Middle East Update: Yemen's oil production climbing, potential great

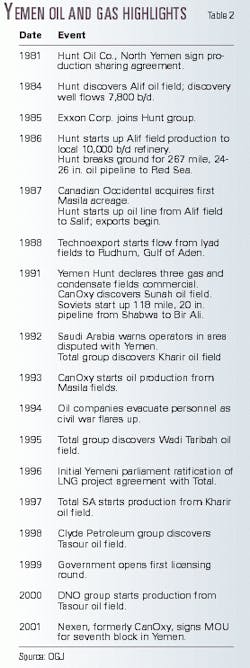

Yemen, still one of the smallest countries in the Middle East in terms of reserves, has made remarkable progress the past 15 years.

Its crude oil and condensate production has grown to 440,000 b/d in 2000 from a minimal figure in 1986, but the country has not yet been able to tap its formidable gas reserves.

The largest producer in the country is vocal about what it believes is significant remaining potential, and almost all of Yemen's available acreage is under license.

The outlook for 2001 and beyond seems to be for continued but slower gains in oil production, renewed efforts to establish an LNG industry, and a wider emphasis on exploration in numerous basins including those along the border with Saudi Arabia.

Discoveries are still being reported, and smaller fields are beginning to go on production, joining the top producing areas that have been the source of oil shipments via pipeline to coastal terminals for all or part of the 1990s.

The top producing areas remain the Masila block operated by Nexen Inc., Calgary, formerly Canadian Occidental Petroleum Ltd., and the Marib-Jawf area operated by Hunt Oil Co., Exxon Mobil Corp., and others, and the Shabwa area led by TotalFinaElf.

What follows is a rundown of E&D activity in Yemen.

Masila block action

The Masila block, Yemen's premier producing property, averaged 230,000 b/d of oil in early 2001. Operator Nexen expects Masila production to grow for the eighth straight year in 2001.

Nexen has a 52% working interest in the block. Partner Occidental Petroleum Corp. said Masila contains more than 126 producing wells in 16 fields.

The company's drilling program in 2000 on the block in Hadramaut Province was the busiest since 1992 and will expand in 2001.

Nexen said seven horizons produce at Masila. Plans for this year are to expand facility capacities and delineate and exploit secondary horizons. Nexen will begin waterflood projects in Upper Saar clastics, which it said have significant areal extent and offer excellent growth potential.

Nexen said it tested Saar in 10 existing Qishn producing wells at rates as high as 5,200 b/d last year. It also tested oil from the Naifa carbonate section for the first time. That well made as much as 700 b/d of 24° gravity oil on a test limited by wellbore conditions.

The company will also drill eight exploration wells and 45 development wells at Masila this year.

Nexen said Masila "is still a long way from maturity and will be a source of continued growth for years to come."

Nexen exploration

Much of Nexen's exploration acreage lies in northeastern Yemen along the border with Saudi Arabia.

Nexen said it will boost overall E&D spending in Yemen 90% to $216 million this year.

Nexen acquired 2,500 line km of seismic in 2000 on its six exploration blocks in Yemen last year and will continue acquiring seismic on the four northern blocks this year.

The budget includes $32 million for three wildcats to be drilled on the six exploration blocks that span a combined 22 million acres. These include a well on Block 51 targeting structures much like those producing at Masila, a well on Block 50, and one well on one of the four other blocks to target large Paleozoic plays similar to those producing in southeastern Saudi Arabia.

The other blocks are 11, 36, 12, and 54. Nexen signed a memorandum of understanding for a seventh exploration block, 59, in January 2001. Nexen said Yemen created Block 59, 250 km north of Masila, as a result of a recent border agreement between Saudi Arabia and Yemen.

Nexen was to mobilize a fourth rig in second quarter 2001 solely for exploratory drilling.

Occidental Petroleum

Occidental in January 2001 signed an agreement to explore 6,335 sq km Block 44 just north of the Masila block.

Oxy's partner is Ansan Wikfs (Hadramaut) Ltd., Sana'a, Yemen. Block 44 is in the Sanyun-Masila basin with geology expected to be similar to Masila's.

Occidental also holds a 38% interest in Nexen-operated Masila Block, 28.6% in the East Shabwa block that adjoins Masila, an interest in Block 20 at Marib-Jawf and in blocks 11, 36, 12, and 54 along the Saudi border. Block 54 also borders Oman.

