Refinery feed, complexity determine investment for US fuel specs

The types of crudes processed and the complexity of a refinery will significantly impact the level of investment required to make new US fuels.

US refiners face fuel-specification challenges associated with the potential phase out of methyl tertiary butyl ether (MTBE) and lower sulfur requirements for gasoline and diesel at the beginning of the 21st century.

Foster Wheeler USA Corp., Clinton, NJ, studied six different US refining scenarios to establish a better understanding of MTBE phase out, the mandatory reduction in gasoline sulfur, and the proposed reduction in diesel sulfur. Changes in crude diet, new process unit investment alternatives, and unit revamps are potential solutions.

While this study does not represent any particular US refinery, the six configurations are typical of US refineries. Each configuration processes a different crude slate. Differences in the base-refinery configurations were limited to those changes required to process a particular crude slate.

This study evaluated six crude slates: a Middle Eastern crude blend, a North Sea crude blend, a Venezuelan crude blend, a Canadian crude blend, a Mexican crude blend, and a non-blended Nigerian crude.

MTBE problems

A potential nationwide ban on MTBE presents US refiners the simultaneous problems of reducing gasoline sulfur and replacing lost octane barrels. At the same time, refiners want to minimize or defer investment and improve or sustain refining margins.

The elimination of MTBE from the US gasoline pool will have a dual effect on the US refining industry.

First, refiners may find it difficult to replace the loss of octane barrels from the gasoline pool. While ethanol will be the most likely MTBE replacement, the use of ethanol will account for only a portion of the lost octane barrels. The higher oxygen content of ethanol and the maximum oxygen limit imposed by the EPA on US gasoline limits ethanol volume.

Second, the reduction in the dilution effect resulting from the loss of MTBE will increase the average sulfur content of the US gasoline pool. Although this will be partially offset by the use of ethanol, the average sulfur content of the gasoline pool will still be higher for a constant crude slate and refinery operation.

MTBE and sulfur solutions

For many refiners, modification of the crude slate, the purchase of naphtha as reformer feed, the purchase of atmospheric residue as vacuum-unit feed, and the installation of additional reformer capacity alleviate the problems associated with MTBE phase out. Foster Wheeler's most recent client inquiries suggest that many US refiners are considering the installation of additional reformer capacity.

The combination of crudes, purchased naphtha, and purchased atmospheric residue will vary from refinery to refinery. The correct mix depends on the original crude slate, original product slate, refinery configuration, refinery location, processability, contractual arrangements, and availability of feedstocks.

Alkylation and isomerization unit revamps are also potential solutions. Refiners need to evaluate as many options as possible to establish the most economic solution.

Although reforming can reduce the gasoline-pool sulfur in many cases, the required maximum gasoline-pool sulfur of 30 ppm (wt) cannot be achieved without additional processing. The sulfur reduction that is achieved, however, can be used for the accumulation of sulfur credits and allotments that will help defer investment.

For refiners with a fluid-catalytic cracking unit (FCCU) feed hydrotreater, increasing the level of desulfurization across this unit will reduce the FCCU-gasoline sulfur content enough to satisfy the 30 ppm (wt) gasoline sulfur requirement. This can be accomplished by catalyst replacement or unit revamps.

Other options include the use of gasoline desulfurization or sweetening and extraction processes, changes in FCCU-gasoline cut points, and reprocessing of heavy FCCU gasoline in the reformer.

While some refiners will minimize their investments by using gasoline hydrotreating processes, other refiners are considering the installation of FCCU-feed pretreatment, and a few of these refiners are considering mild hydrocracking operations.

The options available for diesel-sulfur reduction are less attractive and will probably involve significant investment, particularly for those refiners producing large quantities of cracked stocks.

Base-case models

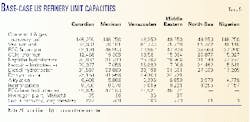

For each crude diet, the Foster Wheeler team used the Haverly Systems GRTMPS II linear-programming platform to create and optimize a base model of a typical US refinery. Each refinery had a fixed crude-distillation capacity of 150,000 b/sd.

Major process units common to all six refineries were:

- Crude unit and gas-recovery unit.

- Vacuum unit.

- FCCU and gas plant.

- Naphtha-hydrotreating unit.

- Continuous catalyst-regeneration reformer.

- Alkylation unit.

- Isomerization unit.

- Kerosine-hydrotreating unit.

- Diesel-hydrotreating unit.

- Amine regeneration and sulfur-recovery unit.

