Cooperative economics needed to tap stranded Kamchatka gas

An indicator has been developed quantitatively to characterize pipelines based on the propensity of their profiles to induce liquid holdup.

While further analysis is needed and a variety of technical, environmental, fiscal, and legal issues have still to be worked out, the region's petroleum resources offer the potential to:

- Contribute substantial environmental benefits through the substitution of natural gas for heavy fuel oil in the generation of electricity, and

- Satisfy the requirements of economic viability, including the goal of enhancing the prospects for improved and sustainable economic development.

Promising geology

Maxwell and Chinakayev of CEP International Petroleum provided a synopsis of the petroleum potential of the Kamchatka back-arc basin on the west side of the Kamchatka peninsula in the Russian Far East.1 The peninsula lies between 50°-61° N. Lat., roughly northeast of Japan. It is bounded by the Sea of Okhotsk on the west, the Pacific Ocean on the south, and the Bering Sea on the east (Fig. 1).

The Kamchatka Oblast, including the Koryak Autonomous Okrug, covers 518,000 sq km with a population of some 470,000. The capital, Petropav- lovsk-Kamchatskiy, on the east coast, has about 250,000 people.

Kamchatka faces an urgent energy problem: Frequent power outages cause its citizens to be without heat and light for extended periods, even in winter. Potential natural gas development is seen as offering the possibility to help alleviate this problem.

With respect to the resource potential, Maxwell and Chinakayev observed that "(the) basin is a relatively unexplored petroleum region ellipse Similar in many respects to the Sumatra basin in Indonesia, this region of Russia has the promise of becoming a major producing region."

They conclude by highlighting that "like other prolific petroleum basins along the Pacific Ring of Fire, the Kamchatka back-arc basin offers potential for the discovery of large petroleum reserves. The basin offers the appealing combination of rich source rocks, good reservoirs, and seals and the presence of large untested structures."

The authors noted that some 15,000 km of seismic data were acquired in this area in 1986-94, and 26 exploration wells have been drilled since 1982. This exploration effort has led to the discovery of "several significant gas-condensate fields." To date the most significant discoveries are on land. In two of these discoveries, Nihzne Kuakchikskoye and Kshukskoye, the combined recoverable reserves are estimated at 430 bcf (12 bcm) of gas and 5 million bbl of condensate.

Kamchatka gas economics

The purpose of this article is to provide comment on the potential economics associated with the identified reserves.

The 12 bcm reserves estimate is taken as a base case. In addition, sensitivities are performed so as to afford comment on two other reserves estimates, a low of 8 bcm and a high of 17 bcm.

While cost sensitivities are not included here, gas prices are considered across a range from $40-120/Mcm ($1.13-3.40/Mcf). This range represents at the low end the current domestic gas price in Russia and at the high end the delivered price in the lucrative Asian market. The domestic price can be expected to improve over time. In the interim, however, it remains constrained by economic realities as Russia struggles to manage the transition from controlled to competitive markets.

It is highlighted that, like so many other gas discoveries around the world, Kamchatka gas is "stranded gas;" that is, it confronts the problems of insufficient local demand and a considerable transportation disadvantage.

Most likely gas use

The most likely use for Kamchatka gas in the short and medium terms would be the displacement of existing fuels (coal and heavy fuel oil) used to generate electricity. This, at least, could be an option for the volumes such as those identified above. In fact, this analysis assumes that such an option will be realized.

Therefore, although questions surrounding export and future increased production are interesting, they are not considered further here. It is envisaged that fuel from the gas-condensate fields in the west would be transported via land pipeline to the demand centers in and around the capital. Several communities along the route could also be connected to the gas distribution network.

Under the assumption of an integrated gas-electricity development, the effective gas price would be higher than the above identified domestic upstream price of $40/Mcm. The precise price will depend on a host of cost, production, and other factors, which are beyond the scope of this article to assess.

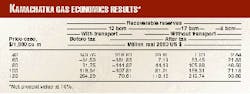

To reflect the reasonable possibilities and to provide a point of reference for analysis, a base case gas price of $80/Mcm is assumed. The range of $40-120/Mcm is retained for comparison. The estimated costs for capital investments, operations, and transportation are presented in Table 1.

Before discussing the economics results shown in Table 2, the following additional analysis assumptions are also noted. Condensate production is not incorporated, nor is the possibility of an oil discovery. While these assumptions serve to undervalue the region's petroleum resources, they are adopted here because of the limited opportunity for discussion in a single journal article and because the primary intent of this article is to focus on the gas alone.

