Several world regions still recovering from '98-'99 exploration slump

From November 1997 through March 1999, the petroleum industry suffered its most significant oil price collapse since 1986. OPEC surprised many by reducing quotas in March 1999, and it has enforced them since then.

OPEC's announcement triggered a dramatic price rebound, with crude prices more than doubling by the fourth quarter.

Following the surge in the oil price was an increase in exploration in latter 1999 following a very depressing first 6 months.

This article will focus mainly on exploration and delineation wells completed and contracts or concessions awarded to give an idea of world activity levels in 1999. Some of the more significant events will be discussed (Fig. 1).

The OPEC crude price averaged $15.40/bbl in 1999, compared with $12.28/bbl the previous year. Prices fluctuated between a low of about $10 to a 9-year high of $25 in December. The Brent price also fluctuated throughout the year (Fig. 2).

Exploration summary

This review for the most part does not cover seismic or development drilling.

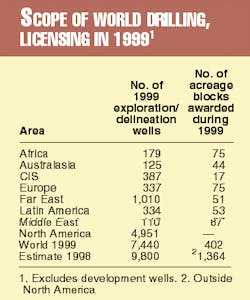

IHS Energy estimated that the total number of exploration and delineation wells completed worldwide during 1999 was 7,433 compared with around 9,800 the previous year. This represents a worldwide fall of around 24%. Exact figures are not available for some areas such as Russia, onshore China, and India.

The 24% decline was much less than expected at midyear, largely as a result of North America's second-half upturn. Countries outside North America generally saw a fall of 30-40% in exploratory and delineation well drilling during 1999 compared with the previous 12 months.

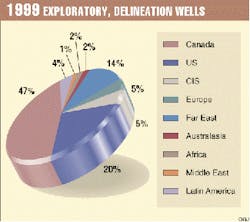

Of the 7,433 wells completed, 3,458 (approximately 47%) were drilled in Canada and 1,493 (20%) in the US. Countries outside North America thus accounted for 2,458 (or 33%) of the wells completed in those categories. Major discoveries were made in Iran, Azerbaijan, the Gulf of Mexico, Angola, Equatorial Guinea, China, Brazil, Argentina, and Bolivia.

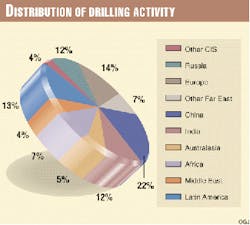

Fig. 3 shows world geographic distribution of exploratory and delineation wells, and Fig. 4 indicates the high percentage of drilling outside North America.

Far East activity

The most active area in terms of drilling outside of North America was the Far East with some 1,010 wildcats or delineation wells completed.

The region also saw 51 contracts or concessions awarded. The drilling figure of 1,010 completions is inflated due to state oil company activities in India and China, which IHS estimates completed 300 and 528 wells, respectively, but of which few details are available.

Indonesia was next most active in the Far East with 90 well completions. Interestingly, reflecting the oil price hike and stabilization of the political situation, 71 of these were drilled in the second half of the year.

Many other countries saw a drilling surge in the latter part of the year.

Among the year's highlights in the country was the green light from Pertamina for Unocal to begin development of West Seno and Merah Besar oil fields off East Kalimantan. Production will begin in 2002. The project represents Indonesia's first deepwater development. Unocal drilled a large number of wells on this deepwater acreage during the year with mixed results.

Conoco led the fourth quarter spurt, drilling successful gas wells to prove up reserves for Phase 2 of the West Natuna Gas Project.

Other active operators included Maxus-YPF, which drilled a series of slim-hole wells near producing fields in its Offshore Southeast Sumatra Block, and Caltex, which undertook a multiwell program in its onshore Sumatra Rokan Block.

Eastern Indonesia had little exploration, but Pertamina/Arco did make a sizable oil and gas discovery at Senoro-1 on Sulawesi's remote northeast arm. Senoro reserves have been quoted as high as 2 tcf and 80 million bbl of oil.

