VALUE CREATION IN DOWNSTREAM US-1: Refining, wholesale businesses should play strengths

Despite a grim outlook for the average US downstream competitor, those downstream companies that have consistently created value in the industry have been rewarded with a good return on their investments.

Particularly, those refiners and wholesale marketers who know and use their strengths reap the highest returns.

The downstream market includes refining, product distribution, and marketing.

PricewaterhouseCoopers LLP, global energy and mining, conducted a study identifying the sources of value creation in the industry to understand how particular companies succeed and how their successes will evolve in the future.

The consulting firm developed analytical models for refining, wholesale marketing, and retail marketing, correlating strategic and operational characteristics with high shareholder returns.

The models, used in conjunction with workshops, identified strategies of downstream companies that correlate with profitability. Downstream companies performed well when they understood the advantages and disadvantages of their business models and when they focused on excelling in those areas that play to the strengths of their chosen business model.

The term "business model" encompasses the manner in which a company is governed, the strategic direction it takes, and how it configures its assets and networks to develop its core competencies.

This is the first in a two-part series addressing the challenges facing the US downstream industry. Part 1 evaluates the strategies of the refining and wholesale marketing segments. Part 2 will examine the goals of retail sales and give recommendations for greater profitability within the US downstream industry.

Industry nature

The inherent nature of the downstream industry makes profitability and value creation a challenge. The environment is one with a high concentration of competitors, high environmental exit costs, significant sunk costs, and ceilings on margins due to substitutes and supply-demand economics.

In 1998, about half of the downstream fuels industry did not earn its cost of capital-the minimum return needed to prevent deteriorating shareholder value.

As shown in Fig. 1, 1998 was a poor year in refining. The average crack spread was $0.67 less than the average crack spread in the previous 6 years. The light-heavy spread in 1998, however, was steady; it was well within the band of the previous 4 years.

The US downstream market will become more competitive with time as majors sell additional assets to competitors and new clean-fuel and fixed-emission environmental regulations sweep across the US. Given the intensifying competitive forces in this mature market, value-destroying years such as 1998 will be more commonplace in the future.

Business models

To understand how companies have excelled, one must first appreciate the basic differences in value propositions that each business model employs. At the highest level, downstream companies compete in one of three broad business models: the major refiner, the independent refiner, and the value-added retailer.

- The major integrated model includes companies that both produce and refine crude oil and market refined products.

Majors are the large players such as ExxonMobil Corp. or Chevron Corp. Their downstream strengths tend to be in refining. Their lower costs of capital, economies of scale, and (in some cases) upstream integration give them advantages in the market.

The majors tend to run wholesale marketing as a cost center. The focus in wholesale is often on minimizing cost and achieving scale.

In retail, the majors may command a healthy brand premium, but their focus on fuel at the expense of merchandise and on maintaining similar store configurations across regions can put them at a disadvantage.

- The independent refiner-marketer is a company that only refines crude oil and markets the products.

The value proposition for independents such as a Tosco Corp. or Koch Industries Inc. is largely in the wholesale arena. Independents can achieve success well beyond the majors in this area by having flexibility, responding to market conditions, finding niches, and maximizing near-term returns as opposed to cost structure.

In refining, however, the independents are at a disadvantage. Their sometimes-limited capital base, older refineries, and overall lower refining margins are barriers to creating the world-class refineries that reward shareholders handsomely.

Similarly, in retail, the independents are tightly squeezed between two groups: the majors that have similar store configurations but enjoy greater value from high brand-recognition, and the value-adding retailers that are cost leaders and often also provide consumers with a greater feeling of satisfaction.

*The value-adding retailer is a company that only markets gasoline and convenience store (c-store) products.

There are three types of value-adding retailers. First, discounters such as Racetrac Petroleum Inc. are able to offer a significantly discounted fuel price by buying distressed spot fuel, accepting only cash, and selecting nonpremium locations.

Distressed gasoline is gasoline that is discounted because the seller must sell it immediately.

The second category, full-service c-store providers, such as QuikTrip Corp., provide a premium experience to the c-store customer.

Finally, existing retailers, such as Wal-Mart Stores Inc. and Albertsons Inc., are adding discounted fuel to their existing products as an incentive or loss-leader to attract additional customers.

