OGJ Newsletter

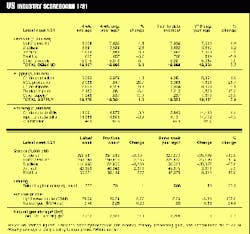

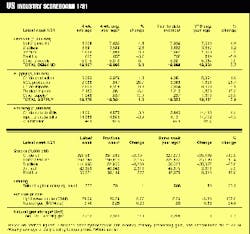

All the supply-demand indicators are confirming what oil prices have been signaling of late: oil markets are getting tighter.

Demand for crude oil sustained steady growth during the fourth quarter of 1999, while supplies declined significantly, says IEA.

Worldwide demand in 1999 averaged 75.5 million b/d, an increase of 1.3 million b/d from a year prior and about 0.2 million b/d higher than was expected. "There has been a disconnect in the oil markets between the amount of supply needed and the perceptions of key participants," IEA said.

During the last quarter of 1999, demand rose to 77.2 million b/d from 74.8 million b/d in the third quarter, which resulted in a sharp draw on oil stocks, IEA notes. These higher-than-average figures IEA attributes, at least in part, to the trepidation felt by some market players hoarding ahead of zero hour for the Y2K computer glitch in fear of a supply disruption. IEA also credits high demand in Asia and the US, as they both demonstrated robust economic growth.

Supply in December, meanwhile, fell 0.5 million b/d to 74 million b/d. OPEC output fell by 0.6 million b/d, says IEA, and non-OPEC supply growth failed to take up the slack. OPEC's December production compliance was 78%, down from a revised 81% a month before, the agency says.

IEA expects oil deliveries to fall this month by 2.5-3.0 million b/d. Meanwhile, February deliveries are expected to rise again by 2-3 million b/d, which modifies the seasonal pattern of anticipated oil demand, it says. For 2000, IEA expects demand to average 77.3 million b/d.

Following weeks of stiff negotiations to obtain EU Commission approval of its planned merger with Elf, TotalFina has submitted its commitments-notable among them being the sale of 70 highway service stations chosen from both firms' networks. The merger would have given the combined group a 57% share of the highway fuel market, or about 432 stations. Reportedly eyeing the assets is one of the supermarket chains-now all but absent from the highway fuel market-which foster a low-price policy that undermines the oil companies' marketing business in France. Other commitments involve divesting certain LPG distribution-marketing assets, and the opening up of the supply infrastructure at the Lyon and Toulouse airports. The commission is expected to reach a decision on the merger by mid-February.

Ottawa refuses to confirm or deny that an investigation on an oil project led by Talisman Energy in Sudan will contain some criticism but won't recommend sanctions. Sources say a report by special envoy John Harker was to be delivered last week to Foreign Affairs Minister Lloyd Axworthy. Harker visited Sudan in December to probe allegations of human rights abuses by the Khartoum regime related to oil operations in southern Sudan (OGJ, Jan. 17, 2000, Newsletter, and p. 38). Axworthy earlier said that sanctions would be considered if the report indicates Talisman operations have exacerbated the civil war or led to human rights abuses. Human rights groups have made allegations of slavery and other abuses by the Sudan government in a long-running civil war. They allege Khartoum is using revenues from the oil project to finance the war.

Operatorship of Agbami oil field, the latest giant found off Nigeria, has come into question.

Agbami deepwater field, about 112 km offshore and southeast of Lagos, is thought to contain more than 1 billion bbl (OGJ, Jan. 17, 2000, p. 26). Geological studies show it covering about 45,000 acres astraddle Blocks 216 and 217.

Block 216 operator Famfa and co-licensees Braspetro and Texaco unit Star Deep Water Petroleum will be jockeying for the operator's slot against a combine of Texaco and Statoil, which holds the license on Block 217. The two groups will have to work out which is better-positioned to operate and develop the field, with Nigeria's Department of Petroleum Resources to serve as mediator for the negotiations. Ultimately, the higher percentage of the field on either of the two blocks will determine Agbami's operator.

