OGJ Newsletter

Market Movement

Market shrugs off Iraqi oil stoppage, watches weather

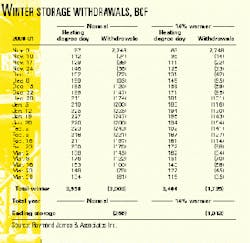

Oil prices fell last week as markets refused to be rattled by another stoppage of Iraqi crude exports.

NYMEX crude fell through the $30/bbl watershed last week for the first time in 4 months, closing at $29.53/bbl Dec. 5 vs. topping $35/bbl for most of the preceding 2 weeks. Almost all of that slide occurred since Baghdad halted exports (see related story, p. 40).

Other prices were mostly down due to several factors. WEFA Energy Services noted a slight easing of tight middle distillate supplies amid predictions of continuing cold weather in the US.

WEFA said, "The market has been responding to every shift in expectations for US weatherellipse.Recent counterseasonal increases in heating oil stocks, despite cold weather, have begun to bring inventories closer to normal levels and are changing the market psychology."

The analyst noted that the primary key to the oil market in the weeks to come, particularly in the Northeast US market, is a resurgence of cold weather, which could cause heating oil demand to spike sharply-beyond the ability of regional supplies to cope.

WEFA also noted that the shortage of Jones Act tankers was affecting Gulf Coast refiners' ability to bring fuel to the Northeast, but that the Colonial product pipeline expansion to North Carolina would help alleviate the problem.

Natural gas withdrawal rates rising

The return to normal winter weather suggests a hefty withdrawal rate throughout the next 4 months that will keep markets exceptionally tight and gas prices extremely volatile (but volatile at the high end of the range). Yet another price barrier fell last week, as NYMEX gas futures handily pierced the $7/Mcf mark.

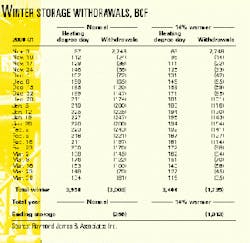

As analyst Raymond James & Associates notes, a pattern of normal winter weather-with total winter heating degree days of 3,958-will boost consumption to more than 3 tcf (see table).

"Since we are beginning the winter with only 2.75 tcf in storage, this normal winter scenario would leave us with an impossible negative balance of 255 bcf in storage," the analyst said.

In the event of another warm winter resembling the last one (with 14% fewer heating degree days vs. the historic average, or 3,404 heating degree days), the market ends the season with an acceptable (if not ample) cushion of a little over 1 tcf, if everything else stays the same. But it won't. The National Weather Service had forecast even colder temperatures for last week, so that meant another big withdrawal from inventory, perhaps 100 bcf. That then leaves the end-season storage level at less than 900 bcf with another winter like last year's, or an inconceivable minus 293 bcf in storage if the current weather pattern persists.

"The key driver here," the analyst noted, "is that exceptionally warm winters for the past four winters have masked the strong economic growth that has occurred in the US over the past 5 years."

Obviously, it is impossible to have negative storage numbers. Not only can the industry not draw upon the base gas that is injected into storage sites as a physical cushion, experience shows that when storage falls below 600 bcf, deliverability problems often ensue. So to balance the market, gas prices must rise to the point where they remove price-sensitive consumption out of the market.

"In other words," Raymond James said, "gas prices must continue to rise sufficiently to drive as much as 5 bcfd of demand out of US gas markets.

"What is that price? We have no idea, but it is safe to assume that price will be somewhere higher than $5 and likely somewhere less than $50/Mcf."

null

null

null

Industry Trends

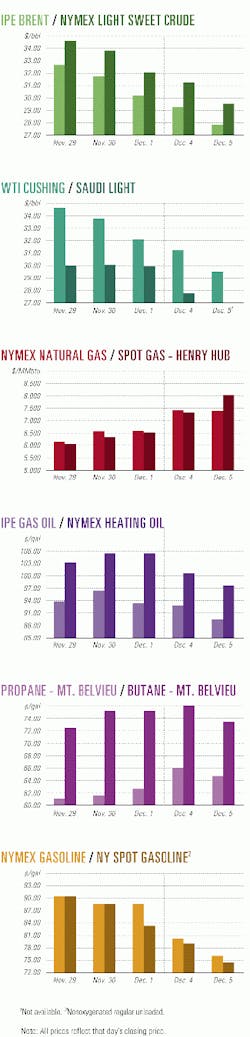

US ELECTRIC POWER PRODUCERS CONTINUE TO DRAW HEAVILY ON NATURAL GAS SUPPLIES THIS WINTER.

