Financial commitments brighten 2001 GTL prospects

The stage is set in 2001 for major developments in the conversion of natural gas to synthetic petroleum using Fischer-Tropsch technology.

Royal Dutch/Shell Group's Shell International Gas Ltd. in 2000 announced that it was studying some $6 billion in spending for 70,000-75,000-b/d GTL plants in Indonesia, Iran, Egypt, and Trinidad. The project in Egypt would also involve a single-train LNG facility.

Several factors are influencing the GTL industry starting the new century, including continued emphasis on environmental issues facing the petroleum industry.

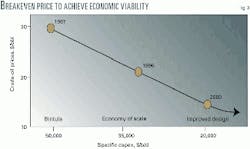

The economics for Fischer-Tropsch GTL conversion have dropped to less than $25,000/bsd ($20,000/bsd for Royal Dutch/Shell Group's Shell International Gas Ltd. and its Shell Middle Distilate Synthesis technology) in capital expenditures for a greenfield plant, according to several companies in the GTL business, and oil prices are well above the breakeven cost for construction of an Fischer-Tropsch facility.

If crude oil prices remain in the $20 range, says Mark Agee, chairman and chief executive officer, Syntroleum Corp., Tulsa, "we'll see a number of projects go forward."

At the beginning of 2001, several commercial projects were in front-end engineering design (FEED) stages, including Syntroleum's Sweetwater project in Western Australia, Rentech Inc.'s methanol plant conversion in Commerce City, Colo., and the Chevron Corp.-Sasol Ltd. global joint venture's greenfield plant in Nigeria.

(Editor's note: See accompanying article by Syntroleum for an update on the Sweetwater project.)

Another marked change in the industry in 2000 involved new names of several small-to-medium-sized oil and gas companies entering the industry, such as Ivanhoe Energy Inc., Calgary, and TransAtlantic Petroleum Corp.

The same sea change was evident on the project side of the business as well. Two firms that aren't mainstream GTL technology companies-Reema International Corp., Denver, and Sicor Inc., Houston-made strides towards the start-up of projects in Trinidad and Ethiopia, respectively.

During 2000, one pilot plant began operating for Synergy Technologies, while Syntroleum and ARCO (now BP) closed their pilot plant at the Cherry Point refinery near Bellingham, Wash. And BP Amoco and Conoco both announced construction of pilot plants to prove their technology.

There is also emphasis on small-scale GTL facilities for wellhead operation. Several new technologies are being touted, and prototype facilities are under development.

A continent-by-continent look at GTL projects and developments follows.

North America

Record high natural gas prices have dampened gas-conversion projects in North America, including methanol and ammonia. The largest single variable cost for Fischer-Tropsch conversion is the cost of the feedstock. Every $0.10 increase in the price of natural gas adds $1/bbl to the cost of the product.

Not all gas has pipeline access, however. The North Slope of Alaska and areas in the Rocky Mountain region still have stranded gas. The high prices have made pipeline delivery of North Slope gas more attractive at the moment.

The US Department of Energy (DOE) continues to promote GTL for the North Slope in an effort to extend the productive life of the Prudhoe Bay fields. Minimum throughput for the Trans-Alaska Pipeline System is estimated to be between 200,000 and 400,000 b/d.

A DOE report estimated GTL production could extend the life of TAPS by 9 years, from 2016 to 2025, and result in an additional 500 million bbl of oil production (Fig. 1).

Two companies-Alaska Natural Gas To Liquids Co. (ANGTL), Anchorage, and ExxonMobil Corp.-have discussed plans for construction of 50,000-b/d facilities on the North Slope. BP Amoco has begun site work for construction of a 300-b/d pilot plant in Nikiski, Alas., to test its proprietary GTL catalyst technology.

Richard Flury, chief executive officer, BP Gas & Power, told a recent conference in Canada that gas-to-liquids technology is "close to commercial application at sustained oil prices below $20/bbl." Further improvement will push this competitive price lower, he added.

ANGTL is promoting its GTL project that uses Sasol Ltd.'s technology and is working to create tax breaks for products in US markets as well as support for tax-free revenue bonds to build its plant. In 2000, the company hosted several US Congressmen in South Africa to visit the conversion processes there and see that the technology is viable.

ExxonMobil has not been publicly promoting its technology.

