OGJ Newsletter

NL Bulletin

Australian Timor Sea LNG development is being accelerated to meet urgent demand for gas in southern California and Mexico's Baja California peninsula. Phillips Petroleum Co. and El Paso Corp. have signed a letter of intent to develop a world-class LNG project that entails exporting 4.8 million tonnes/year of LNG from a proposed Optimized Cascade process plant near Darwin, Australia, to a proposed terminal on the North American West Coast. The gas would come from the Timor Sea's Greater Sunrise fields, estimated to hold 9 tcf (OGJ, Dec. 11, 2000, Newsletter, p. 8). Units of the two firms have signed a letter of intent for El Paso to purchase LNG on a long-term basis beginning in 2005. The LNG would be regasified for El Paso to deliver 680 MMcfd to customers in Baja California and southern California. The terminal location isn't yet determined, but the two firms are working with both Mexican and US authorities for permits; it would link with existing pipelines.

Market Movement

Another OPEC cut possible this week

Will OPEC proceed with another production cut at its ministerial meeting in Vienna this week? And will it be justified?

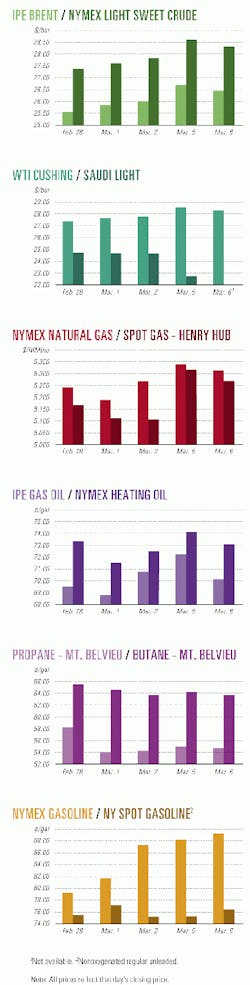

There are some signs that a bear market may be getting entrenched, contends WEFA Energy Services' Michael Lynch. Recent bullish market and political events have failed to strengthen oil prices, which have re- mained under pressure from weakening demand, he says. WTI closed out last month just above $27/bbl, edging closer to the lows seen in second quarter 2000.

The one ma- jor factor put- ting upward pressure on oil prices in early March has been the anticipation of possible further cuts in OPEC production. Ironically, OPEC itself may have talked up the price to the point where it may seem to obviate the need for another cut-which suggests that prices have room to slide again after the meeting if no cut is forthcoming.

"If, as some reports have it, the Saudis are playing a delicate balancing act, trying to keep the [OPEC basket] price at $25/bbl, not just above it, then the near-term price will be more influential on OPEC deliberations than usual," Lynch said.

Capacity growth

At the same time demand is weakening, higher oil prices have begun to spawn another round of oil production capacity growth within and outside OPEC.

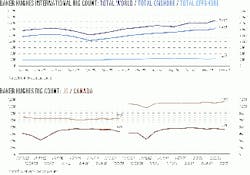

Lynch estimates non-OPEC production capacity growth this year at 1 million b/d, compared with projections of 700,000 b/d, 800,000 b/d, and 600,000 b/d by, respectively, Deutsche Bank, IEA, and EIA.

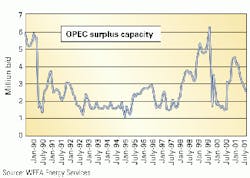

At the same time, OPEC's surplus productive capacity is growing again, after taking a nosedive in second half 2000 (see chart). Even with the recent quota reductions that have resulted in reduced output, there is evidence of a growing capacity surplus, Lynch contends.

During 2001-02, he estimates, planned capacity additions in OPEC will total more than 3 million b/d. "However, the increases in Nigeria and Venezuela, in particular, are almost certainly exaggerated, and the others are likely to see some adjustment if and when markets are weak," he said. "As a result, 1 million b/d is a more reasonable estimate of the likely increase in OPEC capacity by yearend, excluding Saudi plans."

Pressure to cheat

The expanding capacity surplus within OPEC is spurring a growing temptation by some members to cheat on quotas. Essentially, the market until recently has been so strong that OPEC discipline has been largely irrelevant.

