OGJ Newsletter

US INDUSTRY SCOREBOARD 2/7 - The US Federal Trade Commission's attempt to halt the $26.8 billion merger of BP Amoco and ARCO is shaping up as the biggest oil antitrust legal battle since the government broke up Standard Oil nearly a century ago.

Both sides have vowed a court battle that could go all the way to the US Supreme Court. As OGJ went to press, Richard Parker, director of the FTC's Bureau of Competition, said the government has every intention of entering court in San Francisco as early as Feb. 4 to halt the combine. However, company officials say they still hope some settlement can be reached to avoid a protracted court battle.

On Feb. 2, the FTC voted 3-2 against the merger, which would have created the second largest non-state oil company, just behind ExxonMobil. The two dissenting commissioners claimed it was premature to seek a preliminary injunction against the union. While branding the union "anticompetitive," FTC said the decision stemmed from concerns over the newly formed supergiant's possible domination of Alaskan North Slope production and, consequently, having out-and-out control over West Coast gasoline prices. Alaska, which had approved the merger following concessions by the companies, voiced dissatisfaction with the FTC decision.

North America's biggest gas pipeline system is about to get bigger.

Continuing its buying spree, El Paso Energy has agreed to buy most of the beleaguered All American Pipeline from units of Plains All American Inc. for $129 million. El Paso plans to spend $75 million to convert to natural gas service a segment of the 1,223-mile, 30-in., California-Texas oil pipeline-built in the 1980s to move Alaskan and California crude oil from Santa Barbara to McCamey, Tex. El Paso's purchase will cover the 1,088-mile segment from McCamey to Emidio Station, near Bakersfield. El Paso already operates a major gas pipeline system from Texas to California, and the conversion will enable it to replace existing compression facilities with more efficient looping while increasing inlet capability on the east end of its system. The conversion is slated to start up in first quarter 2001. The All American Pipeline has languished at subpar throughput levels for years, as the expected big incremental volumes of Alaskan and Offshore California crudes never materialized. Plains recently took preliminary steps to close down the system (OGJ, Nov. 29, 1999, p. 27).

El Paso just topped its proposed $16 billion merger bid with Coastal Corp. with an acquisition of PG&E Texas assets that will also make it the second biggest US midstream operator (see related story, p. 31).

Venezuela's major gas initiative is getting under full swing.

The gas initiative, centerpiece of the new petroleum policy of President Hugo Chávez, received a jump-start last week when the Ministry of Mines and Energy approved the creation of a joint-venture company owned by a unit of state oil company PDVSA and private sector companies within or outside Venezuela, to transport gas on and to operate and expand the Anaco-Jose gas pipeline-a $120 million project. PDVSA Gas last week started work on a tender for a "strategic partner" to operate the Anaco-Jose pipeline and to begin efforts toward a licensing round for exploration and production of nonassociated gas in the country. A second tender would involve operatorship and expansion of a gas pipeline from Barbacoas to Margarita Island at a cost of $80 million. Both pipeline project tenders are to be ready by July. Subsequent tenders are planned for the Anaco-Barquisimeto and the Anaco-Puerto Ordaz pipeline projects.

Chávez is expected to make a key speech Feb. 10 announcing the opening of Venezuela's gas industry to domestic and foreign private investors.

Middle East oil prospects may be opening wider to outside players as evinced by TotalFina's proposed participation in drilling rights along with Japan's Arabian Oil Co. in the Saudi-Kuwaiti Neutral Zone.

TotalFina reportedly is prepared to utilize "sophisticated technology" and improved financing along with its Japanese partner. AOC's efforts with the Saudis to renew a 40-year-old drilling rights contract in the Saudi portion of the zone thus far have failed. As a condition to the contract's restitution, Saudi Arabia has asked Japan to invest $2 billion into a railway project-a request the Japanese say is workable.

Elsewhere in the Middle East, Jordan and Iraq have pledged to reach an accord before yearend over the decision to lay a pipeline to move Iraqi oil to a refinery near Amman. Local reports have pegged the project's financing as a chief hurdle. A previous agreement has been renewed, however, between the two countries that firmed up Iraq's supply to Jordan of 4.8 million tonnes/year of oil-half of which would be priced at $19/bbl and the other half given by Iraq as "a gift." Oil will reportedly continue to be transported to Jordan via tanker trucks for the rest of the year.

Is the day of the "virtual" oil company drawing closer?

