OGJ Newsletter

Market Movement

Methanol markets confound expectations

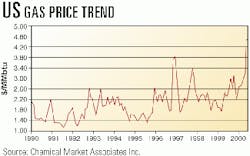

Instead of the oft-predicted global surplus in supply of methanol and resulting soft prices, the market has seen a tightening supply-demand balance that occasionally yielded spot prices higher than the prices for volumes under contract-a good indicator of a robust market.

Methanol demand has remained surprisingly strong, in all derivative sectors and all world re- gions, ac- cording to Chemical Market Associates Inc. (CMAI), Houston.

"Especially significant was methanol demand for formaldehyde and MTBE production, despite fears of an eventual MTBE phasedown or phaseout in the USA," CMAI said. "The economy in most Asian countries turned the corner quite quickly in mid and late 1999 from the recession of 1997-98. This created unexpected strong methanol demand in 2000; [a] demand [level] that was not expected for 1 or 2 more years."

The surge in spot prices in major regional markets owed to the combination of high natural gas prices in the US and Europe and local and regional tightness in methanol supply.

Crucial developments included the start-up problems with world-class new methanol plants in Iran and Trinidad and Tobago that had been expected to go on line early this year; both were delayed from coming on line with full capacity by at least 6 months.

The supply outlook was also aggravated by an unusually large number of plant operating problems, regular maintenance turnarounds, and several plant closures spurred by the high cost of feedstock natural gas (see chart).

"This on-purpose outage was double the 1.5 million tonnes of new capacity that was scheduled for completion in Iran and Trinidad, and this contributed to a significant supply shortfall," CMAI said.

"Experience has demonstrated that, when feedstock prices in the USA remain below $2.00/MMbtu, local production can compete with most offshore facilities," it said. "But when feedstock values in the USA go above $2.00-2.50/MMbtu, US methanol plants start to lose their competitiveness."

Gas markets still looking tight as heating season arrives

With the official start of the heating season arriving Nov. 1, are US natural gas markets looking any less tight than they did a few weeks ago?

Analysts last week continued to voice concerns about gas price spikes this winter because of low storage levels, along with expectations of a return to near-normal colder temperatures in key heating areas of the US.

In order to reach a storage level of 2.7 tcf of gas by Nov. 1, the industry late in October faced having to inject another 53 bcf of gas into storage facilities at the rate of 7.6 bcfd, said Ronald Barone, gas industry analyst at PaineWebber.

That's considerably more than the refill rate of 900 MMcfd at this same time in 1999, when industry managed to meet its targeted 3 tcf by the start of the heating season. The prior 5-year average gas storage injection rate for the same period was 4.6 bcfd, Barone said.

An early cold wave limited gas injections to only 29 bcf during the week that ended Oct. 13, including injections of 20 bcf in the US East, 3 bcf in the West, and 6 bcf in the primary US gas producing region, he said. That compares with total injections of 62 bcf during the first week of October and injection rates of 42 bcf and 58 bcf during the same periods in 1999 and 1998, respectively.

Despite a return to milder temperatures during the week ended Oct. 20, the industry won't be able to make up that shortfall, Barone said. A projection of 2.7 tcf-or less-of gas in storage by Nov. 1 "remains on track," he said.

Moreover, the latest forecasts suggest "normal" winter conditions in the Midwest, Northeast, and Mid-Atlantic regions this year, with warmer-than-normal conditions in the south-central and Southwest US.

Combining with weather and storage factors are "a robust underlying demand creep" even through the "very mild winters" of recent years, and "ongoing questions" about deliverability in the face of rapidly accelerating depletion rates in the main gas producing areas, said Barone.