While it is important to understand the basic value proposition of a downstream company at a high level, true competitive advantage is established within each value-chain area.

The following sections examine the value-chain segments of refining and wholesale marketing.

Refining

Identifying the factors that most influence profitability for a refiner will help refiners find profit in a grim environment. Although the 1998 crack spread was somewhat low, it likely represents the average crack spread in the future.

PricewaterhouseCoopers found that a majority of the 16 US refining companies that it studied destroyed value in the area in 1998. In fact, 12 of the 16 refiners earned less than their cost of capital in 1998.

The study group found that the majors can command an advantage in US refining. They tend to have more complex, more expensive refineries, which are able to command a margin of almost $1 over their independent competitors. This margin translates into a higher return on fixed assets by several percentage points (Fig. 2).

Although the majors tend to have larger, more complex refineries, these refineries do not necessarily outperform the others. Fig. 3 shows that neither complexity nor throughput was an accurate predictor of a refinery's ability to achieve a higher return in 1998.

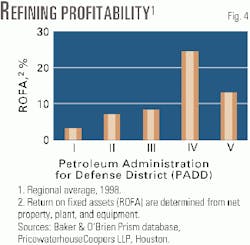

In refining, the main driver of profitability is the location of the refinery (that is, the supply region). For example, the mature East Coast refineries tended to perform the worst, earning a 3% return on average in 1998; the niche Mountain state (PADD IV) refineries, however, enjoyed sizable premiums in 1998 (Fig. 4).

At a high level, the eastern part of the US tends to destroy significant shareholder value in refining. The East Coast suffers from refined-products import pressure in all directions: from Europe, from the Hess St. Croix complex, and from the more-efficient US Gulf Coast (USGC) refineries.

Refineries in the Gulf Coast and Midwest are generally competitive, earning slightly below their costs of capital on average. The profitable regions of the US consist of the Mountain and West Coast states, particularly the Pacific Northwest.

The USGC and Northwest Europe essentially place an upper limit on East Coast gross margin as arbitrage opportunities are taken. As margins rise in the region to cover transportation costs, the imports from Europe rise as well. The refineries in the east are victims of a readily accessible market and more-efficient competition.

The Midwest refineries have similar competition from the efficient Gulf Coast refineries and thus are only marginally profitable. Only the Mountain and West Coast states enjoy significant entry barriers. They have a limited infrastructure, the Rocky Mountains physical barrier, export legislation, and unique environmental regulation.

Within a given region, profitability is driven by matching refining configuration and throughput to the characteristics of the region. In some areas, high complexity or throughput correlate well with strong profitability. In other regions, these factors virtually assure shareholder deterioration.

Refineries in some regions can become profitable with a focus on crude acquisition cost or operating cost; in others, cost-leader positions destroy value.

For example, consider two refineries in the Midwest operating within 100 miles of each other. In this region, simpler refineries tend to excel, particularly when combined with a configuration biased toward cheaper crude. In this example, both refineries have a similar throughput, but Refinery A is significantly less complex than Refinery B.

What is the difference in profitability? Refinery A enjoyed a 13% return on assets in 1998, while Refinery B destroyed significant value, earning a 0.2% return on assets. As the light-heavy spread widens, Refinery B's profitability will rise.

Future for US refining

Clearly, environmental regulation will only heighten throughout the country, serving to challenge refiners into the foreseeable future. Pending legislation such as changes to National Ambient Air Quality Standards requires significant reductions in gasoline and diesel sulfur levels. The American Petroleum Institute suggests that large capital investments will be required for average refiners to meet these requirements.1

Certainly, smaller refineries will have difficulty collecting the large amount of capital required to comply with the regulations. PADD IV (Mountain states) refineries, which have high sulfur, indigenous crude, and Canadian imports, are also somewhat disadvantaged with this legislation. Refineries with existing heavy desulfurization capacity will be competitively advantaged, however.

Another key trend lies in the gradual erosion of the location advantage.

As additional pipelines are built and more efficient operations in transportation are found, the location advantage found currently in the Mountain and West Coast states could deteriorate. However, this being said, there is no indication that the unattractive conditions in PADD I (East Coast) will improve in the future. Investment will continue to earn less than the cost of capital in this area for the foreseeable future.

