OGJ Newsletter

NL Bulletins

Two massive blasts have crippled the world's largest semisubmersible production platform, working in Roncador oil field in Brazil's Campos basin.

Two explosions, 30 min apart, partially destroyed the Petrobras P-36, killing one crewmember and seriously burning two others; 10 remained missing at presstime. Efforts to extinguish the resulting fire were still under way at presstime, all wells were shut in, and no oil was spilled. The cause of the explosions was still under investigation late last week.

The P-36 was developing the deepwater giant oil field, where it had been producing 80,000 b/d of crude and 45.5 MMcfd of gas.

Market Movement

Market sending OPEC wrong signal?

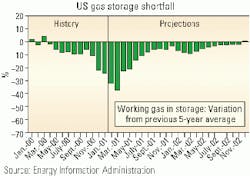

Despite warnings from analysts that another production cut is not warranted-and could, in fact, endanger oil demand growth and the global economy-OPEC got a decidedly bearish signal from oil markets last week, just ahead of its ministerial meeting.

As speculation mounted that another production cut was imminent last week, oil prices on Mar. 14 collapsed. NYMEX crude fell to a 2-month low of $26.41/bbl, a drop of $1.18/bbl on the day. That correlates to about $23-24/bbl for OPEC's marker basket of crudes, near the low end of its official price band of $22-28/bbl and below its unofficial target of $25/bbl.

That gave OPEC's price hawks comfort, as the group seeks to bolster sagging prices in the face of weakening demand. OPEC was expected to pare another 500,000-1 million b/d at the Mar. 16 meeting in Vienna. The group already had cut its collective quota by 1.5 million b/d, effective Feb. 1, at its January meeting, citing expectations of seasonally slack demand. But the market has not yet ab- sorbed the February cuts. And Iraq-excluded from the OPEC quota system because of UN sanctions-has sharply boosted its output. Baghdad's output spike of 320,000 b/d in February comes on top of the 500,000 b/d OPEC is currently producing in excess of its quota.

Also underpinning the price hawks' position was IEA last week making what it called an "alarming" reduction in its estimate of 2001 global oil demand growth. IEA cited North America's slowing economy, milder winter weather, and a decline in demand owing to high oil prices. At the same time, the agency emphasized that global stocks of crude and products are now at their lowest level relative to demand since 1991.

The OPEC cuts and the outage of at least 80,000 b/d from explosions that crippled a major production facility off Brazil late last week (see related story, this page) were likely to put a prop back under oil prices for the short term.

But the "alarm" that IEA raises is one that OPEC might do well to heed, before its zeal for capturing the fiscal benefits of its new-found solidarity leads to the demise of its "golden goose," demand growth; the "bird" in question seems to already have a bad case of the sniffles.

EIA: Gas demand to slow, but prices stay strong

High prices are also slowing demand for natural gas in the US, but the market fundamentals are considerably more bullish in this sector.

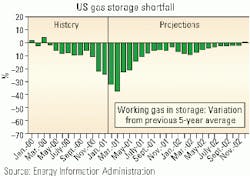

EIA expects gas demand growth to slow this year, but prices are expected to remain strong against weak storage refill numbers.

EIA expects gas in storage to reach 689 bcf by heating season's end on Mar. 31, or 100 bcf higher than last month's projections. But that would still be 38% below the previous 5-year average (see chart) and the lowest on record; it would also be virtually impossible for storage levels to catch up by the start of the next heating season. Injection rates would have to surpass historical levels by more than 25% to bring storage up to par by Nov. 1-and that would have to occur during the second, cooling-related demand spike in the summer.

President Bush has indicated his administration will consider oil and gas drilling on "all public lands," including the national monuments that the Clinton administration scrambled to create in its waning days.

During a Mar. 13 media roundtable, Bush reiterated his intent to pursue E&D on the Arctic National Wildlife Refuge coastal plain but stressed that all federal lands in the US West would also be considered for leasing.

