OGJ Newsletter

Market Movement

US heating oil outlook remains uncertain...

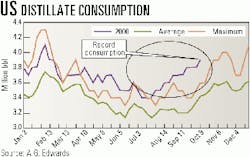

US heating oil stocks remain stubbornly low despite record distillate production levels, and concerns about this winter's supply may rest more in the perception of shortage than in reality (see related story, p. 20).

Heating oil stocks currently are still the lowest on record at a time when they typically reach a seasonal peak. Stocks actually declined during the last 3 weeks of October. But the storage data, which relate to primary storage, may in fact be deceptive.

During the period from mid-July to the start of the heating season, US distillate consumption hit an all-time high for the period, notes analyst A.G. Edwards. In September, demand exceeded the previous record for the period by 2.8 million bbl/week (see chart).

A.G. Edwards noted that once refiners sell a product, it's considered consumed under DOE data, even if it is stored down the distribution chain at the retail or consumer level and thus not counted as inventory.

"This could be rather significant," A.G. Edwards said, "It is possible this distillate is being hoarded at lower levels in the distribution chain, which suggests prices may be less vulnerable to a cold snap than the primary storage data would indicate."

...But now concerns arise over propane shortages

Meanwhile, a Houston consultant says low US propane stocks in secondary and tertiary storage have set the stage for spot shortages in the Midcontinent region during periods of extreme cold this winter.

Dan Lippe, of Petral Consulting, made the prediction in an article that will be published in the Dec. 4 Oil & Gas Journal.

Noting the concentration of propane supply in a few major hubs, Lippe said, "Heating market demand is distributed over a wide geographic area. Propane markets rely on a few pipelines that deliver product from primary supply centers to end-users. These pipelines have finite pumping capacities."

Based on monthly analyses of regional propane supply and demand trends it has made since 1988, Lippe has devised a proprietary formula for calculating secondary and tertiary storage levels and concluded that they have fallen to critically low levels during the past 3 years.

He defines secondary storage as aboveground pressurized and refrigerated storage tanks that propane retailers operate. Tertiary stocks are those held in residential, commercial, and industrial consumers' tanks.

"Because of the inherent physical capacity limits of the US propane distribution system, inventories in secondary and tertiary storage in the retail markets are the most important component of supply during the winter heating season," he said.

Lippe said US propane supply this year will be about 7 million bbl lower than in 1999. He contends propane supplies in secondary and tertiary storage meet 15-25% of total residential and commercial consumption during the heating season.

Undervalued stocks to fuel more M&A action

The surge in oil and natural gas prices hasn't given the stocks of all energy companies a boost, according to PricewaterhouseCoopers's recent mergers and acquisitions (M&A) forecast for 2001. The lack of translation between high commodity prices and stock prices for energy companies will most likely continue to fuel M&A activity within the energy industry for the coming year.

Cash flow and earnings are up significantly for many energy companies, but Pricewaterhouse- Coopers noted last month that "companies aren't being rewarded in the stock market for many reasons."

Competition for capital funding has tightened due to both the volatile nature of oil and gas prices that has deterred investors and the substantial amount of spending directed toward technology companies, said PricewaterhouseCoopers: "The fact that oil prices soared so quickly just reinforced the energy sector's volatility to investors."

Within the next 12-18 months, Pricewater- houseCoopers expects to see another megamerger similar in size to Chevron and Texaco's recently announced plans to merge operations (OGJ, Oct. 23, 2000, p. 28).

But companies that have accumulated large reserves of cash can also create concern for investors as to whether these companies will spend the wealth wisely, the consultant said.

null

null

null

Industry Trends

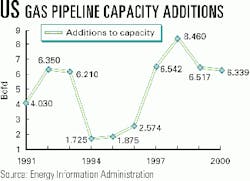

US natural gas pipeline capacity constraints and bottlenecks could arise during severe weather this winter, but for the most part, capacity appears adequate to serve the needs of the upcoming heating season, says EIA.