The decision not to comment on the condensate and oil potential also serves to introduce some further caution to reflect the still considerable uncertainties with respect to reserves, prices, and costs. All fiscal calculations reflect the terms of the existing Russian generic fiscal system.

Economic results

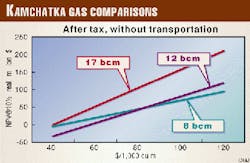

The economics analysis results presented in Table 2 and Fig. 2 illustrate the following:

The 12 bcm project would be economically viable at a price of $80/ Mcm on a before-tax basis. The associated NPV@10% real would be $31.75 million.

Application of the fiscal system renders the project uneconomic, reducing the NPV to negative $144.82 million.

The project becomes economically viable again when the transportation burden is removed. This is true for all but the extreme low price case. Such removal is considered reasonable since this infrastructure would benefit more than this single project.

With the transportation infrastructure in place, the 8 bcm case also becomes economically viable, with a positive NPV of $46.50 million.

Presentation of the economic results without the transportation cost burden illustrates one option for helping solve the "stranded gas" problem in Kamchatka. In this context, it is further observed that the existing fiscal burden is such that an improvement in fiscal obligations from industry's perspective would also be a reasonable expectation, effectively bringing the level of government take more in line with international norms.

Initiatives such as these are not uncommon around the world, even in developed economies. Examples include the choice of a rent-based fiscal system and the provision of infrastructure assistance for the Hibernia offshore oil project on Canada's East Coast, and the current "payments-in-lieu-of-taxes deal" proposed by Alaska for gas pipeline construction.

Economic accommodation

While this analysis reveals the importance of improved fiscal terms, we must not lose sight of the practical realities of Russia's current depressed fiscal and budgetary position.

It would be unreasonable to expect Russia to make up the full shortfall in company NPV through a complete removal of all taxes. Some combination of fiscal improvement on the part of Russia, investment from both Russian and western sources, and direct financial contribution from western financial institutions would be ideal.

Indeed, given that the West is committed to assisting Russia in its transition to a competitive economy, Kamchatka gas would seem to be an ideal candidate. The project would afford significant social and economic development opportunities for a severely disadvantaged region.

It would also afford the opportunity to displace existing fuel consumption with a more environmentally friendly fuel source. Justification for such involvement would be supported by the positive economic results even under the low reserves case of 8 bcm and by the attractive upside potential reflected in the 17 bcm case (Table 2).

These results help illustrate the long term viability of the project once the initial investment in transportation infrastructure is made. The results for the 8 bcm case also show that investment in transportation infrastructure would significantly lower the break-even reserves level, thereby contributing to improved economics attractiveness for the entire basin. This would also contribute to the improved long-term prospects for increased tax and royalty revenues for Russia in general and for Kamchatka Oblast in particular.

The payoff

With reasonable fiscal improvements on the part of Russia, and financial cooperation between Russia and the West, the economics of the Kamchatka back-arc basin could be managed so as to realize the attractive resource potential identified by Maxwell and Chinakayev.

Positive decisions with respect to the project would be economically justified on the basis of the sound economics results, contributing to long-term sustainable socio-economic development for the Kamchatka region.

To be sure, much uncertainty should still be attached to the economics results at this stage.

In addition to the need for more and better cost and price information, as well as for refined reserves and production data, this region can be classified as sensitive environmentally. There is a vibrant fishing industry (both inland and offshore), and the region is subject to seismic and volcanic activity-there are 300 cones, some 29 of which are active.

All of these uncertainties, plus the acknowledged positive economic potential, point to the need and justification for further analysis, taking into account the full scale economic, social, and environmental consequences.

Acknowledgments

The following provided input and valued assistance: Nataly Halturina, SlavNeft Vostok Co.; Janet Keeping, Canadian Institute of Resources Law; Alexey Khitrov and Tatiana Krasilnikova, Russian Ministry of Fuel and Energy; Robert Maxwell, CEP International Petroleum; and Vladimir Poroskoon, Russian Ministry of Natural Resources. Canadian International Development Agency funded the author's work in Kamchatka.

Reference

- Maxwell, Robert, and Chinakayev, Rustam, "Potential outlined for Kamchatka back-arc basin, Far East Russia," OGJ, Aug. 30, 1999, p. 98.

The Author

Barry Rodgers is a petroleum economist specializing in project financial analysis, fiscal system design, and benefit/cost analysis. Before beginning an international consulting career in 1997 he held the position of Director, Energy Policy with the Government of Newfoundland and Labrador, working on projects such as Hibernia and Terra Nova, and on the design of the province's onshore and offshore royalty systems. He is a graduate of Memorial University with concentrations in economics and mathematics.