Depending on the crude slate processed, some base-case models included delayed coking, FCCU-feed hydrotreating, and hydrogen production and purification. The study included these three processes in only those refineries running Canadian, Mexican, Venezuelan, or Middle Eastern crudes.

As expected, those refineries processing heavy, high-sulfur crudes, were unable to achieve the current, average gasoline qualities specified in the model without an FCCU-feed hydrotreater.

Without the FCCU-feed hydrotreater, these heavy, sour crudes produce an FCCU gasoline with a sulfur content in excess of 2,300 ppm(wt). This high-sulfur content results in a total gasoline-pool sulfur of about 800 ppm(wt) and is not representative of the current US average of 338 ppm(wt).

Of the 40 US refineries processing 150,000 b/sd or more, 37 (93%) have FCCUs. Of these 37 refineries, 19 (51%) have some form of FCCU-feed hydrotreating and 22 (59%) have both alkylation and isomerization units (OGJ, Dec. 21, 1998, p. 49).

The alkylation units in the model used sulfuric acid and processed C3s and C4s. The model assumed that the kerosine and diesel hydrotreaters had a desulfurization capability of 97% and the FCCU-feed hydrotreater had a capability of 90%. The delayed coker operated at low pressure and low recycle for maximum production of clean, high quality liquid products.

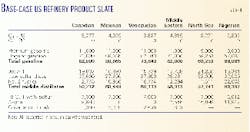

In each base-refinery model, the products included C3 LPG, C4 LPG, unleaded oxygenated regular and premium gasoline, jet fuel, low-sulfur diesel, No. 2 fuel oil, heavy fuel oil, asphalt, coke, and sulfur.

The modeling team established minimum and maximum product demands for unleaded regular gasoline, unleaded premium gasoline, jet A-1, low-sulfur diesel, heavy fuel oil, and asphalt, based on average US demand presented in Oil and Gas Journal's Industry Scoreboard (OGJ, Oct. 11, 1999, through May 8, 2000).

The team did not define minimum values for C3 LPG, C4 LPG, No. 2 fuel oil, asphalt, and heavy fuel oil.

In all cases, the model allowed natural gas purchases to supplement refinery-fuel requirements or hydrogen-plant feed.

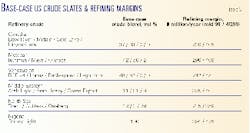

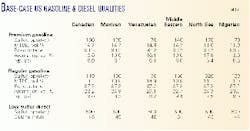

All product specifications were consistent with current, average US requirements. Table 1 summarizes a few of the gasoline, jet, diesel, and fuel-oil specifications defined for each base refinery model.

All gasoline products were traditional, oxygenated, non-reformulated gasoline, with purchased MTBE as the base refinery oxygenate because MTBE has been the most widely used oxygenate.

Table 2 presents average landed crude and product prices for mid-1999 and fourth quarter 1999. The mid-1999 prices were used in the linear-programming (LP) model. The results for each converged solution were tested against the fourth quarter crude prices.

Table 3 presents a list of the crudes included in this study, a summary of the optimal crude slate, and the net margin for each base refinery model based on mid-1999 and fourth quarter 1999 crude and product prices.

Tables 4 and 5 present the product slate and process unit capacities for each base refinery.

Table 6 summarizes some of the qualities of the gasoline and diesel products for each base-case US refinery.

Model assumptions for MTBE

One way to reduce the impact of the potential phase out of MTBE and the consequent increase in sulfur content is to modify the crude slate.

The analysis presented here assumed that crude selection is based on price and ability to produce a particular product slate. In reality, other issues-such as contractual arrangements, crude availability and processability (for example, metallurgy compatibility), and crude transportation-need to be considered.

For example, some crudes received on the US Gulf Coast may be difficult to process in a Canadian crude refinery. Most Canadian crudes are refined in the northern US and transportation of crudes from the gulf may be difficult or uneconomical. These issues are refinery-specific and need to be considered in greater detail outside of these studies.

Although crude prices increased significantly in the beginning of 2000, the resulting increase in gasoline prices had little effect on the US demand for gasoline (OGJ, US Industry Scoreboard, Oct. 11, 1999, through May 8, 2000).

The work presented here assumes that the majority of US refiners will maintain their current gasoline-supply targets and will look for ways to replace the lost octane barrels associated with an MTBE phase out.

The model assumed that the use of oxygenates in US gasoline will be maintained and purchased ethanol will be the likely substitute for MTBE.

