OGJ Newsletter

Market Movement

Reduced drilling fleet threatens oil, gas production

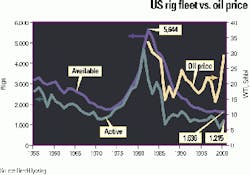

Unless the industry begins looking at bringing more rigs into the drilling fleet, continued rig deletions in the US may threaten mid to long-term production of oil and gas.

"Looking back on available rigs beginning 45 years ago..., the fleet has seen 2 decades of continuous decline," said John Deane, vice-president and general manager of Schlumberger Drill Bits, at the IADC annual meeting last week.

Data presented at the conference from the 48th annual Reed-Hycalog rig census show the US rig fleet netted a loss of 8 rigs in the preceding 12 months covered by the census.

"This year's count came in at 1,636 [active drilling rigs over a 45-day period], another all-time low in the history of the rig census," he said.

As a tell-tale sign of an aging fleet in need of replacement, capital expenditure requirements have exceeded $100,000 for land rigs and $1 million for offshore rigs. Such a high replacement cost has reduced the active fleet by 40 units this year (see chart). In addition, the second largest category, scrapped rigs, saw a loss of 24 rigs this year vs. 41 in 1999. Deane says these losses also indicate "that this low-cost source of replacement parts is close to being depleted."

Drillers cannibalizing parts from stacked rigs may in turn exacerbate the problem. "In 1998, there were 62 rigs assembled from components, in 1999 only 9, and this year it jumped back up to 34 rigs. We're just running out of old rigs and parts for this to be a sustainable method of building rigs," he said.

Rig utilization rates

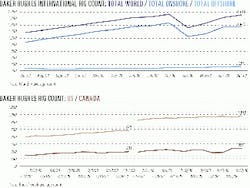

The depletion of the US rig fleet comes when increased demand for oil and gas may produce a "Catch-22" situation, with gas rigs taking up successively larger chunks of total drilling activity. Baker Hughes says 816 rigs were drilling for gas in August, vs. 194 units for oil. Yet in 1995, the split was only 50-50. If this trend continues, US reliance on foreign oil will grow, as fewer rigs will be devoted to oil drilling. - This special analysis of the Reed-Hycalog rig census against the backdrop of current oil and gas markets was provided by Dean E. Gaddy, Senior Editor-Drilling & Special Projects.

On the other hand, if operators do not commit most of the US rig fleet to gas E&D, industry may not be able to meet future demand for gas. The answer to rebuilding the UXS fleet may be through increased utilization. Rig Data estimates 1,334 rigs were actually drilling in the US by its latest count, vs. 1,012 rigs by the Baker Hughes tally. This places utilization at 82%, based on Reed-Hycalog's estimate of 1,634 available rigs. And as utilization rates go higher, day rates may eventually rise to support newbuild rigs.

"We now believe that active rigs, as we measure them, will be up 20% next year or at roughly 1,450 rigs, with commodity prices at or near the contractor consensus of $27/bbl oil and $3.60/Mcf gas," Deane said. "We continue to believe that rig availability will remain relatively unchanged at around 1,600 rigs, which will bring utilization rates dangerously close to 90%."

Access to land denied

Even if higher day rates underpin a wave of new-build work, however, a lack of access to federal lands may rein industry's ability to meet domestic energy needs.

For example, US gas inventories are low for the coming winter, despite back-to-back record warm winters. And the ever-growing power sector will underpin continued strong gas demand.

Raymond James & Associates estimates the US power grid will require 146,000 Mw of new capacity to return the capacity margin back to its comfort level of 15% and more than 275 gas-fired power plants are to start up over the next 6 years (OGJ, Oct. 2, 2000, p. 34). "We are in the midst of the worst energy crisis we have ever had," said Matt Simmons, president of Houston-based Simmons & Co., "and the drilling industry is going to have to carry most of the heavy lifting."F

null

null

null

Industry Trends

Volatile oil prices are squeezing Asian refiners.

