InterOil builds first refinery in Papua New Guinea

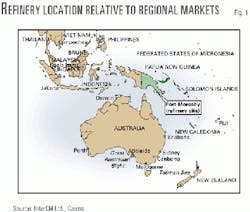

InterOil Corp., Cairns, Australia, is building a US$180 million hydroskimming refinery in Napa Napa, Papua New Guinea (PNG), on the western side of the Port Moresby Harbor (Fig. 2).

This will be the first refinery in the country and the first refining project for InterOil, a company established in 1996 whose sole purpose was to finance and construct a niche market refinery in PNG.

Since December 1998, InterOil has owned 99.97% of SP InterOil LDC (SPI), whose most significant project is the development of the new oil refinery. SPI owns a greater than 90% share of the oil refinery. It is also involved in oil and gas exploration and has interests in six petroleum prospecting licenses in PNG.

The PNG government has supported this refinery project to reduce the country's dependence on foreign petroleum products. It has entered a 30-year agreement with InterOil to allow the new refinery to purchase crude oil from PNG producers at the producers's export price and sell refined products at import parity price. InterOil also will be allowed to supply 100% of PNG's refined products demand.

The government has given the company a 5-year tax free holiday, which becomes effective on the first day of the financial year following start-up. The refinery also has a customs-duty exemption, which exempts equipment and material for refinery construction from customs duties.

Made of relocated, refurbished, and new equipment, the refinery will have a nameplate capacity 32,500 b/d. Products from the refinery will be marketed within Papua New Guinea and to nearby export markets of the South Pacific region. InterOil expects completion of the refinery in the second half of 2002.

Scope of work

Scope of work for the engineering, procurement, and construction (EPC) contractor includes site civil work (Fig. 2), a storage tank farm, a 32,500-b/d crude distillation unit, a 5,000-b/d hydrodesulfurization (HDS) unit, a 3,500-b/d catalytic reforming unit, a jetty with ship loading and unloading facilities, utility systems including steam and power generation, and site infrastructure and support facilities.

The crude unit is from Chevron Corp.'s former Nikiski, Alas., refinery, which was closed in 1991. The semiregenerative reforming unit and associated HDS unit are from an Oklahoma refinery, also previously owned by Chevron.

InterOil shipped this refinery equipment to Beaumont, where it is awaiting inspection, refurbishment, and modifications.

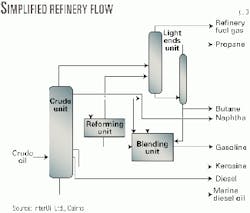

Fig. 3 shows a simple refinery flow diagram for the refinery. The refinery has no conversion units because its light, sweet crude will be able to make on-specification products without them. The refinery's design allows for future inclusion of a naphtha isomerization unit.

The HDS and reforming units will produce 3,500 b/d of reformate for gasoline blending. The refinery will blend the gasoline online, although batch blending is also possible. No other products will be blended.

The straight-run diesel is a viable product with no need for hydrotreating to remove sulfur.

The refinery will provide its own power, hydrogen, and inert gases. It will generate electricity by using two 3.5-Mw gas turbine generators, primarily fueled by refinery offgas.

Hydrogen for desulfurization will come from the catalytic reformer. The reformer will also maintain a pressured supply of hydrogen for unit start-up. PNG will have banks of high pressure cylinders of hydrogen for excess capacity.

An air-separation plant will provide nitrogen when needed.

Although the refinery configuration is simple, InterOil will install a distributed control system. This installation will ease the transition to advanced process control, which will be implemented to a limited degree in the future. It also simplifies data recording and trending and includes tank-farm inventory management.

The refinery will have a single central control room for the entire complex, which will be linked to corporate headquarters.

Project engineering

Kvaerner John Brown (now Kvaerner Process), Houston, produced the front-end engineering design (FEED) package in 1997. InterOil used this work to solicit bids for the EPC contract, which was awarded to Clough Engineering Ltd. of Perth, Western Australia.

Clough Engineering subsequently carried out the work to refine and update the FEED package.

Clough Niugini Ltd., the operating arm of Clough Engineering, began detailed engineering in April 2000 for the first phase of the lumpsum turnkey EPC contract. It has since concentrated mainly on process simulation and design as well as site layout.

The EPC contract currently allows for 20 months of construction, followed by 6 months of commissioning and ramp up time. InterOil anticipates, however, that these figures will be improved.

The lumpsum EPC contract to complete the refinery, together with performance and completion guarantees, is $96 million.

To avoid delays as a result of onset of the wet season, the project schedulers released the road upgrade, site preparation, and civil works early. This work has been completed within the budget. This completed project portion has the advantage of removing potential latent contract conditions as a result of possible geotechnical problems.

The peak construction workforce is 180 on site and 240 off site personnel. After the refinery is completed, InterOil Ltd., a wholly owned PNG subsidiary, will own and operate the refinery, using specialist subcontractors when appropriate. It plans to employ 75-100 people for operations and maintenance.

Feed, products

Initially, a tanker will supply all crude to the refinery. Depending on the development of other small producing fields, barges or road trucks may bring in part of the feedstock. Initial crude storage capacity will be 750,000 bbl.

