US heating fuel price differential nears trigger level

The US Northeast Heating Oil Reserve is in place, and conditions for oil release from the reserve have been defined in the Energy Policy and Conservation Act of 2000 (EPCA).

Among the conditions triggering release is a "dislocation in the heating oil market." Such a dislocation is deemed to occur only when:

- The price differential between crude oil and the residential price of heating oil in the Northeast exceeds 60% of its 5-year monthly moving average.

- The condition continues for 7 consecutive days.

- The differential continues to increase for the most recent week for which price information is available.

In practice, the Department of Energy is calculating differentials as the difference between the average of New England and Mid-Atlantic states' residential prices observed weekly (Mondays) and the average of West Texas Intermediate spot prices for the prior week.

This article considers trends so far this season in differentials vs. the price "trigger."

So far, current differentials are well above the 5-year monthly averages and not far from trigger levels. In part, this is because the trigger levels are relatively low early in the heating season. Unlike the situation of late January through early February of this year, the high differentials reflect primarily national conditions rather than special problems in the Northeast.

Differentials to date

The blue bars in the top chart of Fig. 1 show the current season differentials to date between retail heating oil prices and WTI, while the brown and purple lines show the monthly 5-year moving average differentials and the monthly price triggers (60% above the 5-year averages) for this season.

The green line shows the differentials for the 1999-2000 season. In November last year, the price trigger was 83.5¢/gal. In December, the trigger rose to 87.9¢, and in January, to 100.9¢. The trigger value peaked in February at 107¢/gal and fell back to 95.8¢ in March.

While for all months the trigger was 60% above the 5-year monthly average differential, the absolute difference varied significantly-from a low of 30.2¢ in October to 40¢ in February.

This year, in late November, the season's differentials were averaging about 74¢/gal, less than 10¢ below the trigger and about 22¢/gal above the 5-year average. In effect, the relatively low seasonal starting levels for the trigger raise risks of meeting conditions for a release of the reserve well before the coldest part of the heating season, although the president would not be required to release it.

The price trigger provision of EPCA was designed to limit the conditions under which a "dislocation in the heating oil market" is deemed to have occurred for purposes of a presidential finding of a "severe energy supply interruption." Again, the president is not obligated to make such a finding.

The chart at the bottom of Fig. 1 shows the current and previous heating season differentials in terms of percentage of their relevant 5-year monthly average differentials. For this heating season, the 5-year average is based on monthly differentials prevailing in the 1995-96 through 1999-2000 seasons, while, for last year, the average would be based on the 1994-95 through 1998-99 seasons.

The 5-year monthly averages for this season are roughly in line with those for the 1999-2000 season, with the prominent exceptions of January and February, where the 5-year moving averages for this season's calculations are 6¢ and 9¢/gal, respectively, above the moving averages for the 1999-2000 season. So far this season, price differentials are running about 40% above their 5-year average, not so far below the 60% trigger.

Last year at this time, the differentials were running 10-15% below their 5-year averages, reflecting what, at that time, appeared to be a comfortable inventory situation and forecasts for a warm winter. Of course, conditions later changed dramatically as the differential moved from 10% below the 5-year average in mid-January to 125% above it over the course of 3 weeks.

NY vs. Gulf Coast prices

Last year's price spikes were confined to the Northeast, as local demands surged beyond local ability to bring in immediate new supplies. The temporary imbalances reflected the time required for transporting new supplies from the Gulf Coast and from foreign sources.

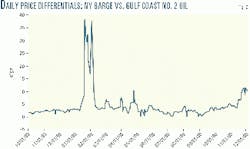

The local, temporary nature of the problem is illustrated by the trend in differentials between spot prices for distillate (No. 2 oil) in New York Harbor and the Gulf Coast.

The trend in daily differentials since the beginning of October 1999 is shown in Fig. 2. From the beginning of October 1999 through early January 2000, the differential was less than 3¢/gal. Within less than 10 days, the differential surged to 38¢/gal, a level reached again in early February. Thereafter, the differential declined sharply with the arrival of substantial new supplies, falling below 4¢/gal by mid-February.

Differentials were low at the beginning of this heating season-averaging 2-3¢/gal in early October-but they have since moved up noticeably, especially since mid-November. As of early December, the differential is averaging about 10¢/gal, an indicator of limits on ability to supply the region.

Currently, pipelines are full, and shipping is tight, both at a time when concerns about exceptionally low inventories in the Northeast are encouraging higher, precautionary demands.

The authors

Larry Goldstein is president of PIRA Energy Group and president and a member of the board of PIRINC. He has been a member of the Petroleum Advisory Committee of the New York Mercantile Exchange and a contributor to studies by the National Petroleum Council. He served as a board member and treasurer of the Scientists Institute for Public Information.

Ronald B. Gold is a consulting senior adviser to PIRA Energy Group-a private consulting firm-and a consulting vice-president of Petroleum Industry Research Foundation Inc. (PIRINC), New York. He retired from Exxon Corp. at yearend 1997, where he was company economist and manager of the Energy Outlook division for Exxon Co. International. Gold also has worked for the US Treasury Department, Office of Tax Analysis, and was an assistant professor of economics at Ohio State University. Gold has an undergraduate degree from Brooklyn College, City University of New York, and an MA and PhD in economics from Princeton University.

John H. Lichtblau is chairman and CEO of PIRINC. He headed PIRINC as executive director during 1961-90. He has served since 1968 on the National Petroleum Council, an industry advisory group appointed by the Secretary of Energy, and is a member of the Council on Foreign Relations. Lichtblau also is chairman of PIRA Energy Group. A leading international expert on the petroleum industry and petroleum economics, he has authored a number of publications, has been a frequent witness at congressional hearings on energy policy, and a keynote speaker and lecturer at conferences and seminars. Lichtblau performed his undergraduate work at the City College of New York and graduate study at New York University.