OGJ Newsletter

Market Movement

Low gasoline stocks bolster refiners' margins

US refiners face a combination of ever-tightening environmental strictures and growing capacity constraints that has created a basic imbalance in the market structure.

Following on the heels of a market downturn, US refiners last year had little incentive to build stocks of either crude or products. At the same time, the bewildering welter of gasoline specifications designed for certain regions of the country according to those regions' particular air quality regulations spawned a number of "boutique" gasolines that exacerbated the problems that already existed with the fungibility of US refined products. So when gasoline demand growth surprised everyone this year while crude and gasoline stocks were low, any supply difficulties-such as pipeline or refinery outages-were complicated dramatically. That created a situation where refining margins reached, on average, 6-year highs in the US and even record levels in some areas.

If the expected return to normal winter weather materializes early in the US and Europe, then heating oil markets will be stretched to the breaking point, and prices and margins could rocket to new highs.

The turning point really came with gasoline, however, early this year. With gasoline stocks already low at a seasonally slack time of the year, a stretch of maintenance turnarounds and belated demand for heating oil with a late cold snap helped reduce gasoline stocks still further. With a limited capacity for making the new gasoline on top of the meager stock levels, concerns mounted over adequacy of supply for the summer driving season, and refining margins begin to expand. On the Gulf Coast, second quarter refining margins shot up almost two-fold, or by almost $2/bbl, with the gasoline crack spread there reaching the highest level in 10 years.

This situation underpinned the highest nominal retail gasoline prices in more than 5 years and the highest, in inflation-adjusted terms, since the Persian Gulf war (see chart). Not only did pump prices top $2/gal in the Chicago and Wisconsin markets, but regional outages caused many independent marketers to run out of gasoline for the first time in more than 2 decades.

OPEC production hike barely moves oil prices

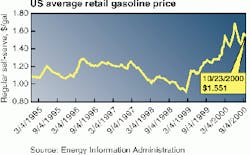

Oil prices responded weakly to OPEC's announcement of yet another production increase, this time triggered by its price-band mechanism (see related story, p. 24).

The day of the OPEC announcement, crude futures prices in New York and London rose by considerably less than a dollar, as markets had already discounted the move.

NYMEX crude for December delivery closed Oct. 30 at $32.81, up 7¢ on the day, while December Brent crude closed 19¢ higher on the day to close at $31.14/bbl.

There remains some skepticism as to whether OPEC actually has the spare capacity to boost output by another 500,000 b/d. Coupled with continuing concerns over high tensions in the Middle East (see Government Developments, p. 7), that skepticism kept US oil futures prices hovering near $33/bbl.

Meantime, reports coming out of some OPEC member states signaled moves were already afoot to implement the increase ahead of the Oct. 30 announcement.

Algerian Energy and Mines Minister Chakib Khelil announced over the preceding weekend that his country would raise its oil output by 36,000 b/d starting Oct. 30. Speaking on Algerian television, Khelil stated that Algeria's quota allocation would be 872,600 b/d.

Meanwhile, Obaid bin Saif Al-Nasseri, UAE Minister of Petroleum and Mineral Resources, has said that his country supports a 500,000 b/d increase in OPEC output. Al-Nasseri was quoted by the official UAE news agency as saying: "The UAE favors enforcing the adjustment mechanism. The application of this mechanism is a way of reinforcing OPEC's credibility."

Al-Nasseri stressed that each OPEC member state should shoulder its individual "responsibility" when it comes to producing the additional quantities called for by the organization's quota system. "It is unthinkable that one country would produce over its quota to compensate for another that is unable to increase output," he stated.

null

null

null

Industry Trends

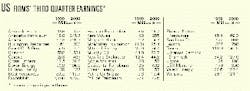

THIRD QUARTER EARNINGS for a selected group of US oil and gas companies showed marked gains over third quarter 1999 (see table). Earnings also continue to illustrate an upward trend when compared with previous quarters this year (OGJ, Aug. 14, 2000, p. 22 and Aug. 21, 2000, Newsletter, p. 7).

Both major and independent E&P firms attributed these gains largely to higher oil and gas prices and to increased production. Refiners, meanwhile, cited strong refining margins and higher refinery throughputs helping to establish their increases.

M&A boom

In addition, many companies' strengthened balance sheets were fueled by merger and acquisition activity, which-according to a recently released forecast by PricewaterhouseCoopers's (PWC) transaction services group-will only accelerate in 2001.

"This is a wild time for the oil and gas sector," said Rick Roberge, head of the PWC group. "Companies are flush with cash in this high commodity price environment, but the stock market has not responded. Ultimately, capital constraints will force companies together to fuel growth.

"[Companies'] boards are also putting pressure on management to improve returns on invested capital. It's no wonder that CEOs are looking to play the M&A card," Roberge said.