The refinery is designed to use indigenous crude Kutubu Blend, which has a 0.04% sulfur content and a 44.0° API gravity. Current production-decline curves indicate that this crude will be available in sufficient quantities to satisfy the refinery for more than 10 years.

The refinery can also use various Asia Pacific light, sweet crude when necessary.

The light Kutubu Blend limits the capacity of the light-ends unit, which limits the refining distillation capacity to 35,500 b/d. Although this throughput may be possible, Clough Engineering has guaranteed only 32,500 b/d in its design.

The refinery will produce commercial propane, commercial butane, and various grades of naphtha for petrochemical feedstocks. Transportation products include unleaded gasoline, automotive diesel fuel, jet A-1 aviation fuel (kerosine), and low-sulfur marine diesel fuel.

Within certain limits, the refinery will be able to adjust the product quantities based on distillation cut points. The main tradeoffs will be between kerosine and diesel production. The refinery will likely maximize diesel because it is a highly demanded product in the PNG market.

The refinery will be able to maximize kerosine production by making up to 20% of its production kerosine and 26% of its production diesel. Or it can minimize kerosine production to 7% and maximize diesel up to 40% of production.

Table 1a shows typical refinery yield, based on a 32,500-b/d throughput and a 96% on stream factor. Table 1b shows expected consumer demand for targeted markets in 2002. PNG's total refined-products demand in 1999 was 17,000 b/d.

Unless otherwise required, finished products will meet or exceed relevant Australian standards.

Environmental issues

The environmental permitting concerning this complex was unique since this is the first facility of its type in PNG. There were no existing domestic environmental standards for building a refinery.

The company therefore, according to InterOil, committed to meeting or exceeding environmental standards recommended in the World Bank guidelines for oil refineries. This forms part of the EPC contract terms and conditions.

All major permitting requirements have been granted or fulfilled, said InterOil.

The PNG government granted InterOil two 99-year leases on May 27, 1997, for the site of the refinery.

Before construction, InterOil submitted a detailed third-party environmental impact assessment and an environmental plan to the PNG Department of Environment and Conservation (DEC). It was duly approved in June 1998.

On Feb. 15, 2000, the Petroleum and Energy Department of the government of PNG granted InterOil a petroleum processing facility license, which allows the company to "construct, refurbish, install, and commission and oil refinery facility at the site of Napa Napa in accordance with the terms and conditions imposed upon it by the Project Agreement of 29 May 1997 (as amended by the Extension Deed of 1 July 1999)."

As for environmental reporting, the refinery will be generally self-monitored as recommended by ISO-14000. InterOil will keep the DEC informed, however, of developments relevant to environmental issues. This communication includes design changes, normally reportable incidents, and results of environmental measurement surveys.

Since the crude oil feedstock has a very low sulfur content, the refinery design requires no sulfur plant. Details of air-emission quantity and quality will be determined during the project's detailed design phase. Sufficient work has been completed, however, to ascertain that the project will meet or exceed World Bank guidelines for environmental performance of refinery facilities.

The refinery will generate little or no waste under normal circumstances except for oily waste water from the process. This waste water will pass through a four-stage treatment process and be monitored before being discharged to sea.

Markets

As well as eliminate refined product imports, the new refinery will be a good fit for the upstream oil development in PNG.

Although PNG has various known oil prospects, the prospects can not be economically connected to existing oil export facilities. The refinery will provide an outlet for these oils, enhancing incentives of petroleum exploration. Particularly, smaller-field production will become viable with the existence of a refinery.

The company has 6.2 million acres of prospective property onshore with three proven gas fields. It also has prospecting licenses for 1.5 million acres offshore in the Gulf of Papua.

InterOil is primarily considering the PNG domestic fuels market for refinery products. The refinery design will be able to accommodate a limited amount of surplus production of finished fuel products to allow for PNG market growth.

Export products will be mainly excess naphthas, which have already been contracted to a major oil trader. Total exports will be about 38% of refinery output.

With the exception of small quantities of fuel required for piston-engined aircrafts, once the refinery is in place, PNG will be a self-sufficient provider of transportation and power-generation fuels.

Eliminating refined-products imports amounts to an estimated foreign exchange savings of $73 million, said Christian Vinson, vice-president and chief operating officer of InterOil. Average unit operating costs are estimated at under $2/bbl.

Net Asset Capital Inc., a Toronto-based equity research firm, estimated that after commencement of operations, InterOil will achieve an after tax cash flow of $40 million/year and a payback period of 4 years.

InterOil has estimated a cash margin of $4.40/bbl for the first 5 years of operation.

PNG currently imports refined products from the South Pacific region (including northern Australia) and Singapore. In serving the PNG market, the new refinery will have the advantages of lower transportation costs and simpler logistics than its present overseas refined product suppliers.

InterOil believes these advantages will ensure its refinery a niche margin above these competitive refineries. The company should be able to pass these savings onto local consumers in the form of price reductions.

InterOil has raised equity of about $100 million, of which $65 million has been spent on the purchase of the secondhand refinery from Chevron, a catalytic reformer, and development costs.

The balance of InterOil's cash will be invested in the project along with a loan of $85 million from Overseas Private Investment Corp. (OPIC), an agency of the US government.