By the end of the year, interregional natural gas pipeline capacity will have grown 27%, or 20 bcfd, since 1990, with 5% of the additions installed since 1998 (see chart). At least half the additions were built to ac-commodate shifts in supply, EIA says. By year-end, the agency estimates, the industry will have invested $4.6 billion on expanding and upgrading the system since January 1999.

But new bottlenecks are cropping up. In California, where utilization levels on the major transmission pipelines have been well above 90%, government analysts say the system could reach its limit if demand continues to increase.

Looking ahead, analysts say, while there have been no sustained pipeline outages since the mid-1970s, additional pipeline capacity will be needed, especially in the Northeast, to avoid disruptions during peak demand.

Estimates of British Columbia's natural gas resources are dropping despite a drilling recovery.

Estimates of undiscovered natural gas resources for northeastern British Columbia have dropped to 30.8 tcf from 33.2 tcf over the past 5 years, Canada's National Energy Board reported.

NEB said the Foothills region is the most likely to yield large gas discoveries. Drilling activity in the region in 1992-97 opened 2.5 tcf of initial marketable gas reserves. Adjustments based on drilling and reservoir reviews increased that estimate by 66 bcf in the period.

The board said drilling in northeastern British Columbia has rebounded from a low of 158 wells in 1992 to an average of more than 400/year in the past 3 years.

During the study period, drilling activity resulted in 1,070 gas wells, 536 dry and abandoned wells, and 401 oil wells. The number of producing gas wells increased to 1,425 in 1997 from 886 in 1992.

NEB said the annual conversion rate of undiscovered gas resources to proven reserves was about 1.4%, or a total of 7% over the 5 years.

It said the Foothills region is the most prospective for large gas discoveries. They are expected to exceed the average northeastern British Columbia find of 6.5 bcf. Devonian plays in the northern part of the region should also yield discoveries larger than the average pool size for the region.

NEB said exploration activity must shift to the Foothills area to add the volume of reserves needed to meet or exceed production forecasts.

Government Developments

CALIFORNIA MAY GET ITS OWN STRATEGIC GASOLINE RESERVE.

It has enacted bills to study the feasibility of creating a state-owned strategic gasoline reserve and the possibility of importing more gasoline from the Gulf Coast via pipeline.

The state legislature passed the bills, and Gov. Gray Davis signed them last month.

California Attorney Gen. Bill Lockyer said the requirement for the studies resulted from a 5-month research project on California's gasoline market.

A spokeswoman for the California attorney general's office said the legislature did not pass a third bill, which would have directed the state's Department of General Services to use state funds to seek a way to increase gasoline imports.

The attorney general's office had released a report on gasoline pricing in California in May. The study said a lack of competition and supply disruptions had contributed to price spikes and would recur unless steps were taken to ensure a steady flow of gasoline.

It said the price spikes that sent pump prices soaring above $2/gal during 1999 and 2000 in some parts of California eroded "the competitiveness of California businesses" and reduced state residents' real income.

Lockyer recommended that state refinery capacity be expanded and refinery problems addressed. He said the state should encourage conservation and use of alternative fuels and hybrid electric cars.

The state attorney general also supported proposals to allow branded dealers to buy gasoline from any source that meets the specifications of the brands they sell under. He advocated policies encouraging the growth of independent gasoline marketers.

The study said California gasoline demand is expected to rise from 14.5 billion gal in 1999 to 16.5 billion gal in 2010.

OIL COMPANIES OPERATING IN THE UK FEAR A "WINDFALL PROFITS" TAX stemming from this year's oil price rise.

Some analysts say that the amount levied could be as high as 10%, which would raise the UK government some $1.6 billion in revenue.

This would be enough to offset the planned inflation-linked fuel duty increase.

However, the supplementary tax levy could jeopardize government efforts to promote cooperation with the oil majors to prevent any repeat of the fuel blockades that paralyzed the UK in September.

Protesters have vowed to renew the blockades starting Nov. 13, if fuel prices are not reduced.