What factors will continue to drive M&A activity next year? The PWC group identified five:

- Continued oil and gas price volatility, which will ultimately hurt the smaller-capitalization stock companies when larger firms look to purchase them.

- High energy prices that don't necessarily translate into high stock prices for some firms.

- Companies needing to chose between earnings and growth-"[Companies] must know when they cross that line; their strategy depends on it."

- The weakening of the Canadian dollar.

- Companies that are now flush with cash are looking to put it to good use.

Earnings recap

Gains by supermajors ExxonMobil and the newly formed ChevronTexaco were particularly robust.

"Excluding merger effects, ExxonMobil's third quarter 2000 earnings improved substantially from the same period a year ago and were a third consecutive quarterly record," said Lee R. Raymond, the company's chairman. And Raymond said that the company's capital expenditure program will continue to increase during the fourth quarter, after reaching more than $2.6 billion on capital and exploration projects during the third quarter. In light of the Chevron-Texaco merger announcement, the PWC group says to look for at least one other megamerger in the next 12-18 months.

Many refiners boasted record earnings, despite some citing losses on the retail side. "Typically, as crude oil prices rise, the street price of gasoline lags and there is a temporary erosion in the retail margin," said Tosco Chairman and CEO Thomas D. O'Malley. "Margins recover when wholesale prices stop rising."

Certain independents doubled-and even tripled-their earnings for the quarter.

Apache Chairman and CEO Raymond Plank attributed the company's substantial production growth to the company's "recent transformation" into a "stronger, more profitable company," following its recent wave of acquisitions.

Still other independents will likely seek solace through mergers, as illustrated by the recently announced merger agreement between Stone Energy and Basin Exploration. The firms unveiled a plan to merge in a deal valued at $410 million early last week (OGJ Online, Oct. 30, 2000).

Government Developments

THE RENEWED ISRAELI-PALESTINIAN CONFLICT IS NOT EXPECTED TO DISRUPT OIL SUPPLIES.

Robert Morris at Salomon Smith Barney said he doesn't expect a major disruption of Middle East oil, short of a widespread war in that area.

Violence continues to escalate, said former ambassador to Israel and Syria, Edward P. Djerejian, now director of the Baker Institute for Public Policy at Rice University in Houston, "I would not exclude any option, but I would hope [OPEC] will not use the so-called oil weapon."

Djerejian said much will depend on Saudi Arabia, the swing oil producer in the region, and its leaders' close ties to Arafat. But with thousands of Arabs taking to the streets in Middle East countries from Morocco to Oman, Arab leaders have to be concerned about public opinion, he says, potentially narrowing the Saudis' ability to help broker a deal to calm things down in the region.

"It becomes more difficult for Saudi Arabia to play this role when the streets are so impassioned," he said.

Both the Israelis and the Arabs must "rein in the extremists" and get the peace process back on track, Djerejian said. Despite some calls for war, he noted war has dogged the Middle East since 1948 without ever solving the problem. "Another war is not a magic solution," he says. If the crisis continues, Djerejian says, "I think we can see very high energy prices this winter. The market has already demonstrated the jitters."

Prior to his nomination by Pres. Clinton as US Ambassador to Israel, Djerejian served both presidents Bush and Clinton as assistant secretary of state for Near East affairs and Bush and Pres. Reagan as US ambassador to Syria.

Quick Takes

Chevron and Sasol plan to invest more than $5 billion in GTL technology over the next 5-10 years.

Their 50-50 JV for GTL technology development, Sasol Chevron Holdings, will actively pursue application of GTL technology for selected Chevron and Sasol gas reserves, for third-party gas reserves, and on behalf of host countries seeking to monetize their gas reserves.

Sasol and Chevron also entered into an agreement covering certain areas of West Africa to allow the companies to jointly expand their upstream activities and provide additional resources for the global JV's GTL operations.

The JV's first GTL project is the Nigeria Escravos GTL project (OGJ Online, Sept. 11, 2000).

Brazil plans to open its refining sector to private investment.

Brazil is expected to attract new refineries through foreign investment by 2005, said David Zylberstajn, executive director of the National Petroleum Agency.

The director said the expansions will likely occur after Petrobras's oil production reaches more than 2 million b/d. At present, Petrobras produces around 1.2 million b/d.

In Brazil, Petrobras refineries process around 1.7 million b/d of oil. The federal government is pressuring Petrobras to sign partnerships with the private sector in refining to diminish the company's hegemony in the refining sector. Zylberstajn estimates installation of a refinery requires investments of $1-1.5 billion.

Petrobras is working to trim refining costs to 80¢/bbl by 2005 from the present $1.08/bbl. Petrobras's strategic plan calls for an increase in refining capacity of 4%/year to meet estimated consumption of 2.2 million b/d in 2002. Investments for modernizing and expanding the refineries are estimated at $5.5 billion during 2000-05.

