Industrial gas partnership enables upgrade at BP refinery

In a rare type of partnering, BP and the BOC Group jointly invested in a major upgrade of BP's Bulwer Island refinery in Queensland, Australia.

The development of a refinery project's commercial and technology content with an industrial gas provider facilitated synergies, resulting in an estimated net annual benefit of several million dollars under typical market conditions. Project economics do not rely on government subsidies or special incentives.

The purpose of the Queensland Clean Fuels Project (QCFP), completed in October 2000, was to produce cleaner fuels and minimize emissions.

It has resulted in a ten-fold reduction in the refinery pool gasoline sulfur content and a hundred-fold decrease in diesel sulfur content. Refinery throughput has increased by about 25%, and refinery conversion is also higher.

In addition, the project has significantly reduced refinery emissions. SOx and NOx emissions have decreased by 30% and 10%, respectively, while CO2 emissions have decreased by about 10% on a per-barrel basis.

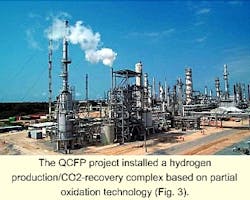

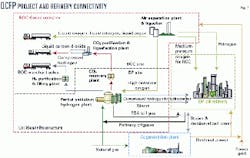

Industrial gas elements of QCFP include an air separation unit (ASU) and a hydrogen production-CO2 recovery complex based on partial oxidation (POx) technology.

The refinery upgrade consisted of a new refinery hydrocracker and an integrated hydrotreater, coupled with the revamp of the existing catalytic cracker to a resid catalytic cracker (RCC) employing oxygen enrichment.

A new cogeneration plant, owned by the Bulwer Island Energy Partnership (BIEP), supplies energy within the fence to BP and BOC.

Industrial gas partners

As refiners restructure to produce cleaner fuels and minimize emissions, they must examine various solutions to meet these objectives and their short and long-term strategies. One approach involves sourcing appropriate technology and performing an evaluation of the site regional strategy with support from external resources, including potential project partners.

Traditional industry partners typically have been process licensors, catalyst companies, and engineering, procurement, and construction (EPC) firms. In the past, technical economic evaluations of industrial gas applications in refinery settings were separately performed by refiners and industrial gas companies, occasionally with inputs from their respective engineering companies and process licensors.1-4

As the QCFP project exemplifies, future partners may include industrial gas companies, long-term coinvestors, who can supply industrial gas and utilities.

Industrial gas companies can work with the refiner to develop and execute the optimal project process scheme. These partners can also help improve project viability, financing, and approval prospects.

It is important to recognize the strong dependency of unit costs on the overall industrial gas-production scheme as well as on refinery operations.

The traditional approach for evaluating industrial-gas applications is not appropriate for many cases for several reasons:

- The economics of industrial gas and utility production are not constant but depend on magnitude and type of requirement.

- The traditional approach does not account for potential synergies across the industrial gas-utilities matrix.

- The wide acceptance of advanced control technologies has resulted in multiconstrained refinery process operation, which renders traditional shift-based modeling approaches unsuitable for nonincremental process scheme optimization.

- The ramifications of novel commercial arrangements and related implications of sharing gain, risk, and financing in the selection of the flowsheet and technology constituents need to be taken into consideration.

In view of this situation, it is difficult for either the industrial gas supplier or the refiner to perform adequate scoping exercises in isolation.

Therefore, BOC uses a systematic approach to develop and evaluate optimal schemes that meet the refiners' broad objectives. The approach integrates nonlinear multivariable optimization of select processes with traditional refinery linear programming (LP) modeling.

The evolutionary nature of the modeling tools and the complexity of the optimization require experts who can analyze the possibilities and frame the overall problem scope.

BP and BOC used elements of this approach in developing QCFP.

QCFP approach

A major contributor to successful project development and execution has been the acceptance of a transparent joint approach by the principal owners, BP, BOC, and BIEP. This joint approach has included:

- A joint commitment even during the early scoping stages.

