Conoco: Long-term view elicits success in Russian oil sector

Conoco Inc. entered Russia about 10 years ago, beginning with a relatively small project that allowed the company to build relationships.

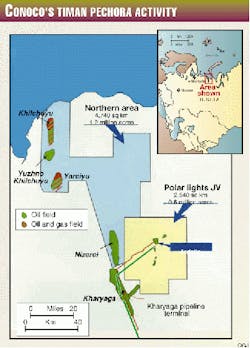

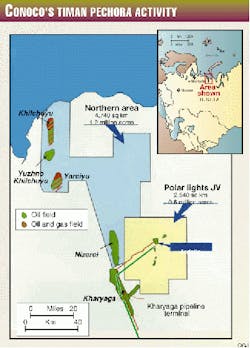

After extensive studies and negotiations, Conoco and Russian firm Arkhangelskgeoldobycha (AGD) formed a 50-50 joint venture called Polar Lights, located in the Nenetski autonomous okrug east of Arkhangelsk (see map). Russian major Rosneft later joined the JV, leaving Conoco with 50% and AGD with 30%. Currently, the JV produces 35,000 bo/d and has produced 61 million bbl of oil since start-up.

In 1992, Polar Lights began developing Ardalin field, which contained about 125 million bbl of oil. In August 1994, Ardalin was then successfully brought on stream, becoming the first oil field to be developed by a partnership of Russian and Western oil companies.

Ardalin success

"Technically and geologically, Ardalin has been an outstanding success," said Thomas Knudson, chairman of Conoco Exploration Production Europe Ltd., at the Russian Energy Summit last December in Moscow. "It was completed on schedule and within the original budget of $400 million."

Knudson told OGJ that five factors led to Conoco's success. First, "We have a quality asset where the reservoir performs as well as any in the world." Second, "I would stack our workforce, which is 95% Russian, against any workers in the world. Our personnel have a strong work ethic, work in a safe manner, and have done a superb job in driving down our operating costs while increasing production."

Third, "We have had good success working with our partners, AGD. You definitely need good partners and good relationships to do it right in Russia." Fourth, "We have taken an integrated approach. We are involved from tax management to oil movements, trading, and government relations-not just field operations."

Finally, "We are taking a long-term view. We believe that, if you look around the world for countries that have big reserves and big market potential, there aren't many. Russia is one that does. It's a place that we feel we must be."

Problems

But Conoco has encountered problems with an ever-changing tax regime, one of the greatest problems with JVs and the general subsoil regime in Russia. "The government take is now much higher than when we started. But fortunately, the quality of the asset has helped at least to partially overcome this problem," Knudson said.

One of the most significant factors was the loss of 100% export rights, which was a key element of the original agreement. "Mandatory domestic sales, at prices that are deeply discounted relative to world prices, are effectively another tax-and a very big one at that," he said.

In addition, domestic pipeline capacity is limited, and although the Polar Lights JV achieved record output of 45,000 bo/d last year, it was unable to maintain that level as there is not enough pipeline capacity to handle such production levels.

Finally, cash management has been difficult. "So far we have been able to deal with ruble and dollar-exchange issues, the ruble devaluation, and bank failures, but I certainly don't want to minimize the challenges," Knudson said.

"For these reasons, Conoco has strongly advocated the use of PSAs (production-sharing agreements) for future energy projects," adding that it intends to develop a group of four oil fields, known as the Northern Territories, located just northwest of the Polar Lights JV area in the Timan-Pechora region. "We're encouraged by the progress that our partners and the Russian authorities have made in the last year toward reaching this goal," Knudson said.

The project, which involves a 1.2 million-acre block that includes the large Yuzhno Kilchuyu field, will be jointly developed by Lukoil, AGD, and Conoco at a cost of $3 billion.

Knudson said the large Yuzhno Kilchuyu field contains three to four times the reserves of Ardalin. To get crude oil to market, in an area already constrained by lack of pipeline capacity, the partners intend to transport it by tanker. "The lowest cost means of opening up Timan-Pechora's extensive reserves will be tanker export to Western Europe," he said.