One of the year's more disappointing aspects in Indonesia was the failure of Japex and Inpex's deepwater wells in the Timor Sea. Pertamina awarded eight contracts in 1999 including the deepwater North Sumatra Krueng Mane Block to Lasmo.

Elf brought Maharaja Lela oil and gas field on stream, Brunei's first hydrocarbon production not operated by Shell.

Thailand exploration was focused in the gulf, where newcomer Harrods Energy made several oil and gas discoveries. PTTEP made a gas-condensate discovery with Arthit 15-1, first well in the former Vietnam-Thailand overlapping zone, Chevron made an oil and gas discovery at Jarmjuree-4, and Unocal made a significant oil and gas discovery at Yala-3 near the overlapping zone with Cambodia.

Unocal itself was the most active operator, drilling 14 of the 22 wells completed in Thailand with a 90% success rate. It also brought on stream Trat and Pailin gas-condensate fields.

In the Malaysia-Thailand JDA a gas sales agreement was signed for CTOC-operated Cakerawala gas-condensate field. Nine wells were completed in Malaysia, including Shell's successful appraisal of the deepwater Sabah Kamansu East-1 gas discovery. The four contracts signed in Malaysia included three to newcomer Murphy.

Vietnam again had low levels of exploration although state PetroVietnam pressed its policy to attract investors by awarding five contracts. Meanwhile BP Amoco moved closer with plans to develop Lan Do and Lan Tay gas fields offshore.

It was a highly successful 12 months off China after many years of frustration for foreign oil companies. Phillips discovered and appraised large Penglai 19-3 oil field in Bohai Bay, and Santa Fe discovered Panyu oil field in the Pearl River Mouth basin. Kerr-McGee also made an oil discovery in its Caofeidian 11-1-1 wildcat in the Bohai Bay that was being appraised at yearend.

Phillips' Penglai field is reported as having original oil in place of 2.1 billion bbl of heavy crude. That would make it China's second biggest oil field after Daqing. Santa Fe's Panyu field's OOIP is quoted at 140 million bbl.

IHS rates Penglai as the biggest oil discovery in the Far East/Australasia since Mobil's Bach Ho (White Tiger) discovery in the Mekong basin off Vietnam in 1975. Bach Ho has around 950 million bbl recoverable in IHS's database plus 1.3 tcf of gas.

Onshore, state China National Star Petroleum Co. discovered a "medium sized" oil field on the Tibetan Plateau, making it the world's highest altitude oil field. Ground elevation at the drillsites is not known. Elevation in the general area, near Yangtze River headwaters, is around 4,555 m, reservoir depth 350 m, and TD 400 m.

China National Petroleum Co. continued appraising gas discoveries in the northern and western Tarim basin.

It is estimated that 528 wells were completed in China during the year. Around 500 of these were drilled by the state oil companies onshore, and actual classification of the type of well is often unclear and exact figures impossible to obtain. China awarded seven licenses.

South Korea moved closer to becoming a hydrocarbon producer when its offshore Gorae gas field proved commercial. Three wells were drilled in Taiwan, including an unsuccessful deep exploratory well.

In North Korea, the state agency drilled one offshore wildcat. It was suspended pending further tests. No significant discoveries were reported among the eight wells completed in Japan.

An estimated 300 wells were completed in India, but again most are onshore and drilled by state entities with few details available.

One significant well was Shell-Cairn's Guda-2 oil discovery. It was important because, as well as being the first discovery of its kind in the Rajasthan basin, it is the first made in the country by a foreign company since the introduction of licensing rounds over 20 years ago.

India launched a licensing round in early 1999 under the terms of the New Exploration Licensing Policy. It was partly successful with a total of 45 bids received for 27 of the 48 exploration blocks on offer.

Pakistan saw the first award of a deepwater exploration block, to TotalFina. Among the drilling highlights were Ocean Energy's spudding of Pasna-1, still active at yearend and the first offshore well off the Makran Coast since 1977, and OGDC's oil and gas discovery at Chanda-1. Chanda is significant because it was the first made by any company in the North West Frontier Province and opened a new exploration area in the western Potwar basin.