Burlington Resources has agreed to outsource operations of its Gulf of Mexico properties to Houston service company Baker Energy. Under the contract, Baker will operate and maintain all of Burlington's OCS gulf properties. Involved are 54 manned and unmanned oil and gas facilities. The contract will run for 3 years at a minimum at more than $20 million/year.

In what would appear to be an noteworthy commodity-management agreement, Atlanta-based Southern Co.'s energy trading and marketing arm is to take over management of Calgary-based natural gas marketer Pan-Alberta Gas, which has sales of about 1.2 bcfd. The deal is to close in the second quarter and would increase Southern sales 17% to 8.2 bcfd. Southern said the deal fits its expansion strategy and gives it access to natural gas production and pipeline capacity in western Canada. Pan-Alberta is a marketing partnership owned by about 400 western Canadian gas producers.

Royal Dutch/Shell wants to establish an LNG terminal at the private port of Kakinada, Andhra Pradesh, on India's eastern coast, to handle gas imported from Bangladesh. Shell and the project's four other partners-GVK, Maytas, Ispat, and the local Nagarjuna group-are looking to supply an initial 1-2 million tonnes/year of LNG. "We would like to utilize the latest technology to develop a floating LNG scheme," Shell Group Managing Director Phil Watts told OGJ. "We firmly believe that the gas delivered at Kakinada can compete with coal and naphtha as fuels for power generation and also open up opportunities for downstream businesses that utilize gas."

The Shell group also is looking at establishing an LNG terminal at Hazira in Gujarat to serve many industries in the area that would use LNG as fuel. State-owned Petronet LNG is already in the process of setting up an LNG terminal at Dahej, not far from Hazira.

The tendency among OPEC members to extend their vowed production cuts beyond March is strong, says Kuwaiti Oil Minister Sheikh Saud Nasser Al-Sabah. Al-Sabah envisions the likelihood of a further extension of 9 months, but a more certain decision will be reached in Vienna on Mar. 27, when the OPEC ministerial conference convenes. That meeting had originally been slated for Caracas-along with an OPEC heads of state meeting-but was switched to Vienna in light of the Venezuelan mudslides disaster.

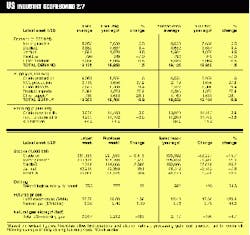

Thanks to the OPEC-spawned doubling of oil prices last year, early reports of US petroleum companies' fourth quarter 1999 results reveal a dramatic recovery vs. a year ago-most companies fully recovering from losses.

Year-on-year results, however, didn't fare as well, due to a dawdling recovery period in the first half.

A comparison of fourth quarter results for 1999 and 1998 for a sample of companies follows, with 1999 results listed first, in millions of dollars. Losses are in parentheses: ARCO 572 vs. (794); Occidental 383 vs. (38); Conoco 324 vs. (263); Enron 259 vs. 176; Phillips 250 vs. (210); USX-Marathon 171 vs. (86); Coastal 169.0 vs. 137.4; Kerr-McGee 110 vs. (325); Vastar 74.7 vs. 18; Anadarko 28 vs. (56.7); Santa Fe Snyder 18.8 vs. (81.0); Helmerich & Payne 14.1 vs. 12.8; Pogo Producing 8.1 vs. (32.3); Triton Energy 5.8 vs. (130.3); Ocean Energy 5.4 vs. (229.9); Equity Oil 0.4 vs. (3); Burlington Resources (84) vs. (411); Ashland (166) vs. (11); and McMoRan (773) vs. (2.1).

A year-on-year comparison for 1999 and 1998 follows: ARCO 1,422 vs. 452; Enron 893 vs. 703; Conoco 744 vs. 450; USX-Marathon 654 vs. 310; Phillips 609 vs. 237; Coastal 498.9 vs. 444.4; Occidental 448 vs. 363; Vastar 213.1 vs. 136.4; Kerr-McGee 142 vs. (68); Anadarko 31.7 vs. (49.3); Pogo Producing 22.1 vs. (43.1); Triton 16.2 vs. (190.6); Burlington Resources 1 vs. (321); McMoRan 0.1 vs. (18.1); Equity Oil 0.4 vs. (5.8); Ocean Energy (47.1) vs. (407.3); and Santa Fe Snyder (124.9) vs. (98.7).