OGJ Newsletter

Market Movement

US SPR drawdown not seen easing heating oil supply worries

With the drawdown of crude oil stocks held in the US Strategic Petroleum Reserve well under way, the effects that the withdrawal plan have had on oil markets are becoming more apparent. Oil prices, in fact, retreated more than $5/bbl since Pres. Bill Clinton's announcement late last month to draw down 30 million bbl of the SPR stockpile (see related story, p. 46).

But equally apparent is the infinitesimal likelihood that the SPR drawdown will do anything to resolve jitters over US Northeast heating oil supplies this winter.

According to Poten & Partners, the drawdown from the SPR may be a short-term solution to several misread problems. Poten & Partners said, "The problem is not a shortage of crude for the nation's refineries. The nation's refineries are operating at near-nameplate capacity with plenty of crude feedstock. The problem is not a shortfall in heating oil production. The past 4 weeks' average production of 1.23 million b/d is 13% ahead of last year."

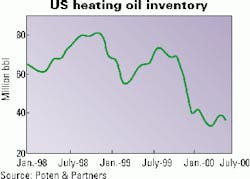

The problem is, the analyst contends, low heating oil inventories, which have been on the decline in recent years. "The average 6-month inventory for heating oil was 68 million bbl in 1998, 65 million bbl in 1999, and 38 million bbl in 2000," Poten & Partners said (see chart).

And, the problem is even more specific and provincial than that, according to Energy Security Analysis Inc. (ESAI). The Wakefield, Mass., think tank contends that the problem lies with heating oil tightness in the US Northeast, and the problem is getting worse, not better.

Even with New York Harbor heating oil prices as high as they are, they are not high enough to pull cargoes away from Europe or even the Gulf Coast (when added shipping charges are factored in), ESAI says. The strength in Rotterdam, ESAI claims, is a buying binge by Germans trying to fill 255 million bbl of tertiary storage ahead of what is expected to be a return to cold winters.

Not only would an SPR drawdown not have much impact on New York-Rotterdam differentials, ESAI contends, it could even make the situation worse, if the SPR drawdown were to weaken WTI more than it does Brent crude, which, in turn could do more to support gas oil prices in Rotterdam relative to those in New York.

The analyst characterized the drawdown as "little more than politically motivated price manipulation to assuage consumers."

Gas storage levels on target

Current US storage levels for natural gas indicate that gas utilities are well prepared again to meet their customers' needs this winter, AGA reported last week (see related stories, p. 44).

The 2.48 tcf of gas already held in underground storage nationwide has surpassed the amount withdrawn from storage during each of the last five winters, AGA said.

AGA notes that there is more than a month of the traditional storage refill season left. Storage injections have continued all the way into December as recently as 1998, it said.

East of the Mississippi River, the region with the highest winter demand for natural gas, the amount of gas in storage has already reached 1.49 tcf, or at 82% full.

"Storage levels in the [US East] consuming-regionellipseare closely watched, because for many companies, as much as 50% of peak-day supply may be pulled from storage," McGill said. "So far, working gas injections appear to be very strong, lagging only about 7% behind the 5-year average for the region," McGill said.

In contrast, the so-called producing region has entered the heating season with volumes as low as 760 bcf or as high as 923 bcf, reflecting the diverse influences that affect decisions on whether to store or flow gas from the region, McGill noted. At the end of September, more than 600 bcf was already in storage in the producing region.

Past AGA studies have shown that, on average, 20% of US gas consumed during a 5-month winter season comes from storage. The remainder of the gas consumed during an average winter, about 65%, comes from domestic production, while 13% comes from imports, mostly from Canada, and supplemental supplies such as LNG.

null

null

null

Industry Trends

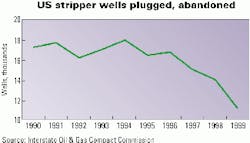

the number of plugged stripper wells in the US HAS STARTED TO DWINDLE.

Efforts by US regulators and legislators in producing states to keep stripper wells in production reduced the rate at which these wells were plugged and abandoned in 1999.

A report released earlier this month by the IOGCC said the number of stripper oil wells plug- ged and abandoned fell by nearly 2,700, to 11,227 wells in 1999 from 13,912 in 1998. That is the biggest year-to-year drop in the number of idled stripper wells in the past decade.

Strong gas prices also have reduced the number of stripper gas wells plugged and abandoned, to 3,541 in 1999 from 4,235 in 1998. That number could fall further this year, if prices remain strong as producers work to meet US demand, IOGCC said. US stripper wells produced more than 313 million bbl of oil and more than 1 bcf of gas in 1999.

These wells represent about 27% of the oil and 8% of the gas produced in the US, excluding Alaska, Florida, and offshore leases, which have no stripper production.