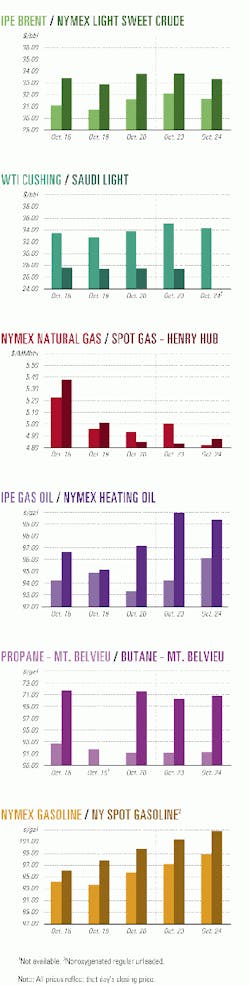

Industry Scoreboard

null

null

null

Industry Trends

GLOBAL MARINE'S SCORE SHOWS oFFSHORE DRILLING ON THE UPSWING.

Global Marine said its Summary of Current Offshore Rig Economics (SCORE) for September increased to 33.8, up 1.8% from the previous month.

SCORE compares profitability of current mobile offshore drilling rig rates with that of the industry's 1980-81 peak.

The September 2000 SCORE represents a 46.6% increase from September 1999 and a 23.6% decrease from the same period 5 years ago (see table).

Global Marine Chairman, CEO, and Pres. Bob Rose said, "September marks the 13th consecutive month of improvement in the worldwide SCORE and the 15th consecutive month of improvement in the Gulf of Mexico SCORE. With worldwide offshore drilling rig utilization at 80%, commodity prices strong, and customer inquiries about extended drilling programs in international locations on the rise, we appear to be well-poised to see a continued worldwide strengthening of offshore rig markets."

US Natural gas pipeline and storage capacity must be increased by 50%, or 40 bcfd of deliverability, to accommodate operating needs of new gas-fired power generation, says Jim Donnell, CEO of Duke Energy North America.

"We need tremendous increases in storage," he said, to support up to 300 Gw of new electric generating capacity. "There is no other means to meet the operational needs for fueling the merchant generation fleet." Donnell contends that much of this incremental demand exists today and that the majority of the balance will be needed by 2005, Donnell said this month at the PowerMart conference in Houston.

Donnell is confident about the power industry's ability to add generation to serve growing demand. Over a reasonable period of time, the industry has the ability to add new resources in the regions where the need is greatest, he said.

But coming up with an additional 7 tcf/year of gas supply will be a serious challenge, he said.

"Rig counts will have to ramp up, trained operating staff will have to come from somewhere," Donnell said. Producers will be forced into costlier, deeper waters in the US Gulf of Mexico and off northern and eastern Canada, he added.

Government Developments

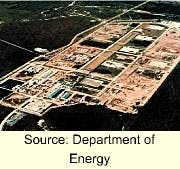

US DOE reopened bidding for 7 million bbl of crude from the Strategic Petroleum Reserve after three companies that had previously submitted winning offers could not provide the necessary financial guarantees (see Watching Government, p. 30).

Separately, DOE said filling of the 2 million bbl heating oil reserve in the northeastern US is complete.

DOE had offered to swap 30 million bbl of SPR oil in exchange for that amount, plus additional oil, to be returned next year. After three obscure small firms failed to provide letters of credit and thus had to relinquish their winning bids, three well-known companies stepped in to take up the 7 million bbl reoffered by the Oct. 23 deadline. The new winning bidders were BP, 3 million bbl, Vitol, 2.5 million bbl; and Marathon Ashland, 1.5 million bbl.

DOE made two major changes in the solicitation: the crude must be taken before Jan. 1, rather than before Dec. 1, and a bid bond must accompany offers.

DOE said the bond must guarantee that, if the winning bidder cannot produce the required letter of credit, it must pay the lesser of 5% of the value of the offer or $3 million.

To ensure that small businesses could participate, DOE reduced the dollar threshold from $10 million, the amount it would require in an actual emergency drawdown and sale of SPR crude.

And it said the letter of credit must be for 110% of the value of the SPR crude on the day of the contract award, rather than the 100% previously set.