The model used $1.69/bbl as the differential price of ethanol over MTBE. This price differential will undoubtedly be volatile over the next few years, while refiners make the changes required to replace lost gasoline octane barrels and the EPA ponders the question of a suitable MTBE replacement.

Ethanol tax incentives were not considered.

Model results for MTBE

The author performed a series of LP runs for each base-case US refinery model defined above. The goal was to phase out MTBE while minimizing changes to the product slate and to the existing units. The LP selected the optimal combination of crudes from the list of crudes included in this study.

The program did not accept changes in the base-case product slate (increased or decreased production) that were greater or less than 10%.

The overall objective was to avoid a loss in net margin relative to the base case without the need for investment. If investment was required, the goal was to maximize the increase in net margin relative to the base case.

Initially, a series of LP runs were made with purchased ethanol to maintain the crude and product slate as close to the base case as possible.

For these runs, no feasible solutions could be found for any of the refineries. That is, for a refiner processing a crude blend from a particular source, such as the Middle East, there were no variations of this blend which would maintain the quantity and quality of the product slate at or close to the base case.

In subsequent LP runs, the model introduced the purchase of naphtha into the base-case refinery as reformer feed; for heavy crude refiners, the model evaluated the purchase of atmospheric residue to maintain vacuum unit and delayed coker capacity.

For each refinery, the following three cases were completed:

- Case 1-Purchase naphtha as reformer feed; attempt to maintain crude source.

- Case 2-Modify crude slate.

- Case 3-Purchase naphtha as reformer feed; purchase atmospheric residue as vacuum unit feed; modify crude slate.

The models purchased ethanol in all cases. Purchased naphtha cost $1.74/bbl less than regular gasoline; the price of purchased atmospheric residue was equivalent to 1% sulfur heavy fuel oil.

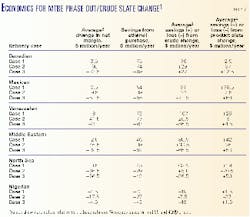

All cases maintained the base-case product specifications. Table 7 presents a summary of the economics for Cases 1 through 3.

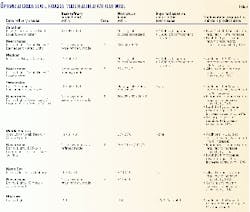

Table 8 summarizes the revised crude slate relative to the base case for each refinery with the selected case identified. It also notes the required process-unit revamp or new installation for each refinery.

Table 9 shows the change in gasoline-pool properties for each refinery.

The following statements summarize Tables 7, 8, and 9:

- In all cases, the smaller quantity of ethanol used in the gasoline pools, relative to MTBE, results in significant cost savings. This study assumes that the ethanol industry will undergo major modifications to gain the ability to satisfy refining demand.

Today, ethanol is not used more because of problems with distribution and availability. Most US refineries are not located near ethanol-producing facilities.

- Case 3 (modified crude slate with purchase of naphtha and atmospheric residue) offers the best solution for the Canadian and Mexican crude refiners. It had the highest average change in annual margin from mid-1999 through the end of 1999 relative to the base case.

- Case 2 offers the best solution for the Venezuelan, Middle East, and North Sea crude refiners. This case had the highest average change in annual margin from mid 1999 through the end of 1999 relative to the base case.

- Case 1 (maintain crude with purchase of naphtha) offers the best solution for the Nigerian crude refiner.

- All modified crude slates included some quantity of Bonny Light crude, emphasizing the need for a low-sulfur, light crude.

- The crude slate for each heavy crude refiner included some quantity of Arab Heavy crude.

- All refineries except that which processed North Sea crude required additional reformer capacity.

- The gasoline-pool sulfur decreased in 50% of the refineries.

- The gasoline-pool Reid vapor pressure (rvp) increased slightly in most of the refineries.

- The gasoline-pool aromatics increased in most of the refineries.

For the Canadian and Mexican crude refiners, the improved margin shown in Table 7 is a result of savings associated with new crude purchase, increased revenue from additional products (the product rate increase was limited to 110% of original product rates), and savings associated with the ethanol purchase.

The sulfur content of the modified crude slate decreased from 2.21 to 1.81% for the Canadian crude refiner and from 2.49% to 2.04% for the Mexican crude refiner.

For the Middle East, Venezuelan, and North Sea crude refiners, the improved margin was mostly a result of savings associated with crude and ethanol purchases.

The sulfur content of the modified crude slate decreased from 2.68% to 2.21% for the Middle East crude refiner. The Venezuelan crude refiner experienced an increase in crude sulfur from about 1.59% to 2.64%, and the North Sea crude refiner experienced an increase from 0.3% to 0.36%.