Lynch points out that some of the OPEC nations, notably Venezuela, have asked foreign investors to absorb some of the OPEC quota cuts.

But, in fact, the rising capacity operated by these foreign firms puts more pressure on OPEC governments to seek higher quotas or cheat, he contends.

"The result is that surplus capacity within OPEC would start to resemble what was seen during the Asian economic collapse of 1998."

But if the added volumes from cheating are as trivial as is likely and if OPEC discipline continues to hold, then Lynch thinks that it boosts chances the group can stabilize markets in the middle or upper end of its $22-28/bbl basket marker price band.

null

null

null

Industry Trends

CONSOLIDATIONS IN THE POLYOLEFINS INDUSTRY ARE transforming the polypropylene industry.

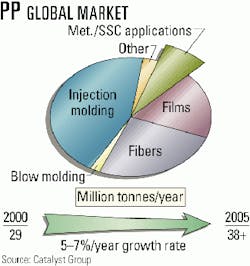

Recent consolidations and restructuring among producers, coupled with new and improved metallocene and single-site catalysts, have dramatically changed the shape of competition in the polypropylene (PP) industry, said Catalyst Group. In an update of its recent study (OGJ, Jan. 29, 2001, p. 56), the analyst noted that the PP industry is characterized by two strong opposing forces:

- Global demand for PP will grow at an annual rate of 5%, to 38 million tonnes from 29 million tonnes, and in turn stimulate capacity expansion.

- Abundant PP supplies and high monomer and energy prices have resulted in unsatisfactory margins and earnings for producers. And the only way to raise producer earnings is to either idle capacity or place on hold planned new capacity expansion.

Despite these conditions, the industry will continue to take advantage of new technologies, in addition to new specialty PP copolymers and terpolymers, including resin systems that enable both engineered and elastometric PP grades to be produced, said Catalyst Group (see chart).

"While large producers such as Basell, BP, ExxonMobil, and Dow are leading the way, it is clear that the PP industry as a whole retains latent and commercially underdeveloped product technology with cost-performance advantage. Access to these technologies will clearly play a role in improving producers' profitability longer term," said Catalyst Group.

Natural gas continues to drive a shift in global energy demand.

Driven by power generation, gas is the key beneficiary of a shift in global energy demand away from oil and coal, says Bernard de Combret, president of TotalFinaElf's gas and power trading unit.

But he said oil should not be discounted as a fuel safety valve when gas demand becomes overheated, especially in the US, where gas supplies are increasingly tight.

Speaking at a Cambridge Energy Research Associates conference in Houston last month, de Combret noted that most new combined-cycle plants in the US and elsewhere are designed for dual-firing of natural gas and middle distillates, making them a vital tool in creating arbitrage opportunities, de Combret said.

Such flexibility will be key in the future, he said, in an increasingly tight market. Mature gas markets function best when they are deregulated, but deregulation cannot overcome the limits of imbalanced markets resulting from a shortfall of storage, production, or a surge in demand tensions caused by climatic extremes, he said. "In the absence of a governmental strategic gas reserve, deregulated gas markets need a large share of interruptible consumers who can safely switch to alternative products-primarily oil products," said de Combret.

Government Developments

US Energy groups are urging EPA to revamp its diesel sulfur rule.

A score of associations has urged US EPA Administrator Christie Todd Whitman to reconsider her agency's rule slashing sulfur in diesel fuel.

The rule would require a 97% cut in sulfur levels by June 2006 (see Editorial, p. 19).

In a letter to Whitman, the groups said, "We believe that a revision of the rule is warranted because of the likelihood that the rule in its current form will result in a shortage of highway diesel fuel. Such a shortage would have a serious negative impact on the economy, because diesel is the nation's premier commercial fuel.

"Most American goods are shipped by diesel trucks, which means that any supply shortage and resulting cost impacts will immediately be felt throughout the national economy."

They said, "We are concerned that here, as in the case of California's electricity market, policymakers have taken energy supply for granted in an attempt to attain other policy objectives. We believe that revisions to the diesel sulfur rule can be made to address the potential supply shortage while still meeting environmental protection goals."