An innovative government-backed mentoring scheme, designed to aid small and medium-sized enterprises (SMEs) in the UK offshore industry in bringing their services and technology more quickly to market, was launched this month in Aberdeen.

Through the scheme-the Oil & Gas Business Mentoring Initiative-senior executives from oil industry mainstays including BP, Royal/Dutch Shell, Hallibur- ton, and Wood Group Engineering, will work in "close partnership" with 20 SMEs across the UK over 18 months to "develop ways to better align business strategies and practices."

It is hoped the scheme, launched by the UK Department of Trade and Industry (DTI), and government-industry partnership body Pilot, will help SMEs build a greater understanding of the industry's future needs, while giving major oil companies and contractors a "better insight" into issues facing suppliers and service specialists.

First order of business for the mentors and the SMEs, said DTI, will be drawing up a strategic program identifying "improvements" to be made in both the mentor company and its charge. The work will be supported by the formation of a new network-the Mentors & Mentees Club-which will launch a website and meet quarterly to discuss the scheme's progress.

Quick Takes

Esso e&P Chad and its partners have started construction on the Chad-Cameroon oil development and pipeline project, said parent ExxonMobil.

The $3.5 billion project will develop oil fields in southern Chad and transport the crude oil 663 miles to the coast of Cameroon for export. The project is expected to start up as early as 2003. Production is expected to reach 225,000 b/d of oil.

Esso E&P Chad Pres. Pres. Tom Walters said, "Pipeline installation will begin in 2001, parallel with construction of oil field processing facilities. Drilling of the first of the planned 300 wells will begin in late 2001 and continue through initial production start-up." Esso E&P Chad is the operator of the consortium developing the project. Other partners are Petronas and Chevron.

In other development news, TotalFinaElf awarded Iranian Offshore Engineering & Construction (IOEC) and its Singapore partner, Sembawang-a unit of Sembcorp Industries-a subcontract to work on the Balal oil field project off Iran, reported Middle East Economic Digest. The contract is worth $100 million and includes construction of a wellhead platform, living quarters, production facilities, a flare tower, and a bridge. The choice of IOEC and Sembawang follows a year-long dispute between National Iranian Oil Co. (NIOC) and TotalFinaElf over which should repair or replace a 100-km subsea pipeline to the coast, damaged during the 8-year Iran-Iraq conflict. The dispute has now been settled, and "NIOC has undertaken responsibility for the line," reported the weekly, adding NIOC is now negotiating a "repair contract with three unidentified [Persian Gulf]-based firms." Unocal is gearing up to start its first crude oil production in the Gulf of Thailand, a development expected to cost $270 million over the next 6 years. Unocal Thailand has submitted an application to the Thai Department of Mineral Resources for commercial crude oil development from Yala, Plamuk, Surat, and North Kaphong fields. Unocal expects to start producing 3,500 b/d of crude in July next year from Plamuk, Yala, and Surat, ramping up to about 15,000 b/d towards yearend, according to Randy Howard, Unocal vice-president for international energy operations.

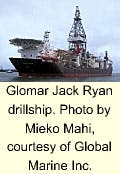

global marine's jack ryan drillship will soon enter the fleet.

The drillship construction cycle that began 3 years ago is nearing completion with delivery of Global Marine's Glomar Jack Ryan. The two remaining drillships still on order-R&B Falcon's Deepwater Discovery and Transocean Sedco Forex's Discoverer Deep Seas-should join the fleet by yearend.

The 759-ft long Jack Ryan will depart for Trinidad and Tobago in early November to begin a 3-year contract for ExxonMobil. Global Marine will receive a day rate of about $195,000 for the drillship. The vessel has a streamlined hull that allows transit speeds of up to 13.52 knots.

While drilling, the Jack Ryan will maintain station within 1 m through the assistance of six fully retractable thrusters, a differential global positioning system, and an acoustic backup. The ultradeepwater vessel is equipped with 8,000 ft of riser and will be able to drill in 12,000 ft of water with additional riser. Rated drilling depth is 35,000 ft.

oil production ENHANCEMENT PROJECTS take center stage this week.

