Focus on growth vs. costs key to oil company merger success

Global merger activity is at an historical high, despite the fact that most mergers fail to deliver superior returns to shareholders.

This holds true for the oil and gas industry, which also has recently experienced intense acquisition and industry consolidation activity prompted by cost-reduction strategies. Although these consolidated firms have a cost advantage that enables them to outperform their peers, the overemphasis on cost reduction has distracted them and impeded their ability to deliver top-line growth. As a result, they have not realized the uplift that firms in other industries have experienced.

Record global mergers

Global merger transaction volume through October 2000 reached $3.8 trillion,1 a record level trending 12% higher than 1999 levels (Fig. 1a). This merger frenzy is increasing at a 5-year cumulative average growth rate of over 29%.

In addition, the average deal size has tripled over the last 5 years to over $100 million, as seen with the "supermergers" across all industries-America Online Inc. with Time Warner Communications; General Electric Co. with Honeywell; and Exxon Corp. with Mobil Corp.2

However, most mergers fail to increase shareholder value. Unfortunately for investors, growth through acquisition has not always translated into the creation of wealth. The anticipated uplift from mergers frequently is not realized.

In fact, a global survey that AT Kearney Inc. conducted in 1998-99 of 115 transactions revealed that, for a period of 3 months before and 2 years after the merger announcement, 58% of the mergers failed to reach the value goals top management had set and failed to outperform the Standard & Poor's (S&P) 500 index.3 Thus, three out of five mergers fail to create substantial upside returns for shareholders4 (Fig. 1b).

Why, then, are so many companies attracted to mergers? Because the few companies that are able to integrate successfully are greatly rewarded (Fig. 2).

Oil and gas mergers

Major integrated oil and gas firms have employed M&A as a primary strategy to achieve cost reductions. The executive leadership of most oil and gas firms has been under enormous pressure in recent years from a number of factors:

- Wide oil and gas price fluctuations.

- Overcapitalization.

- Excess products supply in certain regions.

- Slowed demand growth.

- Low shareholder returns relative to key benchmarks such as the S&P 500.

Responding to these challenges, company decision-makers have attempted to create value by driving cost leadership through increasing scale, streamlining their organization and its assets, and deploying innovative technologies and processes.

The industry has rapidly implemented an internally focused strategy of stringent cost reduction through consolidation, which has resulted in a flurry of M&A activity. During 1996-2000, the oil and gas industry realized more than $500 billion in global merger transactions, including megacombinations such as BP (merger of British Petroleum Co. PLC, Amoco Corp., ARCO, and Burmah Castrol PLC), ExxonMobil Corp. (Exxon Corp. and Mobil Corp.), and TotalFinaElf SA (Total SA, Petrofina SA, and Elf Aquitaine SA). The transaction volume during this 5-year period surpassed the cumulative total of all oil and gas M&A activity over the previous 95 years.

Performance vs. peers, S&P 500

As observed, the initial focus of recent oil and gas mergers was capturing efficiency synergies and cutting costs. Consequently, these merged oil and gas majors are cost-advantaged and have outperformed their peers (Fig. 3). The peer group studied consists of Chevron Corp., Marathon Oil Co., Phillips Petroleum Co., Royal Dutch/Shell Group, and Texaco Inc.

The mergers have provided a mechanism to achieve larger cost-reduction goals-and at a faster pace. For example, BP, ExxonMobil, and TotalFinaElf have been successful in identifying and realizing annual merger synergies totaling more than $9.8 billion.5

Applying 50% of the savings to upstream costs would result in total upstream savings exceeding $4.9 billion, or $1.45/boe produced.6 This translates to an 18.9% cost advantage vs. their peers' costs.7

The newly formed "Super Three's" reduction in operating costs is reflected in the performance of their shares over the past 2 years. From June 1998 through September 2000, BP, ExxonMobil and TotalFinaElf, on average, outperformed their peers in total shareholder return (TSR) by 19.4%.8 This is understandable, as their cost-effectiveness makes them able to realize improved E&P productivity and margins, a key driver in oil company valuations, relative to the industry.

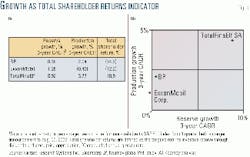

Nevertheless, although they outperformed their peer group, these firms have failed to realize the top performance observed by merged companies in other industries as a result of M&A activity (Fig. 4).9

TSR analysis from 3 months prior to each merger announcement through Aug. 30, 2000, shows that only TotalFinaElf has outperformed the S&P 500 index-by 10.9%. BP and ExxonMobil have both underperformed, compared with the S&P 500 Index, with returns of -3.65% and -12.2%, respectively.10

Top quartile firms, on average, yield 25% more than the S&P 500 average according to Kearney research of global M&A activity. Clearly, these oil and gas firms have not realized the uplift seen in other industries.