Citing estimates that diesel prices could jump 15-52¢/gal in a shortage, they noted that the National Petroleum Council has said it is unlikely the US could import enough low-sulfur diesel to cover domestic shortfalls.

A congressional coalition filed legislation to block drilling on the coastal plain of alaska's Arctic National Wildlife Refuge.

Sen. Frank Murkowsk (R-Alas.) and others earlier proposed legislation that would permit leasing of the region (OGJ Online, Feb. 26, 2001).

Sen. Joe Lieberman (D-Conn.), Rep. Nancy Johnson (R-Conn.), and Rep. Ed Markey (D-Mass.) proposed to add the ANWR coastal plain to the wilderness preservation system. The bill has 120 Republican and Democratic cosponsors in the House.

Markey said, "The oil industry has placed a bull's eye on the heart of the refuge and says, 'Hold still. This won't hurt. It will only affect a small surface area of your vital organs.' We should not drill for oil and gas in the arctic refuge. We should preserve it, instead, as the magnificent wilderness it has always been and must always be."

API spokesman Juan Palomo, Washing- ton, told OGJ Online that today's technology for finding and producing oil and gas greatly reduces the surface disturbance in delicate areas.

"ANWR's coastal plain is one of the numerous areas we believe should be open for exploration and production to meet the country's increasing demand for energy. The federal government estimates are that there is enough oil in ANWR's coastal plain to replace what we import from Saudi Arabia for the next 20-25 years," Palomo said.

Quick Takes

China natural gas development projects continue to sizzle.

Operator BP said it will proceed with the $1.3 billion Nam Con Son gas development project off Viet Nam.

BP said the planned development, made up of Lan Tay and Lan Do gas fields on Block 6/1 off Viet Nam, is the country's largest foreign investment and its first dedicated gas-to-power project.

BP estimates that the two fields contain 2 tcf of gas reserves. The gas will be brought ashore by pipeline and used by three power plants to generate electricity for the Ho Chi Minh City area.

BP will develop the two fields via a steel production platform and deliver the gas via a 360-km pipeline to an onshore gas processing terminal. The pipeline is designed to accommodate future supplies from the Nam Con Son basin, said BP, including Hai Thach field discovered in 1995.

Meanwhile, Petronas has announced completion of the first phase of development of Angsi field off Malaysia in the South China Sea. First gas from Angsi is expected in first quarter 2002. The development is being undertaken by a JV of Petronas subsidiary Petronas Carigali and Esso Production Malaysia. Work on the Southern Gas Pipeline System, included design, fabrication, and installation of a drilling and riser platform, modifications to the Guntong D platform-a satellite to the producing Guntong field-and modifications to the Jerneh onshore slug-catcher in Kertih, Terengganu. Phase II of the project, which consists of design, fabrication, and installation of two additional platforms-a central processing platform for production of crude oil and natural gas and a drilling platform-has already started. The two platforms, being built at Pasir Gudang and Kuching, respectively, will be installed by the third quarter this year, together with a 48-km crude oil export pipeline to the existing Tapis pump platform.

In other development action, Norsk Hydro let a $56 million contract to Kværner to build the generator module and living quarters for the Grane platform. This latest work for the Norwegian North Sea development, the largest proven but undeveloped oil field in the region, brings the value of Kværner's work on Grane to $472 million. Grane field is on Block 25/11, northwest of Stavanger, in 127 m of water. The field will be developed via an integrated platform with drilling facilities, living quarters, and production facilities. First production from the field, which has estimated reserves of 700 million bbl of heavy oil, is due in the autumn of 2003. Hydro said in October that the field is expected to reach a maximum output of 214,000 b/d in 2005.

TotalFinaElf said that the UK government has approved its development of the Nuggets N2 and N3 gas fields 20 km south of Alwyn satellite field Dunbar in the North Sea. The Nuggets N1 development plan was approved in July 2000. The fourth Nugget field, N4, will be developed later. The fields are in 100-125 m of water. The development plan calls for subsea wells to be tied back via pipeline to the Alwyn North facilities and controlled from the Dunbar platform. Nuggets gas will be processed on the Alwyn North platform and moved to the St. Fergus terminal in Scotland through the Frigg pipeline (OGJ Online, Aug. 2, 2000). All three fields are expected on stream by the end of the year. Combined production will be 165 MMcfd.

