Worldwide refining capacity steady in the past year

After years of steadily increasing, worldwide refining capacity remained essentially flat the past 2 years.

In last year's refining report, OGJ reported a worldwide capacity of 81.5 million b/cd as of Jan. 1, 2000; this year, OGJ's survey reflects a total capacity of 81.3 million b/cd-a difference of about 250,000 b/cd.

Increases and decreases in distillation capacity cancelled out each other.

The Former Soviet Union (FSU) contributed to the largest regional decrease in capacity, 1.3 million b/cd. This was largely a result of elimination of capacities associated with idle units. The sum of the other regions accounted for an increase of about 1.1 million b/cd.

The Asian region experienced the largest increase in crude-distillation capacity, 521,800 b/cd. The South American and Caribbean region followed with an increase of about 228,500 b/cd. The African region was third with an increase of 220,900 b/cd.

The remaining regions, North America, the Middle East, and Western Europe, contributed an insignificant amount of additional capacity to the worldwide total.

There were four new refineries this year: two in Asia, one in Egypt, and one in Russia. With the exception of several decomissioned refineries in Russia and closure of the Shell Sola, Norway, refinery, shut downs this year were minimal.

New refineries

Four new refineries contributed 390,000 b/cd to worldwide capacity.

Formosa Petrochemical Co., Taipei, started up 150,000 b/cd of its 450,000 b/cd refinery in Mailiao, Taiwan, early this year. The remaining planned capacity should come on stream in 2001.

The Middle East Oil Refinery told OGJ that it expects to be up before the end of the year. This is a 100,000-b/cd refinery in Alexandria, Egypt.

A new 100,000-b/cd Punjab, Pakistan, refinery built by Pak-Arab Refinery Co. (PARCO) began processing crude in September. The refinery significantly increases Pakistan's ability to make refined crude, increasing the country's crude capacity by 72%.

Tyumen Oil Co. (TNK), Moscow, started up a new 40,000-b/sd refinery at Nizhnevartovsk, Russia, early this year. The $18 million refinery will refine crude from TNK producers.

TNK owns two other refineries: a 361,500-b/cd plant in Ryazan and a 320,000 b/cd refinery in Lisichansk, Ukraine.

Refinery closures

Refinery closures occurred in Russia, Norway, Argentina, and the US.

The most significant closures happened in Grozny, Russia. The Chechen War damaged all three of the refineries there, a total capacity of 429,700 b/cd: the Grozny-former Lenin refinery, the Grozny-Sheripov refinery, and the Novo-Grozny refinery. Most of the lost capacity came from the closure of the 389,600-b/cd Grozny-former Lenin refinery.

According to Mikhail G. Rudin, senior engineering advisor, Mustang Engineers & Constructors, Houston, it is not clear whether these refineries will be restored; they may or may not return to operation after repairs in 2-3 years. Thus, OGJ has excluded them from the list this year.

The Georgian American Oil refinery in Sartichala, Georgia, in the FSU also shut down this past year. Its capacity was 2,400 b/cd. The Georgian Parliament's ban on imports of pyrolyzed tar, brought its production to a standstill.

The only other significant shut down was Shell's Sola, Norway, refinery.

Shell shut down its 53,000-b/cd Sola refinery at the end of the first quarter this year. It could not justify the investment required to make future stringent-quality products.

Before it closed the refinery, Shell set in place a swap with Statoil AS so that it would have some output from a Norwegian refinery. It exchanged 10% of its Shell Nederland Raffinaderij BV's Pernis refinery for 22% of Statoil's Mongstad, Norway, refinery.

The Sola plant closure follows the company's rationalization of excess refining capacity. Last year, Shell closed its 39,000-b/cd Niigata, Japan, refinery and its 92,000-b/cd Shell Haven, UK, plant. It also reduced capacity in its Berre l'Etang refinery from 127,000 b/cd to 82,000 b/cd last year.

Esso SA Petrolera Argentina closed the smaller of its two refineries in Argentina, the 19,000 b/cd Galvan refinery, in the past year.

In April, Pennzoil-Quaker State Co. (PQS), in a move to exit the refining business and concentrate on its core automotive products business, sold its 15,700-b/cd Rouseville, Pa., refinery to Calumet Lubricants Co. LP, Indianapolis, which is using the refinery to process wax instead of crude. Although PQS's 46,200-b/d refinery in Shreveport, La., is still operational, it is up for sale and almost closed.

