E&P Investments: Optimizing value

Selecting the right upstream investments ensures company growth and prosperity, and in today's climate of uncertainty a thorough evaluation of exploration and production opportunities is becoming increasingly crucial to commercial success.

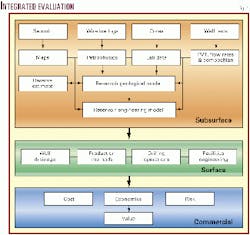

Most discoveries are in hostile environments where risks are higher and costs increase. Therefore a complete integrated assessment is vital at the early identification phase of a project if maximum value is to be generated. Complex geological and reservoir data must be converted into the realistic production profiles and cost-effective development options essential to the business decision process.

Combined with economic assessment and risk management strategies, these factors have a big influence on successful managerial and investment decisions (Fig. 1).

Value creation

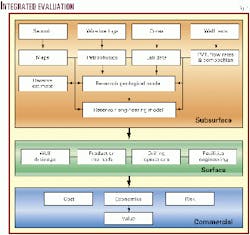

Value creation is a problem-solving approach based on creative and positive thinking; it provides the best development solution at minimal cost and can be carried out by a multidiscipline team of exploration and production specialists working simultaneously.

Innovative thinking and ingenuity are the principal concepts in creating value; geared towards the development of optimized solutions, they permit the team to create a large number of options efficiently and in a very short time.

To create added value in E&P opportunities an integrated team should be established as early as possible in the evaluation process to consider the five main aspects of opportunity evaluation, namely:

- Subsurface analysis.

- Reservoir engineering

- Surface and cost engineering.

- Economic analysis, and

- Risk management.

The scope for enhancing the value of a project is at its greatest during the early phases of a development (Fig. 2), and by concentrating on the "value zone" organizations can then be confident that the best development options are selected at the minimum cost.

From uncertainty to reserves

The principal challenge of geoscientists and petroleum engineers is to convert inherent subsurface uncertainty into reliable reserve estimates. The volumetric method is the one most widely used in the early stages of the evaluation process. There are three key elements in a volumetric reserve estimate, which are as follows:

- Subsurface geometry of the hydrocarbon accumulation (bulk rock volume)

- Effective pore space (pore volume)

- The dynamics and nature of the reservoir content (hydrocarbons in place)

Establishing the subsurface geometry of a hydrocarbon accumulation is the task of the geophysicist and geologist. Based on mapping of seismic data (2D, or preferably 3D), a geological three-dimensional image of the subsurface is produced. Sophisticated conversion methods of time to depth and calibration with well data are used to generate a graph representing the area versus depth of the reservoir.

The estimation of pore space effectively available for hydrocarbons is the result of close co-operation between geophysicist, geologist, and petrophysicist. The direct visualization of hydrocarbons in the subsurface, based on seismic amplitude studies and geological modeling, has been made possible with the help of powerful workstations. With the additional assistance of the latest wireline logging techniques, a reliable range of estimated pore space values can be generated.

The results of the various subsurface evaluation techniques are interpreted in a probabilistic manner. The outcome ranges, like bulk rock volumes, porosity distributions, recovery, and so on, are used in a so-called Monte Carlo simulation to produce an expectation curve of reserves. The ultimate objective of integrated subsurface evaluation is to reduce risk and to increase the probability of success.

Reservoir considerations

The determination of oil and/or gas in place, recovery factors, numbers of wells, and the estimation of a production profile are the activities of reservoir engineers. Their objective is to devise a development plan that will permit optimum recovery of hydrocarbons at minimum cost.

Using a reservoir model, oil and gas production forecasts are generated, from which the economist can produce cash flow models and financial forecasts; these provide the basis for the income stream during economic modeling.

To ensure that the reservoir yields the maximum amount of oil and gas possible it is important that the most appropriate production and development techniques are employed. Selecting a development scheme involves both technical and economic considerations. Profitability will be calculated over many years, and as a consequence it will be necessary to predict future reservoir production-an uncertain and complicated process.

The development and production of a reservoir is very complex and dependent on, among others, factors such as number of wells, permeability, viscosity, reservoir continuity, and secondary recovery techniques. The production profile will be based on these variables and any enhanced or tertiary recovery techniques; several simulations will need to be completed so that a number of hypothetical production scenarios can be established and compared.

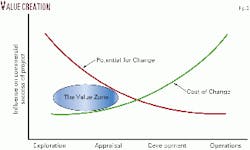

As an example, Fig. 3 displays some of the results that could be experienced from an offshore field with an OOIP of 750 million st-tk bbl. Using reservoir simulation, the production profiles have been plotted for high quality crude (with and without water injection) and heavy oil.

The reservoir has a 50% chance of being a nonassociated gas bearing structure, and consequently a gas-production scenario has been included assuming that the field will supply gas under a gas purchase agreement. These production models provide the basis for the sizing and costing of surface and operational facilities.

Facilities and their costs

The oil and gas reserves now being discovered and developed are often in "frontier" areas, remote locations, or greater depths offshore. The technology and strategies employed to develop such fields must be cost efficient in order to maximize potential.

Expenditure on a project is at its lowest during the exploration and appraisal stage, and facility optimization in the "value zone" can lead to reduced capital and operating costs. It can be seen from Fig. 4 that capital expenditure is very low during the pre-project phase but the opportunity to reduce costs is very high (Fig. 5). During this period it is important to identify and consider all the technically feasible schemes based on the following:

Unbiased consideration is given to all possible development options.

There is a clear understanding of the effect of relevant and/or new technology on the selected schemes.

Risk and uncertainty have been identified and their potential effect on the project is fully appreciated.