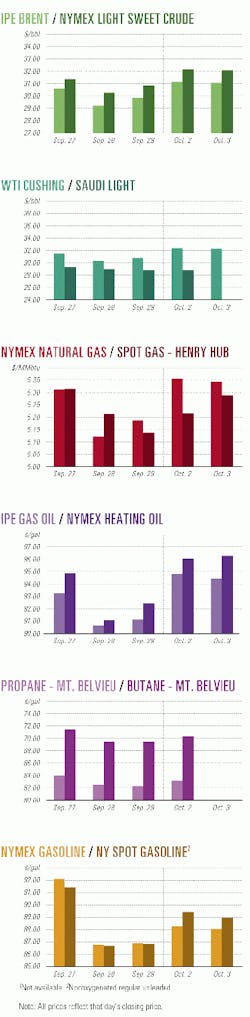

Recent high oil prices-as well as their perpetual volatility-have hurt Asian refiners by constraining margins and demand, Jock McKenzie, Caltex chairman and CEO, told the Asia-Pacific Petroleum Conference in Singapore late last month.

McKenzie noted that high oil prices have led Caltex to cut its demand growth forecast in the Asia-Pacific and African regions to just 2.7% this year from earlier estimates of 3.5-4%. And, demand in the Philippines and South Africa has actually fallen. McKenzie says these are disturbing signals that continuing high crude prices are undermining the regions' economic recovery.

Although the controversial recent decision to release US SPR supplies has moderated oil prices, he says, they are likely to remain volatile. The consensus among industry analysts, he contends, is that a range of $22-26/bbl would encourage E&P while preserving sustainable economic growth in Asia.

Current projections are for Asian oil consumption to rise to around 29 million b/d by 2010 from the current 20.5 million b/d, accounting for half of the projected global increase to 95 million b/d from 77 million b/d.

Although there is a perception that high oil prices have meant "super" profits in terms of margins for Asian refiners, McKenzie said, margins that had been at historical lows have had to rise to fund investments to meet demand for diesel and middle distillates.

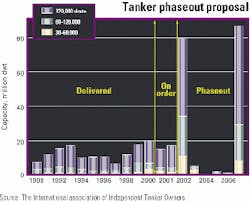

Intertanko is seeking a realistic phaseout schedule for single-hulled tankers.

Intertanko has asked delegates to an International Maritime Organization environmental committee meeting in London to agree on a schedule for the phaseout of single-hulled tankers that is "reasoned and practical."

Intertanko said the EC proposals on the accelerated phaseout of single-hulled tankers was "the most controversial" of a series of three initiatives the commission launched immediately after the sinking of the tanker Erika off France last December.

After lobbying by governments and industry bodies, EC agreed to pursue its proposals through IMO rather than introduce its measures solely as a regulation for EU member states.

However, should IMO fail to agree on a solution deemed to be acceptable, the danger remains of regional action being taken in Europe.

The initial proposal has reached IMO, slightly modified, in the form of a joint submission from France, Belgium, and Germany. This and several other initial proposals call for the accelerated phaseout of single-hulled tankers under a schedule that Intertanko contends could create problems for the world shipbuilding and scrapping industries.

The French-German-Belgian proposal would create peaks in demand for new tonnage, Intertanko said, that must be smoothed out if global oil deliveries are to continue at current levels (see chart).

Intertanko said its proposal calls for the entire phaseout to be gradually achieved during 2010-15. This timetable is closely aligned with the US Oil Pollution Act requirements for the phase-in of double-hulled tankers.

Government Developments

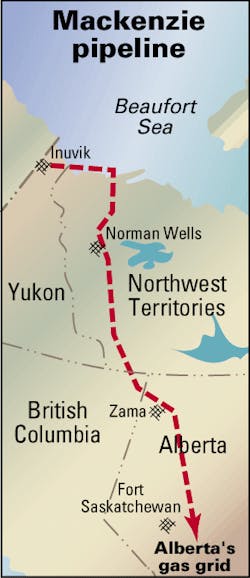

The North American Arctic gas transportation debate continues.

Competing projects such the Alaska Highway (ANGTS) and Mackenzie Delta pipelines to move arctic gas to southern markets are not mutually exclusive, contends Pat Duncan, premier and minister of economic development for Canada's Yukon Territory.