The Algerian parliament last week greenlighted a new program that would open up its energy sector, among others, further to private capital.

The plan would entail state oil firm Sonatrach establishing ventures with foreign companies in refining, petrochemicals, and power generation. International Monetary Fund Managing Director Michel Camdessus was said to have offered Algeria IMF assistance in its efforts, according to local reports. He contends there is an urgency to accelerate development and get Algeria "stable and cheap" methods of financing for various projects.

Peru's state-owned Electroperu inked a deal Jan. 14 with the Camisea natural gas committee that would guarantee an initial market for the gas Camisea expects to bring on stream in November 2003.

Electroperu will negotiate with Etevensa and Edegel-Peru's main thermal electric generators-to transfer the contracts to them. The companies, however, have rejected take-or-pay (TOP) contracts on Camisea, claiming the conditions offered would cause them to lose money. (Spain's Endesa is the majority shareholder and operator of both companies.) Electroperu's president says the state firm would build a gas-fired plant to absorb the gas, if necessary.

Consultants say the contract will cost Electroperu $35 million/year for gas supply and transportation. Electroperu's contract obliges it to purchase a minimum 70 MMcfd of gas, including a TOP clause for 80% of the contract over 15 years. In recent years, more than 75% of Peru's power needs have been met by hydro, although the percentage falls in dry years.

The Camisea committee estimates an initial market for the gas of 126 MMcfd, including industrial demand, with potential to grow steadily once the gas is available. Recently, the tender for the transportation and distribution of the gas was rescheduled for Mar. 6, instead of the original planned date of Jan. 25. However, the tender for development of the fields will be held Feb. 15 as scheduled, the committee said. Eleven companies have qualified to bid for the downstream concessions and 12 for field development, although a high percentage dropped out along the way. The tender was postponed three times since it was first announced at the end of May 1999.

Venezuela's LNG export scheme may be on the front burner again.

In a move marking the first step in the creation of an industrial center on eastern Venezuela's Paria Peninsula, PDVSA has revived talks with Shell, ExxonMobil, and Mitsubishi regarding an LNG export project on the peninsula.

The so-called Cristobal Colon LNG export project, approved by Venezuela and backed by the same three firms, was shelved for lack of market (OGJ, Dec. 9, 1996, Newsletter). It called for development of gas fields off the peninsula and an LNG export terminal with capacity of 6 million tonnes/year. The new project version, dubbed LNG of Venezuela, envisions 4 million tonnes/year.

Oil companies are scrambling for the first bites of the lucrative e-commerce pie that some claim could produce $11 billion in savings and efficiencies for energy companies worldwide.

Statoil, Royal Dutch/Shell, and Chevron have each formed a strategic e-commerce partnership in recent weeks.

Statoil is teaming with SAP, a leader in inter-enterprise software solutions, to develop a global online marketplace through SAP's trademarked mySAP.com infrastructure. Statoil will recruit a "select number" of its suppliers to participate in the pilot program, expected to begin in the second quarter. The firm expects substantial future savings from its $4 billion 1999 procurement budget.

Shell signed a memorandum of understanding to form a JV with Commerce One, an e-commerce leader with a global trading web. The firms expect to sign a binding agreement by the end of March and "go live" in the second quarter through Commerce One's MarketSite portal. That system will be open to energy companies and their suppliers and customers, with emphasis on small to midsize regional firms. Shell will have a majority stake, with Commerce One having an equity stake and collecting license fees for its internet technology.

Chevron is joining with Ariba, another e-commerce leader, to create Petrocosm Marketplace, to be owned by buyers and suppliers throughout the energy industry. Chevron, Ariba, and Crosspoint Venture Partners will have minority stakes in that operation, with most of the equity ownership going to industry participants based on the amount of business committed through the internet marketplace. Those who commit the soonest will get special consideration, officials said. That operation also is expected to start up in the second quarter at www.petrocosm.com.