NLNG set to add LPG volumes to world trade

Based on a presentation to the 13th Annual Purvin & Gertz US/International LPG Seminar, Houston, Mar. 21-23, 2000.

In June 1999, after 3 years of construction, Nigeria LNG Ltd. (NLNG), completed its two-train, 5.9 million tonnes/year (tpy) base project on time and under budget. Currently, NLNG has begun work on Train 3.

With these facilities, the country will begin to play a major role in the LPG export market.

NLNG, a limited join-venture company incorporated in Nigeria in 1989, is owned by Nigerian National Petroleum Corp. (NNPC, 49%), Shell Gas BV (25.6%), Cleag Ltd. (ELF; 15%), and Agip International BV (10.4%).

The business of the company is to liquefy natural gas produced from the large gas reserves owned by three joint-venture projects in Nigeria for the export market. The company's liquefaction plant is in Finima on Bonny Island in Rivers State, Nigeria.

The decision to construct the base project (two-trains) was taken by the shareholders in November 1995. Construction of the plant started that year with first cargo exported in October 1999.

In 1997, NLNG studied the feasibility of expanding the LNG plant, and in February 1999, fewer than 18 months after preliminary evaluations, decided to embark on a fast-track expansion LNG project with construction of a third LNG processing train of essentially identical design and capacity as the two trains in the base project.

The engineering, procurement, and construction (EPC) contract for the expansion project was awarded to TSKJ, a consortium of Technip, Snamprogetti, MW Kellogg, and Japan Gasoline Corp. (JGC) in March 1999 and the facilities will start operations in fourth quarter 2002.

The scope of the expansion project includes modifications to enable the entire plant to process 100% associated gas. This will allow monitization of substantial amount of the gas that is currently being flared, and, as importantly, the expanded three-train plant will have a significant volume of LPGs available for export

Base-project design

Nigeria LNG is a Nigerian-registered company incorporated in November 1989 whose liquefaction plant sits on Bonny Island, approximately 40 km south of Port Harcourt, Rivers State, in southeastern Nigeria.

It stands on the Bonny River bank, about 3-km north of its confluence with the Atlantic Ocean. Other industrial facilities on the island include Shell's Bonny crude oil terminal and Mobil's Oso NGL plant.

The total facility consists of the two-train LNG plant, a 217-km gas-transmission system, and a residential area for staff.

NLNG's plant site is large enough to accommodate five LNG trains (Fig. 1). The base project involved the construction of the first two trains and associated facilities, while the third train is being constructed alongside the first two. Further development of the site is under active consideration.

Successful completion of NLNG's base project alone represents a major advance for the Nigerian economy. It will enable Nigeria to diversify its economy, reduce gas flaring and its dependence on export of oil, develop its substantial gas reserves, and generate a major new source of income as it becomes a major player in meeting the demand for LNG and LPG in the Atlantic and the Mediterranean basins.

The base project LNG plant consists of the following:

- Two liquefaction trains, each with a design LNG production capacity of 2.9 million tpy (assuming 329 on stream days/year), feed-gas pretreatment to remove acid gas using diethanolamine (DEA), dehydration, and treated-gas liquefaction using propane pre-cooled-mixed refrigerant liquefaction technology with no LPG recovery except for refrigerant make-up.

All refrigeration compressors and electric power generators are gas-turbine driven. Recirculated freshwater cooling water is used for all plant cooling requirements.

- Each liquefaction train also includes a refrigerant fractionation process consisting of a demethanizer, de-ethanizer, depropanizer, and debutanizer for recovery of ethane and propane for refrigerant make-up purposes and condensate (C5+ fraction) as a saleable by-product.

- Condensate production of 2.2 million bbl/year. Condensate cargo sizes (35,000-45,000 tonnes).

- Two condensate storage tanks with a gross capacity of 36,000 cu m each.

- Power generation and common facilities. A fully, self-supporting grassroots installation producing all required electric power, potable water, firewater, instrument air, inert gas, heating fluids, and sewage and industrial waste treatment.

- Two 84,200-cu m capacity, full-containment aboveground LNG storage tanks.

- LNG loading facilities capable of loading 135,000-cu m ships via a dedicated marine jetty. The LNG loading jetty is also used for condensate loading and has a capacity of 10,000 cu m/hr of LNG and 4,000 cu m/hr of condensate.

- A materials off-loading jetty built for use during plant construction will be used as the plant marine base for mooring tugs, pilot boats, etc. as well as continuing to be a materials and equipment receiving dock during operation of the plant.

- A residential area.

- Seven LNG carriers.

The health, safety, and environment (HSE) policy established by Nigeria LNG Ltd. contributed substantially to the success of the project. NLNG has strictly enforced internationally accepted norms and standards in respect of HSE. These will continue to be met by the company, its contractors, and subcontractors for all expansions of the site.

In addition, several environmental studies have been commissioned since the inception of the base project including an environmental baseline study and an environmental impact assessment (EIA) study.

These studies confirmed that the plant construction met the standards demanded by international organizations, Nigeria's Federal Environmental Protection Agency (FEPA) and Department of Petroleum Resources before the project was certified for construction.