Duncan, speaking last week in Calgary at the International Pipeline Conference, said the pipeline projects are complementary means to unlock natural gas reserves in Alaska and northern Canada. She also notes that the gas market outlook for 2010 makes LNG a viable export option, too.

She said the ANGTS project could get Prudhoe Bay gas to market sooner than a pipeline moving Prudhoe gas to the Mackenzie Delta and then south, and at a cost lower than government and industry officials have suggested.

Duncan said that, although shorter, the $2.5 billion for the proposed Mackenzie Delta pipeline doesn't include the cost of connecting the 30-32 tcf of Prudhoe gas (see map, this page, and for ANGTS pipeline route, OGJ, Aug. 7, 2000, p. 68).

Such a connection, capable of delivering 3 bcfd into the Mackenzie Delta area and picking up another 1 bcfd there "would be a massive project." It would require a very large, high-pressure pipe, much larger than any of the current proposals.

And it would require a subsea section from Prudhoe Bay to Mackenzie Delta, then through the Mackenzie Valley. Mackenzie Delta gas development may require as much as $1.5 billion, bringing the total cost to "at least $10 billion."

Two key members of the US House are urging the passage of a tough pipeline safety bill.

Reps. John Dingell (D-Mich.) and James Oberstar (D-Minn.) said a bill passed by the Senate late last month would not provide the necessary protection for people living and working near natural gas and hazardous-liquids pipelines.

Dingell said, "The Senate bill does little to protect people from the deadly consequences of regulatory lassitude, nor does it sufficiently address issues of maintenance and corrosion."

Although Congress is expected to adjourn in mid-October, Dingell and Oberstar said there is enough time for the House to draft and pass its own pipeline safety bill and go to conference with the Senate.

They said legislation should require pipeline operators to adopt integrity management programs, regardless of whether the Department of Transportation completes a pending rulemaking to require them.

Quick Takes

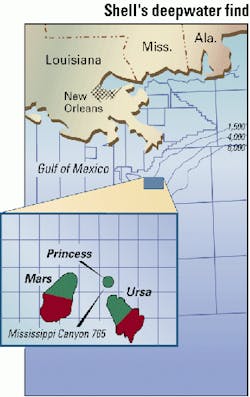

SHELL has unveiled its latest deepwater Gulf of Mexico find, Princess field, right on the heels of its announced plans to develop the Na Kika deepwater oil and gas development nearby (see related story on p. 35).

The Princess discovery is on Mississippi Canyon Block 765 in 3,600 ft of water (see map).

Four wells on the prospect have found 300 net ft of pay in several zones, said Shell, which estimates the find's potential reserves at 200 milllion boe.

Operator Shell holds a 45% interest in the field; BP, 23%; and Conoco and ExxonMobil, 16% each.

Elsewhere on the exploration front, Anadarko Petroleum will participate in three exploration blocks off West Africa through various farm-in agreements signed with subsidiaries of Devon Energy. Anadarko will participate with a 50% interest in Ghana's Keta Block and Gabon's Aga* Block. It also will hold a 37.5% interest in the Marine IX Block off the Republic of Congo. A deepwater seismic survey was recently completed on the Keta Block, and a shelf-edge exploration well is planned later this year. Another deepwater 3D seismic survey is planned for the Aga* Block early next year to evaluate prospective areas identified on a recent 2D survey. A deepwater exploration well is planned for the Marine IX Block in 2001. Devon Energy will retain operatorship in Ghana. Anadarko will operate in the Congo and in Gabon.

Phase II of Statoil's Gullfaks project is almost complete.

Installation of the remaining 22,000 tonnes of subsea equipment for Phase II of Statoil's Gullfaks satellite project-including 10 subsea templates, flowline bundles, spool pieces, and protective frames-is in the home stretch on the seabed at the Norwegian North Sea field, the operator reports.

With 62% of the project now complete, the total bill for Gullfaks Phase II-which built in the cost of development work, drilling, and the new gas export line from Gullfaks A and C platforms to the Statpipe trunkline-looks likely to come in at 6.8 billion kroner. This is some 300 million kroner less than the original estimate, according to project director Harald Vandbakk (OGJ, Sept. 25, 2000, p. 76).

