OPEC deems 1 million b/d production cut 'prudent'

The Organization of Petroleum Exporting Countries considers its agreement to cut crude production by another 1 million b/d effective Apr. 1 to be a "prudent" measure to stem declining oil prices in the second quarter.

But the group must deal with concerns that the cut may not be enough to stem a later slide in prices while, conversely, it must cope with fears that sustained higher prices will harm world's economies and thus crimp future demand growth.

This ambivalence was reflected in markets last week, as oil prices on London and New York futures exchanges scarcely rippled in immediate response to the latest round of OPEC cuts and actually drifted down a bit further by midweek. At presstime, New York Mercantile Exchange crude for April delivery was trading just under $26/bbl, down $1 on the week. Meanwhile, Brent for April delivery had slipped below $25/bbl at midweek, also down about $1 since the Mar. 16 close.

Buttressing prices

The move is intended to buttress crude prices as global demand declines in the coming months, OPEC Pres. Chakib Khelil and Sec. Gen. Alí Rodríguez Araque announced Mar. 17.

Khelil restated that the aim of this latest cut was to stabilize crude at $25/bbl, as the impact of the slowdown in the US economy begins to be felt worldwide, but he stressed that the organization's price band would remained unchanged at $22-28/bbl.

OPEC also hopes its target price will counter the seasonally sharp drop in oil demand in the second quarter.

"The slowdown in the global economy was present all the time in our analysis," said Rodríguez. "So was the traditional drop in second-quarter demand, which may be as much as 2 million b/d.

"We consider this decision to be a prudent one," he added.

The real cuts

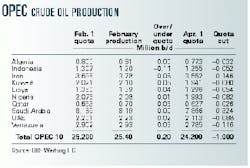

The reduction, the second agreed to by OPEC this year and at the upper end of analysts' expectations, will decrease the collective output of the organization's 10 quota-bound members to 24.2 million b/d (see table).

The total rollback to global output levels, however, may amount to a volume as high as 1.5 million b/d, as the non-OPEC producers-including Russia, Mexico, Oman, Angola, and Kazakhstan-that attended this OPEC conference as observers pro- mised to curb their production in support of OPEC.

Qatar's Minister of Petroleum Abdullah bin Hamad Al Attiyah said "all non-OPEC countries at the meeting" had offered to restrain their production. Some reports suggested this restraint will translate into a cut of about 300,000 b/d.

In a statement, OPEC said its member countries had "strongly emphasized their firm commitment to the agreement, and each stressed its commitment to continue to maintain full compliance."

Compliance remains a crucial issue, as Washington-based Petroleum Finance Co. estimates that about 500,000 b/d of OPEC members' quota reductions under the January accord remains on the market.

Demand affected

"The critical factor [in determining what effect OPEC's production cut will have on crude prices] is going to be demand," said Mehdi Varzi, director of research at Dresdner Kleinwort Wasserstein AG, "and how much the turmoil in the financial markets affects commodities markets.

"We know there will be an effect over time, but if economic growth gets hit, then demand is going to get hit. Demand for OPEC oil may not grow as people think in the second half of the year," he said.

"Everyone is assuming [that], at some stage, OPEC will have to raise the quotas. But there is a question mark. There is no guarantee of this," said Varzi.

The International Energy Agency has said softening demand for oil is "increasingly apparent" across most key markets with emerging economies, because of a dependence on US imports to balance their payments, confronting the twin problems of high oil prices and fallout from the North American downturn (see Market Movement, p. 5).

Iraqi wild card

Iraq is another unknown variable in the oil price equation, especially as it is exempt from quotas because its production is governed by the United Nations under international sanctions against the Baghdad regime.

IEA estimates Iraqi production climbed by 320,000 b/d in February. Iraq, according to its Minister of Oil, Amer Mohammed Rasheed, aims to ramp up its output by the end of this month to about 3 million b/d.

Varzi is concerned there may be a countervailing force at work on Iraq's "gradually recovering" production level, if credence is given to Iraqi claims that the UN, under pressure from US and UK governments, is attempting to tighten the pricing formula in a bid to curb Baghdad's premium from oil sales.

"If [the UN] does that, you wonder why the Iraqis should export. I think Iraq is going to a very uncertain factor over the next 3-4 months," he said.

Dresdner Kleinwort calculations support the belief that OPEC will be able to defend the bottom end of its $22-28/bbl price band this year, Varzi added.