coverage low, the market will be strong during the second quarter.

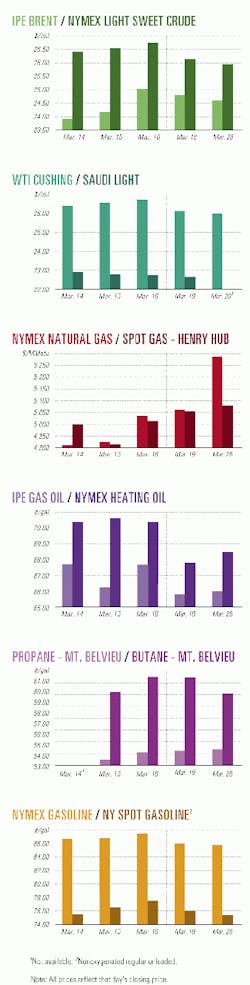

Futures prices, refining margins slip

The NYMEX and IPE futures markets recently reflected what has been happening to the physical markets for crude. Adequate supply and weaker refinery demand in the Atlantic Basin caused the short-term forward price curves for WTI and Brent crude to slip out of backwardation and into shallow contango. Even if only for the short term, the upward-sloping price curve indicates that traders were willing to ignore low stock levels. This should have encouraged some building of crude inventories.

Despite an abundance of refinery maintenance, US Gulf Coast refining margins dropped sharply in February following a squeeze in the Brent market. The average margin for processing Brent-related grades fell to $0.99/bbl in February, a 1-month decline of $3.60/bbl.

Cracking margins for WTI also moved lower from January levels, dropping $2.57/bbl to average $2.07/bbl in February. IEA expects US Gulf Coast margins to bounce back soon, attributing the February weakness to a backlog of crude feedstock caused by both maintenance and weather problems that limited output of products.

Trade data track market

With its latest market report, IEA makes crude and product trade data a regular feature "in the spirit of promoting greater market transparency."

New tables show OECD regional imports by supplier for crude, gasoline, gas oil and diesel, jet fuel and kerosine, and residual fuel oil. The figures show, for example, that North American imports of crude increased during 1998-2000 by 430,000 b/d, and North Sea crude met all but 50,000 b/d of the extra supply.

Also detailed are the destinations, either North American, European, or Pacific IEA member countries, of selected crude streams such as Saudi Medium or Mexican Mayan. For example, this table reveals that, as OECD Europe lessened its imports of Iranian crude by more than 200,000 b/d during 1998-2000, the reduction was nearly entirely in heavy crude.

null

null

null

Industry Trends

DRILLING RIG CONTRACTORS ARE URGED TO MAKE IMPROVEMENTS DURING THE MARKET UPTURN.

The future success of the oil and gas drilling industry "rests on our ability to change our cost structure and engage the best talents," the chairman of the International Association of Drilling Contractors said.

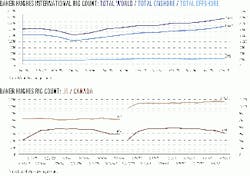

Thomas P. Richards, president and CEO of Houston-based Grey Wolf Inc., said, "The upturn that we've been looking for is now in full swing. Oil prices are up by 31%. Natural gas prices are up over 170%. And rig utilization has risen by 91%." He spoke earlier this month at a joint meeting of the IADC and the Houston chapter of API.

"Many of us see this up cycle as another opportunity to build cash reserves to weather the next downturn," said Richards. "But if that's all we do, we may be missing the real opportunity."

Drilling contractors now have the chance "to position ourselves to be the most efficient and profitable sector of the upstream oil and gas industry. Our long-term survival and our ability to attract people and capital depends upon recognizing that opportunity and correctly addressing three major challenges," he said.

Those challenges include:

- Safety. "A poor safety record can put a company out of business more quickly than poor performance for an operator, poor relations with shareholders, or lagging technology," Richards said.

- Personnel. "We have a real opportunity during this upturn to hire the next generation of drillers," said Richards. But contractors also must emphasize development of the next generation of managers to lead the industry, he said.

- Technology. With improved rig rates, drilling contractors can "generate high enough returns to invest in technologies that will forever reduce the costs of finding oil and gas," he said.

SEG's PRESIDENT-ELECT CONTENDS THAT GEOPHYSICISTS WILL EXPAND INTO OTHER INDUSTRIES.

Future geophysicists will apply the skills and technology developed for oil and gas exploration to environmental, engineering, infrastructure development, and other industries yet unimagined, said Walt Lynn, SEG president-elect, in Houston last week.