The government first proposed a review of the North Sea oil tax regime 2 years ago, but this was abandoned when the price of oil plummeted.

The UK Offshore Operators Association has warned the government against the levy, saying that the extra financial burden could jeopardize the sector. UKooa pointed out: "The North Sea has smaller fields, deeper waters, and higher costs than its rivals in Eastern Europe, West Africa, South America, and The Far East."

Quick Takes

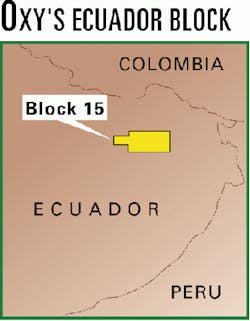

OXY is seeking to boost E&D on its Ecuador block.

Alberta Energy Co. agreed to farm into Oxy's Block 15 in Ecuador's Oriente region (see map). AEC will earn a 40% interest in the block and will assume certain capital costs through 2004. Oxy will remain block operator.

Oxy said it is engaged in an "extensive" exploration program in Block 15 and is moving forward with plans for the development of its 115 million bbl Eden-Yuturi oil discovery. Gross production from the block is 30,000 b/d.

Both Oxy and AEC are members of a consortium currently bidding to build a new heavy crude oil pipeline in Ecuador. Oxy said its ongoing Block 15 development plans, which target an increase in gross production to 70,000 b/d by 2003, are tied to the successful completion of a new pipeline (OGJ, Oct. 9, 2000, p. 58).

In other exploration news, Canada-Nova Scotia Offshore Petroleum Board on Nov. 2 announced high bidders for eight exploration licenses off Nova Scotia. The board offered the tracts last June. The high bids represented what the winners would spend exploring the blocks during the first 5 years of a 9-year lease. BP Canada and Anadarko Canada 50-50 bid $97.8 million (Can.) for Parcel No. 6, which covers 185,580 hectares in 200-2,500 m of water. Kerr-McGee Offshore Canada was high bidder on three parcels: $27.2 million for No. 1, which covers 306,800 hectares in 500-3,000 m of water; $20.6 million for No. 2, which covers 114,010 hectares in 100-1,700 m of water; and $13.1 million for No. 7, which covers 296,440 hectares in 1,500-3,000 m of water. Canadian Superior Energy was high bidder on two parcels: $5.1 million for No. 4, which covers 24,050 hectares in less than 100 m of water, and $22.6 million for No. 5, which covers 20,776 hectares in less than 100 m of water. Richland Minerals bid $2.1 million for No. 3, covering 25,935 hectares in less than 100 m of water and $3.2 million for No. 8, which covers 279,990 hectares in 2,000-3,500 m of water. The board will issue exploration licenses for the parcels if the federal or provincial governments do not object within 30 days. The board plans to consider bids for tracts next June that are nominated by Mar. 31.

India will launch the second round of oil exploration license awards under the New Exploration Licensing Policy in December. The authorities also are considering giving domestic petroleum products marketing rights to private and foreign companies if they are willing to invest more than $500 million in the oil exploration, refining, or infrastructure sectors. The country's oil import trade has already been deregulated, and domestic petroleum marketing has been opened up for all products except transport fuels, subsidized LPG for cooking, and kerosine. In addition, India has about 65 million cu m/day (MMcmd) of gas available for sale, but its total demand has been placed at 115 MMcmd. The gap would be bridged by large-scale imports of LNG, said Ram Naik, petroleum and natural gas minister.

Pakistan granted a petroleum exploration license to a JV of operator Pakistan Petroleum (95%) and Pakistan government holdings (5%) for Karsal Block 3272-8, which covers 625.26 sq km in the Chakwal district of Punjab Province. The block was awarded Nov. 1. The JV intends to invest about $7.2 million in acquiring 60 sq km of 3D seismic data and drill one exploration well during the initial 3-year term.