Phase II, part of Statoil's larger plan to extend the producing life of the main Gullfaks field, entails recovery of gas with associated oil and condensate from the Brent reservoir in Gullfaks South; it is due to come on stream in October 2001.

In further development news, Hurricane Hydrocarbons said its directors authorized the development of three Kazakhstan fields-Qyzylkiya, Aryskum, and Maibulak. The project is estimated to cost $140 million, said the company, including pipelines and an associated rail loading facility. Other projects are expected to increase Hurricane's total capital investment in its upstream business over the next 5 years in Kazakhstan to more than $250 million.

Pride International will purchase two semis.

The firm said it will acquire two semisubmersible drilling rigs from an unnamed party for $42 million in cash, $75 million worth of shares of its common stock, and 400,000 stock purchase warrants.

Both of the semis are currently in the North Sea. The second-generation semi is idle, and the third-generation semi is under charter to an affiliate of Transocean Sedco Forex through September 2001, said Pride.

It also agreed to acquire a jack up for $22 million in cash. For the past year, Pride has been operating the jack up-rated to 250 ft of water-under a bareboat charter agreement off Bangladesh.

Rounding out drilling action, Statoil UK awarded a $16.8 million contract to Transocean Sedco Forex to use its Sovereign Explorer semi to drill two wells. The contract will begin in April 2001 and should take about 105 days, said Transocean.

Topping pipeline news, Dominion Resources scheduled an open season through Dec. 5 to seek customers for its proposed Greenbrier pipeline project.

The $400 million, 600 MMcfd line would extend from Dominion's Cornwell Station near Charleston, W.Va., to Transcontinental Gas Pipeline Line in Rockingham Co., NC.

The line would access gas supplies from Canada, Appalachia, the Gulf Coast, and the Midcontinent.

Completion is expected in June 2005, when Dominion expects regional demand will exceed existing transportation.

In further pipeline news, Coastal pipeline affiliate Wyoming Interstate Co. filed an application with FERC to loop its southeastern Wyoming Medicine Bow Lateral system. WIC will initially increase capacity out of the Powder River basin by 6.6 MMcfd. WIC said producers have committed to firm contracts to transport 5.4 MMcfd on the expanded system. The existing lateral is a 24-in. line that extends from the southern end of the Power River basin near Douglas, Wyo., to WIC's main line southwest of Cheyenne, Wyo. The proposed $160 million lateral loop project would parallel this line with a new 36-in. pipeline and add 7,170 hp of compression. If all goes as planned, WIC plans to have the new pipeline in service by Dec. 1, 2001. x The US National Transportation Safety Board scheduled a Nov. 15-16 hearing at its Washington, DC, offices to explore pipeline safety issues (see related item, Government Developments, p. 7). NTSB said recent pipeline accidents have raised concerns about the nation's aging pipeline infrastructure. "Many of the hazardous-liquid and natural gas transmission pipelines in our country are 30-50 years old. Although age alone does not indicate that a pipeline may be unsafe, determining the integrity of pipelines becomes increasingly important as our pipeline systems age," said NTSB. The hearing, says the board, will provide a forum to examine technologies available to assess the integrity of pipelines, such as use of internal inspection tools and the capability of pipeline operating systems to identify leaks and enact timely responses.

A sakhalin consortium has slated russia's first lng plant.

Sakhalin Energy Investment let a contract for a 9 million tonne/year LNG plant to be built on Sakhalin Island to a group headed by Fluor Daniel.

Under the $10 million contract, the group will provide engineering services to prepare project specification and Russian permitting documents.

The plant will be the first world-scale LNG plant to be built in Russia, says Fluor Daniel, and will use a proprietary process owned by Royal Dutch/Shell.

Other participants in the engineering consortium are Chiyoda and OAO NIPIgaspererabotka. Work will continue through August 2001.

Sakhalin Energy is a JV company established by Shell, Marathon-USX, Mitsui, and Mitsubishi to develop the Sakhalin II oil and gas production and export project.

