Cornerstone: US reserve values bounce back despite lag in deal activity

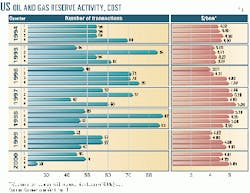

The value of reserves in US oil and gas asset transactions rose in the third quarter of this year, despite a lag in the number of deals. The median value of these transactions reached $5.05/boe in the third quarter vs. a revised price of $4.55/boe in the second quarter of this year and $4.66/boe in third quarter 1999 (see chart).

So says Houston-based investment banking firm Cornerstone Ventures LP in a recently released quarterly reserve report.

Also, the aggregate value of US onshore merger and acquisition (M&A) activity for the third quarter was $19.2 billion vs. $37.8 billion during the second quarter, Cornerstone said. These deals consisted of 2% cash, 60% stock, and 38% debt. This compares with the second quarter's revised breakdown of 10% cash, 70% stock, and 20% debt.

Incidentally, the firm added, if the three biggest deals that closed during the third quarter were excluded-namely the mergers of Anadarko Petroleum Corp. and Union Pacific Resources Group Inc., Devon Energy Corp. and Santa Fe Snyder Corp., and BP and Vastar Resources Inc.-the aggregate value of the deals remaining would be about $700 million, which is about half the level considered typical for quarterly transactions, Cornerstone noted.

"The [oil and gas] industry is experiencing a convergence of dramatically reduced pressures on potential sellers to sell, coincident with an increasing reluctance on the part of potential buyers to jump into the market at the relatively high price levels at which sellers now are willing to sell," Cornerstone said.

"In terms of sellers' motivations, the robust commodity prices have greatly reduced the pressure to sell, and bank debt is being paid down as perhaps never before. In such a climate, sellers' expectations are at the high end of the price scale, and if no buyers come forward at such prices, the sellers are in a position to be patient."

At the same time, the firm said, it is easy to understand why buyers wait to make their purchases, "given the general consensus on forward pricing curves-particularly for natural gas-and the higher levels of uncertainty and volatility at this juncture."

Cornerstone noted that the 26 onshore deals that closed during the third quarter represented an "unusually sluggish" level of activity. In fact, the firm said, the low number of deals is down from third quarter 1999's total of 57 deals, which is the average number of transactions that closed during the third quarter in each of the last 10 years.

"One additional factor that we believe is also contributing to the slow pace of deal-making is that the anticipated wave of property dispositions as a result of the recent major merger transactions has not yet reached the market," Cornerstone said. "No doubt some potential buyers simply are waiting to look over these high-quality properties before making any significant acquisitions."