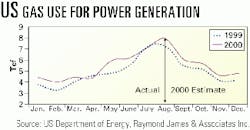

Increased consumption of natural gas by electric power producers coupled with low natural gas storage levels heading into the winter season could spell disaster, according to Raymond James & Associates Inc.

The analyst noted that consumption by these electric power producers rose 12% during the first 7 months of this year (see chart).

"This very bullish gas demand indication is being driven by the roughly 20,000 new gas-fired Mw that have been added to the grid this year (mostly after June 1st)," said Raymond James. Over the next 30 months, an additional 70,000 Mw is expected to come online, in turn, reducing natural gas storage levels even more this year.

"The bottom line is that exceptionally strong electric power output could have the potential of heightening the natural gas storage crisis heading into this winter," the analyst stated.

EPA is expanding its STAR program to promote cost-effective management practices that could save up to 25 bcf, or more than 70%, of the natural gas lost annually by the gathering and processing segment of the industry.

The new program proposes to reduce gas losses through market-based activities that are profitable for industry partners and beneficial to the environment. Industry partners would choose among a number of best management practices recommended by EPA to minimize equipment leaks, reduce gas releases from unit operations, and improve equipment efficiency. The nine partners in this latest program are BP; Conoco, Dynegy Midstream Services, El Paso Field Services, ExxonMobil Produc- tion, ONEOK Field Services, Pioneer Natural Resources, Texaco E&P, and Utili- Corp United.

EPA launched the STAR Program in 1993 as part of the US Climate Change Action Plan, the federal government's strategy for fulfilling voluntary greenhouse gas reduction commitments under the 1992 United Nations's Framework Convention on Climate Change.

Conventional oil reserves in Western Canada continued to decline in 1999, but remaining reserves of crude oil and oil equivalent increased by 2.1 billion bbl, says the Canadian Association of Petroleum Producers (CAPP).

The CAPP reserves report to yearend 1999 said reserves additions came primarily from oil sands areas; the industry also added an estimated 5 tcf of gas.

The report said conventional oil reserves in western Canada declined by 3.7% in 1999 to 3.5 billion bbl. The industry replaced 70% of 1999 production of 441 million bbl.

The report noted the reserve replacement occurred despite soft oil prices and low activity levels in the first half of 1999, when the price for benchmark light, sweet crude averaged $15.36 (US)/bbl.

Government Developments

MMS is proposing natural gas drilling incentives for the federal lease sale in the Gulf of Mexico next March that officials say could increase US gas production by 1 tcf within 6 years.

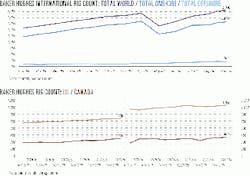

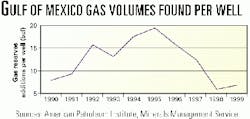

During first quarter 2000, gulf gas production fell 8.6% vs. first quarter 1999. The federal outer continental shelf-primarily the relatively shallow waters of the Gulf of Mexico-has long been the largest one source for US gas, supplying 27% of current domestic gas production.

In recent years, the amount of gas volumes found per well drilled in the gulf has dropped and thus higher sustainable drilling activity is needed to replace existing reserves, said MMS (see chart).

"We believe that this concern about the region's ability to meet projected growth in gas demand is the driving factor behind a potential royalty relief initiative," MMS noted. MMS proposes to suspend royalty payments on the first 20 bcf of gas produced from deep wells drilled 15,000 ft below sea level in the gas-prone shallow-water shelf area of the gulf.