- A combined approach to technology evaluation and selection of other project partners and suppliers.

- Joint project design, value engineering, and execution.

BOC's role as project partner with BP and coinvestor facilitated this approach. The capital investment by BOC exceeded $100 million.

The owners (BP, BOC, and BIEP) worked through the concept and project development phases to achieve the right balance between principal objectives and facility integration. This approach fostered a culture of working together for mutual benefit with the EPC partners, namely, Kvaerner Process Systems Pty. Ltd., and Fluor Daniel. Stork ICM Australia Pty. Ltd. joined the EPC team subsequent to the project sanction.

Kvaerner Process had a substantial role in the concept and project development phases in addition to its role in project management during the execution phase.

High-caliber refinery operations personnel were involved in the project team from the earliest stages through execution and commissioning.

Once POx was adopted as the preferred process technology for hydrogen generation, the parties agreed upon guidelines that enabled scope variations within the basic commercial structure. Alliance principles, such as gain and risk sharing elements, were incorporated at an early stage among the owners, the cogeneration plant partnership, and related engineering partners.

Australian R&M

Since the early 1970s, the number of major refining and marketing (R&M) participants in the Australian market has halved to four. This decrease is the result of restrictions, moderate product demand, and a disadvantaged position against imported products.

During the past several months, Australia has set sulfur standards for gasoline and diesel similar to those set in the US, Europe, and Japan. BP conceived the QCFP project well in advance of the announcement of these regulations; substantial planning has taken place among BP, BOC, and other partners since the mid-1990s.

Like other parts of the world, the Australian R&M industry has experienced changes and challenges in recent years. Challenges have included global margins, government legislation pertaining to use of indigenous feedstocks, product and marketing restrictions and pricing controls, local cost structures and labor rates, aging infrastructure, inconsistent demand patterns, and increased investment for federal and local environmental mandates.

A reform package is moving Australia towards market-driven retail and distribution and deregulation. This includes a transition of the government's role from product price setting to price surveillance by the Australian Competition and Consumer Commission with cooperation from the Australian Automobile Association and major oil companies.

The reform package in conjunction with the repeal of the highly restrictive Petroleum Retail Marketing Sites and Franchise Acts of 1980 are intended to strike a balance between protecting small players and enabling the majors to improve overall efficiency.

Project scope

BP's Bulwer Island refinery, in operation since 1965, is located on the east coast of Australia in the vicinity of Brisbane in Queensland (Fig. 1). Prior to the upgrade, major refinery processes included:

- Crude and vacuum distillation.

- Catalytic cracking and alkylation.

- Naphtha reforming.

- Distillate hydrofinishing.

- Sulfur recovery and utilities.

- Bitumen production.

Historically, the typical crude processed was a combination of 25% Middle Eastern grade and 75% regional sweet crudes. Throughput increased to more than 70,000 b/d in the early 1990s.

The goals of the QCFP initiative were to enable the refinery to meet diesel, gasoline, and jet fuel quality targets as well as projected demands of these transportation fuels. BP and BOC also wanted to minimize air-pollutant emissions.

The selected hydrocracker configuration is based on Chevron Corp. technology and has a capacity of about 17,000 b/d. The unit is designed to operate at a conversion level of about 70 wt % and to produce diesel with 50 ppm sulfur.

The incorporation of a hydrocracker increased the production of higher quality distillate fuels. An initial assessment of this desired hydrocracking capacity indicated a net refinery hydrogen requirement of 25-30 MMscfd.

BP and BOC evaluated three hydrogen production options: steam reforming, autothermal reforming, and POx. The weighted rating approach used included factors such as return on investment, environmental performance, risk, feedstock flexibility, operability, robustness, and ability to accommodate future needs.

The final macro flowsheet included the following major elements:

- Mild hydrocracker and integrated diesel hydrotreater.

- Partial-oxidation based hydrogen generation.