In other refining action, Tyumen Oil signed an agreement for a $198 million loan guarantee to modernize the Ryazan refinery, 120 miles southeast of Moscow, the company said last month. The deal was part of a delayed $672 million loan package. The Ryazan loan had been in limbo for more than a year because of BP's opposition to Tyumen's Chernogorneft takeover (OGJ Online, Apr. 10, 2000). Completion of the project is expected in early 2002. Tyumen Oil said, "The modernization, already under way, includes an expanded fluid catalytic cracking unit, a new vacuum gas oil hydrotreater, and a number of supporting facilities. When finished, the project will increase diesel fuel output by 16%, gasoline yield by 25%, and high-octane output by 70%. The project will enable the refinery to meet European specifications for fuels through at least 2005."

Pluspetrol's peruvian unit faces a hefty fine for an oil spill.

Peru's organization for the supervision of the energy industry, Osinerg, ordered Pluspetrol Peru to pay a fine of 600 tax units-1,640,000 soles, or about $470,000-for a 5,500-bbl crude oil spill in the Mara

A barge carrying the oil to the Yanayacu terminal, origin point of the North Peruvian Pipeline, went aground Oct. 3. The barge was carrying 6,612 bbl of oil from Block 8, which is operated by Pluspetrol.

Although the barge is owned by the Peruvian navy and operated by a company called Ofepecos, companies exploring and producing oil and gas in Peruvian territory are responsible for emissions, spills, and disposal of waste or other damages to the environment.

Osinerg on Oct. 9 gave Pluspetrol 5 working days in which to present its case. Pluspetrol did not comply. The company has up to 30 days to pay the fine. Pluspetrol has appealed the fine until the cause of the oil spill is clarified and the amount of ecological damage assessed.

Next year, Petrobras will ink contracts WITH THE PRIVATE SECTOR TO BUILD FOUR OIL TANKERS.

Petrobras is negotiating with Eisa, Maua, and Verolme shipyards in Rio de Janeiro to build two 130,000 dwt Suezmax oil tankers and two Panamax 60,000 dwt tankers at a cost of $150 million.

These new investments will result from easier financing conditions for shipbuilding in Brazil, increasing amortization for loans to 20 years from 15, reducing interest rates to 4% from 6%, and increasing the maximum value of financing to 90% from 85%, said Mauro Campos, president of Transpetro, the transport subsidiary of Petrobras.

Coflexip stena plans to build a rigid pipe spool base.

Coflexip Stena Offshore Group said that one of its units, Coflexip Stena Offshore Inc. (CSOI), will build a rigid pipe spool base at Mobile, Ala., to support its offshore pipelay and construction work with the CSO Deep Blue and CSO Apache vessels in the Gulf of Mexico.

The base is on a 130-acre site for which CSOI secured a long-term lease. The $10 million investment involves a deepwater dock, access roads, rail access, storage areas, and infrastructure for high-specification pipe welding, preparation, and loading.

It will provide a facility for the assembly, storage, spooling, or loading of rigid pipelines before installation in deepwater.

The first project for the base will be CSO Deep Blue's 100-mile Boomvang-Nansen export pipeline project contract, announced last month (OGJ Online, Oct. 11, 2000).

In other pipeline news, Buccaneer Gas Pipeline-a joint project of Duke Energy and Williams-said Pasco County, Fla., approved Buccaneer's landfall. The 674-mile gas pipeline will cross the Gulf of Mexico from Mobile Bay to a point just north of Tampa Bay. The company expects to receive a final US FERC certificate early next year.

BP has begun a $100 million/year, 4D seismic program for its North Sea fields that will last at least the next 5 years, said BP.

The supermajor said a $10 million, 4-year seismic processing contract awarded last month to Cie. Generale de Geophysique was the first in a number of contracts for its 4D seismic data initiative.

Peter Rattey, BP exploration business unit leader in Aberdeen, said "...This contract is the first in a number that will be awarded over the forthcoming months, which will include acquisition and further processing, leading to continued drilling. These contracts will... [stimulate] more infill drilling programs to extend the lives of producing fields."

In other exploration news, Swift Energy New Zealand entered into agreements with subsidiaries of Fletcher Challenge Energy (FCE) to earn participating interests in properties in New Zealand's Taranaki basin. Swift will earn a 20% interest in PEP 38718, which covers 57,401 acres, and a 25% participating interest in PEP 38730, covering 48,929 acres. As operator, FCE was to begin drilling on the Tuihu prospect in the northern portion of PEP 38718 in late October (OGJ Online, Oct. 20, 2000). The well is expected to be completed in 45-60 days. Swift also announced that the second delineation well at its Rimu discovery in the Taranaki basin, the Rimu-B2, spudded Oct. 24, will take 45-60 days to complete. The Rimu-B2 well is the third well to be drilled by the company in the Rimu area. Swift holds a 90% interest in this permit (PEP 38719), which covers 100,652 net acres both onshore and offshore on the western coast of New Zealand's North Island.