Major North Slope gas owners BP and Phillips Petroleum Co., Bartlesville, have also been studying LNG options for North Slope gas and, along with ExxonMobil, have committed $75 million to study of a pipeline option for the natural gas. BP has noted repeatedly that there is enough gas on the North Slope for multiple development options.

ExxonMobil is now looking at the various options for pipelining North Slope gas into Chicago, says Dennis Yakobson, chairman, president, and chief executive officer, Rentech, Denver.

At $5/MMbtu, which the company could receive, a pipeline seems "more viable on the North Slope for ExxonMobil at this time," he says.

Synergy Technologies Corp. has been conducting field tests of its SynGen technology in Brooks, Alta., since mid-2000 (Fig. 2). The SynGen technology is the first stage in the company's two-stage process, which uses a plasma arc called GlidArc.

The second Fischer-Tropsch stage uses a proprietary, chain-limiting catalyst in its reactor, according to the company. Use of its catalyst, the company says, has eliminated the third step found in competing processes, hydrocracking of waxy paraffins.

Early in 2000, Conoco Inc. signed an agreement with Howe-Baker Engineers Inc. for design of a 250-500 b/d GTL plant to start up in mid-2002 testing Conoco's proprietary syngas and Fischer-Tropsch technologies.

While a subsidiary of DuPont, Conoco has said, it was able to take advantage of the catalyst-development technology DuPont had available and has gone through more than 4,000 catalyst formulations and some 68 reactor designs.

Conoco, among the more pessimistic companies in the GTL industry, believes in economies of scale and that only large-scale plants (minimum capacity of 60,000 b/d) are viable. In several articles, company representatives have said they want to "inject some reality" into the process.

Rentech's major project in North America is the conversion of the Sand Creek methanol plant in Commerce City, Colo., to an 800-1,000-b/d GTL plant. The company is currently in the permitting stage for the facility and hopes to have the conversion complete by early 2002.

"Sand Creek represents a milestone for both Rentech and the US GTL industry," Yakobson says. By utilizing the syngas-generation section of the methanol plant, Rentech estimates that it can save 50-60% of the cost of a greenfield GTL plant.

The plant will include a 9-Mw fuel-cell power plant from FuelCell Energy Inc.

Anschutz Investment Co. and Forest Oil Corp., both of Denver, became shareholders in Rentech in early 2000. Forest also executed a memorandum of understanding under which Rentech expects to issue one or more site-specific GTL licenses. The firm is studying a GTL plant in Alaska.

Although high US natural gas prices raise a warning flag for Rentech's Sand Creek project, it's not the only GTL prospect being studied.

Final reports on feasibility studies for two GTL facilities using off-gases from two chemical plants were completed in January and early February. The companies have since begun to evaluate the projects.

Rentech will also receive an $800,000 grant for a GTL feasibility study from the State of Wyoming Business Council. The funding will be used to evaluate two potential GTL projects.

The first phase of the project involves retrofitting a portion of an existing methanol plant for production of up to 2,500 b/d of GTL projects. The second phase is for a separate 10,000-b/d greenfield plant at the same site.

The study should take 6-9 months. The award is the result of almost 2 years of discussions, planning, and negotiations between Rentech and the council.

One other pilot plant operation-Syntroleum and ARCO's (now BP's) Cherry Point facility-was shut down in July 2000, after successfully completing all of the tests required by ARCO.

Ken Agee, chairman and chief executive officer, Syntroleum, says "We have the scale-up data that [are] necessary for building a large-scale fuels plant, which is totally different from Sweetwater."

The equipment for the plant will remain at Cherry Point until BP decides if it wants to conduct additional tests or give the equipment back to Syntroleum.

Australia

The only Fischer-Tropsch GTL project currently under way in Australia is the 10,000-b/d Syntroleum facility.

At the Sweetwater project on the Burrup Peninsula in Western Australia, the company is in the final stages of negotiating the lump-sum engineering, procurement, and construction (EPC) contract with Tessag-Anlagen GmbH.

"We're very close [at Sweetwater to having] financial close and start of construction, which should occur in first quarter 2001," Mark Agee says.

He adds that for Sweetwater, "we're negotiating for contract product sales, but we're financing the plant as a merchant plant. We do not have to have offtake agreements in hand in order to get it financed."

Indicative of the trend towards smaller oil and gas companies becoming involved in GTL, Ivanhoe Energy Inc., Calgary, has become a major player in the Sweetwater project.

