Oil market turning point seen in 2Q 2000

Oil market performance in the second quarter of 2000 will signal whether escalating prices threaten the economic recovery in Southeast Asia that is spurring the growth in worldwide demand for oil.

So said officials of Arthur Andersen and Cambridge Energy Research Associates (CERA) in their 14th annual report on world oil trends.

1999 trends

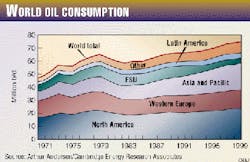

According to the Arthur Andersen/CERA report, total world oil consumption increased 1.6% to a record 75.3 million b/d in 1999, including a 3% rebound in Asian demand to nearly 20 million b/d that followed an astounding drop in 1998 (Fig. 1).

But global production of crude oil dipped nearly 1.9% to 64.9 million b/d from a record output of 66.1 million b/d in 1998 (Fig. 2).

Worldwide production of crude and NGL totaled 71.6 million b/d last year.

North America registered the big- gest decline among non-OPEC producers, with average oil and NGL production of 13.7 million b/d-the lowest level since 1979.

Those market fundamentals of supply and demand caused the price of oil to almost triple last year from previous lows. But the market remains fragile, because rising prices could threaten the economic rebound that is fueling demand, especially in Southeast Asia, said Joseph Stanislaw, CERA president.

OPEC's dilemma

"The future of global oil markets will hinge on whether OPEC's effort to manage the market through production policies creates a stable pricing environment or leads to greater price volatility," said Stanislaw. "The goal will be to avoid a repeat of the shocking oil price collapse in 1998. However, any small supply deficits or surpluses can dramatically affect oil commodity prices, as swings over the past 2 years have shown," he said.

The market's stability-or lack of it-beginning this March when winter weather subsides will be a key factor, Stanislaw said.

High oil prices for 1 quarter of the year is no big problem. But 2 quarters of high prices may derail the economic recovery in Asia by interfering with reform efforts to remove government subsidies for energy.

Three quarters of high prices could stimulate more non-OPEC production, which would, in turn, threaten OPEC's newfound integrity in adhering to production quotas.

"OPEC members know they can't be greedy-hogs get slaughtered," said Stanislaw. "But they are not entirely in control" of today's market. "Growing demand is colliding with shrinking supply. OPEC can't wait too late to supply the additional barrels," he said.

One of the dilemmas facing OPEC is whether to authorize small production increases on a quarterly basis or make the whole increase at once, he said.

Company performance

Meanwhile, the strong rebound in oil prices has not yet triggered a similar "euphoria or irrational exuberance" in the stock market, said Stanislaw.

Stock prices for the average integrated oil company have increased about 25% in the last 2 years, while the average value of E&P stocks has fallen, he said. New technology has had a major impact in reducing finding and development costs to push down the break-even point for projects, said Victor Burk, managing director of Arthur Andersen's energy group in Houston. At the same time, he said, the industry is expanding into areas previously closed to them.

At the low points of each supply-and-demand cycle, companies have to look for ways to cut costs. Development of strategies to reduce costs and retain a competitive advantage will be the key, said Burk. "Rapid changes driven by technological innovation and the impact of e-business create new opportunities, but the speed of change challenges the management of all companies," he said.

"Success will require more-flexible organizational structures and vastly improved knowledge-sharing. The critical success factors will include the capability to adapt to the rapidly changing world, to cope with the transition process, and to be prepared for the unexpected," he said.

Price, supply concerns

Despite the fly-up in oil prices, retail prices for oil products remained relatively unchanged in most of the larger countries in the Organization for Economic Cooperation and Development, officials reported.

The US was a major exception. Despite a 6.7% increase during 1999, retail prices for US oil products-when adjusted for inflation-remained 5% below 1980 levels.

The trend report also found that oil inventories of OECD countries totaled 3.7 billion bbl at the start of this year, a significant drop of 156 million bbl from levels at the start of 1999. That amounts to an 83-day supply, 4 days less than a year ago and the lowest level since 1980, officials said.

Company-held crude inventories in North America declined by 6 days to a 52-day supply, the lowest level on record, officials said.

Worldwide refining capacity increased by 800,000 b/d in 1999 to 81.4 million b/d at the start of 2000, they reported (Fig. 3). North American capacity increased 0.7% to 20.6 million b/d, while Asia registered the biggest increase, up 770,000 b/d to 19.2 million b/d.