Conoco said it would acquire half of the 80% interest held by two Royal Dutch/Shell subsidiaries in two exploration and production blocks off Malaysia. Conoco will gain access to more than 1.5 million acres and will commit to drill at least four wells on the G and J deepwater blocks off Sabah. The two blocks are near the Baram-Champion delta of northwestern Borneo. Block J lies in 650-3,200 ft of water, while Block G is in 2,300-5,900 ft.

A NOBLE AFFILIATES UNIT IS MARKING PROGRESS ON ITS CHINA BOHAI BAY DEVELOPMENT. Energy Development Corp. (China) selected Paragon Engineering Services to assist it in developing Cheng Dao Xi Block A field in the southern half of China's Bohai Bay, Paragon said.

Paragon has completed preliminary design and is currently performing detailed design of a central drilling-production platform to be installed in 25 ft of water.

Through a $2.6 million contract, Paragon will perform engineering, design, drafting, and procurement services for the entire platform, including jacket, deck, and topsides equipment, for EDC, the field's operator.

Cheng Dao Xi field is 5 miles off the northern coast of Shandong Province in Bohai Bay.

Paragon expects the design work to be complete by yearend. The platform will be designed to produce 8,500 b/d of oil.

In other development news, Norsk Hydro awarded Aker Verdal a 670 million kroner ($70.4 million) contract to construct the steel jacket for the Grane platform. This is the last major contract for the 15 billion kroner Grane project, which is in the North Sea 185 km west of Stavanger. Grane's partners will develop the field via an integrated accommodation, process, and drilling platform mounted on the steel jacket. Engineering of the 17,500-tonne, 150-m tall steel jacket will begin immediately; the jacket should be complete Mar. 1, 2003, said Norsk Hydro. The field is expected to reach peak output of 214,000 b/d in 2005. The oil will be transported by pipeline to a terminal northwest of Bergen, Norway (OGJ Online, Oct. 12, 2000). Hydro owns 24.4% interest in Grane; the Norwegian state's direct financial interest holds 43.6%; ExxonMobil, 25.6%; and Statoil 6.4%. Statoil recently announced its intent to sell its interest in Grane to Conoco (OGJ Online, Oct. 25, 2000).

Unocal's Mahoni Field will be key in helping OPEC member Indonesia meet its production quota.

Unocal has begun producing 4,700 b/d of oil from Mahoni field off Indonesia's Borneo Island. Production started from a single well in Balikpapan Bay, off East Kalimantan.

Unocal plans to bring another 3 wells in the field on stream by yearend. Unocal is developing the field, discovered last year, under Indonesia's new incentive scheme for marginal field development.

Unocal said production from Mahoni will help in the effort to hike Indonesia's production an additional 41,000 b/d, as planned under the recent OPEC agreement (OGJ Online, Oct. 30, 2000).

In other production happenings, Mariner Energy began production of 10,000 b/d of oil and 4 MMcfd of gas from its Black Widow project on Ewing Bank Block 966 in the Gulf of Mexico. The oil and gas comes from a single subsea well in 1,890 ft of water that is tied back 3.8 miles to Agip's Morpeth platform on Ewing Bank 921. Mariner operates the block with 69% working interest, and Devon Energy holds 31%.

Chevron Canada and partners have begun production from their M-25 well, near Fort Liard in Canada's Northwest Territories. Chevron said the well flowed 35 MMcfd of gas, which will increase to 50 MMcfd by Nov. 9 and be held at that level for a month. The facilities can handle rates of up to 75 MMcfd. The gas is processed at Westcoast Energy's Fort Nelson, BC, gas plant. Chevron said recently it cannot expand the hot Fort Liard gas play because land will not be available until disputes are settled between the federal government and aboriginal groups.

A horizontal oil well drilled in italy's villafortuna-tracate field may have set a world record.

ENI and Schlumberger are claiming a record for the world's deepest producing horizontal well after reaching a TD of 6,421 m (21,066 ft) at an angle of 89.6° with its Villafortuna 1 well. The well had a TVD of 6,062 m (19,888 ft) and the horizontal drain extended for 184 m with inclinations of 85-90°.