Keys to merger success

The following seven rules (Fig. 5) incorporate keys to merger success.11 When these rules are applied, evidence shows that shareholder value is created (see table):

- Guide the post-merger integration with a clear and realistic vision derived from thorough due diligence. Too often mergers are created based upon a superficial "fit" or financial fit. Neither should be the basis for a forward-looking business case. To be successful, a firm must clearly define what it can do and where it wants to go, and it must remain realistic.

- Identify and handle leadership as the central issue before closing the deal. Don't leave any leadership vacuums at any time. Leadership is the most urgent priority when a merger closes. The faster a merged company can establish its management, the faster the company can take advantage of growth opportunities inherent in its "one- business" vision.

- Focus on growth, not on efficiency synergies. While almost all mergers provide an opportunity to save money, the primary reason for the merger decision should be top-line growth. This should be accomplished by leveraging the new assets obtained in the merger to create growth synergies and unlock the "merger value added."

- Obtain early wins. Act, get results, and communicate successes. This will minimize uncertainty and confusion that can permeate the organization following a merger announcement.

- Build a new corporate culture. Cultural differences are the most frequently quoted reason for merger failure. It is often more suitable, especially in mergers of equals, to combine the cultures, creating a "new" culture rather than imposing the culture of the dominant company on the acquired.

- Plan communications according to timing and target, get the word out, and actively obtain feedback. Ultimate success will depend upon management's ability to influence and persuade the new organization to follow the new vision and execute the strategy. Don't underestimate the importance of candid communications to foster buy-in and support from the organization.

- Prioritize projects; then identify, categorize, and embrace the risks associated with them and do it continually. During the merger, there will be long lists of tasks to complete. Those that present the greatest risk should be identified and addressed quickly. Evading or ignoring risks will greatly reduce the potential for achieving high returns following the merger.

The missing dimension

It is clear that all of the Super Three energy firms have strong leaders who have integrated their firms well. These companies have had early success in meeting early objectives on time or ahead of plan and have communicated their success. In addition, they have done an exceptional job in reducing cost in their businesses.

As illustrated earlier, they have met or exceeded merger-related cost-reduction goals and have established themselves as cost leaders. In addition, the present macroeconomic conditions-with oil prices at $20-30/ bbl-favor the integrated oil and gas firm. So why have the shareholders not been rewarded more?

These merged firms announced production growth targets of 3-5% for 2000, which do not represent a significant improvement relative to historical independent, internal growth rates. Research has shown that it is the commitment to long-term growth that generates sustainable, superior shareholder wealth creation.

While no one would argue that cutting and controlling costs are unimportant in today's environment, cost synergies should, nevertheless, take a back seat to this primary objective of top-line growth.

It appears from analysis of these mergers that the ability to grow has not been significantly enhanced by the mergers. These firms will not realize the uplift seen in other industries until they can demonstrate, through improved execution, that they can grow from leveraging or creating new competencies and assets acquired through the acquisition.

Growth needed

Growth is linked to shareholder returns. The ability to increase both reserves and production is a key measure of success for oil and gas firms, and it is rewarded in the financial marketplace.

There is little evidence to suggest that a merged oil and gas firm can execute better or grow faster than a firm with a "go it alone" strategy. An analysis of production and reserve growth suggests that BP and ExxonMobil have increased in these areas at only moderate levels-a fact reflected in their returns to shareholders (Fig. 6). Only TotalFinaElf has demonstrated the adoption of a successful growth strategy, which is reflected in its more positive TSR.

Two primary factors are responsible for the lack of growth in oil and gas firms. First, cost reduction, rather than growth, has been the primary area of focus for these firms in the past several years due to a challenging macroeconomic environment. Second, this environment, combined with the complexity of integration and the time required to integrate these enormous, global organizations, has resulted in significant loss or delay in realizing growth opportunities.

Growth has not been the primary focus for most major integrated oil and gas companies. Their primary focus has been on containing costs. In recent years, cost savings have been achieved through increasing scale, with M&A activity.

While management has been successful in reducing costs, an opportunity to focus on growth opportunities now exists. Growth can come in many forms-from geographic expansion, entry into new markets, the introduction of new products and services, or diversification into new technologies and innovations.

With the present profits of these firms, there should be ample resources to invest in new growth opportunities. Therefore, the leadership of oil and gas firms should establish top-line growth as a priority.