Bangladesh continued its impressive high level of exploration success with five gas discoveries including Unocal's Moulavi Bazar-2, expected to contain several trillion cubic feet of reserves. Unocal brought Jalalabad onshore gas field on line.

Australasia exploration

Australasia saw 125 wells completed and 44 contract or concession awards.

Australia was the most dominant country with 109 wells completed and 32 license awards.

In the Timor Sea Zone of Cooperation Phillips's Bayu-Undan gas-condensate project got the go-ahead. It should eventually benefit newly independent East Timor.

Also on the Northwest Shelf, Woodside brought Laminaria and Corallina oil fields on stream using the world's largest FPSO vessel, and BHP started up Buffalo oil field.

In Papua New Guinea, Oil Search made the first hydrocarbon discovery on the onshore Fly platform when its Kimu-1 wildcat tested gas, and Santos made a gas discovery at Stanley-1 in the same area shortly after. During much of the year sensitive discussions concerning the proposed gas pipeline from the Highlands of PNG to Queensland continued.

Latin America figures

Latin America recorded 334 wildcats and delineation wells and the award of 53 contracts or concessions.

The year's highlight was opening of the Brazilian petroleum sector to foreign companies, resulting in the signing of 12 contracts. Foreign companies also signed 22 joint venture contracts with Petrobras, the state oil company, with $2.5 billion in work commitments the next 3 years.

Petrobras claimed the deepwater production record with a well in Roncador field. The 1-RJS-436A began producing in 1,853 m of water. Petrobras also set the world record in 1999 for drilling in the deepest waters with the 1-RJS-543 wildcat in 2,770 m of water in the Campos basin.

Petrobras discovered an oil field with estimated reserves of 700 million bbl, the first giant and first deepwater find in the Santos basin.

Some 60 well completions were recorded in Brazil, and seismic activity represented one of the world's most aggressive campaigns ever. About 22 seismic vessels were working Brazilian waters around yearend 1999, shooting spec and proprietary surveys along most of the country's continental shelf.

Argentina was Latin America's most active in terms of drilling with 140 well completions. The 1998 Loma Negra discovery was further delineated and proved to be a significant field with reserves of 240 million bbl. Several other oil finds were made close to Loma Negra. The government awarded 17 licenses.

Bolivia was one of a few countries in the world to register a significant increase. It had 33 wells completed versus 22 in 1998, and the result was a sharp increase in proved gas reserves. The hike in drilling reflected the start-up of gas export capacity.

TotalFina discovered 7.3 tcf proved and probable on Block XX in Gran Chaco Province with Itau X-1A near the Argentina border where most of Bolivia's large discoveries are made. Repsol-YPF-Maxus discovered Margarita field with about 2 tcf, while Petrobras attributed 7.1 tcf to discoveries on the San Alberto and San Antonio blocks.

Successful exploration was a two-edged sword as only one block out of five on offer was taken in the second Bolivian bid round. The reason: an oversupply of gas to the market in Brazil.

Political problems plagued Colombia during the year that ended with violent guerrilla attacks, the resignation of Ecopetrol's president, and the subsequent resignation of the minister of mines and energy.

Twelve licenses were relinquished and one new one signed, but several were awaiting award at yearend. One potentially commercial discovery was the CMS Energy Abanico-1 in the Upper Magdalena basin. Emerald Energy significantly upgraded oil reserves in its 1998 Gigante-1A discovery to 400-590 million bbl.

In Ecuador three oil discoveries were made by Cayman (Palo Azul-1 and Pata-1) and City Investing (Shirley-1). Arco-Agip's Villano oil field, a role model for future development in environmentally sensitive areas, went on production. Ecuador granted seven licenses compared with one in 1998.

Guyana awarded its first contract in 5 years, granting Esso a large deepwater block, the first in the Guyana basin.

Peru saw a large drop in activity with four wells drilled and a single contract awarded.

