Land rig builders expected to see rising orders in 2000

The international land rig market is showing signs of a recovery from the extended industry downturn of 1998 and early 1999, if newbuild orders and a rising rig count are accurate indicators.

The road to recovery for builders of onshore rigs has been a long one. This sector of the petroleum industry is typically among the last to bounce back following cyclical slumps in oil markets.

But, according to a report by Donaldson, Lufkin & Jenrette Securities Corp. (DLJ) on the performance of the oil field service sector in third quarter 1999, a rebound in both the onshore and offshore rig markets is imminent.

Citing particularly pivotal months in 1999, DLJ said that Baker Hughes's international combined land and offshore rig count (rigs operating outside the US and Canada) "bottomed at 556 in August, was essentially flat at 557 in September, and recovered modestly to 565 in October. And the tally continues to strengthen.

"Because a number of drilling contractors were recently awarded international rig contracts commencing in the first quarter of 2000, we believe the international rig count could rise to over 600 in that quarter," said DLJ. December 1999's count stood at 574.

Orders rising

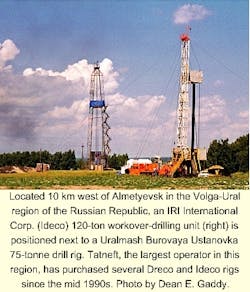

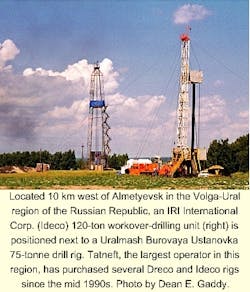

Signs for a more bullish land drilling market abound internationally, says DLJ. Early last month, for example, Houston-based IRI International Corp. said that, during third quarter 1999, it secured $40 million in orders for workover and drilling rigs and associated equipment for delivery in 2000. Included in the orders are: 10 sidetracking drilling rigs and associated equipment for work in Russia; 3 workover and 2 shallow drilling rigs for Kuwait; and 1 shallow drilling rig for Austria.

IRI says that increasing US sales, as well as orders from some of its long-established international markets, are some of the first signs that higher oil prices are improving its business prospects.

The areas of high demand for onshore rigs change from year to year, says Gary Stratulate, IRI International president and COO. Areas of concentration tend to fluctuate along with the market, as do other business trends, he says.

The two countries where IRI's Ideco brand name have historically had a stronghold in the land rig market-Russia and China-have undergone rapid changes over the last few years. Stratulate observed, "Russia, quiet for some time, now is showing renewed signs of life, and China is active again."

IRI delivered the last of its rigs for 1999 to Kuwait Drilling Co. in October. In the last 4-5 months, says Stratulate, the company has seen a 30% increase in business for its downhole products.

At certain times, the effects felt in the rig market are different from those felt by the rest of the industry, he explains. IRI tends to sell equipment in areas such as Russia, for instance, regardless of commodity price fluctuations. "These developing countries tend to proceed, regardless, to generate hard currency," Stratulate said.

Pete Miller, National Oilwell's president, products and technology group, believes the newbuild rig market is headed for an "uptick" period, rather than a full rebound.

In general, Miller sees Algeria as a relatively hot spot for land drilling and rig contracts in the coming year. Most companies will be enticed to the area, Miller notes, due to state oil firm Sonatrach showing signs of not wishing to serve as operator in all cases and, instead, allowing new companies to come in and assist. Kuwait and Oman will also be decent play areas, Miller says. He sees the newbuild rig market as strengthening, given an increase in National Oilwell's backlog, which he attributes largely to the pick-up in oil prices.

DLJ comments

According to its latest quarterly study on oil field service and equipment companies, DLJ says that rebounds are likely for some firms participating in international land plays but not for others.

Parker Drilling Co., for example, may experience difficult quarters, as the land rig market fights to improve and civil unrest persists in Nigeria, says DLJ. The drilling contractor's earnings should rebound sharply into 2001, however, as day rates continue to improve for US jack ups and international land drilling activity increases.

In the case of Parker, although it is not seeing any pickup in demand for its core fleet of 32 international land rigs, it has recently received a $35 million contract for two rigs-one refurbishment and one newbuild-for use in Kazakhstan. These units are expected to start drilling in late 2000 and early 2001.

In contrast to Parker, companies with leverage in the South American land drilling market, such as Pride International, may experience meaningful recoveries, says DLJ. Improvements for Pride have been "driven by increasing utilization in Argentina, its largest land market.

"Pride has seen a further increase in day rates and utilization in Argentina and is also starting to see a demand in Venezuela and Colombia, which should lead to gradually improving contribution from this segment going forward."