In other developments in the gas processing sector, Rentech will conduct a feasibility study to apply its proprietary Fischer-Tropsch GTL process to convert industrial offgas (IOG) into sulfur and aromatic-free GTL products.Rentech said a major chemical company has asked it to perform the study at a US plant. The parties, which agreed to keep terms of the deal confidential, expect the work to take 60-90 days. Rentech expects the plant could begin producing GTL products as early as 2002. Rentech said indications are that IOG-GTL retrofits can be built at a cost of $8,000-10,000/b/d with 12-18 months required for start-up. Rentech says that greenfield GTL projects fed by natural gas, meanwhile, are being quoted at $20,000-30,000/b/d of capacity with 3-5 year lag times to reach commercial status. Earlier this year, Rentech said it would convert the Sand Creek methanol plant near Denver to the first commercial GTL plant in the US (see related story on p. 55).

Petro-Canada started work on its McKay River oilsands project, 36 miles northwest of Fort McMurray, Alta.

The company has applied for a production increase to 30,000 b/d from an already approved 22,000 b/d and is assessing the potential of its in situ oilsands leases inventory to increase production to 80,000 b/d by the end of the decade.

The $290 million (Can.) project is scheduled to go on stream in 2002. Capital and operating costs are estimated at $10/bbl of capacity.

Petro-Canada is also studying the possibility of integrating its refinery at Edmonton to upgrade and refine 80,000-150,000 b/d of bitumen from McKay River into gasoline. By 2004, the company will install new sulfur-reduction equipment that will be designed to later form part of a bitumen upgrading process at the refinery.

The McKay River project will use steam-assisted gravity drainage technology to produce bitumen from oilsands using pairs of horizontal steam injection and production wells, a technology successfully tested for 10 years in a pilot.

Petro-Canada has also reached an agreement with Enbridge whereby Enbridge will construct a $55 million, 25-mile pipeline that would bring McKay River oil to the Athabasca pipeline for sale on the North American market.

Elsewhere on the production front, India's ONGC has embarked on an improved oil recovery program for its wells, including those at Bombay High field. The recovery program overall is expected to yield an additional 10.3 million tonnes of crude oil in the next 5 years and 22.7 million tonnes in the next 10 years, says ONGC. The firm has extensively studied the feasibility of improved oil recovery in Bombay High and has finalized plans for Bombay High North, which is expected to yield an additional 5 million tonnes in the next 5 years and 15 million tonnes in the next 10 years. F Devon Energy said it began initial combined production of 51.1 MMcfd of gas and 1,600 b/d of condensate from Eugene Island 156 No. A-1 and No. A-2 wells in 82 ft of water off Louisiana in the Gulf of Mexico. The wells were drilled in the second quarter of 2000. Construction of a production platform and facilities was completed in August. Devon is operator of the block and holds a 100% working interest.

Petrobras said the Landulpho Alves refinery in the Brazilian state of Bahia has returned to operating at near capacity after a blaze crippled production late last month.

Repairs were completed on Unit 32, and the naphtha, diesel, kerosine, and fuel oil unit has gradually returned to full capacity. Petrobras declined to say how much it spent to repair the unit, which is the refinery's largest.

Normally, Unit 32 produces about 28,000 cu m/day of naphtha, diesel, kerosine, and fuel oil, or about 60-65% of refinery's total output.

In other refining news, TotalFinaElf said it will make a new ultralow-sulfur gasoline available to motorists at the beginning of 2001. It will contain 0.001% sulfur, which the French firm says is 1/15th the level contained in gasoline currently sold on the market. The gasoline is intended for use in passenger cars with lean-burn direct-injection engines. It will be made available at about 100 Total and Elf-branded stations in principal urban areas, then progressively made available across Europe, said TotalFinaElf.

The US Ex-Im Bank and SACE, the export credit agency of Italy, awarded Taylor-DeJongh a joint contract to provide financial advice on Rio Polimeris's proposed integrated ethylene and polyethylene complex to be built in the state of Rio de Janeiro, Brazil, said Taylor-DeJongh.

The advisory firm said the facility would be the first natural gas-feed ethylene cracker in the country, with a 520,000-tonne/year-design capacity. It will adjoin Petrobras's Duque de Caxias refinery.

Participants in the $1 billion project are Unipar, Suzano, and Petrobras.