Repsol-YPF drilled two disappointing wildcats off Peru. The country's Camisea gas fields tender was postponed three times.

Suriname benefited from interest in the deepwater Atlantic margins with the signing of a contract by a Burlington-Shell group.

Trinidad and Tobago saw a slight drilling decline as companies continued to explore for gas to feed proposed second and third trains at the Atlantic LNG complex. First LNG was shipped in April.

The most significant well was Shell's Hadyn-1 on deepwater Block 25a, which set a water depth record for the country and was rumored to have encountered hydrocarbons.

Venezuela experienced changes to its petroleum policy as a result of a new political regime being installed. New plans were announced to develop gas reserves and, in the event of OPEC quota being maintained, Pdvsa would reduce its production so that foreign contractors could increase production from new and marginal field licenses.

Drilling in Venezuela fell significantly, but several important oil discoveries included Conoco's Corocoro-1, Lasmo's Tortola-1, Tecpetrol's La Palma-1X, Phillip's LVC-28X, and Maxus's Tropical-1X.

A Cuban deepwater licensing round generated little interest.

Mexico saw an increase in drilling with at least 22 exploratory and appraisal wells completed. Several discoveries included Pemex's Cantarell 418D in the Bay of Campeche. This discovery has been described as the most significant in Mexico in at least the last decade.

Nitrogen injection was to start in mid-2000 at the $10.5 billion Cantarell enhanced oil recovery project in Campeche.

Pemex increased Burgos basin E&D to produce nonassociated gas and delay the prospect of becoming a net gas importer as early as 2002.

North America

Completions totaled 4,951 exploratory and delineation wells.

Canada registered the most exploration and delineation wells drilled by a single country during the year with around 3,458 completions, many of which were drilled in and near established gas producing trends in western Canada. The figure 3,458 is comprised of 118 new field wildcats (down from 218 in 1998), 1,437 new pool wildcats, 384 deeper pool tests, 1,450 delineation wells, and 69 "exploratory" British Columbia wells.

The overall number of wells spudded in Canada (including development) during the 12 months was 12,213, third highest since 1988. In 1998, 3,454 exploration and delineation wells and 6,559 development wells were drilled (combined total of 10,013).

A robust second half of 1999 saw Canadian figures restored to above 1998 levels. The high levels of drilling were the result of gas demand, improved gas prices, and opening of new export pipeline capacity. Most activity was focused onshore in Alberta, where around 75% of the wells were drilled.

Eight exploration-appraisal wells were drilled in eastern Canada (Nova Scotia and Newfoundland), but this represented a two-fold increase on 1998. Husky made two discoveries off Newfoundland, North and South White Rose, totaling 400 million bbl of oil and 2 tcf potentially recoverable.

Newfoundland and Nova Scotia held successful offshore bidding rounds that involved financial exploration commitments totaling $253 million (Canadian) over the next 5 years on 16 licenses.

First gas was piped in late December from the Sable Island complex off Nova Scotia, which was expected to achieve a production rate of 500 MMcfd within a year. In the same month, Canada's first offshore oil fields, Cohasset and Panuke, ceased production, having yielded a total of 44 million bbl since starting up in 1993. The total number of licenses in Canada stood at 14,762, third highest yearend total on record.

The US recorded 1,493 exploratory well completions including 860 new field wildcats where, similar to Canada, the main focus was on gas and coalbed methane.

BP Amoco-Mobil discovered Crazy Horse field with around 1 billion boe of reserves in the deepwater Gulf of Mexico. Several other deepwater oil discoveries were made.

Alaska's highlight was the National Petroleum Reserve-Alaska lease sale, which covered most of the Alaskan Arctic slope west and southwest of Prudhoe Bay. The sale drew bids totaling almost $105 million for 133 tracts with six companies dominating the subsequent awards: Arco, BP Amoco, Anadarko, Chevron, Phillips, and R3 Exploration. As part of the deal to secure acceptance of the BP Amoco merger with Arco, the companies agreed to sell certain assets.

The proposed merger had put a damper on exploration in Alaska during the year.