Wholesale marketing

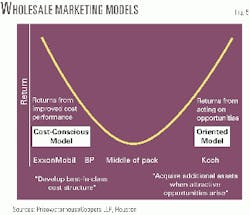

Two primary business models have emerged in wholesale marketing: a low-cost focused model and an opportunity-oriented model.

The low-cost focused model emphasizes managing wholesale as a series of cost centers. The concentration is on creating a best-in-class cost structure using size advantage and supply-chain optimization, while increasing throughput to the desired channels of trade. Examples of this approach can be found at ExxonMobil and BP.

The opportunity-oriented model, on the other hand, manages wholesale from a profit-center perspective. The focus is on evaluating opportunities to maximize short-term margin. Additional assets are acquired when an attractive opportunity surfaces. Examples of the opportunity-oriented approach can be found in Koch and Tosco (Fig. 5).

The differences between these two business models exist along several dimensions: supply, channel of trade, trading, and exchange management.

- Supply. In supply, the low-cost focused model, the wholesale marketer sources the majority of refined products from owned refineries; the spot market is a secondary source. The focus in supply is driving refinery barrels through the system.

Those companies who adopt an opportunity-oriented perspective choose the source of the terminal barrels based on the best opportunity at the time, whether it be refineries or the spot market. Trading position is the key component in the system.

- Channel of trade. From a channel-of-trade perspective, the low-cost focused model will drive barrels through the retail arm. Branded wholesale is secondary, although oil companies move significant volumes through the wholesale channel of trade.

The opportunity-oriented model drives barrels based on the best opportunity. Marketers who use this model constantly reevaluate their existing markets and actively seek new markets. This flexibility is realized in part by the absence of a retail arm or a low fuel-brand value.

- Trading. There are also significant differences in trading strategy between the two models. Low-cost focused companies see trading as a tool to sell excess capacity and manage risk. They do not perform speculative trading.

In the opportunity-oriented model, trading is a key component in supply-demand to evaluate sourcing opportunities. Companies who employ the opportunity-oriented model actively seek profit opportunities and participate in some speculative activities.

- Exchange management. Finally, in exchange management, the low-cost focused model uses exchanges to grow market share in areas where refinery throughput is not available. The focus is on low-cost exchange opportunities.

The opportunity-oriented model treats exchanges as one more component of the overall position. The company actively manages balances against the market and responds to market changes.

ExxonMobil is an example of the low-cost focused model. It seeks to maximize margin on the ends of the supply chain, while managing supply and trading as a cost center. The focus is on maximizing refinery return and balancing the supply network around it. This model has been successful from a supply standpoint; PricewaterhouseCoopers rated Exxon the highest value-adding refiner for 1998.

Koch, on the other hand, is clearly in the opportunity-oriented camp. Koch aggressively manages its position and customer channels, monitoring its price and inventory. Examples of Koch's approach to wholesale include its moves out of the domestic lease gathering market and the northeast wholesale markets as a result of lack of margin opportunity. Each of these decisions was made using margin-component analysis.

While both models are potentially profitable, a key mistake for downstream companies is to be caught in the middle between these two approaches of low-cost and opportunity focus.

Companies attempting to be both are likely to be squeezed from both sides. The companies will not be able to achieve the economies of scale and efficiencies required for a best-in-class cost position, nor will they have the flexibility, nimbleness, and skill sets actively to seize opportunities in the marketplace.

In the future, companies will likely be reconfigured around their core competencies. Companies such as the Williams Cos., Kaneb Pipe Line Partners LP, Kinder Morgan Energy Partners LP, and TransMontaigne Inc. often buy distribution assets as the majors shed them.

Transportation and terminal operations may be principally owned by companies such as these in the future.

Reference

- "Cumulative Impact of Environmental Regulations on the Refining, Transportation and Marketing Industries," American Petroleum Institute, October 1997.

The author

Chris Bauschka was a principal consultant in the strategic change practice of the PricewaterhouseCoopers global energy and mining group when he wrote this article. His areas of focus included strategic planning, profitability and value analysis, portfolio management, and performance management. He holds a BS in electrical engineering from the University of Texas at Austin.