It also proposes a 2-year extension of the 5-year primary lease if an operator needs more time to process and interpret 3D seismic data after drilling a first subsalt well. Giving operators more time to pick their next drilling targets in such complicated geology would prevent premature lease expirations and the consequent delay in exploration.

Director Walt Rosenbusch said, "These incentives may contribute additional gas production in the range of 500 bcf to 1 tcf/year in 2004-06."

The US Department OF Justice filed suit Nov. 28 against Colonial Pipeline, alleging the company violated the Clean Water Act (CWA) by spilling about 3 million gal of oil and petroleum products from its 5,349-mile pipeline over 20 years.

The lawsuit charges that pipeline corrosion, mechanical damage, and operator error resulted in numerous spills by the pipeline in Louisiana, Alabama, Georgia, Tennessee, South Carolina, North Carolina, Maryland, Virginia, and New Jersey. The suit was filed in a district court in Atlanta last month on behalf of EPA.

The new lawsuit asks the court to order Colonial Pipeline to cover exposed and shallow pipe, inspect for and repair corrosion and cracks promptly, and to upgrade and maintain its cathodic protection system and leak detection strategy and system. Justice also is seeking significant civil penalties from Colonial Pipeline under the CWA. Colonial Pipeline spokesman Steve Baker said the company was "disappointed" with the lawsuit, adding that Colonial has been working "very hard" with Justice to reach a settlement.

Since the Reedy River spill (OGJ, July 8, 1996, p. 31), Baker said, Colonial has changed its top management and made safety and maintenance the "absolute number one priority," cutting its operator error incidents 80% over the past 2 years.

Quick Takes

Woodside energy and Phillips have joined forces on the Timor Sea gas project.

Woodside Energy and Phillips Petroleum have put their names to an "in-principle" deal that will see the two firms cooperate in moving ahead on development of their respective Timor Sea gas resources, the Greater Sunrise and Bayu-Undan developments.

For Woodside and Phillips, the agreement also clears the way for plans for a major new domestic LNG export project based in Darwin, among other gas-based projects (see map).

Under the deal, the two companies said that they would share offshore and onshore facilities to cut the development costs at both Bayu-Undan, where first liquids production is expected in late 2003, and Sunrise, where gas production should start in 2005.

Woodside Managing Director John Akehurst and Phillips CEO Jim Mulva said the cooperative concept is designed to combine the "early gas delivery potential of Bayu-Undan with the large reserve base of the Greater Sunrise fields."

The Bayu-Undan development, located in 80 m of water in the so-called Zone of Cooperation between East Timor and Australia, is thought to contain some 400 million bbl of condensate and gas liquids and 3 tcf of natural gas.

Greater Sunrise, located in Australia's Bonaparte basin, is made up of the Sunrise, Sunset, and Troubadour fields. Woodside postulates that the fields hold 9.2 tcf of gas. Bringing this development to first gas is projected to call for $2.5 billion (Aus.) in offshore facilities and pipelines.

In other development news, Lasmo signed a revised agreement with Pakistan's Petroleum Ministry for the development of Bhit gas field in Sindh Province. Lasmo and partners Kirthar Pakistan and Oil & Gas Development Co. will invest $260 million to develop the field, which will produce at a plateau of 235 MMcfd. Previous announcements indicated the Bhit partners would invest $268 million to produce 270 MMcfd of gas. The gas will be sold to state company Sui Southern Gas (OGJ Online, Oct. 11, 2000). Production from Bhit will begin in December 2002, and the field should reach its production plateau in 2003. Originally discovered in 1997, Bhit field is estimated to contain more than 1 tcf of gas. Lasmo holds 20% of the field, Kirthar Pakistan holds 40%, and OGDC holds 20%.

TOPPING PRODUCTION NEWS THIS WEEK, India's Oil & Natural Gas Corp. awarded a $27 million contract to National Petroleum Construction Co., a unit of Abu Dhabi National Oil Co., for a platform and the laying of subsea pipelines in the Bombay High producing complex off India.

