New Ecuadorian pipeline plan elicits three bids

Final bids to build a second crude-oil export pipeline in Ecuador included a surprise bid from a group led by Ecuador's Army Corps of Engineers (CIE) along with two other private-sector bids.

Joining CIE in what had been expected to be a private-company competition were the Brazilian firms Andrade Guti

Bids to build the heavy-oil pipeline were also submitted by the US-based Williams group and a producer consortium headed by Spain's Repsol-YPF Ecuador SA.

All bids were due at the offices of Ecuador's Ministry of Energy at the end of the day, Aug. 31.

Proposals

CIE and its civilian partners are proposing to build a pipeline with initial capacity of 290,000 b/d at a cost of $470 million.

The group has proposed two possible routes-one along the northern border and the other parallel to the Transecuadorian Pipeline System (known by its Spanish acronym "SOTE"). That line currently carries crude oil from eastern Ecuador west to the Pacific Ocean export terminal at Esmeraldas and provides the main source of export revenue for the country.

Financing for CIE proposal would be obtained by AG through a 12-year loan from the Brazilian Bank for Economic and Social Development and the Bank of Brazil. The proposed tariff for that project is $1.50/bbl.

After amortization of that project over 10-12 years, profits would be divided among the two Brazilian firms, CIE, and other Ecuadorian government agencies that may become shareholders in a specialized company to be formed.

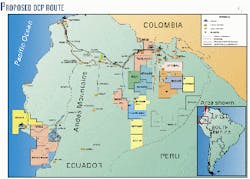

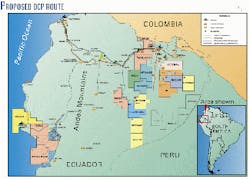

In another proposal, a consortium of five companies under the newly formed OCP Ltd., would build and operate a 500-km, 26 and 30-in. OD heated pipeline (Fig. 1). OCP (Oleoducto de Crudos Pesados) consists of Repsol-YPF Ecuador SA (25.1%), Alberta Energy Co. Ltd. (27.3%), Agip Oil Ecuador BV (9.6%), Kerr McGee Ecuador (5.1%), Occidental del Ecuador Inc. (23.9%), and Techint International Construction Corp. (Buenos Aires; 9%).

All but Techint will be shippers on the new line in the same portions as ownership; the Repsol-YPF unit will hold shipping rights to 34.1% of the capacity.

There would be five pump stations to move flow up the eastern side of the Andes Mountains and four pressure-reduction stations on the western side. Highest elevation on the line-4,064 m-would be at the 200-km point at La Virgen, about 10 km downstream of the last pump station.

Throughput capacity would be 356,000 bo/d, with 310,000 b/d already committed by the consortium members. Estimated final cost is $600 million.

The OCP proposal calls for heating the oil to 170° F. at each pump station and an additional 3.9 million bbl of storage, including:

- 750,000 bbl at the injection-point pump station in the producing region.

- 10,000 bbl at each of the next four pumping stations along the 26-in., 190-km first section of the line.

- 2.7 million bbl at the Balao terminal near Esmeraldas.

At Balao, twin pipelines, each consisting of 56 and 42-in. OD segments, will move crude from the new storage tanks to two new SPMs for loading 250,000-dwt and 130,000-dwt tankers.

Eliseo Gomez, Repsol-YPG Pacific region director based in the country's capital Quito, told Oil & Gas Journal that OCP's new heavy crude pipeline will allow Ecuador to duplicate current production and boost the country's currently weak economy; the "country has been waiting for this for several years." The construction schedule is 18 months.

The OCP consortium "has worked on this project for more than 2 years and everything is ready to kick-off construction as soon as government authorization is awarded. This would not be the case for other proposals," said Gomez.

Williams' initiative

The original consortium of five producers that move their oil through SOTE initially had no interest in owning or operating the new heavy oil pipeline, said Williams officials in an exclusive, pre-deadline interview with Oil & Gas Journal and OGJ Online.

But that changed with a shift of ownership among those companies: Alberta Energy Co. Ltd. bought out City Investing; Kerr-McGee Corp. merged with Oryx Energy Co.; Repsol SA took over YPF; and Agip Corp. acquired ARCO's interests.

Williams says it dropped its participation in that consortium in mid-July to submit its own proposal to Ecuadorian officials to build the heavy oil pipeline, weeks ahead of its competitors.

The company officials said their plans call for a $575 million, 500-km open-access, heavy-oil pipeline that would complement the existing SOTE.

"There are now a sufficient number of new concessions that have been awarded and are under development to consider an additional export pipeline. There's enough production to fill it up," said Larry R. Fisher, Williams' managing director for international operations.

"The SOTE has been running at capacity for the past 5-6 years. There has been an internal competition between Petroecuador and the other producers on whose crude has been exported," said Stan E. Hooley, another Williams international managing director.