Afire halted production at woodside energy's newest producing field off Australia.

Woodside Energy said a fire last month caused it to shut down production from the Laminaria and Corallina fields, but flow disruption is expected to be minimal.

The company has begun an investigation into the blaze on the Northern Endeavour FPSO vessel, which produces from the fields on Block AC/L5 off Australia. The fire was localized at the LPG-recovery system, said Woodside. Production was automatically shut in as soon as the fire began. The vessel's automatic deluge system and on-board fire response crew quickly controlled the blaze. No one was injured, and the fire caused no environmental problems, said the company.

Woodside expects the damage to the system to be minimal. Production was scheduled to restart in late October, said the company. Equity interests in production license AC/L5 and the Corallina oil field are Woodside Energy, 50%; BHP Petroleum (North West Shelf), 25%; and Shell Development (Australia), 25%. Equity interests in the Laminaria oil field are Woodside, 44.9%; BHP, 32.6%; and Shell, 22.5%.

Elsewhere on the production front, Emerald Energy said that the Gigante No. 1A well in the Upper Magdalena Valley in Colombia is back in production following remedial work to clean up the site after a blowout and fire earlier this year (OGJ Online, July 12, 2000). Oil production is flowing at 2,400 b/d. A pressure test is now being conducted before installation of an electric submersible pump that is expected to boost production to more than 4,000 b/d.

Shell Canada warned that it expects costs to rise at its $4.1 billion Muskeg River oilsands project near Fort McMurray in northern Alberta. Shell said there is potential for a 10% cost increase in the upgrader portion of the project, originally estimated at $2.4 billion. Shell said the project is on schedule for completion in 2002. Shell said the increases are due to labor and bulk material costs and more definitive engineering. Shell has a 60% interest in the project, which includes the Muskeg River mining operation and a bitumen upgrader at Shell's Scotford refinery, near Edmonton, which will be linked to the mine by a pipeline.

Statoil takes center stage this week in development news.

Statoil said it is mulling over a plan to develop a marginal 6-7 million bbl oil structure 9 km east of its Danish North Sea Siri field.

Statoil is developing Siri with a production jack up platform mounted on a 14,500-ton storage tank, which was installed in November 1998 (see photo). Although no final development decision has been made, current thinking at Statoil favors the use of a small unmanned wellhead platform linked by oil, gas, and water injection flowlines and remotely operated from the Siri platform.

The oil company suggested that bringing the Siri East satellite on stream via a "low-cost and efficient solution" would "demonstrate that [Statoil] can also make profitable use of small discoveries."

Although the satellite is not expected to provide sufficient oil to extend the producing life of the Siri installation beyond the forecast 6-8 years, Statoil has plans to add "several strings to Siri's bow" by drilling on the Siri East Downdip and Sara structures. Statoil estimates that Siri field holds some 51 million bbl of oil. The partners at Siri are Statoil (40%), Enterprise Oil (20%), DONG E&P (20%), Denerco Oil (7.5%), and Phillips Petroleum (12.5%).

Meanwhile, Statoil confirmed an extension of the Agbami structure in Offshore Production License 217 off Nigeria with a recently completed well.

A production test of one oil-bearing zone in the Ekoli-1 discovery well flowed 4,800 b/d. Drilled by R&B Falcon's Deepwater Millennium drillship in 1,461 m of water, the well reached a maximum depth of 4,510 m between July 7 and Oct. 3. It penetrated an extension of the Agbami structure that Texaco proved with the Agbami-1 well in neighboring Block 216 last year.

Erik Syrstad, manager of Statoil's Lagos office, said the Ekoli-1 "came in as forecast, confirming that Agbami extends into our 217 block and substantially increasing that field's proven reserves." Statoil Nigeria holds 53.85% of OPL 217, while Texaco Nigeria Outer Shelf holds the remaining 46.15%.

In other development action, Kufpec Indonesia awarded contracts to a consortium of PT Istana Karang Laut (IKL) and Daewoo Corp. for development of Oseil oil field off Indonesia. The contract covers Phase I engineering, procurement, installation, and construction (EPIC), together with an operations and maintenance contract for the Phase I production period of about 2 years. The lump sum agreement is worth $61.7 million. The Oseil oil discovery within the Seram JV area in the Maluku Sea is slated to come on stream in first quarter 2002. Initial production is anticipated at 12,000-18,000 b/d of oil. Project duration of the EPIC contract is anticipated to be 18 months. Kufpec Indonesia is a unit of Kuwait Foreign Petroleum Exploration.