"A lot of our employment may be in those industries in the future" as the scope of geophysics broadens, said Lynn, who also is senior vice-president of technology marketing for Petroleum Geo-Services ASA, Houston.

Speaking at the 30th annual meeting of the International Association of Geophy- sical Contractors, he said the division among subsurface disciplines will blur with growing cooperation among industries and the overlapping use of technology.

SEG officials have drafted a study that tries to project what the geophysical industry may be like 30 years in the future, Lynn said. Among the things considered in that study are cooperation and even possible mergers of "subsurface societies" such as SEG and IAGC, he said.

Both organizations are looking to develop relationships with other industry groups to improve their effectiveness in representing their members and the oil and gas industry on various issues.

Government Developments

US SECRETARY OF ENERGY SPENCER ABRAHAM said last week that the Bush administration would issue its energy strategy recommendations in a few weeks.

Abraham outlined the general policies underlying that strategy in a talk at a US Chamber of Commerce energy summit (see Editorial, p. 19). Ab- raham was due to deliver an interim report on energy policy changes when President George W. Bush met with his energy task force Mar. 19.

Abraham told the chamber the administration would offer legislation to implement its policy proposals.

The secretary expressed dismay at OPEC's decision to reduce collective production by 1 million b/d on Apr. 1. He said the administration would continue quiet diplomatic negotiations with OPEC nations (OGJ Online, Mar. 17, 2001).

Earlier, Abraham had said, "In light of the current world economic conditions, OPEC's decision to cut their oil production quotas is disappointing. OPEC's decision demonstrates the importance of increasing America's domestic production and developing a national energy policy that will ensure a stable, reliable, affordable, and diverse supply of energy."

PICKING UP THE ENERGY POLICY CHALLENGE FROM ABRAHAM, PRESIDENT BUSH said last week the US needs to develop more refining capacity to prevent future product shortages.

"We think that-the major impact on gasoline prices, if they go up, is a result of not generating enough supply, enough refined product to meet the demand of US drivers," he said. "And we haven't built a refinery in 25 years in America. We're not generating enough gasoline to meet demand."

Bush made the remarks following a meeting with his National Energy Policy Development group, an interagency task force headed by Vice-Pres. Dick Cheney.

Citing a need for long-term solutions, Bush said that, rather than relying on short-term fixes, the cure for US energy woes includes not only conservation measures but also exploration and development of oil, gas, and coal in the US.

API became the second trade group to sue US EPA over controversial low-sulfur diesel rules.

API asked the US Court of Appeals for the DC Circuit to overturn EPA's rule 2 weeks after the Bush administration said it planned to carry out the plan, which was finalized in the last weeks of the Clinton administration.

Last month, NPRA filed a lawsuit, saying it believes that "the Clinton administration failed in its duty to fashion a rule that balances energy supply concerns with environmental objectives" (OGJ Online, Jan. 23, 2001).

Both NPRA and API say the EPA standard of 15 ppm of sulfur in diesel by 2006 is not a cost-effective way to reduce air pollution. Environmental groups argue health risks associated with diesel fuel emissions justify the cost and that industry has a long lead time to adjust to the new standard.

Quick Takes

LNG IMPORT TERMINALS TAKE CENTER STAGE THIS WEEK IN GAS PROCESSING.

BP plans to spend more than $180 million on the first phase of a JV project to construct China's first LNG import terminal.

BP was chosen to negotiate exclusively a role as partner in a JV to develop the Guangdong project in southern China. The project will be made up of a 3 million tonne/year LNG regasification terminal near Shenzhen and an associated 300-km pipeline linking the facility to the region.

Phase 1 of the project is expected to be on stream in 2006, said BP.

BP expects to jointly carry out a feasibility study with its Chinese sponsors, which, subject to approval by the country's authorities, would lead to the creation of a JV company responsible for the construction and initial operating phase of the plant.

In other gas processing news, Chevron said it is reviewing options for importing LNG to the US West Coast. If deemed economically viable, LNG could begin arriving as early as 2005. Earlier this month, Phillips Petroleum and El Paso Corp. announced plans to supply southern California and Mexico's Baja California with Timor Sea LNG. The two companies' subsidiaries signed a letter of intent for El Paso's long-term purchase of LNG from a plant to be built by Phillips near Darwin, Australia (OGJ,, Mar. 19, 2001, Newsletter, p. 8).

