During December 2000 and January 2001, an unprecedented surge in gas prices rolled through the US economy. Standing directly in its path, gas processors and ethylene producers suffered substantial economic damage.

This article chronicles the market conditions that sparked the spike in gas prices and highlights the impact of surging gas prices on gas-processing economics, gas-plant NGL production, ethylene production costs, and ethylene production.

The US gas-processing industry recovers about 1.9 million b/d of NGL when operating at full recovery levels. When gas-processing margins collapse, however, NGLs become much more valuable as natural gas.

NGL production volumes are equal to about 6 bcfd on a standard dry natural gas basis. Gas-plant production volumes of ethane and propane alone are equal to about 4 bcfd of dry-gas production based on a standard btu content of 1,030 btu/cu ft.

Weather and markets

In late November, a large mass of polar air plunged south and blanketed the eastern two thirds of the US. For the next 6 weeks, other cold fronts moved south and kept most of the US in a deep freeze.

Based on statistics from the US National Oceanic and Atmospheric Administration (NOAA), heating-degree days in December 2000 were 25-30% higher than in 1999 and 10% higher than the 30-year average. The unrelenting cold weather pushed natural gas demand in December to cold January levels.

The US Energy Information Administration (EIA) has published preliminary estimates that show natural gas demand in the residential-commercial sector averaged 42-44 bcfd.

During 1998 and 1999, natural gas demand in the residential-commercial sector in December averaged 31-33 bcfd. During 1990-1999, that demand was never higher than 38 bcfd.

Petral Consulting Co., Houston, estimates that total demand for natural gas averaged about 83 bcfd in December 2000, or about 13 bcfd higher than demand in November and 8-10 bcfd higher than any December during 1990-1999.

Withdrawals of working-gas inventories averaged 23 bcfd or about 10 bcfd higher than normal for December. Natural gas markets began to fear that working-gas inventories could be completely exhausted before the end of the winter heating season if deep-freeze weather continued to grip the US during January and February. These fears sparked an unprecedented surge in natural gas prices.

Heightened levels of concern regarding natural gas supplies for the winter heating season began pushing natural gas prices steadily back in April 2000. By late October, natural gas prices had risen to more than $5/MMbtu or almost double March's average price.

Natural gas prices jumped to $6/MMbtu during December bid-week or more than three times higher than in March. The record withdrawals from inventory during the first few weeks of December pushed gas prices to stratospheric levels of $10/MMbtu or almost double what prices were in October.

The first break in the cold weather began to ease the market's fears regarding working-gas inventories, and natural gas prices fell sharply from peak levels of late December and early January. Fig. 1 shows the trends in natural gas prices during late November through early February.

Gas processing

Based on December bid-week natural gas prices and spot NGL prices in early December, many gas processors had locked in marketing commitments based on positive profit margins. These gas processors maintained full-recovery operations in December.

But spot prices for NGLs lagged far behind surging gas prices during December. By the second week in the month, spot prices for all NGL products were well below their btu values vs. natural gas. Profit margins for gas processors on a spot-spot pricing basis had collapsed.

Furthermore, surging gas prices gave a clear signal that gas markets could easily absorb a substantial increase in gas volumes and btu content.

During December, spot propane prices in Conway, Kan., were substantially higher than in Mont Belvieu, Tex. But prices for all other NGL products in Conway were lower than in Mont Belvieu.

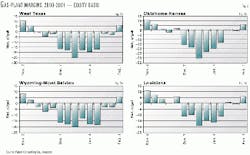

Gas-processing margins in all major production regions collapsed as a result of the spike in natural gas prices.

Fig. 2 presents trends in gas-processing margins for key production regions on a week-by-week basis. These graphics illustrate margins for gas processors who operate gas plants on a purely equity basis.

The equity model for gas processing is only one of the business models used extensively in the gas processing industry.

Other economic models in widespread use by gas processors include percentage-of-proceeds (POP) contracts, percentage of proceeds contracts with keep-whole ("Keep whole") provisions for ethane recovery, and percentage of proceeds with keep-whole provisions for all products.

In a POP contract, gas processors get to keep a defined percentage of the liquids they recover from the gas producer's gas stream. This percentage is typically 20%.

A POP contract with keep-whole provisions obligates the gas-plant operator to make sure that the gas producer receives at least the equivalent of the price of natural gas for all NGLs that are removed by the gas plant.

Significantly, gas processing using the POP approach with full keep-whole provisions is effectively the same as the equity processing business model.