- Upgrade of catalytic cracker to an RCC, including oxygen-enrichment and a flow-through catalyst cooler.

- ASU providing oxygen to the POx unit, RCC, and BOC's merchant needs.

- Upgraded crude and vacuum distillation capability.

- New sulfur-recovery facilities.

- Cogeneration unit supplying power and steam to BP.

Partial oxidation complex

This POx unit (Figs. 2 and 3) has a nameplate capacity for the production of 32 MMscfd, 2,700+ psig hydrogen of 99.5% purity. The process licensor was Texaco Inc.

Hydrocarbon feedstock to the unit is a combination of refinery fuel gas supplemented by natural gas. There is an allowance for a substantial gas composition variation depending on the overall refinery fuel gas balance.

BOC had to consider feedstock selection from the perspective of the POx complex as well as the associated catalytic cracker revamp and hydrocracker installation. Optimization studies indicated that the preferred option was to route some of the hydrogen-rich fuel gas streams to the gasifier, as feedstock, as opposed to installation of auxiliary recovery units.

At nominal capacity, the unit consumes about 300 tonnes/ day of oxygen from the ASU.

Although the POx train is configured to handle gaseous feedstock, the flowsheet and plot plan were developed to easily enable potential unit modification to allow for processing heavier feeds, such as resid, in the future. This approach retains the strategic attribute of enhanced bottoms upgrading benefits while reducing current investment.

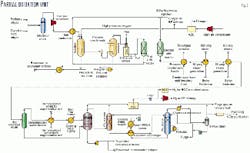

The POx flowsheet consists of the POx reactor with a water quench and syngas scrubber, a multi-stage water-gas shift, waste-heat recovery, an amine system for CO2 removal, a CO2 liquefaction-purification system for food-grade CO2 production, and a hydrogen pressure-swing adsorption (PSA) system for product recovery followed by product compression (Fig. 2).

The unit gasifiers are designed for typical operation with gaseous feedstock at about 2,500° F. and at a pressure slightly less than 800 psig.

An attractive feature of POx is the limited amount of feed treatment required for a poor quality hydrocarbon feedstock. The noncatalytic reaction in the POx reactors avoids the issue of catalyst and process-performance degradation during the cycle, inherent for most catalytic processes using steam reforming.

While the components and operation of the POx train resemble those for other POx complexes, the team improved the integration among the blocks and between the POx unit and the remainder of the refinery and industrial gas complex without sacrificing operational robustness. There was considerable integration in utility components, such as the steam and demineralized water systems and compression facilities.

The environment in the POx reactors is "net reducing." As a consequence, there is no production of pollutant oxides of nitrogen and sulfur.

The reduced forms of nitrogen that are generated, such as ammonia, are essentially scrubbed out of the system.

The monodiethanolamine (MDEA) system removes CO2. The raw CO2 is piped from the POx complex and further purified in the CO2 liquefaction/ purification unit.

Only a portion of the syngas is routed through the MDEA system because of the relative needs for hydrogen and CO2; the remainder is sent directly to the PSA system. The scheme allows for the hydrogen-depleted PSA system tail gas to be used as fuel in the new mild hydrocracker complex.

Most of the hydrogen product is post-compressed to 2,700 psig for the hydro cracker; a small portion is withdrawn for merchant sales using tube trailers.

The planning and optimization studies performed to arrive at the final configuration included a large number of variants: POx unit feedstock, POx train configuration, heat-recovery and steam systems, hydrogen and CO2 product-recovery options, and integration between the POx and the planned cogeneration unit, the ASU, and BOC's merchant requirements.

Parallel, value-engineering exercises by the owners identified more than 300 engineering options, of which at least 50 options were shortlisted and assessed in detail. Implementation of the selected engineering improvements resulted in considerable savings in capital and operational costs, which are critical for a project of this magnitude.