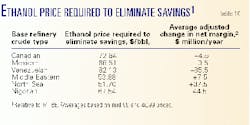

The savings associated with the purchase of ethanol relative to MTBE diminishes as the ethanol and MTBE price differential increases. Table 10 presents the ethanol price, in dollars per barrel, required to eliminate the savings reported in Table 7, assuming the price of MTBE remains constant and disregarding any ethanol tax credits.

Also included in Table 10 is the adjusted net margin for the selected case of each refinery at the higher ethanol price.

The impact of increasing ethanol prices will vary from refinery to refinery. It is unlikely, however, that the price of ethanol will increase this much. If prices approach these levels, however, based on the results shown for the Nigerian crude refiner, a gasoline-price increase as high as 4 cents/gal is required to offset losses.

Price mainly drove the inclusion of the Bonny Light and Arab Heavy crudes in the modified crude slates. For the Middle East and Venezuelan crude refiners, the inclusion of Bonny Light provided additional naphtha to produce reformate. The additional reformate supplemented ethanol in the replacement of octane barrels lost with MTBE.

The North Sea crude refiner is the only refinery that did not require additional reformer capacity. This is because the gasoline pool in the base-case refinery included the minimum quantity of MTBE and not the maximum, as in most other cases.

For those refiners that require additional reformer capacity, the installation of this capacity will also provide additional quantities of hydrogen.

Although the gasoline rvp and aromatics increased in most cases, the final pool values are at or below the maximum values specified.

Using the average, positive margins presented in Table 7 and assuming a 3-year simple payback with 100% equity, Table 11 summarizes the investment cost per refinery that can be tolerated without an increase in the price of gasoline.

In most cases, the tolerated investment is large enough to cover the cost of the required unit revamps or new unit additions defined in Table 8. At worst, the payback period may increase to 4 or 5 years, but a gasoline price increase will probably not be justified, all else being equal-at least not because of an MTBE phase out.

For the refiner processing Bonny Light crude, there is no acceptable level of investment because the margin has decreased for all cases considered. For this refiner, other crudes not considered here could be evaluated or a major refinery upgrade with a change to a heavy crude slate could be considered.

Increasing the price of gasoline will also suffice to make a Bonny Light crude refiner profitable. An increase of $0.19/bbl (0.5 cents/gal) is required to cover the loss in annual margin, all else remaining equal.

It is important to note that the models assumed that MTBE was purchased in each of the base-case refineries. For those refiners with an MTBE unit, modification of the unit for the production of ethyl tertiary butyl ether (ETBE) or iso-octane should be considered.

Gasoline-sulfur reduction

The results presented in Table 9 show that modifying the crude slate can reduce the gasoline-pool sulfur in about 50% of the refineries studied. Although none of the pools achieved 30 ppm (wt) sulfur, these reductions can earn sulfur credits and sulfur allotments to defer investment or sold to other refiners to help cover the cost of investment.

As with MTBE phase out, the best way to achieve 30 ppm(wt) gasoline-pool sulfur is also refinery-specific.

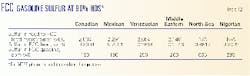

For those refiners with FCCU-feed hydrotreating capabilities, increasing the level of desulfurization may reduce the FCCU-gasoline sulfur enough to satisfy the 30 ppm(wt) sulfur gasoline-pool requirement. Table 12 summarizes the sulfur content of the feed to the FCCU-feed hydrotreater, the feed to the FCCU, and the FCCU gasoline at 90% desulfurization in the FCCU-feed hydrotreater for each refiner.

Table 13 presents the FCCU-feed hydrotreater desulfurization level required to achieve a gasoline-pool sulfur of 30 ppm(wt) for each refinery with an FCCU-feed hydrotreater.

Depending on the unit's design, the increase in the level of desulfurization in the FCCU-feed hydrotreater may be achieved by replacing the catalyst or by changing operating severity.

In other cases, unit revamp will be required. If revamping an existing FCCU-feed hydrotreater is not easily achievable, then post-treatment of FCCU gasoline can be considered.

Those refiners who need to revamp their existing FCCU-feed hydrotreaters should evaluate conversion of the unit to a mild hydrocracking operation. In addition to the production of a low-sulfur FCCU feed, mild hydrocracking will convert a portion of the gas-oil feed to ultra low sulfur, high-cetane-index diesel.

This conversion will reduce the quantity of FCCU feed, resulting in the need to purchase additional gas-oil feed to the hydrocracker to maintain FCCU-feed quantity.