Closures OGJ missed in previous years but are reflected in this year's survey include Pride Refining Inc.'s 44,800-b/cd refinery and Lakeside Refining Co.'s 5,600-b/cd Kalamazoo, Mich., refinery.

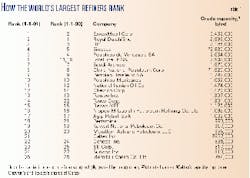

Largest refining companies

Table 1 lists the top 25 refining companies which own the most capacities in the world. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Europe. Capacities from these two tables include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve ExxonMobil Corp., Royal Dutch/Shell, TotalFinaElf, and Tosco Corp.

ExxonMobil and Royal Dutch/Shell switched places as world's top refiners as a result of the ExxonMobil merger, which was finalized at the end of 1999. Shell, which owns 4.0 million b/cd of crude distillation could not compete with ExxonMobil's 5.4 million b/cd.

Like the ExxonMobil combination, TotalFinaElf moved from 11th place on the list to 6th because of its merger with Elf Aquitaine earlier this year.

Again, Tosco made the biggest dent in refinery ownerships by continuing its swallowing of refining assets.

In June, the company announced its acquisition of the 286,000-b/d Wood River, Ill., refinery from Equilon Enterprises LLC.

A week after selling its 168,000-b/cd Avon refinery in Martinez, Calif., to Ultramar Diamond Shamrock Corp., San Antonio, in September for $800 million, it put on its purchasing hat again and acquired the 250,000-b/cd Alliance refinery in Belle Chasse, La., from BP Amoco for $660 million. The Louisiana refinery is Tosco's first step in the competitive Gulf Coast market.

In Tosco's first venture outside US refining, it intends to purchase Irish National Petroleum Corp. Ltd.'s 71,250-b/cd Cork refinery before the end of the year. Since this could not be confirmed by Tosco, however, OGJ left the change of ownership off the survey.

The Cork refinery produces about 30,000 b/cd of low-sulfur, straight-run fuel oil, which can feed the firm's surplus upgrading capacity at the Bayway, NJ, and Trainer, Pa., refineries.

These transactions make Tosco the third largest refining company in the US, behind ExxonMobil and BP. Worldwide, its rank is not so shabby either. Last year, it was the 22nd largest refiner and today it is 14th in worldwide standings with a crude distillation capacity of 1.3 million b/d.

Big mergers this year include BP's purchase of ARCO and Chevron and Texaco's pending new company.

BP's purchase of ARCO is reflected in the figures this year. The difference is the transfer of four US refineries, or 500,000 b/cd of capacity, to BP.

Although details of the refining assets for Chevron and Texaco have not been announced, this merger will affect the future disposition of the Equilon Enterprises LLC and Motiva Enterprises LLC US refineries, owned by Texaco Inc., Shell Oil Co., and Saudi Refining Inc.

Largest refinery

The world's largest refineries are listed in Table 3.

This year, as a result of combining the former Amuay and Cardón refineries, both located in the Paraguaná peninsula in Falcón State, PDVSA's Paraguana Refining Center, is the world's largest refinery.

Sibneft, formerly fourth on the list, disappeared this year because OGJ adjusted its capacity to reflect the closure of its idle crude distillation unit-from 566,000 b/cd to 378,000 b/cd.

ExxonMobil's Singapore refinery is new to the list because it is a combination of the former Esso's Pulau Ayer Chawan and Mobil's Jurong refineries. Although by themselves, they each did not have the 400,000 b/cd needed to make the list, their combined capacity is 580,000 b/cd.

Reliance 's Petroleum Ltd.'s Jamnagar, India, refinery, which came on stream last year, made the list this year because OGJ corrected its capacity from 360,000 b/cd to 540,000 b/cd.

The Russian Investment Co. (RINCO) is new to the list this year because of its newly acquired refining assets in the past year. The 440,700-b/cd Angarsk and 94,000-b/cd Kharbarovsk refineries, formerly part of the Sidanco Co., now belong to RINCO. Sidanco now owns only one refinery, the 137,300-b/cd Cracking-Saratov refinery.