Citing the "widespread" aspect of federal lands, Bush said, "There are parts of the monument lands where we can explore without affecting the overall environment."

null

null

null

Industry Trends

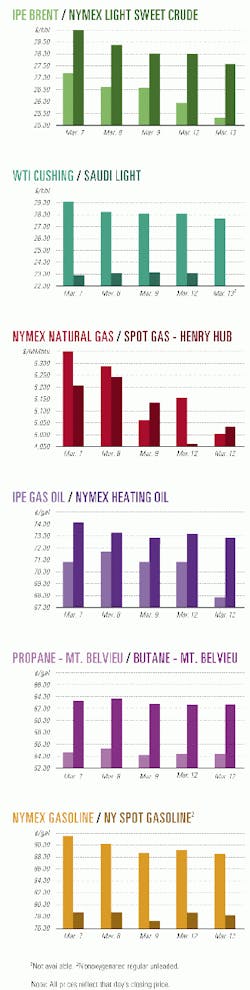

The US rig count continues to surge.

The Baker Hughes tally soared to 1,151 rigs during the week ended Mar. 2 from 790 the same week a year ago.

Year to date, the Baker Hughes US rig count has averaged 1,130 vs. 771 in 2000 and 562 in 1999 (see chart). "More importantly, the February average natural gas rig count rose to a new all-time record high of 898," noted analyst UBS Warburg. "This compares with the January 2001 average of 879, the February 2000 average of 616, and the February 1999 average of 425."

Canada's rig count during the week ended Mar. 6 remained unchanged from the prior week of 614 rigs, but was up from 550 during the same time last year. Year to date, the Canadian rig count has averaged 607 vs. 548 in 2000.

Oil tankers are experiencing a record year, reports Clarkson Research Studies, London.

In a recent report, it said that earnings for oil tankers have doubled and that tanker rates last summer hit levels not seen for 30 years.

Clarkson said, "We are cautiously optimistic. So far, tanker investment has been restrained, and the order book is lower than it was 18 months ago. We think the fundamentals are strong enough to carry the market through another good year, particularly if owners continue to play the game well."

It said 1999 was a poor year for tanker markets as crude exports fell with production cuts, but OPEC has since increased output in an attempt to curb rising prices.

"The overall outlook for tanker demand remains positive," Clarkson said. "Global economic growth is expected to slow slightly in 2001 but nonetheless remain strong."

The coiled tubing business is rebounding, with some exciting technology and applications yet to come, industry officials said earlier this month at the start of a coiled tubing roundtable and exhibition in Houston.

The use of coiled tubing in well servicing, workovers, and even drilling operations is expected to increase 20-25% this year, "back to 1997-98 levels," said Willem van Adrichem, business development manager for coiled tubing with Schlumberger's well intervention services.

"Coiled tubing is less cyclical than the rest of the industry," said Van Adrichem, cochairman of the opening technical session on workover and service applications at the meeting. While drilling drops off during periods of low prices for oil and gas, he said, demand improves for less-expensive coiled tubing operations to help increase production and cash flow.

Government Developments

The Texas Railroad Commission is pushing FOR severance tax relief for natural gas producers in order to boost supplies and thus ease high gas prices.

Severance tax incentives are among the short-term recommendations aimed at stabilizing natural gas prices that TRC approved unanimously earlier this month and forwarded to the Texas legislature.

Stemming from a hearing in Austin, the recommendations were outlined in a letter delivered to the heads of the state House committee on energy re- sources and the Senate natural resources committee.

Commissioners proposed statutory changes in two areas. The first change would be to allow cities to choose to cede their jurisdiction over gas utilities to the commission, just as is currently allowed in electric regulation.

The second change would be to grant the commission authority to determine statewide customer service standards applicable to investor-owned gas utilities.

In addition, commissioners urged lawmakers to consider severance tax incentives to help promote development of additional gas supplies, noting that suppliers and consumers testified that additional gas supply is the answer to stabilizing market prices at lower levels.

Commissioner Charles Matthews called the recommendations, "the first step in addressing the problem of high natural gas prices."