Exploration in Africa

Africa saw the drilling of 179 wildcats or delineation wells and the award of 75 contracts or concessions.

Most active in drilling was Egypt with 43 wells completed and seven licenses awarded. Two of the more significant wells were Apache's Kahraman C-17, which tested commercial oil for the first time from a new play in the western desert, and Dublin International's Hana-1, east of the Gulf of Suez, which also tested oil and was brought on stream before yearend. Several projects were under way in Egypt to export gas from fields in the offshore Nile Delta.

Sudan was next most active in Africa with 30 well completions but no awards. Libya saw the drilling of 13 wells and the award of three contracts. The country also made plans for a forthcoming licensing round featuring some 80 blocks.

Neither Sudan nor Libya reported a major discovery, with much of the emphasis being on delineation and development drilling.

Algeria recorded 26 wells and 16 contracts. Sonatrach was promoting underexplored areas, and operators were preparing to develop Berkine basin discoveries.

Chad was disappointed following Elf and Shell's withdrawal from a consortium that planned to develop a cluster of fields and build an export pipeline.

Nigeria's offshore was one of the world's hottest areas in 1999. The country witnessed 19 wells and 19 contract awards.

Esso's Erha-2 appraisal well confirmed the deepwater play, which may contain reserves in the region of around 1 billion bbl. By contrast, expectations were reduced for the Texaco Agbami deepwater oil field, and Shell's deepwater Doro-1 wildcat discovered only gas. Shell also made a huge financial commitment to develop offshore fields in Nigeria ($8.5 billion overall).

One of the region's most important discoveries of the year was Triton's Ceiba-1 oil well off Equatorial Guinea. Appraisal and 3D work followed immediately on this potential discovery of several hundred million barrels in the Rio Muni basin, and Triton planned to fast-track development.

Chevron brought on stream Angola's first deepwater field, Kuito. Angola had 17 completions, and drilling successes continued with a stream of discoveries for Elf, BP Amoco, and Esso.

Interest remained high in Angola with six new awards including huge signature bonuses paid for ultradeepwater blocks.

Namibia's third licensing round greeted little response.

There was disappointment in the Ivory Coast deepwater following the failure of Ocean Energy's Lahou-1.

Middle East search

The Middle East experienced 110 wildcats or delineation wells, and some 87 contracts or concessions were granted.

Turkey dominated the concession figure; 63 blocks were licensed and 33 were relinquished. Turkey's 27 completions included 9 discoveries. Dominating Turkey were discussions for the proposed Baku-Ceyhan oil export route from the Caspian Sea, but little progress was made. Two notable wells Arco drilled in the Black Sea were understood to be unsuccessful.

Iran had 12 completions, and NIOC discovered giant Azedagan field with an estimated 26 billion bbl in place of which some 8 billion bbl was thought recoverable. This would make it Iran's fifth largest field and by far the world's biggest find in 1999.

Iran's 12 wells included five discoveries by NIOC and two appraisal wells by Total in South Pars field, where reserves were upgraded to 350 tcf. NIOC also drilled its first offshore well, Ashkan-1, since 1993.

Iran awarded five contracts including a block to South Korea's state Pedco in the disputed part of the Caspian Sea. Among the production highlights was Total's Sirri E oil field start-up.

Iraq hosted little serious exploration due to UN sanctions. Iraq announced that, due to its own efforts, production had commenced from West Qurna oil field.

Oman saw the drilling of 25 wells and issued three licenses. PDO continued its development-appraisal of Block 6 and made several significant discoveries in the comparatively less explored southern part of the license.

OPEC quota restrictions reduced activity in Qatar. In Saudi Arabia Shaybah superlight oil field went on stream at midyear. Saudi Aramco made two gas-condensate discoveries east and south of Ghawar field, reflecting the country's ongoing gas exploration program. Hydrocarbon sector opportunities for foreign investors continued in the discussion phase only.

Yemen opened its first licensing round in the third quarter. Several discoveries were made in known play fairways, and five licenses were awarded, including four to Canadian Petroleum.