Stripper oil wells are defined as those producing 10 b/d or less, while stripper gas wells produce 60 Mcfd or less.

Australian refiners continue to face grim prospects after taking a financial beating last year.

Ernst & Young's report on the financial results for 1999 for the "Big 4" refiner-marketers in that country-Shell Australia, Caltex Australia, BP Australia, and Mobil Oil Australia-shows that they lost a combined total of $61 million (Aus.) on their Australian refining operations.

Ernst & Young's annual survey does not report individual figures. However, the companies reported a total profit on refining and marketing operations of $282 million on an investment base of more than $10.68 billion in R&M assets. This equates to an underlying industry profit of only 0.5¢/l. of refined product produced and sold in Australia. Ernst & Young's analysis indicate the companies averaged a return on assets of just 2.6%, which is well below the real cost of capital.

The industry in Australia is also looking at worse to come, because it faces an immediate capital investment program of around $1.3 billion. Seven of the country's eight main refineries must spend large amounts on upgrades in the next 3 years to comply with Australia's directive to produce cleaner (low-sulfur and low-particulate) fuels to comply with increasingly stringent global standards.

Government Developments

France has drafted a law to extend pollution taxation.

Over the objections of the oil and chemical industries and other large energy consumers, the French government released a draft law that extends the General Tax on Polluting Activities to corporate energy consumption. The tax, to be deducted from taxable profits, will affect all enterprises with energy consumption of more than 100 tonnes of oil equivalent (toe)/year. To avoid duplicating taxes, energy production will not be taxed.

The tax will bring in a little under 4 billion francs in 2001. It has been calculated on the basis of 216 francs/toe and according to the carbon content of the fossil fuel used. For instance, heating oil will be taxed at a rate of 18.9 centimes/l., coal 208 francs/tonne, and natural gas-fired power 1.3 centimes/kw-hr. Nuclear and hydro power will be taxed on a lump sum basis of 1.3 centimes/kw-hr.

Special measures were introduced for companies that use over 50 toe/1 million francs of "added value," so that their international competitiveness will not be eroded. These involve 5-year, voluntary emission-reduction agreements that are "quantifiable and controllable" and to be signed from 2002 onwards with the administration. In this case, the tax will be levied only on energy consumption that exceeds the stated targets.

In 2001, before these agreements can be signed, the draft law provides taxing large consumer companies on the basis of their annual consumption, but with abatements of 50%, 80%, and 90%, depending on how much energy has been consumed.

The iea Approves of the US drawdown of Strategic oil stocks but nixes its own.

The governing board of the IEA met earlier this month and affirmed the agency's policy of not using security oil stockpiles other than for a "significant oil supply disruption."

IEA said that was not the case in the oil market today: although stocks are low, there is no crude shortfall, only regional product shortfalls.

However, IEA said it "welcomed the positive effect on the market of the recent decision by the US government to release 30 million bbl of crude from the Strategic Petroleum Reserve." Observers said the statement was unexpected, considering that the IEA does not, as a rule, approve of strategic stock drawdowns unless it has given the signal to do so.

IEA urged refiners to "consider intensified and reconfigured short-term refinery operations" to remedy product shortfalls.

The board said it would "give new impetus" to longer-term policies to reduce oil demand, improve energy efficiency, diversify supplies, and accelerate the deployment of new energy technologies.

Quick Takes

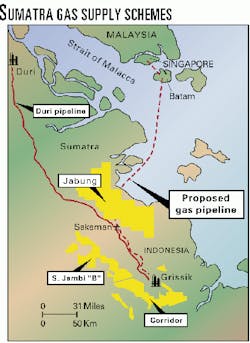

MORE INDONESIA GAS production IS MOVING TO MARKET (see related articles, pp. 34 and 50).

Gulf Indonesia Resources and partners will sell additional gas from their Corridor Block PSC in southern Sumatra to fuel a steamflood at Caltex's Duri field in central Sumatra.

The deal calls for 1.1 tcf of gas to be delivered over 20 years and exchanged for Duri crude. Gas deliveries are expected to begin at 90 MMcfd during 2002, rising to 180 MMcfd by mid-2003.

The gas will be delivered after the installation of compression facilities on the existing 544-km Grissik-to-Duri pipeline owned and operated by Indonesia's PT Perusahaan Gas Negara (see map).

This contract is in addition to the 300 MMcfd of gas being delivered to the project from the Corridor block. Total combined deliveries under both contracts are expected to reach 425 MMcfd by 2003.

Gulf Indonesia also said that Pertamina and Singapore Power unit Gas Supply Pte. initiated a detailed gas sales agreement under which Pertamina will supply natural gas to Singapore. The gas will be supplied from three PSCs in Sumatra. Two of the PSCs-Corridor and South Jambi B-are operated by Gulf Indone- sia subsidiaries, while the third, Jabung, is operated by Santa Fe Snyder.