Curtis Hebert may already be on his way out as FERC chairman.

The White House and Senate Republican leaders were negotiating last week on the terms under which Texas Public Utility Commissioner Pat Wood could become chairman of FERC, industry and congressional sources said.

President Bush reportedly wants Wood, a former FERC staff member, to head the agency.

The agency has come under increasing criticism for not intervening sooner to stop power resellers from allegedly overcharging California electric ratepayers $550 million. The agency has so far called on marketers to justify or refund $69 million. However, critics charge the agency should have policed the state's overcrowded transmission grid sooner when there were warning signals that California's deregulatory program was inadequate.

Current FERC chairman Curtis Hebert is a Republican from Mississippi who won a seat on the five-member board in 1998 with the backing of Senate Majority Leader Trent Lott (R-Miss.).

When Bush assumed office, he named Hebert interim FERC chairman. The White House can alter that, provided the US Senate approves the decision.

Industry sources say that while Hebert's views on regulation are philosophically similar to Wood's, the ongoing bad publicity over the California energy crisis has made the White House rethink Hebert in the top slot.

Meanwhile, Hebert's advocates on Capitol Hill are asking the White House to let Hebert remain chairman until December 2001.

Quick Takes

El Paso Corp. continues its quest for an LNG terminal land site.

El Paso hopes to announce "within months" a proposed site for a new LNG terminal on the US West Coast, said Kathleen Eisbrenner, senior managing director, Global LNG, an El Paso unit. El Paso said earlier this month that it tentatively agreed to begin purchasing LNG in 2005 from an export terminal Phillips Petroleum will build near Darwin, Australia, with plans to ship it to California or Mexico (OGJ, Mar. 12, 2001, p. 5).

By midyear, the companies expect to have a definitive agreement, including permits for the Australian terminal, under which El Paso would buy 4.8 million tonnes/year of LNG. The LNG would be shipped to North America, where it would be regasified and sold as 680 MMcfd of natural gas via existing pipelines.

Cost of the project, including the LNG plant, ships, and a West Coast receiving terminal, is $3-3.5 billion, depending upon the size of the LNG plant, Phillips said.

Elsewhere in the world of gas processing, Qatar Petroleum and Sasol Synfuels International agreed on a $30 million JV for front-end engineering and design for a GTL project. They said the work would begin as soon as the necessary regulatory approvals have been obtained. The $800 million GTL project would start in 2005 and will convert natural gas into 34,000 b/d of liquid fuels. The announcement followed completion of the feasibility study for the venture, to be based at Ras Laffan, Qatar. The project would be based on Sasol's slurry phase distillate technology and would use Qatar's huge North field gas reserves. The GTL project will use 330 MMscfd from ExxonMobil's Ras Laffan-based Enhanced Gas Utilization project to produce 24,000 b/d of middle distillate fuel, 9,000 b/d of naphtha, and 1,000 b/d of LPG.

Petrobras Bolivia said that the San Alberto gas processing plant in Carapari, Bolivia, has gone on stream with its output exported to Brazilian markets through the Bolivia-Brazil gas pipeline. San Alberto field is producing 6.6 million cu m/day of gas and 1,300 b/d of condensate under a 20-year take-or-pay contract with Petrobras (OGJ Online, Jan. 29, 2001). First-stage development of San Alberto field cost $200 million, of which $147 million was exploration and development, while $53 million was for production and transportation, including the plant and 32 km of pipeline connecting the field with the Bolivia-Brazil line. A second development stage is under way with anticipated production of 13 million cu m/day by 2003, escalating to 22 million cu m/day in 2004-05. Reserves are 150 billion cu m of gas and 90 million bbl of condensate.

Talisman Energy takes center stage this week in development news.

Talisman Energy's North Sea subsidiary Talisman Energy UK announced plans for a £32 million redevelopment of the marginal Beatrice field on Block 11/30a in the inner Moray Firth after the British government granted unique tax relief.