"The new technology high-temperature SlimPulse system provides real-time gamma ray measurements, combined with continuous inclination and direction under the extreme bottomhole conditions of up to 180° C. The technology was decisive in successfully geosteering the Villafortuna 1 well towards the target pay zone," said ENI.

Elsewhere on the drilling front, Unocal Thailand on Nov. 2 issued a letter of intent to lease Smedvig Asia's T-7 self-erecting tender rig for 5 years. The contract is estimated at $75 million. The proposed contract includes an incentive arrangement, which could increase the contract value. T-7 is working under a 5-year drilling contract for Unocal Thailand until mid-December, after which it is scheduled for a 6-month, $15 million upgrade, including installation of heavy-lift cranes and a new derrick.Transocean Sedco Forex said its Trident IX jack up was damaged while drilling off East Java in the Madura Straits, Indonesia, for Santos. Transocean said the damage, which is apparently limited to the drill floor area, occurred due to "an uncontrollable release of natural gas which subsequently ignited." All 92 crew members were safely evacuated.

Petrochina will soon begin construction of a new oil products pipeline.

China has approved the construction of the proposed major oil products pipeline in the western part of the country.

PetroChina plans to begin construction before yearend on the 1,207-km line between Lanzhou in the northwest and Chongqing in the southwest. Work will take about 18 months.

The line will move products from Xinjiang and Gansu-area refineries to markets in the southwest, where no major refineries exist. The products will include gasoline, diesel, jet fuel, and naphtha.

No foreign capital is involved in the $450 million line, which will cross Gansu and Sichuan provinces before terminating in Chongqing.

The line's 867-km first section will extend from Lanzhou to Sichuan province's capital, Chengdu City. It will be have a capacity of 5 million tonnes/year. The 340-km second section will be rated at 2.5 million tonnes/year.

In other pipeline news, Williams said that it has placed its $108 million SouthCoast Expansion project into service, increasing capacity on its Transcontinental Gas Pipeline system by 204 MMcfd and providing additional firm transportation capacity for markets in Alabama and Georgia. The expansion loops 44 miles of 48, 42, and 24-in. pipeline in the two states and adds 31,500 hp of compression at stations in Rockford, Ala., and Newnan, Ga.

A JV plans to build a $225 million, world-scale, integrated C4 olefins complex at Port Arthur, Tex.

Shell Chemical will own about 60% of Sabina Petrochemicals, which will operate the venture.

BASF will have 24%, and TotalFinaElf unit Atofina Petrochemicals will have 16%. The companies said a definitive agreement still is being negotiated.

In connection with the Sabina project, BASF Fina Petrochemicals plans to build a $25 million olefins conversion unit next to its naphtha steam cracker and Atofina Petrochemicals' 176,000 b/d refinery in Port Arthur, Tex. Construction of both plants is due to begin in second quarter 2001 and be completed in first half 2003. BASF will operate both plants.

The Sabina plant will consist of a 900 million lb/year butadiene extraction unit using BASF technology and a 662 million lb/year indirect alkylation unit using UOP technology. The BASF Fina olefins conversion unit will process butylene from the Sabina olefins complex and ethylene from the BASF Fina cracker into 690 million lb/year of propylene using ABB Lummus Global technology.

FUTURE TANKER engines may use volatile organic compounds for fuel.

Statoil and MAN B&W's diesel engine plant have jointly developed a prototype engine that can run on volatile organic compounds (VOCs) recovered during tanker loading.

"The environmental aspects of this development could be highly significant in future, following new requirements from the Nowegian Pollution Control Authority," said Statoil.

The first VOC fuel facility is being tested on the Navion Viking shuttle tanker (see photo).

By yearend 2001, all operators who are involved in offshore loading from Norwegian fields will be required to recover VOCs from 30% of their cargo liftings; this rises to 95% by yearend 2005.