Company guidelines concerning issues such as return on investment, hydrocarbon recovery, safety, and environment are adhered to.

Due deliberation is given to a phased development along with the use of existing infrastructure.

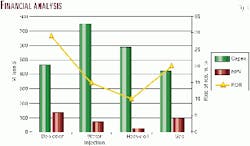

During the above process many cost estimates have to be produced to facilitate the selection of the best development. For illustration purposes and based on the production profiles, the capital costs in Fig. 6 represent the order of magnitude investments required to develop the shallow-water offshore fields in West Africa.

Under a depletion scenario the cost would be around $450 million with an incremental sum of $300 million required for water injection facilities and wells. In comparison, the capital cost for the heavy oil and gas production developments are estimated at $600 million and $400 million, respectively.

It can be deduced from the results that, depending on assumptions, the possible range of cost outcomes can vary dramatically, and this must be clearly understood during the early evaluation phase. The preparation of cost estimates requires a complete knowledge of the technical issues surrounding the project and a lack of understanding on this issue could easily cause rejection of an otherwise attractive project.

Enhancing economic value

Within most companies there is constant competition for funds among various parties; selecting the best investments is the job of management and can lead to company growth and prosperity.

Increased government regulation has resulted in higher costs, which in turn has a negative impact on project economics. Governments are taking a greater share of oil and gas revenue and issue directives that affect a variety of areas including lease sales, pollution control, pipeline approval, and price regulation. Intangible factors such as legal or political conditions, environmental considerations, and market outlook also influence a project.

The optimization of a development involves comparing the potential outcomes against investment criteria so that the most profitable approach can be selected. In Fig. 6 an economic analysis has been completed on four hypothetical cases, based upon a generic production sharing agreement, and the outcomes plotted. Product pricing assumes $18/bbl and $2.50/MMBtu (real terms) with inflation estimated at 3%/year.

The graph clearly demonstrates significant differences in economic return, based upon a discount rate of 8% to cover the cost of capital. Net present value and rate of return are highest under the depletion-only scenario.

The addition of secondary recovery facilities (while increasing oil recovery to 48% from 36%) has reduced NPV and ROR but increased the capital cost by around $300 million. A heavy oil field would generate the lowest economic return, while the nonassociated gas development looks reasonably robust with a NPV of around $100 million and a rate of return of 20%.

These results provide a means of quantifying the relative merits of individual development options from a cost/profit (economic) viewpoint. Although of major importance, economic evaluation should still be considered as only one of several inputs required to make a decision concerning the use of company resources.

As with cost issues, meticulous economic scrutiny of E&P investments will combat risk and uncertainty and will assist management to make effective investment decisions on upstream developments. Integrating the technical and commercial aspects of a project ensures that the economic risks and rewards are fully understood.

Managing uncertainty

The term "risk" has largely negative connotations for most people. As a result of this, risk management is often seen as a means of controlling negative outcomes rather than managing the full spectrum of uncertainty, including potential upsides and opportunities.

In order to overcome this, the term uncertainty is preferable to risk. The fundamental aim of risk/uncertainty is to build up a picture of the future, which enables management to make more informed decisions through knowing where the principal uncertainties lie. This means grasping the most attractive opportunities as well as making provisions for or controlling the principal risks.

The foundations of a successful project are laid at the early stages when uncertainty is at its greatest, and it is vital that potential benefits be realized and risk reduced. Many of the most significant uncertainties will be of a "soft" nature, involving people and organizations in some way.

The influence of pressure groups on high profile environmental projects is a prime example. In a similar way, the level of management effort required to implement major international collaborative projects is often underestimated. Risk analysis must embrace these areas because they can have very significant impact on the outcome; they can also be highly unpredictable.

Integrating the approach

The evaluation process prior to making a development decision is mainly one of reducing uncertainty.

Geologists and geophysicists locate prospects; seismic helps to confirm their existence along with their potential properties and size.

Reservoir engineering data are assessed and, with input from engineers, the final capital and operating costs can be estimated.

Armed with production profiles, cost phasing, and in-country legislation, the economists can generate an economic analysis to enable management to pursue the most profitable opportunities. Decisions are aligned with the strategic parameters of the company, whilst taking into account the needs and requirements of the country in which the prospect is situated.

Integration of subsurface data with technology, economic analysis, and risk assessment will generate effective plans for optimum development, and it is important to carry out this integrated evaluation at an early stage.

As the field is developed expenditure rises steeply and the possibility of making changes to development and production plans is greatly reduced. To put it simply, an integrated evaluation at the pre-project phase is the key to optimizing value and commercial success in exploration and production ventures.

The authors

Clive W. Duerden is a consultant engineer specializing in conceptual, cost engineering, project controls, and risk evaluation on exploration and production projects. He has worked in a consulting role for BP, Conoco, and Shell International and has gained more than 20 years' experience with upstream and pipeline oil and gas developments. He holds a BSc degree in mechanical engineering from Salford University. E-mail: [email protected]

Dr. Jan de Coo is a senior consultant on geological and exploration issues. n PetroVentures International. He has spent over 20 years in the oil and gas industry with Shell International. He has gained extensive experience on exploration and appraisal projects in Africa, Southeast Asia, the Former Soviet Union, and China. He holds a PhD degree in geology from Leiden University. E-mail: [email protected]

Rik Drenth is a senior consultant in reservoir engineering. He spent more than 25 years on reservoir engineering studies with Shell International, including evaluations in the Caspian Sea, Egypt, Pakistan, Nigeria, and Australia. He has completed reservoir simulation work on gas hydrate developments and deepwater turbidite production. He obtained an MSc degree in physics from Groningen University. E-mail: [email protected]