Air separation unit

The ASU (Fig. 4) uses a proprietary BOC-designed cryogenic separation-based technology. The unit is sized to produce about 600 tonnes/day of gaseous oxygen (99.5% purity), nitrogen at multiple pressures corresponding to refinery requirements, and liquid product (liquid nitrogen, liquid oxygen, and liquid argon) to satisfy BOC's merchant requirements.

The design involves an internal liquid compression cycle. Power and utility requirements are integrated with other portions of the QCFP complex.

During typical operation of the QCFP complex, the principal oxygen requirements come from the POx unit and the RCC.

Resid catalytic cracker

The QCFP project converted the existing cat-cracker (Kellogg stacked design) to a revamped RCC (Fig. 5).

The use of regenerator oxygen enrichment and the replacement of a back-mix UOP catalyst cooler with a 32-Mw Kellogg Brown & Root flow-through catalyst cooler enabled a higher throughput with substantially heavier feedstock.

A new air-blower also replaced an old, existing blower.

The revamp was performed in the context of other major cat-cracker constraints, including light gas and liquid-product separation and handling.

The revamp has enabled excellent conversion of various vacuum gas oil cuts and resid to distillate, gasoline, and alkylate from the overall hydrocracker and catalytic cracker complex.

The system is designed to operate at high levels of regenerator oxygen enrichment for maximum conversion of heavy products. Oxygen to the RCC is supplied through a low-pressure oxygen header from the ASU. The team performed substantial work to ensure materials and process compatibility.

Currently, the RCC throughput is 20,000-25,000 b/d, and the feedstock is very heavy. Subsequent to the revamp, the feedstock has had a Conradson carbon residue content of 3-5 wt % and correspondingly higher feed metals contents, exceeding 8 ppm nickel as well as vanadium.

Operations post-revamp include pressure loop and catalyst circulation reoptimization. The regenerator temperature is controlled in the range of 1,275-1,370° F. Care is taken to ensure that velocities are controlled to minimize the near-exponential increase in equipment and catalyst wear characteristics at high regenerator, cyclone, and flue gas velocities.

BP also optimized catalyst selection to ensure consistency with the modified unit objectives and constraints.

BP personnel, with support from alliance partners Kvaerner Process, BOC, and Kellogg, performed many studies to arrive at the optimized planning scenario involving the crude and vacuum blocks and optimized processing for the RCC and the mild hydrocracker.

Supporting units

BIEP is made up of CU Power Australia Pty. Ltd., a subsidiary of the ATCO Group, Lend Lease Capital Services, and Origin Energy (formerly Boral Energy). BIEP's QCFP cogeneration plant, which supplies energy within the refinery fence to BP and BOC, produces 28 Mw power and 1,500 tonnes/day of steam (Fig. 6).

Main features of the QCFP project and connectivity with the remainder of the refinery are illustrated in Fig. 7.

To accommodate the increased production of acid gases and sour water gas, a second sulfur recovery train designed by TPA Inc. has been incorporated. BP has planned for potential capacity and redundancy enhancements of the sulfur recovery facilities using oxygen enrichment by injection with a scope for future SURE Double Combustion technology.

The ASU design has factored in the required oxygen capacity for utilization, as required, in the sulfur block.

Project execution, commissioning

The complexity and level of technical integration required an approach to detailed engineering and project execution different from conventional ones to maximize benefits. Therefore, the owners and contractors created a project execution alliance.

Principal execution and commissioning roles were as follows:

- Fluor Daniel: engineering and procurement for hydrocracker.

- Kvaerner Process: engineering and procurement for other refinery units and overall process integration and project management services.

- Stork ICM: plant construction for the hydrogen generation unit and new refinery units.

- BOC: EPC management and commissioning for ASU, CO2 liquefaction, and hydrogen PSA/trailer-filling plant.

- BP: commissioning of new and revamped refinery units and integration of complex.

- BIEP: cogeneration facility.

The alliance agreement aligned participants' commercial interests and created the greatest added value for the owners' investment.