Israel had two significant gas discoveries offshore. Samedan's Noa-1 and Isramco's Or-1 confirmed the extension of the Nile Delta Pliocene gas play. This led to a number of offshore licenses being signed up, including one offshore Gaza Strip to British Gas adjacent to its Egyptian acreage.

Kuwait in late 1999 convened a conference on its plan to open fields in the north and west for foreign participation. One exploration well was drilled in Kuwait, and this resulted in an oil discovery for Exxon at Kra al Maru-2.

Discussions continued in the Neutral Zone between Japan's AOC and Saudi Arabia for the renewal of AOC's offshore concession, which expires in early 2000.

A total of 22 wells were drilled in Syria, which resulted in nine discoveries. Al Furat made four of these and SPC the other five.

Exploration in the CIS

In the CIS, where Russia dominates exploration, around 387 exploratory or delineation wells were completed and various governments awarded 17 contracts or concessions.

No exact figures are available for the number of wildcats and delineation wells completed in Russia, but based on footage IHS estimates some 300 wells were completed.

Domestic companies dominate the Russian exploration scene. Foreign investors, although recognizing the country's huge potential, are concerned about unpredictable political and economic developments.

The well with the highest expectations spudded in Russia in 1999 was Lukoil's Khvalynskaya-1, first test on the Russian shelf of the Caspian Sea. It was still drilling at yearend.

One of the year's production highlights was the first flow of oil from the Sakhalin-2 project by a group comprised of Marathon, Shell, Mitsui, and Mitsubishi. The project is in the Sea of Okhotsk off Sakhalin Island.

The Caspian Pipeline Consortium began laying pipe for the oil export line from western Kazakhstan to the Russian Black Sea in late 1999.

Kazakhstan was the most successful country in the Caspian Sea region with regards to foreign participation. The government awarded four licenses during the year and some 16 wells were completed. Amerada Hess was the most active foreign operator.

One of the year's most significant wells, OKIOC's Kashagan East-1, was still operating at yearend. Lack of infrastructure hampered development work, but Shell Temir Petroleum started pilot production from Saigak oil field.

Interest in Azerbaijan remained high with some 23 groups active in the country. Five contracts were granted during the year, several others were awaiting signature at yearend, and 8 wells were completed.

The most active operator was BP Amoco, which drilled four wells on the Shah Deniz structure. One of the wells, SDX-1, confirmed a 17 tcf and 700 million bbl (condensate) field.

Turkmenistan awarded three contracts, and state companies drilled 31 wells. The country brought on stream two new fields in the Murgab basin at Byashgyzyl and Uchaji Vostochnyy.

Gas output in Turkmenistan was constrained by a lack of infrastructure and the failure of customers to pay for previous deliveries.

The Turkmen government announced measures to restructure the oil and gas industry and prepared for a Caspian Shelf round to be formally opened in early 2000.

Uzbekistan was working on changes to the petroleum industry in an effort to attract foreign investment. Throughout 1999, only state companies explored, drilling some 19 wells.

In Kyrgyzstan, where foreign interest is limited to one company, one well was drilled and no licenses granted. Drilled by a local group, Basken-1 was suspended for lack of funds.

The government of Georgia Republic introduced a new tax law during 1999 in an effort to attract foreign investors. No acreage was awarded and no wells were completed. One wildcat, Frontera's Niko-1, was operating at yearend.

Tajikistan made no new awards, and drilling was limited to just two wildcats due to the limited finances of local companies and civil war.

European developments

In Europe 337 wells were completed and 75 contracts or concessions were granted.

The largest numbers of wells drilled was in Romania, where around 100 were completed, and Poland where with about 70. Overall activity held up pretty well in these Eastern European countries.

The next most active country in terms of drilling was the UK, where 39 wells were completed comprising 32 offshore and seven onshore. Only one out-of-round license was awarded, however. The UK saw a dramatic (55%) decline in drilling to early 1970s levels, which led to the government announcing a package aimed at boosting exploration.