After review of the project's environmental impact study, FEPA issued a certificate in late 1995 allowing the LNG project to proceed, subject only to the requirement that the project implement the policies and procedures stated in the EIA.

The federal government's Ministry of Petroleum Resources issued a license to construct an LNG plant at Bonny, Rivers State, in December 1995.

Shell Gas Nigeria BV (Shell) was retained by NLNG as project technical advisor in December 1993 for the base project. Services for construction activities are provided under a construction services agreement and services for operations are provided under an operating services agreement.

Construction of foundations for the base project began November 1996. The first liquefaction train (Train 2) achieved "ready for start-up" status on the cryogenic section at the end of August 1999 with first LNG production to storage on Sept. 15, 1999, and the first LNG cargo shipped in October 1999.

Train 1 was started up in February 2000 and, after a short period of testing, was put into production. The two trains are currently producing at design capacities.

Train 3 design

NLNG's decision to expand, taken before completion of the base project, was strongly rooted in the recognition that there was a market for increasing LNG sales beginning in 2002-2003.

The company therefore adopted an accelerated project development and execution plan that allowed a reduction in capital expenditure by awarding the third-train EPC contract to TSKJ, which was already on site and familiar with the requirements of Bonny Island.

Likewise the accelerated schedule was also made possible by the decision to construct Train 3 as an exact copy of Trains 1 and 2. The total time between the development decision and final investment decision on Feb. 21, 1999, was only a year. This is probably the best ever in the LNG industry.

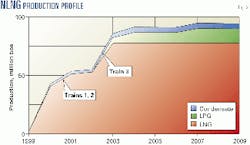

The third train will also be water-cooled and capable of processing 2.9 million tpy of associated or non-associated gas. The expanded plant will then be able to deliver up to 1.2 million tpy of LPG in a first step when supplied with 100% associated gas (Fig. 2).

The third train expansion project consists of the following:

- The additional liquefaction train, copying exactly the design of the existing two trains and capable of processing 2.9 millions tpy, includes full LPG recovery and fractionation for refrigerant manufacture.

As with the base project, all refrigeration compressors and electric-power generators will be gas turbine-driven cooled with recirculated freshwater cooling water.

- The third liquefaction train will also include a refrigerant fractionation process consisting of a demethanizer, de-ethanizer, depropanizer, and debutanizer for recovery of ethane and propane for refrigerant make-up purposes and condensate (C5+ fraction) as a saleable by-product.

- Installation of a new common fractionation unit will handle the increased LPGs resulting from the associated gas as feedstock. The common fractionation unit has 800,000 tpy LPG capacity and is designed to process approximately 70% of the overall LPGs with the remainder processed by the in-train fractionation units.

The common fractionation unit includes demethanizer, de-ethanizer, depropanizer, and debutanizer columns with its own propane-chilling unit for various cooling services.

- Two additional, larger condensate stabilization units are each designed for 70% of condensate production at average gas conditions. They have the capability for full debutanization of the condensate stream to meet required product vapor-pressure limits.

- An additional 84,200 cu m full-containment aboveground LNG storage tank will be installed.

- Propane and butane atmospheric (refrigerated) storage tanks, each of 65,000 cu m (net) and 71,000 cu m (gross) capacity, will be installed.

- An LPG loading jetty with 3,000 cu m/hr loading capacity extended to 15 m water depth in the Bonny River channel will be installed.

- The common utility systems supporting the base project will be expanded and includes installation of two new electric power turbine-generators, an additional heat-transfer storage tank, an additional demineralized water train, and two additional instrument main air compressors.

- A bunker-fuel offloading and a marine passenger terminal will be relocated to avoid conflicts with the new LPG loading jetty.

- The base project's liquefaction Trains 1 and 2 will be modified to accommodate 100% associated feed gas.

The major modifications include changing the acid-gas removal process on liquefaction Trains 1 and 2 from diethanolamine (DEA) to activated methyl diethanolamine (MDEA), changing the molecular-sieve mixture in the dehydrators, and modifying the in-train fractionators for LPG exports.

Construction at Bonny is well underway with completion set before the end of 2002. Total plant guaranteed LNG capacity for the three trains would be 8.7 million tpy, the equivalent of 10.85 billion cu m gas delivered.

- Two newly built LNG carriers will have 138,000-cu m capacity each.

Suppliers, customers

One key factor that has contributed to NLNG being able to commence operating the base project according to schedule and to expand the plant is that the company has been able to guarantee gas supplies.

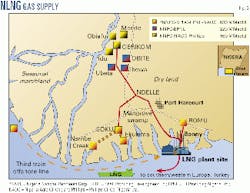

It has signed long-term agreements with three joint ventures operated by Nigerian affiliates of NLNG's three foreign shareholders (Shell, ELF, and Agip) but always with NNPC as the majority shareholder. These foreign shareholders will supply the now 1.5 bcfd feed gas needed for the first three trains (Fig. 3)

Another factor is that NLNG has entered into long-term LNG sale and purchase agreements for the base project with Italy's ENEL, Spain's Gás Natural, Turkey's Botas, Gaz de France, and Portugal's Transgas.