The Beatrice life extension project would add 5-10 years to the expected producing life of the aging field. The key feature of the plan to extend Beatrice's producing life involves laying 60 km of pipeline to replace aging export infrastructure.Refurbishment of the nearby Bravo platform and the drilling of two wells to access areas of "trapped" oil using a jack up cantilevered over the installation are also in the company's redevelopment project. Beatrice is expected to peak at 15,000 b/d and average 10,000 b/d.

Meanwhile, the UK government this month approved Talisman's £33 million subsea development plans for Hannay oil field on Block 20/5a of the North Sea.

The field, with reserves of 8 million bbl and a life expectancy of 8 years, will be brought on stream via a single horizontal well tied back to the Buchan Alpha platform; production will be exported through the Forties pipeline system to St. Fergus.

In other development news, Dansk Undergrunds Consortium has submitted a 4.2 billion Danish kroner ($520 million) plan for further development of Halfdan field off Denmark. A.P. M ller company Mærsk Olie og Gas, Royal Dutch/Shell, and Texaco are partners in DUC. The planned Phase 3 development includes drilling 11 wells with 3,000-5,000 m horizontal sections for production of oil and 11 related water injection wells. Also, the central platform will be extended with a facility for processing and compression of gas and a facility for processing of produced water. In addition, an accommodation platform and a flaring platform, to be bridge-linked to the central platform, will be installed. A.P. M ller expects overall production from the field to increase to 100,000 b/d in 2005. Halfdan was discovered in 1999.

Oxy Permian is devising a plan for CO2 injection at its Snyder, Tex., unit.

Oxy Permian plans a CO2 injection project that will enable it to recover 10 million bbl of oil at its Cogdell Canyon Reef unit in the Permian basin north of Snyder, Tex. The injection is slated for later this year.

Cogdell is approaching the end of its economic life as a waterflood. The 10 million bbl figure is for the first phase of the tertiary recovery project. Oxy Permian awarded contracts to Kinder Morgan CO2 Co., which will provide the CO2 and process contaminated produced gas. Tim Bradley, Kinder Morgan CO2 president, said his company would supply and transport 175 bcf of CO2 over 10 years. Kinder Morgan also announced a 20-year processing contract under which it will process contaminated produced gas for a fee, then return the extracted CO2 to Oxy for reinjection.

Rounding out production news, Petroecuador plans to reactivate 90 shut-in oil wells by forming operating agreements with investors in the private sector. Reactivation is expected to boost Ecuador's output by 20,000 b/d. The wells were closed for numerous reasons, including marginal production, excessive water in the structures, unseated gaskets, burned pumps, loss of production capacity, and high investment costs. Scheduled for reactivation are 20 wells in Auca field, 18 in Lago Agrio field, 22 in Libertador field, 22 in Sacha field, and 8 in Shushufindi field.

Topping petrochemical news, a joint venture of Sinopec, Sinopec Shanghai Petrochemical, and BP will begin building a $2.7 billion ethylene-led petrochemical complex in Shanghai in eastern China in October.

A recently completed feasibility study report has been submitted to the government for approval.The JV will build a 900,000 tonne/year ethylene cracker and polyethylene, polypropylene, and polystyrene plants with a combined capacity of more than 1 million tonnes/year, as well as styrene monomer, acrylonitrile, and other olefins derivatives units, at Shanghai Chemical Industrial Park at Caojing, Shanghai. The companies expect to complete the project construction in 2005.

In other petrochemical action, National Petrochemical Co. has awarded Technip and its Iranian partner Nargan a contract worth 300 million euros for technology and engineering of an ethylene plant. Technip said the 1.4 million tonne/year plant would be the largest ethylene steam cracker worldwide and the only large-capacity steam cracker to use both gas and liquid feedstocks to produce ethylene and propylene. The plant will be built at Assuluyeh on Iran's northern Persian Gulf coast. Technip will provide its in-house ethylene technology and proprietary furnaces along with basic and detailed engineering, supply of equipment and materials, construction supervision, and commissioning.