The economics of a mild hydrocracker operation could be attractive, particularly in consideration of the need to produce lower sulfur diesel in the future. This approach is capital intensive, however, and needs to be studied on a case-by-case basis.

North Sea and Nigerian crude refiners with no FCCU-feed hydrotreater may consider the following options:

- Split the FCCU-gasoline stream. The light FCCU-gasoline stream can be processed in a caustic sweetener with extraction for sulfur reduction. The refiner can desulfurize the heavy FCCU-gasoline stream and blend it directly into the gasoline pool or process it in the reformer for octane improvement.

- Process the FCCU-gasoline stream in a gasoline hydrotreater. Several licensors offer new technology designed to minimize loss of octane and yield.

- Install FCCU-feed hydrotreating.

In all cases, the first and second options will be the cheapest and the third option the most expensive.

The first option has the added benefit of producing additional quantities of hydrogen if the heavy FCC gasoline is processed in the reformer. The second option, although effective in reducing gasoline-pool sulfur, will have a negative payback.

The third option can produce a positive payback as a result of yield improvement around the FCCU. The actual return on investment depends on a number of factors including capacity, feed type, and whether the current FCCU operation includes the use of expensive FCCU sulfur oxides reduction catalysts.

Refineries typically eliminate these catalysts when a desulfurized feed is used in the FCCU.

FCCU-feed hydrotreating may also provide environmental benefits. Each of these options should be evaluated to establish the most cost-effective approach to gasoline-sulfur reduction.

Diesel-sulfur reduction

The EPA has proposed that all on-road diesel sulfur be reduced to 15 ppm(wt), a value that will be difficult to achieve. For most of the base-case refineries studied here, modifying the crude slate and using additional quantities of reformate supplemented lost octane barrels and helped to reduce gasoline sulfur. These changes, however, have little effect on the diesel-pool quality.

To achieve 15 ppm(wt) diesel sulfur, refiners will need to modify current hydrotreating operations to achieve levels of desulfurization in excess of 99%. This level of desulfurization will be difficult to achieve, particularly in cracked stocks such as light cycle oils and light coker gas oils, where much of the sulfur is bound up in aromatic rings. These streams may need to be processed separately in units designed to saturate aromatics.

The installation of hydrocracking processes, including mild hydrocracking, can help by increasing the quantity of ultra low-sulfur diesel that can be blended into the diesel pool. For those refiners with FCCU-feed desulfurization capabilities, modification of these units to achieve increased conversion can help.

Bibliography

- Bavaro, V., "Produce Low Sulfur Gasoline via FCC Feed Pretreatment," World Refining, March 2000.

- Brasher, P., "Feds To Phase Out MTBE Gas Additive," Associated Press, Mar. 21, 2000.

- "Chicago Supports Ethanol Rather Than MTBE," Chemical Marketing Reporter, Jan. 3, 2000.

- "Ethanol Industry Can Quickly Double Production to Replace MTBE," Renewable Fuels Association, Mar. 24, 2000.

- Franz, N., "MTBE Exemption Advances," Chemical Weekly, Oct. 13, 1999.

- Hess, G., "California Air Resources Board Approves Non-MTBE Gasoline Blend," Chemical Marketing Reporter, Dec. 20, 1999.

- "MTBE Ban Gathers Force, Timing, Replacement In Question," Today's Refinery, October 1999.

- Parkinson, G., "Gasoline Minus MTBE," Chemical Engineering, January 2000.

- "Refiners Blast EPA's 15 ppm Sulfur Cap; NPRA Favors 50," Phillips Publishing International, Inc., Mar. 23, 2000.

- Richards, D., "Producers of Fuel Additives Brace for a Dismal Future," Chemical Marketing Reporter, July 19, 1999.

- "Scramble Intensifies In National MTBE Debate," Today's Refinery, November 1999.

- Shorey, S.W., Lomas, D.A., and Keesom, W.H., "Use FCC feed pretreating methods to remove sulfur," Hydrocarbon Processing, November 1999.

- Trotta, R., Marchionna, M. and Amoretto, F., "An Iso-Octane Technology To Produce Alkylate Streams," Today's Refinery, October 1999.

The author

Gary M. Sieli is manager of technical services for Foster Wheeler USA Corp. Previously, he was employed by the BOC Group Technical Center as a research engineer engaged in the study of graphite and needle coke production. Sieli holds a BS in chemical engineering from the New Jersey Institute of Technology, Newark, and an MS in chemical engineering from Rutgers University, New Brunswick, NJ.