Focus redirection

The complexity of merger integration consumes resources better directed at growth initiatives. Whether due to delays in obtaining regulatory approvals or to the complexities of integrating large, international operations, recent mergers have taken an average 7.7 months from the date of announcement to close.12

Coupled with an average 6-12 month integration process, these firms effectively are internally focused for 1-2 years, with many of the best executives and managers consumed with the process of integration.

During this period, there is the potential for company drift, resulting from a lack of focus and crisp decision-making, while employee morale drops due to personal anxiety and uncertainty. As a result, most growth initiatives are stalled, waiting for the merger and integration to be completed, as the focus of senior and middle management is consumed with integration and realizing synergy cost savings.

Best practice across all industries suggests that the integrations should be complete within 90 days.13 Renewed emphasis on top-line growth will result in superior shareholder value.

In summary, much of the record-high general global merger activity has failed to deliver superior returns to shareholders. The oil and gas industry's M&A activities, in particular, have emphasized cost-reduction at the expense of top line growth.

While executing their strategies of cost reduction extremely well and outperforming their peers, most of these merged companies have been so distracted with integration that it has impeded their ability to deliver top-line growth. As a result, they have not realized the uplift that firms in other industries have experienced.

One of the missions of management is to appreciate the value of the companies they lead in order to generate wealth for their stakeholders. By renewing emphasis on top line growth and leveraging the talents and skills of company executives and managers, these firms can unlock growth synergies and finally increase shareholder wealth.

References

- Source: Thompson Financial Securities Data Co.

- Reported acquisition costs: AOL-Time Warner, $106 billion; GE-Honeywell, $50 billion; Exxon-Mobil, $80 billion.

- For US-based firms, the benchmark is the S&P 500 Index.

- AT Kearney Inc. 1998-99 global post-merger integration study. To measure performance in this study, Kearney analyzed total shareholder return (TSR) percentage over or under-performance relative to the S&P 500 industry index within the period 3 months before merger announcement through 24 months after announcement. The success of the merger itself is defined within this time period because, after 24 months, other events begin to impact and influence the corporation (competition, wars, industry dynamics, overall economic growth, etc.). It is more of a pass or fail type of analysis than a long-term trend. TSR is defined as the tangible results investors receive through dividends and stock price appreciation.

- Companies have reported realizing the following merger related synergies: BP, $3 billion; TotalFinaElf, $2.37 billion; and ExxonMobil, $4.6 billion.

- Review of recent merger announcements indicates that, on average, 50% of the merger synergies are from the upstream segment. Estimated 1999 total production from BP, ExxonMobil, and TotalFinaElf was 3.433 billion boe.

- Based on peers' 1998 $4.21/boe production costs and $3.43/boe depreciation, depletion, and amortization (exploration) costs.

- During the period, average TSR for BP, ExxonMobil, and TotalFinaElf was 27.76% and for the peer companies, 8.32%, providing a net improvement of 19.44%.

- Kearney analysis of comparing the firms' TSR percentage over or underperformance relative to the S&P 500 within the time frame of 3 months before merger announcement until August 30, 2000.

- Kearney analysis, data source: Factset Research Systems Inc.

- Habeck, Kroger, and Tram, After the Merger, Seven Strategies for Successful Post-Merger Integration, Pearson Education Ltd., London, 2000.

- Average elapsed time from date of merger announcement until merger closing for BP (with Amoco and ARCO only), TotalFinaElf, and ExxonMobil.

- Habeck, Kroger, and Tram, ibid.

The authors

The authors

Dennis Cassidy, a manager in AT Kearney Inc.'s global energy practice based in Dallas, has over 10 years of oil and gas industry experience. His primary focus is in growth strategy development and operational and organizational improvements in the downstream and upstream segments. Additional areas of expertise include post-merger integration, divesture strategies, and e-business strategy. Cassidy graduated from Texas A&M University with a degree in mechanical engineering and obtained an MBA from Southern Methodist University.

Alicia Lohman is a principal with AT Kearney Inc. She has more than 9 years of industry and consulting experience in a range of industries, with a primary focus in the energy sector. Her areas of expertise include post-merger integration, organizational effectiveness and redesign, business transformation, and value-capture strategy. She graduated from Loyola University with a degree in business. Lohman obtained an MBA from the University of Texas at Austin.

Paul Weissgarber, also in the Dallas office of AT Kearney Inc., leads the company's energy practice in the Americas. During his 20 years of experience in the energy industry and management consulting, his focus has been strategy development and organizational improvement. Most recently, his focus has been helping energy companies identify and capture value through the merger and acquisition process. A registered professional engineer, Weissgarber has an undergraduate degree in Petroleum Engineering from the University of Texas and an MBA from Southern Methodist University.