After signing a license for the Syntroleum technology in May 2000, the company upgraded its initial license and then joined the Sweetwater GTL project in October, acquiring a 13% interest for a $21-million investment.

Europe

The primary function of Europe in the GTL industry at this point is as a major market. But environmental regulations in the European Union could open prospects for placing GTL projects in the EU.

"GTL technologies have the potential to release 'stranded' gas reserves, which are too small to justify an LNG scheme and too remote to be piped to markets," says Gas and Power 2000: An Insight into Europe's Developing Gas and Power Market, published by BP Amoco Gas & Power.

"Many companies, including BP Amoco, are working hard to develop new technology that could allow much smaller plants, supported by smaller fields, to be constructed economically," the report says.

"GTL conversion plants could become an option for the far-north gas being discovered off Norway and elsewhere. . . . The high-quality liquids produced by such facilities will probably be used to make petroleum products, so the overall market for gas will expand," the report concludes.

Rentech continues to work with Swedish company Oroboros to develop a GTL facility using industrial off-gases.

Yakobson says that the company has been working with the government of Sweden, not currently a member of the EU, to convince the EU about GTL fuels.

The Swedish company is hoping to get tax credits from the EU even if the product is made in Sweden.

Africa

In a recent announcement on its $6 billion capital and exploratory spending program for 2001, Chevron Corp. noted it "will begin engineering on a major gas-to-liquids project in Nigeria to further reduce flaring of associated natural gas by converting it to clean petroleum fuels."

The 33,000-b/d GTL plant will be the first facility built under the auspices of the Sasol-Chevron global joint venture. The facilities are to be completed in 2005 with products from the facility marketed in Europe.

The GTL plant will be built next to existing operations at Escravos.

Another project aimed at utilizing associated gas involves a 50,000-b/d plant in Angola that was being touted by ExxonMobil, according to press reports. However, no other information has become available.

In South Africa, Forest Oil funded a feasibility study by Rentech using that company's technology for possible development of the Ibhubesi field.

Rentech estimated the capital cost of a GTL plant in South Africa using Rentech's technology at $25,200/b/sd ($252 million for a 10,000-b/d plant),

The estimate includes feed preparation, steam reformer plant, CO2-removal unit, hydrogen membrane system, Fischer-Tropsch reaction system, power systems, and offsites.

Yakobson says that adding facilities to upgrade the Fischer-Tropsch products may require $110 million, depending on the desired product slate.

The field is off the west coast of South Africa off the mouth of the Orange River near the border with Namibia. Delineation drilling on the field is under way with expectations of reserves up to 15 tcf.

If the field is proven to contain such reserves, Forest Oil could develop its own GTL facility and supply gas to the Mossgas GTL plant at Mossel Bay. Mossgas expects to deplete its current gas supplies by 2007.

Rentech's Yakobson says there "was some talk of shipping gas, maybe up to 200 MMcfd, down to Mossgas to keep that plant in operation and potentially increase the capacity of that plant using a second technology."

Mossgas has been limited by its license to Sasol for fuels only, says Yakobson. If it uses another technology, it could enter the petrochemical market and take advantage of some of the specialty chemicals.

Nigeria and Egypt are potential sites for GTL plants for another mid-sized energy company, TransAtlantic Petroleum, according to Barry Lasker, TransAtlantic Petroleum president.

In late December 2000, the company signed a letter of intent with Protium Energy Corp., Dallas, which would provide an infusion of capital to the company and permit access to a license for GTL conversion.

William C. Morris, chief executive officer, Protium Energy, is also chairman of Dresser Engineering Co., Tulsa, which has an agreement in principle for the exclusive right to provide process engineering and design for the Rentech Fischer-Tropsch reactor in GTL plants.

The company sees access to a GTL conversion process as a method for increasing the potential for TransAtlantic to monetize gas reserves in Africa. The agreement represents a significant opportunity for the company to expand its key focal areas of West Africa and Egypt, says the company.

Egypt is also the target of one of the Shell studies. Egyptian General Petroleum Corp. (EGPC) and the Egyptian Oil Ministry agreed on the terms of a development protocol for a single-train LNG plant and a 75,000-b/d GTL facility.

The plant would be used to develop some of Egypt's uncommitted gas reserves and would be implemented through a joint venture between EGPC and Shell. The LNG plant could be operational by mid-2004, followed a year later by the GTL plant.

