US, Canada Should See Robust Drilling This Year

Healthy increases in oil and gas well drilling can be expected in the US and Canada in 2000.

Wellhead revenues to US producers climbed sharply between 1998 and 1999 and are forecast for another large jump in 2000. But even the $84 billion in oil and gas revenues anticipated for this year would fall short of the $86 billion realized in 1996 and 1997.

The revenue figures are based on OGJ's forecast that prices in the US will average $18.10/bbl for crude oil and $2.30/Mcf for natural gas during 2000.

OGJ at midyear 1999 predicted that operators would drill 18,600 wells in the US during 1999. It now appears that with the drilling surge in the latter months that the year's total was 11% higher than that estimate. The totals are only estimates because operators will still be reporting completions months from now.

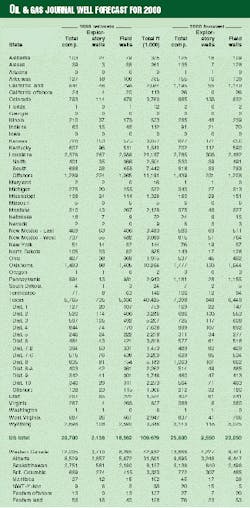

Here are highlights of OGJ's early-year drilling forecast for 2000:

- Operators will drill 25,600 wells in the US, up from an estimated 20,770 wells drilled in 1999.

- All operators will drill 2,550 exploratory wells of all types, up from an estimated 2,138 last year.

- The Baker Hughes count of active rotary rigs will average 800/week this year in the US, up from 623/week in 1999.

- Operators will drill 13,660 wells in western Canada this year, up from an estimated 12,005 in 1999.

US statistics

The estimated $84 billion that US producers can expect at the wellhead this year would be a nearly 10% increase that would follow a nearly 20% climb in 1999 versus 1998 revenues.

Even at 20,770 wells, 1999 was the slowest drilling year in the 1990s. The decade's high was 31,865 wells in 1990.

OGJ projects an even $16 billion in drilling and completion spending this year, up 25% from 1999 outlays. A number of public companies have announced 15-25% increases in their capital and exploration budgets for the new year.

Footage drilled is estimated to have been 109 million ft in 1999. During that year, prices averaged an estimated $15.65/bbl for crude oil and $2.15/Mcf for gas.

Those prices and production of 5,975,000 b/d of oil and 19.58 tcf of gas provided producers with $76 billion in overall revenues, of which OGJ estimates they reinvested $12.7 billion during the year.

Drilling in the US

The year 1999 ended with roughly 800 rigs at work in the US and 400 in Canada, Baker Hughes figures show.

OGJ expects operators to maintain this level of rig activity in both countries during 2000.

Texas drilling this year is pegged at 7,186 land wells and 212 offshore wells, with sharp improvements over 1999 occurring in all Texas Railroad Commission districts.

An expansive coalbed methane development play in the Powder River basin is expected to contribute a majority of the state's 3,143 wells this year, up from 2,698 wells in 1999. Seismic shot-hole and water-well rigs, numbering 44 in mid-1999 and not counted by Baker Hughes, are poking the shallow holes in this play.

Louisiana is to see 2,785 wells drilled this year, including 1,439 offshore.

California land drilling, dominated by shallow wells in the heavy oil fields, should struggle back to 1,195 wells this year from a low 844 in 1999.

Canadian drilling

Numbers of wells drilled in western Canada in 1999 and 2000 are estimated to have well exceeded 50% of US drilling in the same years.

Of the 13,668 wells projected for this year, more than 12,800 will be sunk in Alberta and Saskatchewan.

Marginal increases in drilling are likely this year in nontraditional portions of Canada. These increases will take place in Ontario and the Maritime Provinces, the Atlantic off Nova Scotia and Newfoundland, and the Yukon and Northwest Territories.

Ontario operators have reported steady drilling on land and in Lake Erie. Exploration continues for targets in the Maritimes, with no significant successes reported from the most recent drilling.

OGJ's estimate of Canadian drilling is lower than most others: Canadian Association of Oilwell Drilling Contractors 14,331 wells, and Petroleum Services Association of Canada 13,550 wells.