The platform, to be dubbed ZA, is a pilot project for a larger scheme to increase production from the field. ONGC plans to spend $1.5 billion over 3 years on Bombay High (OGJ, June 19, 2000, p. 62). NPCC will perform the design and engineering, procurement, fabrication, and installation of the platform. It will fabricate the ZA oil platform jacket and topsides at its Mussafah yard and transport them to the site by barge. The contract includes associated modifications to the existing platform.

The work is scheduled for completion by yearend 2001.

Elsewhere on the production front, Petrobras awarded Coflexip Stena Offshore (CSO) and Premier March

Samedan Oil, a subsidiary of Noble Affiliates, said last week that production has begun from its 12-block Viosca Knoll 252 Unit. The project consists of four wells, producing 106 MMcfd of gas, 42 MMcfd of which is net to Noble's interest. The wells are in 100 ft of water. Noble owns a 40% working interest in the unit production. The operator is Chevron with 60%.

The Fort Hills JV signed a licensing agreement with Syncrude Canada to use technologies employed by Syncrude at its North Aurora oil sands mine. Fort Hills is in Alberta's Athabasca oil sands region 90 km north of Fort McMurray. Syncrude will also provide technical assistance to the venture, which is operated by 78% interest holder TrueNorth Energy, an affiliate of Koch Petroleum Canada. UTS Energy holds 22%. The first phase of the $1.1 billion (Can.) Fort Hills project is expected to produce 95,000 b/d of bitumen.

Offshore exploration in Africa tops this week's exploration news.

Esso Exploration Angola had another discovery on prolific deepwater Block 15 off Angola, parent company ExxonMobil announced.

The discovery, Batuque, drilled in 2,400 ft of water to a TD of 12,400 ft, flowed at a test rate of 5,200 b/d. The find was the ninth on the block for ExxonMobil's Angolan division. Block 15 is thought to contain reserves in excess of 3 billion boe.

Esso Exploration Angola has made eight previous finds on the block with the Saxi and Mondo discoveries in 2000, the Chocalho and Xikomba discoveries in 1999, and the Hungo, Kissanje, Marimba, and Dikanza discoveries during 1998. First oil from the Kizoma complex, estimated to hold 2 billion boe, had been set for 2003. Esso Exploration Angola operates Block 15 with a 40% working interest. Partners are BP Exploration Angola, with 26.67%; Agip Exploration, with 20%; and Statoil, with 13.33%. x

Meanwhile, Enterprise Oil finalized a petroleum agreement for six exploration permits off Morocco collectively known as the Cap Draa Haute Mer area. Cap Draa, covering about 12,000 sq km, lies off the Atlantic coast of Morocco in water depths of up to 2,000 m.

Enterprise said the initial period of the 8-year exploration term will be kicked off with a 3D seismic acquisition program, followed by the spudding of an exploration well. The block partners will acquire 3D seismic data over the area in 2001 and expect to begin drilling within 3 years.

Enterprise operates the block with 40%, and Energy Africa owns 26.67%. Kerr-McGee du Maroc recently acquired 33.33% of the concession. The Moroccan state oil company Onarep has the right to acquire 25% of the license upon declaration of commerciality.

Elsewhere in Africa, Repsol Exploracion Egipto said its Neith South-3X appraisal well in the Khalda Offset concession in Egypt's western desert tested 1,100 b/d of 45° oil from one zone in the Jurassic Khatatba. The 3X well is 1.5 km east of the Neith South-1X discovery well, which tested at 2,778 b/d of oil and 4.5 MMcfd from two zones in the Khatatba formation.

Union Fenosa has awarded AN engineering design services contract to M.W. Kellogg for its proposed EGYPTIAN LNG plant.

Spanish utility Union Fenosa awarded a front-end engineering design services contract to M.W. Kellogg Ltd., the London affiliate of Halliburton Co.'s Kellogg Brown & Root, for Union Fenosa's proposed LNG project in the northern Egyptian port of Damietta.

The $1 billion project calls for the development of a single-train LNG complex with an estimated capacity of 3.5-4 million tonnes/year.