Another project in Egypt that is still being evaluated is a methane-to-olefins plant proposed by UOP LLC, Norsk Hydro, and Egyptian Arab Trading Co. The US Trade and Development Agency (TDA) funded a feasibility study headed by UOP.

The plant would be part of a $925-million petrochemical complex at Suez, Egypt, which would include a methanol plant supplying feedstock to the UOP-Norsk Hydro olefins plant.

Another GTL project that seems to have some momentum is a proposed 20,000-b/d plant in Awash, Ethiopia. Representatives of Sicor Inc., Houston, were prepared to sign agreements with Ethiopian officials during first quarter 2001 for the Gazoil Ethiopia project, a $1.4-billion field development, power generation, and GTL plant project, says Ronnie Monk Jr., chairman and chief executive officer, Sicor.

The fields contain an estimated 4 tcf of gas reserves. The GTL plant would use the Fischer-Tropsch process developed by Syncrude Technology Inc. The project would make Ethiopia self-sufficient in some fuels and fertilizers.

Middle East; Asia

One of the four projects being studied by Shell is a 70,000-b/d plant in Iran that would use gas from the South Pars field.

Shell signed a memorandum of understanding with the National Petrochemical Co. in Iran for a feasibility study that was to have been completed in first quarter 2001. The earliest a plant could begin operations is yearend 2005.

Across the boundary line with Qatar, two GTL projects are still being discussed that would use reserves from the North field. Qatar General Petroleum Corp. is working with Sasol on a 30,000-b/d plant, which both companies say will begin commercial operation in 2004.

"We're trying to reduce that cost," said Hamad Al-Mohannadi, general manager, QAPCO. "GTL requires large gas resources, and we have those resources."

He also said that the Qataris were still in discussions with ExxonMobil for a 100,000-b/d plant. The feasibility study has been completed, and negotiations are continuing for the fiscal terms and conditions.

There have been no indications of when the negotiations will be completed and when the plant might be operating. Both plants would be at Ras Laffan Industrial City.

On May 16, 2000, Shell put its Bintulu SMDS plant in Malaysia back in operation, some 28 months after an explosion in the air-separation plant shut down the facility.

Shell used the opportunity to upgrade the entire plant and put a new catalyst into its reactor. The company says a "breakthrough in catalyst performance" has allowed its new design to bring down the cost to $20,000/b/sd (Fig. 3). Such a plant would be viable with oil prices as low as $15/bbl, the firm says.

Sources have said that Shell's new catalyst boosts output from the plant by 20% using the same amount of gas feedstock. That would boost the plant's capacity to 15,000 b/d from 12,500 b/d.

Shell is said to be considering adding four more trains to the Bintulu plant over the next few years, bringing total capacity to 75,000 b/d.

That is nearly the same size plant that Shell is discussing with Pertamina and the Indonesian Ministry of Mines and Energy. A $1.4 billion, 70,000-b/d plant would use about 600 MMcfd.

At the same time, Pertamina is conducting a study with Rentech for a 10,000-15,000 b/d facility.

Yakobson says "Pertamina has some small gas fields that are capable of producing up to 150 MMcfd. Some of them are adjacent to refineries."

Pertamina is providing the marketing data and gas analyses at a site, while Rentech is looking at the technology.

Rentech has also been working with Donyi Polo Petrochemicals on a GTL plant in India. The project is at a standstill, however, because the Indian company is busy with other projects in the country such as a port in Gujurat.

"We are hopeful that at some future time our India licensee will move forward. They still express an interest in the technology. The license is not dead, but the project right now is not moving forward," Yakobson says.

South America

Huge gas reserves in Venezuela and Peru, along with smaller, yet substantial reserves in Trinidad, Bolivia, and Brazil are attracting the interests of the GTL industry.

Venezuela, with 146 tcf of reserves, is studying every method of gas development, including GTL and LNG. PDVSA is moving ahead with an LNG plant in the Paria region of eastern Venezuela that involves Shell, ExxonMobil, and Mitsubishi Corp.

A two-phase feasibility study sponsored by TDA looked at 15,000 and 50,000-b/d GTL facilities in Venezuela. The smaller facility was considered a short-term solution to gas utilization in the country, while the larger plant was considered long-term.

Raytheon Engineers & Constructors Inc., Houston, performed the study which compared six Fischer-Tropsch technologies: ExxonMobil, Shell, Syntroleum, Sasol, Rentech, and PDVSA/Intevep. The first four were evaluated for a full GTL plant, while the latter two were for Fischer-Tropsch synthesis only.