An underground Gas leak in Hutchinson, Kan., continues to puzzle investigators.

Natural gas that apparently escaped from an underground salt storage unit and erupted in Hutchinson, Kan., killing two residents, has put a solution mining operation on hold in the UK and prompted German regulators to seek more information on such activity, an industry consultant said earlier this month.

While there has been no official finding yet, the "working assumption" is that the Jan. 17-18 eruptions of gas and brine in 30-ft geysers in Hutchinson resulted from the loss of 73 MMcf of gas from the Yaggy storage facility 7 miles downdip from the central Kansas community (OGJ Online, Feb. 21, 2001).

The gas is thought to have escaped through "a fist-size hole" in the casing of an injection well that was drilled out in 1992 to convert the former propane storage facility into a natural gas storage unit.

In other storage news, FERC has granted Central New York Oil & Gas permission to build, own, and operate a 12 bcf natural gas storage project near Oswego, NY. The Stagecoach project's maximum injection rate would be 2.5 MMcfd and its maximum withdrawal rate 4.9 MMcfd. CNYOG applied to build the storage facility in 1999. The company, an affiliate of eCORP Holding, will proceed with the project immediately. Injection service is expected to begin in late summer.

Australian exploration leads this week's exploration roundup.

The Australian government said an exploration permit in the Timor Sea off northwestern Australia was awarded to a consortium of Daytona Energy, Eagle Bay Resources, and Westranch Holdings.

The 1,085-km AC-P-32 permit is in the Vulcan subbasin of the Bonaparte basin. Water depths are 60-100 m.

Australian Minister of Industry, Science, and Resources Nick Minchin said the consortium is expected to spend $20.3 million during the next 6 years. "This includes the drilling of two exploration wells and the purchase and reprocessing of seismic and remote sensing data in the area," Minchin said.

Meanwhile, Santos found more oil in the South Australian section of the Cooper basin. The Moomba 136 well pentrated the Jurassic Hutton sand. A drillstem test flowed 3,845 b/d with 210 psig flowing tubing pressure. Santos operates the PPL 9 JV parties. The well will be cased, with production expected by the end of March.

In other exploration happenings, Maple Production del Peru, a unit of Maple Gas, will soon begin exploration activities on Peru's Block 31-E in the northern Ucayali basin. Maple produces 150 b/d from Agua Caliente field in the adjacent Block 31-D. Maple signed an E&P license for Block 31-E with Perupetro, the state oil agency, on Mar. 6. Rex Canon, Maple Production del Peru's executive vice-president, said the company will drill an exploration well on each of two structures on the 141,003-hectare block after running seismic. Maple expects to spend $10 million on initial exploration.

Repsol-YPF announced the discovery of three oil and gas fields on West Madura Block, off Java. Three exploration wells, KE23-1, KE13-1, and KE24-1, were drilled on separate structures in Kujung limestone. On test, the discoveries flowed a total of 6,300 b/d of crude and condensate and 30.1 MMcfd of gas. Preliminary estimates of reserves for the three fields are 13 million bbl of oil and condensate and more than 153 bcf of gas. KE-23 field is expected to come on stream by the end of the third quarter.

A Bouygues Offshore subsidiary has a contract to upgrade Cameroon's refinery.

Commission Nationale des Marchés Financiers du Cameroun awarded a contract for the debottlenecking of the 42,000 b/d Ste. Nationale de Raffinage refinery in the port city of Limbe, Cameroon. Bouygues Offshore subsidiary Sofresid got the 10 million euro contract for engineering, procurement, and construction supervision for the project, which is expected to take 19 months. The debottlenecking will increase distillation capacity of light crude and allow the refinery to obtain a new distillate fraction.

In other refining sector news, Sinopec unit Maoming Petrochemical began building a jet fuel hydrotreating unit at its refinery in southern China's Guangdong province late last month.

The 1.2 million tonne/year unit is being built adjacent to the refinery's other units, at a cost of 80 million yuan. Construction is to be completed by yearend.