Williams' proposed pipeline will connect with existing exploration and production blocks, plus additional blocks that will be offered for exploration and development in the 10th round of leasing after the pipeline is built.

SOTE has recently been expanded with more pumping horsepower, raising its capacity to slightly more than 400,000 b/d, said Hooley. "But that's only handling about half of the near-term capability of production. The new pipeline basically will double Ecuador's ability to export crude," he said.

Moreover, Ecuador produces both heavy and light crudes. "With only one pipeline, [the Ecuadorians] have to blend everything down; so there is lost revenue to Ecuador," said Hooley. Plans call for putting only light oil through SOTE once the new pipeline is built to move heavy oil.

Other sources told OGJ Online that the 23.7° API oil currently pumped through SOTE will continue for at least the next 2 years until the new pipeline will be ready to transport the heavier crude oil (17-22° API).

SOTE then will transport only 28° API crude oil for Petroecuador, either as sole producer or in association with private companies under joint-venture contracts.

Southern route

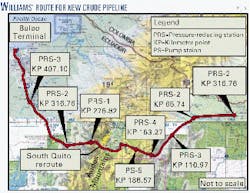

About 90% of the new pipeline proposed by Williams would be built in or closely adjacent to the SOTE right-of-way, "except for one major deviation," Fisher said (Fig. 2).

"Our proposed pipeline goes further south of Quito than the existing line. We've done a detailed route survey and classified the area in terms of difficulty of construction.

"There are significant advantages to routing through the primarily open farmland to the south," said Fisher: It "avoids very congested areas along the existing right-of-way [and bypasses] potential route problems through some bird sanctuaries, national forests, and very pristine areas" to the north.

The proposed pipeline would be about 500 km of heavy-wall, 28-in. OD pipe. Its five pump stations will "mirror existing pump stations" on the SOTE line, and there will be three pressure-reducing stations, said the Williams officials.

A new terminal and export facility at Balao, on Ecuador's Pacific coast, with tankage and a dual loading system for both large and small vessels, are also included in the proposal.

Construction costs for a pipeline with an initial throughput capacity of 310,000 b/d shouldn't exceed $575 million, Fisher said.

The proposed 28-in. diameter is an "odd size," said Fisher, but provides for "an optimized case for initial capacity" with "readily expandable capability" for a future throughput increase to 378,000 b/d.

Based on surveys of area producers, Williams expects at least 300,000 b/d of initial demand almost from the moment the pipeline is completed.

Combined throughput capacity of both SOTE and Williams' proposed heavy-oil pipeline would total about 800,000 b/d, the officials said.

The company could increase throughput capacity by adding horsepower to the pumping stations. "You don't want to go back and build a loop in the Andes. So we're putting enough pipe in the ground to give us expandability," Hooley said.

Open access

He added that Williams' "approach is going to be open access, so we'll build to accommodate future producers that Ecuador is trying to attract."

Fisher added: "That is one of the distinguishing features of what we're offering. We're introducing the concept of an open-access, non-producer owned pipeline that would set up a mid-stream sector of business."

It would provide "a level playing field" for other producers to compete with the members of the current consortium. Such competition would "maximize the benefits" of present and future reserves for the government, he said.

As part of Ecuador's move to privatize industry, Hooley said, a recent presidential decree requires that the new pipeline be built by the private sector with no required financial guarantees or commitments by the Ecuadorian government.

Ecuador officials will take "at least 2-3 months" to award a license for the pipeline, Fisher said. If Williams is the winner, it expects to have a pipeline in operation within 18 months of signing an agreement, which puts start-up in early 2002. The company is already talking to manufacturers about pipe availability.

Williams gained relevant and valuable recent experience, said the two officials, building pipelines through the US Rocky Mountains. Many of the same project team would work on constructing the proposed heavy oil pipeline in the Andes.

Williams sees this as the second chapter of its operations in Ecuador: An earlier incarnation of the company built the SOTE pipeline in the 1970s.

SOTE expansion

Expansion of the SOTE pipeline was recently commissioned after 19 months' work and many years of expectation. It is now pumping 390,000 b/d of 27.3° API crude from Lago Agrio to Balao, an increase of about 60,000 b/d from the previous pumping rate.

Petroecuador, Agip Oil, and Repsol-YPF joined forces to carry out that expansion project. Each company undertook its share of work in various segments of the line. Some equipment had to be specially ordered to fit the old equipment. In other cases, latest technology equipment was put in place.

Each company financed its share of the SOTE expansion. Total cost of the project amounted to $57 million, plus $6 million by Petroecuador. Agip will be reimbursed its investment over a 20-year period, while Repsol-YPF will be paid back by Petroecuador within 18-months.

The pumping tariff was fixed some time ago at $1.62/bbl. The increased pumping capacity will allow each producing company to proportionately increase its production.