Lundin Oil has FOUND oil on Block 5A in Sudan.

The Thar Jath discovery was drilled to a TD of 1,820 m and encountered 63 m of net pay over two sand reservoirs, the Bentiu and the Aradeiba. The well flowed at 4,260 b/d from 3 drillstem tests in both zones.

Appraisal drilling is slated after completion of the Jarayan exploration well, 12 km southeast of the Thar Jath discovery. Upon completion of the Jarayan well, the rig will be moved back to drill the Thar Jath appraisal well.

The Thar Jath exploration well was drilled during second quarter 1999, but testing was postponed because of the rainy season and for construction of a 75 km all-weather road be- tween the well and base camp at Rubkona.

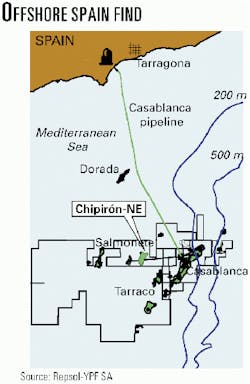

Elsewhere in the world of exploration, Repsol-YPF said it made an oil discovery off Spain near the Casablanca complex of fields. The Chipirón Northeast discovery flowed 8,000 b/d of 40 degrees gravity oil in production tests. Chipirón Northeast is expected to go on stream in second half 2001 and will be connected to the flowline from Chipirón-1 field. Both will produce via the Casablanca platform, which is linked by pipeline to Repsol's refinery at Tarragona. The Casablanca platform produces oil from Casablanca, Rodaballo, Boqueron, and Barracuda fields.

Gulf Keystone Petroleum signed an agreement to explore Block 126 in the Ferkane region in northeastern Algeria. Gulf Keystone will carry out a two-phase work program. The first requires a $15 million expenditure. It includes acquisition of 600 sq km of 3D seismic and the drilling of three wells over a 5-year period. In the second phase, Gulf Keystone will spend $9 million. It will shoot another 600 km of seismic and drill another well.

In the refining sector, Amakpe International Refineries has awarded Ventech Engineers a contract to design Nigeria's first privately owned, privately financed oil refinery.

Ventech is responsible for the design of the 12,000 b/d refinery and construction of preassembled modules for shipment to Eket, Akwa Ibom state.

The plant, to be built adjacent to ExxonMobil's Qua Iboe terminal, will process Qua Iboe crude into naphtha, gasoline, kerosine jet fuel, diesel, gas oil, and fuel oil. Plant start-up is expected in December.

Rounding out refining news, PCK Raffinerie awarded Technip a lump sum contract worth more than 30 million euros for the design and construction of a hydrogen plant in Germany. The plant will be installed at PCK's Schwedt refinery, 120 km northeast of Berlin. Technip will provide licensing and will be responsible for engineering, equipment supply, construction, and start-up of the 35,000 normal cu m/hr plant. Technip said the plant will handle a variety of feedstocks, from refinery off-gas to LPG and naphtha. Technip will execute the work from its engineering center in the Netherlands and will deliver the unit in mid-October 2002.

PLATFORM CONSTRUCTION PROJECTS TAKE CENTER STAGE THIS WEEK IN PRODUCTION NEWS.

Petrovietnam Trading has awarded a $46 million contract to Keppel Fels and Technics Offshore Engineering for preconstruction services related to a central processing platform for Bach Ho field off Viet Nam. Keppel Fels and Technics will design, engineer, and procure equipment and materials necessary for construction and operation of the platform, dubbed CPP-3.

CPP-3 will receive well fluids from nearby blocks, process oil and transfer it to floating storage and offloading vessels, treat produced water, and gather and separate associated gas.

Capacity will be 15,000 tonnes/day for stock tank oil, 19,000 tonnes/day for liquids, and 12,000 tonnes/day for produced water, said Keppel Fels.