For the Train 3 expansion, the design capacity guarantees the delivery of 3.7 bcm/year and a 21-year take-or-pay LNG sales agreement has been executed with Spain's Gás Natural for 2.7 bcm/year, which will make the Gás Natural group NLNG's largest customer. The balance has been sold to Transgas, making NLNG the only supplier of LNG to Portugal.

For the base project, these volumes represent 100 cargoes/year at plateau and 150 cargoes/year when Train 3 comes on stream and reaches plateau level.

The company currently has seven vessels in its fleet with a freight capacity of 122,000-135,000 cu m in place for the transport of LNG from Bonny Island to its numerous buyers overseas.

Four of these, the LNG Bonny, LNG Finima, LNG Port Harcourt, and LNG Lagos, were purchased in 1990 by Bonny Gas Transport Ltd. (BGT), a wholly owned Bermudan subsidiary of NLNG.

In addition to these four BGT vessels, NLNG in 1999 purchased the LNG Abuja and the LNG Edo from Lachmar, a subsidiary of Duke Energy, and has secured another vessel, the LNG Delta, under a long-term time charter, with a purchase option, from Shell Bermuda (Overseas) Ltd.

As mentioned, in addition to the existing seven-vessel fleet, NLNG has ordered two new 138,000-cu m LNG carriers to meet additional shipping requirements when Train 3 comes on stream.

The order for the two Moss-tank-type vessels went to Hyundai Heavy Industries Co. Ltd., South Korea, in August 1999, for delivery in August and September 2002.

LPG production

As mentioned, the two LNG trains of the base project were designed for a specified range of feed-gas composition.

Because a large proportion of the feed gas was to be provided from dry gas fields, the first two LNG trains were initially designed around this composition. Except for refrigerant make-up, no LPG separate production for export was contemplated at this stage.

The decision for the entire complex to be able to run on 100% associated gas from the start of Train 3 was going to affect the operation of the liquefaction trains and the quality of the LNG rundown. Fig. 4 presents the growth of LPG production through 2007 and beyond.

The most significant effects of additional associated-gas processing are as follows:

- CO2 content. Because of the feed-gas composition range of some of the gas suppliers, it will be necessary to debottleneck the CO2-treating unit.

- Feed gas ethane content. One of the most important issues for processing associated gas for LNG exports is the level of ethane in the feed.

It is imperative that the feed gas to the LNG trains have low levels of ethane commensurate with the LNG sales specification and the ability of the trains to reject ethane (into fuel).

- Feed gas pentane-condensate ratio. The ratio of pentane to condensate in the feed gas is significant in determining if there is an excess of pentane, which cannot be blended into the condensate product.

Should the feed-gas composition change so that the ratio of pentane to condensate (C5/C5+) increases, then an excess of pentane will result if the condensate vapor-pressure specification is maintained.

- Feed-gas LPG content. The level of LPG in the feed gas is important because LPGs are used for control of the LNG heating value and Wobbe Index.

The excess LPGs greater than what is required for heating-value control will be exported as separate products, and an LPG export scheme has been required as part of the Train 3 plant expansion.

Process configuration

Additional feed gas is supplied through the existing gas-transmission system, which will be increased in capacity by the addition of booster compression, and a new offshore gas pipeline to bring in associated gas from the fields offshore the Niger Delta.

A common fractionation plant with an LPG production capacity of approximately 1 million tpy will be installed to separate additional liquids recovered as the result of associated-gas processing in the three LNG trains.

Associated-gas content of the feed gas is maximized as soon as the ethane-recovery process constraints in the three LNG trains are removed. This is possible because LNG train debottlenecking increases the ability to reject ethane and maximizes overall capacity to produce LNG.

Major features of the LPG facility will be the following:

- Train design is already available.

- Fast-track development; same operator skills.

- Same EPC contractor.

- No impact on the current EPC contract. Trains 1 and 2 debottlenecking will occur during the first train turn-around set for this month.

- All excess LPGs (that is, above specifications of commercial LNG) are exported. New LPG storage and loading facilities are required. Separate refrigerated storage tanks for C3 and C4 will be installed and will also allow simultaneous loading of both C3s and C4s.

- Excess pentanes will not be exported but will primarily be disposed of into the high-pressure fuel system.

- Up to 100 % associated gas will be allowed in the feed gas.

The accompanying box provides data on LPG production. Fig. 4 shows the planned production build up through 2007 and beyond.

The author

Sveinung J. Stohle has been general manager (commercial) for Nigeria LNG Ltd., Lagos, since January 1998 and is responsible for the company's marketing and shipping activities. Previously, he served as department manager, commercial and license administration division, for Elf Petroleum Norge, marketing manager, natural gas division, Elf Aquitaine, commercial manager, corporate affairs, Elf Petroleum Norge, transportation co-ordinator, corporate affairs, Elf Petroleum Norge, and economic analyst, finance division, Elf Petroleum Norge. Stohle holds a masters of business administration (international business) from the University of San Francisco and BS in finance from California State University at Hayward.