A QUARTET OF EUROPEAN COMPANIES HAS BEEN SELECTED TO DEVELOP BONGA OIL AND GAS FIELD OFF NIGERIA.

Shell Nigeria E&P, on behalf of Nigerian National Petroleum, awarded a string of major contracts to four European companies for the development of its $2.4 billion deepwater Bonga oil and gas field off the West African state.

The field will be developed with a floating production, storage, and offloading (FPSO) vessel. AMEC will be responsible for the engineering design, fabrication, integration, and commissioning of the 17,000-tonne topsides, to be installed on the FPSO's $120 million, 300,000-tonne hull when it arrives from South Korea's Samsung Heavy Industries' yard in third quarter 2002.

ABB Vetco Gray UK was awarded the contract for subsea systems and umbilicals, covering subsea wellhead facilities, subsea manifolds, control umbilicals, and riser gas lift equipment. Stolt Offshore Services will handle the field's flowlines and risers linking subsea manifolds to the FPSO, as well as the gas export pipeline.

Single Buoy Moorings will supply the FPSO's oil offloading single-point mooring buoy, as well as handle the transportation of the FPSO and installation of the subsea infrastructure. First oil from Bonga is scheduled for 2003.

Rounding out development news, PanCanadian Petroleum announced plans for a $1 billion (Can.) development at its Deep Panuke gas field, which has estimated reserves of 1 tcf. Companies have staked out extensive acreage in the region and are in the early stages of seismic mapping (see related item, Exploration, p. 9).

Sheer Energy (Cyprus) has won an $88 million service contract to redevelop Masjed-I-Suleyman (MIS) oil field in Iran. National Iranian Oil negotiated the contract, which is expected to become final within 90 days. MIS field was the first oil pool discovered in the Middle East, in 1908. The 4-year development plan calls for conducting a detailed reservoir simulation study, recompleting 4-6 wells, drilling 2 new vertical wells and 8 horizontal wells, and constructing processing and water reinjection facilities to handle production of an incremental 20,000 b/d of oil over the current 4,500 b/d. MIS field is 210 sq km.

Kellogg Brown & Root, a business unit of Halliburton, the contractor for the Malampaya platform, said SembCorp Engineering International has completed construction of the topsides for the platform, slated for Malampaya gas field development off the Philippines. The topsides was headed to a point off Palawan earlier this month. Shell Philippines Exploration expects the project to go on stream this year.

BJ Services and Precision Drilling said that Petroleos Mexicanos has awarded them a contract

IN REFINING NEWS, PDVSA said a Japanese-Venezuelan consortium signed a $300 million engineering, procurement, and construction contract for the expansion of the Puerto La Cruz refinery. The 200,000 b/d refinery has been processing 150,000 b/d. The expansion is scheduled to begin midyear, and completion is expected by third quarter 2003.

The consortium includes JGC and Chiyoda of Japan and Venezuela's private engineering companies VEPICA and Jantesa. The upgrade will include the installation of units to produce 45,000 b/d of unleaded gasoline for the domestic market and 30,000 b/d of low-sulfur diesel for export to Latin American and Caribbean markets.

Elsewhere on the refining front, China Petroleum & Chemical completed a 3-year revamp and expansion at its Qilu refinery. Qilu's sour crude capacity was increased to 6 million tonnes/year. All five revamped units and three new units are in operation. The new units include a hydrocracker, a terephthalic acid continuous reformer, and a sulfur recovery unit.

CANADIAN OIL SANDS PRODUCTION CONTINUES TO BUILD.

Deep Creek Energy has applied for regulatory approval to build a $20-30 million (Can.) pilot plant in the Alberta oil sands region, 40 miles north of Fort McMurray.

The proposed plant would produce 2,000 b/d of oil by mid-2002. Deep Creek executives said the project possibly could lead to a $270 million, 30,000 b/d operation by 2004. Both the pilot project and a possible commercial operation would use steam-assisted gravity drainage technology for heavy oil recovery.

TOPPING EXPLORATION ACTION THIS WEEK, Canadian Superior Energy said it will spud a wildcat on its Marquis prospect off Nova Scotia by September. The prospect is 20 km northwest of Sable Island, which is 250 km southeast of Halifax, NS. Canadian Superior is planning a 4,500 m wildcat costing $24 million (Can.) and a possible follow-up multiwell drilling program in the area over the next 18 months. It said seismic has identified major Abenaki reefs underlying the company leases, directly on trend and analogous to PanCanadian Petroleum's recent 2 tcf Abenaki reef gas discovery, 25 km to the southwest, where several wells have been tested in excess of 50 MMcfd (see related item item, Development, p. 8).