Meanwhile, BP has given Coflexip Stena Offshore's subsidiary CSO Aker Maritime a contract for up to five spar-design floating production platforms for deepwater developments in the US Gulf of Mexico. Under the deal announced last month, CSO Aker Maritime will take on engineering, procurement, fabrication, and delivery of the complete hulls and mooring systems of the "truss" spars, the first of which is scheduled for delivery in 2003. The agreement includes options for delivery of additional hulls and mooring systems for BP-operated deepwater fields. Water depths in the fields are 1,220-1,830 m.

In other production action, Sonatrach has selected a Japanese JV of JGC and Itochu for a $372 million contract to correct a fall in pressure in Hassi R'mel gas field in Algeria. The project includes construction of three gas compression stations, the drilling of 59 producing wells, and the extension of a gathering network. Work will be completed within 3 years.

Sperry-Sun Drilling Services, an affiliate of Halliburton Energy Services, completed the installation of what it says is the first isolated tie-back system (ITBS). The system was installed in Norsk Hydro's Y-22 well in Troll Olje field. The ITBS, said Sperry-Sun, created a Level 5 multilateral well.

Olympic pipe line has restarted its washington line after a lengthy shutdown.

Olympic Pipe Line has restarted its refined products pipeline in Washington state after successfully completing comprehensive safety and integrity inspections of the entire 400-mile system.

That pipeline automatically shut down Feb. 28 within 10 min of the severe earthquake that shook western Washington. The control center in Renton, Wash., used a backup reserve power system to continue monitoring the pipeline for a few hours after the earthquake disrupted its normal electricity supply, said officials of BP affiliate BP Pipelines North America, the largest partner and operator of Olympic Pipe Line.

In early February, workers began a phased restart of the northern 37-mile section of the 16-in. petroleum products pipeline in Washington. That segment was shut down after the pipeline ruptured June 10, 1999, spilling 229,000 gal of gasoline into a creek in Bellingham, Wash., 90 miles north of Seattle. The spill ignited into a fireball that killed three people.

In other pipeline happenings, US FERC Chairman Curtis Hebert told Congress the agency will act as "quickly as possible" on applications to build new California pipeline capacity. But, he noted, the federal agency has no authority over intrastate pipeline construction and urged California officials to eliminate constraints hindering pipeline development within the state (see related story, p. 29). Testifying before the House subcommittee on energy and air quality in Washington, DC, Hebert offered his support for pipeline construction, noting new pipelines are needed in order for gas buyers to reach the lowest-selling producers. Along with high electric power prices, high gas prices have become a controversial subject in California.

Altagas Services plans to spend $10.4 million (Can.) to expand three of its natural gas gathering systems in Western Canada. A $7 million capacity expansion is under way in the Thorbury area of northeastern Alberta to handle as much as 9 MMcfd of sweet gas from 15 new wells. The company also is building an 11-mile pipeline to connect 3 MMcfd of gas southeast of Alsask, Sask., to AltaGas's Acadia Valley gathering system in the Central Border area of Alberta. Construction is scheduled for completion by mid-March. In a third project, AltaGas and Real Resources will jointly build and own-and AltaGas will operate-a 22-mile line to connect wells owned by Real to the AltaGas Prairie River, Alta., gas plant and gathering system. The companies are seeking regulatory approval to complete construction by July.

POLAR TANKER PLANS TO BUILD A FIFTH MILLENNIUM-CLASS TANKER FOR ALASKAN TRADE.

Polar Tanker-the shipping unit of Phillips Alaska-says it plans to build a fifth Millennium-class tanker to carry crude oil from Alaska to the Lower 48 West Coast and Hawaii. The fifth ship contract is worth $205 million.

The decision to build a fifth tanker for the Alaska trade reflects Phillips's plan to increase its Alaska production to 400,000 boe/d from the current 350,000 boe/d, said Jim Mulva, chairman and CEO of Phillips.

The 125,000 dwt crude oil tankers feature double hulls, twin engine rooms, twin propellers, twin rudders, and a sophisticated navigation and control system.

Earlier this month, Polar Tanker unveiled its second Millennium-class double-hulled tanker-the Polar Resolution-at the Litton Avondale Industries shipyard in New Orleans. The first of the tankers, the Polar Endeavor, will enter the Alaska trade this spring.