Lundin Oil and its partners are implementing a production enhancement project at their Bunga Kekwa field in the PM3 offshore block in the commercial arrangement area between Malaysia and Viet Nam. The partners have already reperforated two producing wells to boost field production to 15,000 b/d, since Oct. 6, from 13,500 b/d.

Design work is under way to boost production from existing wells and to drill two additional development wells during the first quarter of 2001. This program should result in an estimated sustainable production rate of 17,000 b/d, officials said.

They report that work is proceeding on schedule for Phase II of the development project, which should increase production to 40,000 b/d of crude oil and condensate and 250 MMcfd of natural gas after September 2003.

As a result of optimization studies, officials said, capital costs associated with Phase II have been reduced by almost $100 million, or 16% of the original $620 million budget. Lundin Oil holds a 41.44% interest in Block PM3 through subsidiaries Lundin Malaysia AB and operator Lundin Malaysia Ltd. Partners include Petronas Carigali, with 46.06% interest, and Petrovietnam Exploration & Production, 12.5%.

Meanwhile, PanCanadian Petroleum and Dakota Gasification Co. (DGC), a unit of Basin Electric & Power Cooperative, officially launched their Weyburn, Sask., CO2 miscible flood project. The $1.1 billion (Can.) Weyburn project will inject 95 MMcfd of CO2 into the 46-year old Weyburn oil field in southeastern Saskatchewan (OGJ Online, July 19, 2000). Injection, which is already under way, will boost oil production by more than 50% to 30,000 b/d over the next 10 years. The first incremental production is expected next year, said DGC. DGC will supply the CO2 from the Great Plains Synfuels plant at Beulah, ND, to Weyburn. The Weyburn project will sequester 14 million tonnes of CO2 that would otherwise be vented to the atmosphere. The synfuels plant produces 160 MMcfd of natural gas from coal gasification. F The first of four production wells spudded at Statoil's Huldra field in the Norwegian North Sea had to be rapidly shut in this month as gas began flowing in while completion was being carried out aboard the M

THE E&D BOOM IN BRAZIL TOPS EXPLORATION NEWS THIS WEEK.

Brazil's National Petroleum Agency (ANP) will offer 53 blocks in the third licensing round for oil and gas E&P.

The round is expected to take place in June 2001, ANP Executive Director David Zylbersztajn announced at the Rio Oil & Gas Conference in Rio de Janeiro Oct. 19. Blocks offered during the third round are in 12 Brazilian basins, 10 onshore and 43 offshore.

Most of the blocks are in three of the most prolific basins: Santos, Campos, and Espirito Santo, where 34 blocks will be put up for tender. Areas in exploratory frontiers, such as the ParáMaranhão, Barreirinhas, and Jequitinhonha basins, will also be offered.

Of the 43 offshore blocks, 12 are in water depths of less than 400 m, and 31 are in deep waters and ultradeep waters ranging to more than 3,000 m. The average size of the blocks in this third round is 1,695 sq km.

Alliance Pipeline is shifting its commercial in-service date from Oct. 30 to Nov. 13 to complete system commissioning activities on the pipeline system.

The line, part of a system to carry Canadian gas to Northeast US markets, stretches from northeastern British Columbia to the Chicago area.

Commissioning activities have been under way for some time, and the system is flowing 400-500 MMcfd of test gas. "As we have increased the flow of test gas volumes during our system commissioning, we have encountered moisture and debris from construction," said Norm Gish, chairman, president, and CEO of Alliance Pipeline. Debris mostly consists of small pieces of foam from the pigs used to remove hydrostatic test water from the line.

The problem forced Alliance to shut down the system for short periods of time to clean it out. Additional in-line screens designed and installed at Alliance's compressor stations have improved the situation but haven't allowed workers to run the system with the significant volumes necessary to adequately test the system's compressors, officials said.