BP Amoco continued its Wytch Farm Sherwood reservoir development under Poole Harbor, with well L98/6-M-16Z becoming the longest stepout for any production well in the world.

Five discoveries were made in the UK. They included Elf's high pressure-high temperature wildcat on the Glenelg structure in the North Sea central trough which flowed gas and condensate and Conoco's Vixen gas discovery in the southern gas basin.

On the Atlantic Margin west of Shetlands, Mobil operated two deepwater wildcats under "tight" conditions. Well 214/4-1 is rumored to have encountered gas with an oil rim. Conoco also completed a deepwater well in the area as a "tight hole." In addition 22 fields were brought on stream in the UK.

Denmark was one of the few countries in the area that registered an increase in drilling with nine completions compared with three in 1998. These included Maersk's discovery of the 70- million-bbl Halfdan field, on fast-track development.

Statoil began production from Siri oil field, the first commercial offshore discovery developed outside the central graben in a new Tertiary play and the first producing field not operated by Maersk in Denmark. Amerada Hess brought on stream South Arne field, the second largest field in production in Denmark and the largest chalk reservoir development of the 1990s with recoverable reserves of 89 million bbl and 200 bcf. Denmark also awarded four licenses covering 38 full or part blocks, a significant amount of acreage.

Norway awarded 15 offshore licenses in 1999, and 21 wells were completed. Saga, Statoil, Phillips, and Esso made discoveries. Esso made an oil discovery at 25/8-12A, north of Balder field, and indicated that reserves in the area could be around 100 million bbl. Operators started up nine fields in Norway, including Asgard, a staged development in a "frontier" region.

In Germany, Wintershall commenced work on A6/B4 field, the country's first true offshore development. The project will help development of the northernmost parts of the contiguous Dutch North Sea.

Twelve offshore wells were drilled in the Netherlands with four discoveries reported. These were all gas and were made by Clyde, Elf Petroland, TransCanada, and Wintershall. In early 1999 the Dutch government announced it would open formerly closed areas in shipping lanes. It also awarded four exploration licenses.

Offshore Ireland, Enterprise successfully appraised Corrib gas field in the Slyne-Erris Trough. A second well drilled in 1999 by the operator on the Shannon prospect south of Corrib, was dry.

Two licenses were awarded as part of the Southern Porcupine Basin Round, one covering six blocks to Elf and the other with five blocks to Agip. In addition three options were awarded covering 15 blocks. The production highlight in Ireland was the first flow of gas from Marathon's Southwest Kinsale field.

The maritime boundary between the Faroes and the UK was agreed in 1999, and the former "White Area" is expected to be opened for bid in 2000 in the First Faroes Licensing Round.

Greenland was working on plans for a possible licensing round in 2000 with a new oil licensing policy and model contract agreement announced.

Italy was the busiest country in southern Europe with 22 licenses granted and 22 wells completed.

Spain's two wells included Repsol's successful Chipiron-1 oil find in the Mediterranean.

Malta's sole well was the ultradeep Madonna taz-Zejt drilled by ENI on behalf of the government. Drilled to TD 26,439 ft, this well encountered noncommercial gas.

Five licenses were granted in Portugal and one well completed. This was Mohave's Aljubarrota-2 gas discovery.

France saw activity decline to just two wells and awarded six licenses.

The future

As we move into 2000 there are positive signs that OPEC will retain the production quota agreement. Many oil companies are still cautious following the uncertainty of the last year or so.

Oil price firmness has yet to manifest itself in future increased exploration spending in many areas of the world. It is likely that companies are working their 2000 budgets on a price of $14-15/bbl, and therefore we can expect exploration to at least reach 1998 levels worldwide.

The Author

Ian Cross has been based in Singapore the past 10 years and is currently director of Asia-Pacific for IHS Energy Group. His responsibilities include being the regional technical co-ordinator. He is secretary of the South East Asia Petroleum Exploration Society and has held several other positions on the committee. Previously he worked as a geologist for Elf, BP, and Fina and has a BSc from Cardiff University.