The owners, contractors, and suppliers also participated in an innovative risk and reward program that encouraged good performance in the following categories without compromising plant reliability and operational expenditure:

- Capital expenditure.

- Schedule.

- Facilities performance.

- Project health safety and environmental factors.

After some initial rework of the front-end engineering design (FEED) package to enable production of 50-ppm diesel from the hydrocracker, the engineering phase progressed rapidly. The continuity and cooperation among the engineering partners responsible for the FEED packages, namely Kvaerner Process and Fluor Daniel, facilitated this progression.

The project alliance partners decided early in the design phase to use an offshore fabricated modular pipe-rack strategy. This decision affected the design process sequence and delivered substantial savings in terms of schedule and construction efficiency.

The refined FEED corresponding to the new project sulfur targets was completed in November 1998, and EPC took place from December 1998 through August 2000.

The integrated engineering team took advantage of the coordinated approach to consolidate equipment and bulk material inquiries.

The procurement team secured significant cost and schedule savings through bulk purchasing as well as through coordinating the delivery of these items in the face of logistical challenges.

This arrangement included a transportation alliance to ensure seamless site delivery and reduced liability in addition to savings by consolidation.

A truly integrated project scheduling team, which set up and shared appropriate tracking tools, compressed the original schedule, maintained the optimal sequence for plant completion and commissioning, and maintained maximum workforce productivity.

The team employed three major design centers in Melbourne, Brisbane, and Calgary and six major materials fabrication facilities in Asia and Europe.

The end result of this teamwork was the achievement of "steady operation" almost 3 months ahead of schedule. The project was more than 5 months ahead of international benchmarks for similar projects.

QCFP was commissioned during late September and October 2000. The prime minister of Australia, John Howard, officially opened the project on Oct. 26, 2000.

Overall cost was on budget, and individual unit costs have benchmarked well under international averages. Health, safety, and environmental performance attained 1.4 million manhours of LTI (lost time injury)-free heavy construction work.

References

- "Leading the way," Hydrocarbon Processing, February 2001.

- Australian Hydrocarbon Processing, Hydrocarbon Asia, March 1998, p. 20.

- Australia's Downstream Petroleum Industry Poised for Landmark Reform, Hydrocarbon Asia, April 1999.

- "Competitiveness of Gasification in Refinery Setting," Gasification Technology Conference, 2000.

The authors

Raghu Menon is market development manager of petroleum at BOC Process Gas Solutions, Murray Hill, NJ. His previous roles with BOC include various commercial and technical leadership positions. Prior to joining BOC in 1993, he worked with Mobil Corp. Menon holds a masters in chemical engineering and a PhD in chemical engineering practice from the Massachusetts Institute of Technology, Cambridge.

Tarun Vakil is the engineering technology manager in the HYCO product marketing/process solutions group at BOC Process Gas Solutions. He is responsible for technical and process engineering aspects related to BOC's HYCO area worldwide. Prior to BOC, he had 20 years of HYCO and related technical experience in the industrial gas arena. Vakil holds a BS in chemical engineering from the Indian Institute of Technology, Bombay, and an MS in chemical engineering from Pennsylvania State University, University Park, Pa.

Mark Hawkins is marketing manager for process industries at BOC Process Gas Solutions, Australia. Until recently, he was project-execution manager for BOC Process Systems, South Pacific Region, where he had project execution responsibility for the Queensland Clean Fuels Project. Previous roles with BOC include engineering manager, project engineer, and development engineer with BOC Process Plants. He has also previously worked at Dowell Schlumberger and GEC Turbine Generators.

Graeme Saunders is project development manager for BOC Process Systems. He develops tonnage schemes for the Asia Pacific region. Saunders started working at BOC in Australia in 1987 as process industries sales engineer. He has since held roles as marketing manager for the chemicals and petroleum sector in Australia and supply schemes manager in Australia. Saunders graduated with BEng in chemistry from the University of Sydney.