Raytheon chose the two technologies that have been proven on a commercial scale, Sasol and Shell, based on their market study for the short-term solution (Table 1). For the long-term project, the company recommended a re-evaluation of the technologies given the rapid rate of evolution in current designs.

At current state-of-the-art, Sasol and ExxonMobil technologies showed greater overall advantages (Table 2), according to Raytheon.

This study appears to be one of the better comparisons of competing technologies now available, although the figures for Syntroleum are not close to what the GTL company provided.

Syntroleum's estimated plant cost was $351 million for a 15,000 b/d plant. Raytheon's GTL model, however, resulted in an estimated $455 million, some 25% higher than Syntroleum's figure.

Rather than being among the lowest cost plant, Syntroleum became the highest cost plant based on per-barrel-per-stream-day figures. Raytheon says the primary reason for the increased estimate was the investment cost for offsite and utility systems. Syntroleum challenges these findings.

The capital cost per barrel per stream day ranges from a low of $24,380 (Intevep) to a high of $37,920 (Syntroleum) for the short-term project and from a low of $19,590 (Intevep) to a high of $31,450 (Syntroleum) for the long-term project.

It should also be pointed out, however, that the Intevep technology has not been tested; these are very rough estimates.

Rentech is working with BC Projetos in Brazil on a 10,000-b/d plant in the Amazon Basin. "We have a project identified. We're working to get a study approved. In this particular situation, it is very site specific," Yakobson says.

Shell's fourth feasibility study is for a 75,000-b/d plant in Trinidad. The facility would require some 600 MMcfd and could begin commercial operation in 2005 or 2006.

TDA funded a "definitional mission," which provides its staff with technical expertise to guide the agency's decisions on the funding of feasibility studies, for GTL projects in Brazil. The mission was to identify and evaluate two GTL plants and other prospective projects with Petrobras.

Bechtel completed a study for local gas producers in Bolivia on a $1.75 billion, 50,000-b/d GTL plant that would produce synthetic fuels for export to Brazil and Chile.

In an effort to boost the project, the Energy and Hydrocarbons Vice-Ministry was preparing an addendum to the hydrocarbons law that would regulate natural gas refining.

Only one bid was received for the transportation and distribution concession for Peru's Camisea project. The main reason there were so few bidders is that the domestic markets for gas in Peru are extremely limited, and developers will be hard pressed to make the economics work.

If Peru opts to attract industrial development to utilize the gas reserves, however, a GTL plant would be very attractive.

Wellhead GTL plants

One new emphasis in the GTL industry is on portable GTL plants that can produce smaller volumes from isolated fields or even single wellheads.

The pilot plant being operated by Synergy Technologies in Canada is an example of this type of unit.

Another entrant in this market is Blue Star Sustainable Technologies Corp., Arvada, Colo., a subsidiary of Hawks Industries Inc. The company used a catalyzed, pulsed, partial-oxidation process for syngas production.

It is developing a prototype 10-b/d unit that can be mounted on a semi-trailer, which will be tested in Wyoming later this year, using coalbed methane as the feedstock. Patent registration has begun for the company's key ideas, processes, and designs.

Their low-pressure process reduces the tendency for forming nitrogen oxygen, thus allowing the use of air and eliminating the need for an air-separation plant.

A new GTL process was developed by researchers at Texas A&M University that produces a light naphtha and could be economical for gas flows as low as 1 MMcfd.

Texas A&M licensed the technology to Conquest Resources Corp., which then formed Synfuels International Inc., which in turn has built a pilot plant near College Station, Tex., for testing the technology.

Ken Hall, professor of chemical engineering, Texas A&M, says,"We think we can make it economical down to 1 MMcfd. Our initial commercial unit will be 10 MMcfd. The output would be 1,000-1,200 b/d of light naphtha."

Such a plant would cost an estimated $25 million for a one-time purchase. The price for multiple units would be lower, he says.

The author

Scott L. Weeden is managing editor for Remote Gas Strategies and LNG Express for Houston-based Zeus Development Corp., an integrated research consulting firm and publisher. Weeden has been covering the Fischer-Tropsch GTL industry since Remote Gas Strategies began publishing in July 1997. He has 26 years' experience as a journalist in the petroleum industry. He holds a BS in journalism from Oklahoma State University, Stillwater.