In other exploration action, Fusion Oil & Gas signed a petroleum concession contract with Cameroon for exploration of the deepwater Ntem permit in the Southern Douala/Kribi-Campo basin. The prospect-an area of 2,080 sq km where water depths are 1,000-1,800 m-neighbors the northern border of the Equatorial Guinea territory of Rio Muni, where Triton Energy discovered the 500 million bbl deepwater Ceiba field in 1999. Fusion holds 100% equity in the Ntem contract, which has three 2-year exploration terms. The company said it will be shooting 2D and possibly 3D seismic over the permit area in the first term to size up several prospective features, noting that existing seismic data already suggests certain structures with possible direct hydrocarbon indicators.

IN THIS WEEK'S PETROCHEMICAL NEWS, Thai Olefins Co. and Indorama Group have announced a JV to develop a $200 million monoethylene glycol plant on the Thai eastern seaboard. The plant, the first of its kind in Thailand, will be capable of producing 300,000 tonnes/year, effective in late 2003 or early 2004, TOC said. The MEG plant will be integrated with TOC's Map Ta Phut petrochemical complex at Rayong, Thailand. TOC will own 25% in the JV while Indorama, a Bangkok-based polyester and woolyarn-spinning conglomerate, will own 75%.

FERC APPROVED THE GUARDIAN PIPELING PROJECT FOR ILLINOIS AND WISCONSIN AND EXPANSION OF A SONAT SYSTEM IN THE US SOUTEAST.

Guardian Pipeline would build a 141-mile, 36-in. system to carry up to 750 MMcfd from the Chicago hub near Joliet, Ill., to Ixonia, Wis. (OGJ, Mar. 29, 1999, p. 27).

Also, an 8.5-mile, 16-in. lateral is planned to near Eagle, Wis. Guardian Pipeline has agreements with Wisconsin Gas and others to transport 662 MMcfd (88% of design capacity) when the pipeline goes into service in November 2002. Guardian is a partnership of CMS Energy, Wisconsin Energy unit WICOR, and Excel Energy subsidiary Viking Gas. The $224 million pipeline would serve more than 20 natural gas-fueled electricity-generating plants proposed for northern Illinois and southern Wisconsin in the next decade.

Also, FERC approved construction of Sonat's South system expansion to serve electricity generating plants in the Southeast.

The 335.8 MMcfd expansion was supported by 15-year firm transportation agreements with Southern Co., South Carolina Pipeline, and the city of LaGrange, Ga. The project, which includes 73 miles of pipeline loop and more than 34,000 hp of mainline compression, is estimated to cost $147 million. Completion is due in June 2002.

In other pipeline happenings, China National Petroleum has authorized its subsidiary Petroleum Longchang Group to raise funds to build a 1,247-km oil products pipeline. Longchang is expected to raise 189.54 million yuan for the line, which will carry products from PetroChina's refineries in Lanzhou to Chongqing. The line, which will pass through 10 cities before terminating in Chongqing, will have the capacity to ship 5 million tonnes/year. The government is still assessing the feasibility of the pipeline. CNPC plans to start the construction of the pipeline in 2001 and complete it in 2005.

Saipem Inc., as contractor for the TotalFinaElf-led Canyon Express project in the Gulf of Mexico, has awarded Saibos CML-a 50-50 subsidiary of Bouygues Off- shore Group and Saipem SPA-a $30 million contract to lay pipe for the project. Saibos will install two 12-in., 90-km pipelines between the Canyon Station platform and King's Peak, Acon- cagua, and Cam- den Hills deepwater fields. It will also build and install 11 in-line sleds and their connections via 6-in. rigid jumpers to the subsea wells.

El Paso Natural Gas has again delayed a 2-day test of repairs to a 30-in. natural gas pipeline that ruptured and exploded Aug. 19, 2000, near Carlsbad, NM, killing 12 persons (OGJ Online, Aug. 21, 2000). Workers were still cleaning the pipeline prior to sending a smart pig, through it to inspect repairs. Company officials say they will reschedule a test date after the pipeline is cleaned. That inspection will enable the US Department of Transportation's Office of Pipeline Safety (OPS) to determine if that segment of the system is safe to return to operation. The cause of the rupture is still under investigation, OPS reported.