Discussions by Petral with various industry contacts indicate that equity processing accounts for a quarter to a third of the industry's total throughput. When gas volumes processed on POP contracts with full keep-whole provisions are added, the share of gas processing industry's gas- plant throughput rates boosts at-risk processing volumes to an estimated 40% of the industry's typical throughput rates.

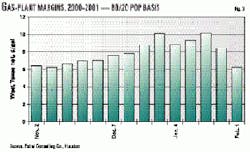

Pure POP contracts dominate third-party gas processing agreements in such production areas as West Texas where rich associated gas accounts for a substantial share of the industry's total throughput (Fig. 3).

Gas processing based on pure POP contracts and POP contracts with keep-whole provisions on ethane only account for about 60% of the industry's throughput, but these plants account for an estimated 70-80% of total NGL production.

When gas-processing margins collapsed after early December 2000, some gas producers and gas processors took extreme measures to curtail gas plant NGL-recovery levels to offset the collapse in gas-processing margins and to boost natural gas availability.

EIA statistics indicate that gas plant production averaged 1.93 million b/d in October 2000. Based on the estimated share of gas throughput at risk and the volume of NGL production at risk, Petral estimates that total NGL production declined to 1.6 million b/d in December and as low as 1.5 million b/d in January.

Petral estimates that ethane and propane production declined by about 185,000 b/d and 60,000 b/d, respectively, and accounted for about two thirds of the overall decline of about 400,000 b/d.

Significantly, gas processors were poised to restore plants to full-recovery operations as soon as margins improved to breakeven levels in mid-January.

Impact on ethylene industry

The surge in gas prices also had a substantial impact on the ethylene industry.

In October, spot ethylene prices were 26¢/lb, and variable production costs from ethane and propane were 17.3¢/lb and 18.1¢/lb. By early December, ethylene prices had fallen to 23-24¢/lb, but variable production costs from ethane and propane jumped to 23.6¢/lb and 25.1¢/lb.

Although spot ethylene prices rebounded to 28¢/lb during December, variable production costs from ethane and propane surged to 26¢/lb and 30¢/lb, respectively, during mid-to-late December. Profit margins for ethylene production based on ethane and propane feeds collapsed.

Ethylene production based on naphtha and gas oil feeds remained profitable in December and January.

During October and November, Petral's monthly survey of ethylene producers reported that ethylene production from LPG crackers averaged about 1.96 billion lb. In December, ethylene production from LPG crackers averaged only 1.73 billion lb.

Ethylene production from LPG crackers in January declined further to an estimated 1.4-1.5 billion lb. Total ethylene production totaled only 3.8-4.0 billion lb in January.

The ethylene market quickly responded to the decline in production with an increase in spot and contract prices that restored all plants to at least marginal profitability.

Implications

Natural gas marketers already anticipate that natural gas markets will be at risk to severe spikes in natural gas prices for the next few years. Unless gas processors modify contract terms for third-party gas processing contracts, gas processing-based NGL production will remain vulnerable to collapses in gas-processing profit margins again next winter.

Gas processors have already begun considering modifications or addenda to standard gas-processing contracts, however, to avoid or mitigate the impact of future gas-price spikes.

These changes might take the form of suspending full keep-whole provisions for POP contracts or fee-for-service provisions to keep gas plants operating at minimum recovery levels.

During mid-December to mid-January when many gas plants were shut down cold, butanes and natural gasoline in unprocessed natural gas condensed in natural gas pipelines and began causing operational problems in the interstate natural gas pipeline system.

The extreme volatility in gas prices during this winter will probably encourage gas processors substantially to expand risk-management activities to offset the risk from gas price spikes during the next few years.

Gas producers must remember that gas processing is a utility function that is necessary to meet dewpoint and btu requirements of gas-pipeline systems in the US.

Finally, gas producers and gas processors should work together during the coming months to revise gas-processing contract provisions to enable gas processors to meet the gas-quality requirements of gas pipelines without suffering unacceptable economic losses.

The author

Dan Lippe is president of Petral Cos., Houston. In 1974, he began working for Diamond Shamrock Chemical Co. in a variety of technical and plant-management positions. He began his consulting career at Pace Consultants in 1979 and was employed by Resource Planning Consultants as a partner 1981-86. After RPC's merger with Bonner & Moore, Lippe served as manager of NGL studies until 1988. He holds a BS in chemical engineering from Texas A&M University and an MBA from Houston Baptist University. He is a member of GPA and chaired its NGL Market Information Committee 1992-94 and 1996-2000.