The three PSCs will supply 150 MMscfd of gas beginning in 2003, increasing to a peak of 350 MMscfd by 2009 for a total contract period of 20 years.

Related to this supply agreement, a 500-km pipeline is planned from South Sumatra to Singapore via Indonesia's Batam Island.

In other production news, Shell Canada will spend $50 million (Can.) to restart a heavy oil project in the Peace River area of northern Alberta using new technology. The recovery process, known as soak radial, uses steam to soak bitumen and improve flow of the crude oil trapped in oilsands. The company targets initial production of about 8,000 b/d. Shell will drill 18 multilateral horizontal wells, and steam will be injected into the reservoir for 2 months. The company says that if results are good, it will consider expanding the drilling program in 2001 to increase production to 12,000 b/d.

PanCanadian broke ground earlier this month at its $400 million (Can.) Christina Lake thermal oil project about 170 km south of Fort McMurray, Alta. The project's $70 million first phase will produce at peak 10,000 b/d of heavy oil, ramping up to that level by 2004 from 5,000 b/d in 2002. Ground preparation for the first phase will start in the next few weeks as crews clear the 16-hectare site and install foundations for the central processing plant. PanCanadian has contracted with AGRA Monenco-Titan JV to complete the detailed design, procurement, and construction management of the project's first phase.

A KAZAKHSTAN MEGAPROJECT COMMANDS CENTER STAGE ON THE DEVELOPMENT SCENE this week.

Karachaganak Petroleum Operating (KPO), operator of giant Karachaganak oil and gas field in western Kazakhstan, awarded an $800 million contract to a combine of Italy's Saipem and Consolidated Contractors International for work related to continuing Karachaganak development.

The contract covers civil works, infrastructure, and mechanical work related to a production unit and gas reinjection facilities, an oil and gas processing plant, and a 635-km, 24-in. pipeline with pumping station and terminal.

KPO partners are BG, Agip, Texaco, and Lukoil. Karachaganak reserves are 1.2 billion tonnes of oil and condensate and 1.35 billion cu m of gas. Production is forecast at 80,000 boe/d this year, vs. 66,000 boe/d last year (OGJ Online, July 26, 2000).

Topping exploration news, Norsk Agip made an oil discovery in the Norwegian Barents Sea that could contain as much as 300 million bbl of reserves, partner Fortum said.

The discovery well found oil in sandstone after being drilled on Production License Area 229 in 381 m of water to 1,500 m TD.

The Norwegian Petroleum Directorate estimates the discovery could contain 175-300 million bbl of oil.

Operator Norsk Agip holds a 25% interest in the well. Other partners include Fortum, 15%; Phillips, 25%; the Norwegian government, 20%; and Enterprise, 15%.

ON THE DRILLING SCENE FOREFRONT, Chiles Offshore placed an order to build another rig on spec-this one a jack up at Amfels shipyard in Brownsville, Tex. Amfels is a unit of Keppel Fels Energy & Infrastructure.

The $110 million rig will be financed by proceeds from Chiles's recent initial public offering and debt financing raised under a US Maritime Administration guarantee. Chiles received a commitment letter from Marad that allows up to $81 million of construction and term financing for the rig.

The commitment letter also allows Chiles to raise an additional $83 million in debt financing, should the company exercise its option to order a second jack up from Amfels within 12 months.

In other drilling sector action, Norway's Smedvig has been contracted by three operators-Conoco UK, Enterprise, and Badr Petroleum-for the use of its West Navion deepwater drillship.

Under the Conoco agreement, valued at $25-33 million, the West Navion would drill two wells: one in 1,000 m of water west of the Shetland Islands and the other in 1,920 m of water west of Scotland. The estimated drilling period is 120-160 days, and start-up of operations is slated the second quarter 2001.

Enterprise's exploratory drilling contract, valued at $12 million, is for drilling of one well on the Errigal prospect in 1,600 m of water west of Ireland. The estimated drilling period is 60 days, and operations start-up is scheduled for sometime between March and August 2001.

Badr Petroleum, a JV of Shell Egypt and Egyptian General Petroleum, has proposed drilling two wells in 1,500 and 1,800 m of water in the eastern Mediterranean, with an option for a third well. The estimated contract value for the first two wells-expected to take about 60 days to drill-is about $11-12 million, said Smedvig. Start-up of drilling operations is scheduled between Dec. 15 and Feb. 1, 2001.

Alberta's Cold Lake pipeline system is to be expanded.

Alberta Energy entered an agreement to expand the Cold Lake pipeline system in northeastern Alberta.