The contract calls for Kellogg to develop a project specification for the proposed facility and prepare an engineering, procurement, and construction proposal for the execution phase of the project. Award of the EPC contract is scheduled for summer 2001. The plant is expected to be operational by mid to yearend 2004.

In other LNG news, Royal Dutch/Shell decided to double capacity of the proposed LNG terminal at Hazira in south Gujarat, India, to 5 million tonnes/year from 2.5 million tonnes/year. On a 2-day visit to Gandhinagar, capital of Gujarat, Shell Gas & Power CEO Linda Cook said Shell expects to tie up with Gujarat Narmada Fertilizer Corp., Indian Petrochemicals, the Gujarat Electricity Board, and Essar to supply LNG as a source of fuel. Cook added that the "good response" from the proposed customers had prompted Shell to increase the terminal's capacity.F

Nova Chemicals plans to close its joliet polystyrene plant in 2001.

Nova Chemicals says it will close a polystyrene plant at Joliet, Ill., early in 2001 because of high costs and low profits there. The company said it plans to write off nonproductive assets at several locations and will take an after-tax charge of about $68 million in the fourth quarter of fiscal 2000.

The Joliet plant, acquired 2 years ago from Huntsman Chemical, can produce 105,000 tonnes/year of polystyrene. Nova said industry margins remain weak and the Joliet plant costs are the highest in its polystyrene manufacturing network. It said the level of investment needed to reduce costs at Joliet couldn't be economically justified.

The Alliance Pipeline has finally reached start-up.

The 2,300-mile Alliance natural gas and liquids pipeline system from Western Canada to the Chicago market celebrated its commercial start-up after three earlier start-up delays caused by weather and commissioning problems.

Originally scheduled to begin operation Oct. 1, the line began operation Dec. 1. The $4.5 billion (Can.) line has an initial capacity of 1.325 bcfd, and volumes can be increased to 2.1 bcfd. Liquids will be extracted and processed at the Aux Sables plant near Chicago.

The line, initially backed by a group of 24 Alberta producers, provides an alternative delivery system to the TransCanada PipeLines system for export gas and eliminates a long-standing capacity bottleneck. The system includes 14 mainline compressor stations, 37 receipt points in British Columbia and Alberta, and 7 delivery points in Illinois.

In other pipeline action, Daugherty Resources completed a 13-mile, 4-in. pipeline as part of the gathering system serving its Kay Jay gas field in Knox County, Ky. Three shut-in natural gas wells have been connected to the system, with six shut-in wells remaining to be connected. The new gathering line will permit Daugherty to move additional gas from the shut-in wells and from future wells it expects to drill in Kay Jay field.

Bay Gas Storage, a subsidiary of EnergySouth, will construct a 24-in., 18-mile pipeline in Mobile County, Ala. The line will stretch from an interconnect at Koch Gateway Pipeline's 30-in. interstate pipeline in Whistler, Ala., to Bay Gas's existing pipeline system in Axis, Ala. Work on the line will begin this month and end in June 2001.

Kinder Morgan subsidiary Natural Gas Pipeline Co. of America (NGPL) will extend its system into east St. Louis, Mo., by constructing a 47-mile, 294 MMcfd pipeline from Centralia, Ill., to Illinois Power Co.'s natural gas distribution system in St. Louis. The $35 million, 24-in. project will be completed in June 2002. Dynegy Marketing and Trade will serve as the pipeline's anchor customer through long-term, natural gas transportation and storage contracts it has signed with NGPL, including a 10-year agreement effective June 1, 2002. That contract will provide Dynegy with 88 MMcfd of natural gas through the new pipeline.

Petrobras is eyeing a new satellite technology to detect oil spills.

Petrobras is considering a new oil spill monitoring system for Guanabara Bay off Rio de Janeiro, which suffered two major oil spills this year.

The system may employ buoys with infrared devices to transmit signals to low-orbit satellites when the devices detect the presence of hydrocarbons in the sea. The satellite would then transmit the signal to Petrobras's control center, enabling technicians to act quickly in case of an oil spill, said Rui Fonseca, the company's environmental protection manager.