Kuwait National Petroleum Co.'s Mina Al-Ahmadi refinery fell off the list because of an adjustment in its capacity-from 427,500 b/cd to 326,800 b/cd. This is the result of an explosion in the refinery in June, which seriously damaged one of its two crude distillation units.

FSU updates

The survey reflects units that were formally shut down in the FSU in the past year. Shut downs of idle units in Russian refineries include:

- Crude and vacuum units at the state's Salavatnefteorgsintes; Bashneftekhimzavody's Nova-Ufa and Ufaneftekhim; Norsi's Kstovo and Nizhny Novgorod; Sibneft's Omsk; Sidanco's Cracking-Saratov; Surgutneftegaz's Kirishi; and Yukos' Novo-Kuibishev, Samara-Kuibishev, and Syzran refineries.

- Chamber coking in Lukoil's Volgograd refinery.

- Thermal cracking at Lukoil's Volgograd and Yukos' Novo-Kuibishev refineries.

- One of the Thermofor catalytic cracking units at Russia's Salavatnefteorgsintes refinery.

- Catalytic reformers and naphtha hydrotreaters at Russia's Salavatnefteorgsintes, Bashneftekhimzavody's Ufaneftekhim, Sibneft's Omsk, Surgutneftegaz's Kirishi, and Yukos' Syzran refineries.

- Lube oil units at Lukoil's Volgograd, Sibneft's Omsk, Slavneft's Yaroslavl, TNK's Ryazan, and Yukos' Novo-Kuibishev refineries.

- Aromatics units at Bashneftekhimzavody's Ufaneftekhim and Lukoil's Perm refineries.

- Alkylation and polymerization units at Yukos' Novo-Kuibishev refinery.

Idle units formally shut down at Ukrainian refineries include

- Crude units at Ukraine's Kherson and Ukrtatnafta's Nadvornaya refineries.

- The vacuum unit at the TNK's Lisichansk refinery.

In Azerbajan, the Azerneftyag refinery shut down some lube oil units and two idle fluid catalytic cracking units.

Regional crude capacities

As a result of the closure of FSU units described previously, Eastern Europe experienced a large decline in operating capacity, a loss of 1.3 million b/cd.

The largest increase in crude capacity, on the other hand, occurred in Asia. There will be 521,800 b/cd more capacity in Asia on Jan. 1, 2001, than the year before. India and Taiwan contributed to most of this increase.

India contributed 255,500 b/cd to the worldwide crude distillation capacity. A 180,000-b/cd capacity change in the Reliance refinery and a 74,000-b/cd upgrade in Hindustan Petroleum Corp.'s Visakhapatnam refinery accounted for most of this change.

In Taiwan, Formosa's new refinery in Mailiao accounted for the 150,000-b/cd difference from last year's survey. The Asian contribution will become even larger as Phases 2 and 3 of the Formosa Mailao refinery bring the refinery's capacity to 450,000 b/cd next year and planned refineries start up in India.

The new refinery in Pakistan increased Asian crude distillation capacity by 100,000 b/cd.

Table 4 lists new regional processing capacities, as of Jan. 1, 2001. Except for in crude distillation, no significant increases occurred in any one category in the past year.

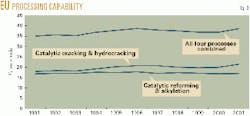

Processing capabilities

Figs. 1-3 show the processing capabilities of Asia, the European Union (EU), and the US. Processing capabilities are defined as conversion capacities (catalytic cracking and hydrocracking) and fuels producing processes (catalytic reforming and alkylation) divided by crude-distillation capacity ("% on crude").

For consistent comparison with previous years, countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.

The processing capabilities for all three areas, Asia, the EU, and the US, increased slightly. This is a reflection of increased conversion capacities and transportation fuel capacities that meet tighter sulfur and aromatics guidelines.

The sudden increase in Asian processing capability in 1994 should be ignored because this was a result of a correction for previously unknown China refining capacity.

Hydrotreating capacities

One big change on the survey this year is the combination of hydrotreating and hydrorefining capacities into one category: hydrotreating. Hydrotreating was historically defined as hydroprocessing in which little or no change in the molecular weight of the feedstock after processing occurred. Hydrorefining was hydroprocessing with a mild or moderate change in the weight of the feedstock.

The distinction between the two categories is rarely made anymore. Thus, OGJ has combined the categories under hydrotreating into 13 cases, as noted in the survey.