The company said that when Masila was discovered, the estimated maximum production rate was 120,000 b/d. Instead, production exceeded that rate in the second year and has been increasing ever since.

The company acquired its East Shabwa interest in 1999 in an asset swap with Unocal Corp. Three fields average about 30,000 b/d, up from 16,000 b/d at the time of the swap, Occidental said. The company said the block has promising prospects for future discoveries and that it will run 3D seismic surveys there this year.

Yemen Hunt

Recent production from the Marib and Jannah blocks has averaged 195,000 b/d of oil and 2.7 bcfd of gas, with the gas being reinjected.

Cumulative production through mid-2000 exceeded 700 million bbl of oil, and Yemen Hunt has produced and reinjected more than 7 tcf of gas on the Marib PSA with less than 1% being flared.

The Marib block contains 15 fields. At last report the deepest producing formation was at about 9,000 ft.

The fields produce to a 400,000 b/d central oil production unit. Oil is shipped through a 225,000 b/d pipeline to Salif on the Red Sea, where a 3 million bbl converted tanker holds it for export.

A 10,000 b/d topping plant and reformer on the block provide oil products locally.

Yemen Hunt has drilled more than 500 development and exploratory wells on the blocks.

Gas reserves, although undeveloped, are considered to exceed 10 tcf as certified by independent consulting engineers.

The gas is dedicated to Yemen LNG Co. Ltd., a combine of Yemen Hunt, ExxonMobil Corp., SK Corp of South Korea, and TotalFinaElf. Yemen LNG plans to set up a two-train, 6.15 million ton/year LNG export project. The project would involve a 199 mile, 1 bcfd pipeline to Balhaf on the Gulf of Aden.

Overall LNG project construction time is estimated at 3 years.

Hunt is also involved with an LNG project tied to development of the Camisea fields in Peru.

Marib-Jawf periphery

Independents were pressing satellite projects to Hunt-Exxon's large fields in the Marib-Jawf basin of western Yemen.

Vintage Petroleum Inc., Tulsa, Okla., and Trans-Globe drilled four wildcats last year on Block S1 southeast of Alif field and south of Halewah oil field.

Trans-Globe said two of the wells on the An Naeem structure tested at rates up to 40 MMcfd of gas and 1,000 b/d of condensate from excellent quality Alif sand reservoirs.

Another well, Harmel 1, found oil and the fourth well tested four formations without success and was abandoned. Harmel 1 pump tested 180-470 b/d of medium gravity sweet crude from three zones at 1,526-2,208 ft. More work is needed.

In May 2000 Adair International Oil & Gas Inc., Houston was named operator of Block 20 near the Yemen Hunt Alif fields. Its partner Occidental was to take over operations if a commercial discovery were made. Saba Yemen Oil Co. Ltd. also participates in Block 20.

Production startup

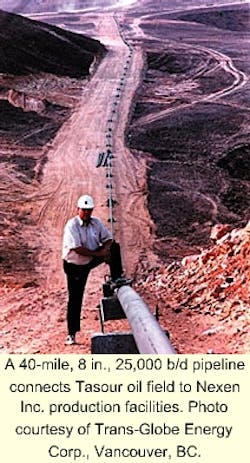

Yemen's most recent production startup came on Block 32 as Tasour field began flowing in November 2000 into Nexen's central production facilities.

Den Norske Oljeselskap ASA, Ansan Wikfs, Oranje-Nassau of the Netherlands, and Trans-Globe Energy Corp., Vancouver, BC, own the field, which quickly reached 10,000 b/d from three wells.

The 1998 discovery well made 29 degrees gravity oil. TD is 8,500 ft.

Tasour 4 yielded 2,500 b/d of 29 degrees gravity oil on a submersible pump from Qishn sand at 5,700 ft on a separate structure. More drilling was planned.

The Tasour field crude, which Nexen was to market, was bringing $30.50/bbl, about $2/bbl less than West Texas intermediate.

Just west of Block 32, Dove Energy PLC is assessing significance after drilling two successful wells on East Saar Block 53, awarded in 1997, held in conjunction with Yemen General Corp. for Oil and Gas.