It has also entered a partnership that has signed long-term transportation agreements with several large Canadian companies. Alberta Energy, Koch Pipelines Canada, and Canadian Natural Resources Ltd. (CNRL) have formed the Cold Lake Pipeline partnership, in which operator Alberta Energy will hold a 70% interest and Koch and CNRL will each hold 15%.

The partnership will construct the Hardisty transmission line, a 250-km, 24-in. pipeline that will transport heavy oil from the Cold Lake area to Hardisty, Alta., at a cost of $143 million (Can.). The pipeline, which will connect at Hardisty with the Express pipeline system, Koch Hardisty terminal, and other facilities, will have an initial capacity of 200,000 b/d and is expected to be on stream in January 2002.

In other pipeline news, Vector Pipeline says the in-service date for its 331-mile natural gas line will be delayed until December due to bad weather. The 700 MMcfd line from Dawn, Ont., to Chicago, Ill., was originally scheduled to be in service Nov. 1, but construction was delayed by heavy rains in Michigan and Indiana. The line is more than 90% complete and will be filled with gas beginning in late October, said Vector. Capacity will be expanded to 1 bcfd late in 2001. F Kerr-McGee, Enterprise, and Ocean Energy have awarded units of Williams contracts to gather and transport oil and gas produced from the Boomvang and Nansen fields in the Gulf of Mexico, said Williams. The Williams units will also process the gas production at a new onshore plant. The $200 million project is expected to be complete during fourth quarter 2001. Nansen and Boomvang fields are, respectively, on East Breaks 602 and East Breaks 642, 643, and 683 blocks in 3,700 ft of water. Williams will construct and operate the Seahawk Gathering System, which will carry all gas produced from the two fields. It will also construct and operate the Boomvang and Nansen Joint Oil System to carry all oil from the fields.

Major synthetic gas projects have taken center stage in Australia.

Top methanol producer Methanex proposes to build a $1.5 billion (Aus.) syngas plant in Darwin. The firm is exploring product and technology options for this proposed syngas project, including methanol and gas-to-liquids.

Methanex said, "If the syngas plant goes ahead, it will be built using new-generation technology. The plant will be one of the largest of its kind in the world and will establish Australia as a significant participant in global petrochemical markets."

The gas will come from the 9.16 tcf, $2.5 billion (Aus.) Sunrise-Troubadour-Sunset (STS) gas field development project, plans for which were also announced last week.

Earlier this year, Woodside and Shell signed a letter of intent with Methanex to deliver gas from the STS project to Methanex's proposed plant (OGJ, Mar. 13, 2000, p. 30). That contract calls for delivery of about 116 bcf/year of gas, starting in 2005. F

In other gas processing news, Ivanhoe Energy said it will pay $19 million to acquire a 13% equity stake in Syntroleum's Sweetwater 10,000 b/d GTL project, currently under development on Western Australia's Burrup Peninsula. Ivanhoe also will provide $2 million for front-end engineering and other project development costs. The project will use Syntroleum's proprietary process to convert gas into ultraclean synthetic specialty products such as lubricants, industrial fluids, and paraffins, among others. In February, Syntroleum signed a gas supply contract with the Woodside-led North West Shelf Venture (NWSV) partners to supply about 137 bcf/year of gas as feedstock for the plant (OGJ, Feb. 28, 2000, p. 36). F Meanwhile, NWSV is spending $2.7 million on modifying the gas liquefaction process at its Burrup Peninsula gas plant at Karratha to reduce greenhouse gas emissions by 300,000 tonnes/year. The greenhouse gas savings represent 6% of the plant's current emissions. F

Capco IS SEEKING TO SET UP A PETROCHEMICAL PLANT IN TAIWAN.

China American Petrochemical Co. (CAPCO) will reportedly set up a 700,000 tonne/year capacity purified terephthalic acid plant in an industrial district adjacent to Taichung Harbor in central Taiwan.

The facility, to be completed by August 2002, will require an investment of $320-383 million. CAPCO's board approved the project late last month, and the company is preparing to sign a contract with Taichung Harbor Bureau, which administers the state-owned land where the factory will be built. F

In other petrochemical action, Borealis Group opened its first Borstar polypropylene plant earlier this month, at its existing production site at Schwechat, Austria. The 140 million euro plant is the most important step for the new generation of polypropylene based on Borstar technology, officials said. It started up in May, ahead of schedule and below budget. The main contractor was Neste Engineering, a unit of Fortum.

Sweden's Skandinaviska Raffinadetti let a 50 million euro contract to Technip for a polymer grade propylene manufacturing and storage project for its 210,000 b/d refinery in Lysekil, Sweden.

The propylene recovery unit is designed for a feed of 75 cu m/hr from the FCC unit. The lump-sum contract covers process design, basic and detailed engineering, procurement, project management, and start-up assistance. The project, to last 22 months, is due on stream in April 2002.