They expect to move increasing volumes of test gas, approaching the line's firm delivery capacity of 1.325 bcfd, before Nov. 13. Investors in the Alliance Pipeline system include affiliates of Coastal, 14.4%; Enbridge, 21.4%; Fort Chicago Energy Partners, 26%; Williams,14.6%; and Westcoast Energy, 23.6%.

Elsewhere on the pipeline front, Russia's Gazprom is keen to participate in the 39.28 billion yuan construction of China's longest natural gas pipeline, to stretch between Xinjiang and Shanghai. Although PetroChina Co. stated it would welcome foreign investment, Gazprom's enthusiasm has not been met with a positive response from PetroChina. The company is unlikely to consider Gazprom as a partner because, it said, Russia is not technologically sophisticated enough and has limited financial resources. The 4,167-km pipeline linking Xinjiang and Shanghai is spearheaded by PetroChina, and construction will start next year. No foreign companies have made a commitment to the pipeline investment. As a result, PetroChina is likely to act alone. Duke Energy Gas Transmission (DEGT) said last week that it plans to expand its East Tennessee Natural Gas system by building a 95-mile extension from Virginia into North Carolina. DEGT said the line, dubbed the Patriot extension, will transport natural gas from producers in the Appalachian region and from the Gulf Coast. It also will provide gas to portions of southwestern Virginia for the first time, said the company. Patriot will extend from the East Tennessee system in Wythe County, Va., cross Carroll, Patrick, and Henry counties in Virginia, and end in Rockingham County, NC, where it will connect with a Transco pipeline. The 24-in. pipeline will be coupled with East Tennessee system mainline enhancements to initially transport 200 MMcfd of gas beginning in fall 2002. The pipeline extension is expandable, in increments, to 600 MMcfd. Gas demand in the region is growing by 4%/year, driven by gas-fired electric generation, said DEGT, describing the extension as the centerpiece of a $215 million project. Norway's Norsk Hydro awarded European Marine Contractors (EMC) a $8.7 million contract to build and install the Vesterled pipeline, which will link the Norwegian gas network and the Frigg Norwegian Association (FNA) pipeline in the Norwegian North Sea.

The fast-track contract, which includes an option for installation of the pipeline for the Norskpipe project, will be carried out in second and third quarters 2001. Once in place in water depths of 110-125 m, the 53.5-km long, 32-in., Vesterled pipe will tie into the "entire Norwegian gas transport network" to the UK via the St. Fergus terminal in Scotland, according to Hydro. The company said "substantial" gas volumes would be available from Norway after 2007. The Vesterled pipeline will have an annual capacity of 11 billion cu m. The project is budgeted at $101 million and includes part of the investment needed to build a new riser platform at Heimdal. As sole bidder, a consortium led by Tecgas NV, a subsidiary of Techint SA, won the concession for transportation and distribution of gas and liquids from Camisea natural gas fields in Peru 8 months after a consortium led by Pluspetrol Resources was awarded the contract for exploitation of those fields. The transportation and distribution contract tender had been postponed several times previously (OGJ Online, Sept. 18, 2000). More than one bid had been expected. The Techgas consortium bid $1.449 billion for the concession, $2 million less than the maximum $1.451 billion value set by the Camisea committee. Spain's Gas Natural Group pulled out of the consortium, which is now composed of Techgas, Argentina's Pluspetrol Resources, Hunt Oil, South Korea's SK Corp., Enterprise Oil, Sonatrach, and Peru's Graña y Montero.

topping alternative FUELS news, the use of vehicles driven by methanol fuel cells is to be evaluated by an international partnership that includes Statoil, DaimlerChrysler, BP, BASF, Methanex, and Xcellsis.

Under the agreement, "various measures will be assessed with a view to facilitating the introduction and commercialization of such vehicles," said Statoil.

Sjur Haugen, business development manager for Statoil's methanol unit said, "Methanol represents an automotive fuel that could be distributed over most of the world at a realistic cost by using existing infrastructures."