Drilling crews receive pay raises, dayrates higher

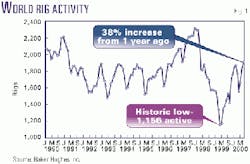

US drilling utilization has effectively approached full capacity because of increased natural gas demand, higher oil prices, and elevated spending levels by operators.

As a result, contractors have begun to receive higher dayrates and distribute pay increases to their field employees. Although international markets have taken longer to rebound than North America, industry leaders say that utilization will also increase overseas.

Worldwide activity

According to Baker Hughes Inc., Houston, the international rig count, excluding the FSU, communist countries, Iraq, and North America, averaged 662 rigs in July, up only 81 rigs from last year and 5 rigs from the previous month (Fig. 3).

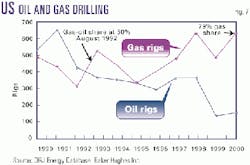

On the other hand, the North American rig count averaged 1,249 rigs in July, a 55% increase over the previous year. In July, the US rig count, including onshore and offshore units, averaged 941 rigs, up from 588 rigs last year.

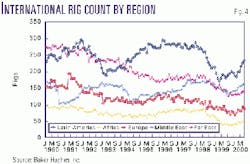

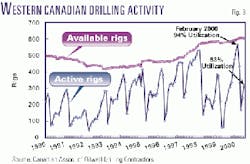

In Western Canada, the June active rig count averaged 316 units, up 115 rigs from a year earlier. In the major international regions (Fig. 4), operators and national oil companies employed 85 rigs in Europe, 160 in the Middle East, 45 in Africa, 233 in Latin America, up 30%, 6%, 18%, and 13%, respectively.

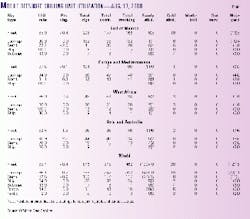

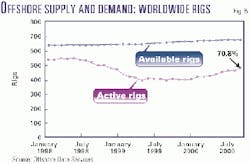

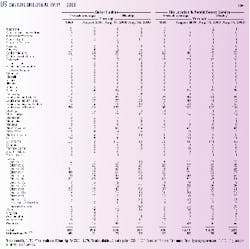

Worldwide offshore activity has maintained a slow but gradual increase since January 2000, with a utilization of 71% in July 2000 (Fig. 5). According to Offshore Data Services, Houston, the working fleet stood at 462 rigs on Aug. 17, 2000 (Table 1), up 6 years from a year ago.

The US picture

OGJ estimates US well drilling and spending should rebound this year to $22.8 billion, an increase of $7.8 billion over 1999. As a result, operators should drill 27,840 wells this year, far more than the estimated 19,940 wells in 1999 (OGJ, July 24, 2000, p. 86).

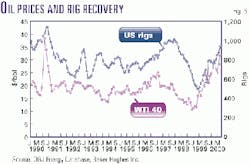

Using West Texas Intermediate (WTI) 40, oil prices rose to $16/bbl in April 1999, up $4.50 over the previous month. Subsequently, increasing demand for crude and product continued to drive oil prices upward, breaking a monthly average of $20/bbl in September 1999 that rose to $32/bbl on average in July 2000.

Correspondingly, the active rig count began a steady increase, lagging about 1-2 months behind WTI (Fig. 6). Based on information provided by Rig Location & Permit Report Service (RLPRS), the top 50 operators in the US had drilled 5,160 wells by August, at an average depth of 7,365 ft, for a total of 38.7 million ft (Table 2).

Additionally, the most active operators in terms of wells drilled included Chevron USA Inc. (332), Barrett Resources Corp. (262), Anadarko Petroleum Corp. (254), EOG Resources Inc. (236), and Texaco Exploration & Production Inc. (201).

Drilling utilization for the top 25 US drilling contractors began the year at 64%, climbing to 75% in August 2000 (Table 3). Another indicator of a reviving upstream sector includes growing demand for drill pipe. According to Grant Prideco, a company that manufactures 65% of the world's drill pipe, its largest plant located in Navasota, Tex., has more than doubled production in an 18-month period, to 11,000 joints/month this September. Of this, 60% of Navasota drill-pipe sales currently remains in North America.

US land rigs

Based on a 4-week, mid-August average for US onshore activity, RLPRS says 1,211 units were drilling, up 429 rigs from the year before (Table 4). Thus, with 1,370 available land rigs in 2000 (48th Annual Reed-Hycalog Rig Census), operators utilized 90% of the land fleet, up from 57% a year earlier.

According to Ed Seifert of RLPRS, "The data from last year reflected the delay in drilling activity. This year, however, the impact of high oil and gas prices has become apparent. The problem we see now is drilling capacity."

In essence, as rig utilization approaches 90%, the effective capacity actually approaches 100% because downtime, involving rig moves and weather does not allow a rig to drill full time.

Furthermore, personnel shortages are beginning to be noticed. "Some rigs are being rigged up on location but have had to wait on crews before drilling could begin," said Richard Mason of the Land Rig Newsletter. "Unless we find the labor to staff the rigs, we're pretty much at effective capacity utilization"

Wages and dayrates

As a result of rising demand for rigs and crews, day rates and wages have begun to rise. "During mid-May, we were looking at $7,000/day for a 1,000-hp rig and $8,000/day for a 1,500-hp rig," said Ronnie McBride, senior vice-president for Grey Wolf Inc. "Today (mid-August), those same rigs are getting $8,500/day plus fuel while the bigger rigs are getting $10,000/day."

Additionally, Grey Wolf, which did not cut wages or alter work schedules during the downturn, gave a wage increase to its field employees in July and September. "We lost a tremendous number of people in the last downturn. If this business stays the way it is now, and we give pay raises, we may attract new people into the industry."

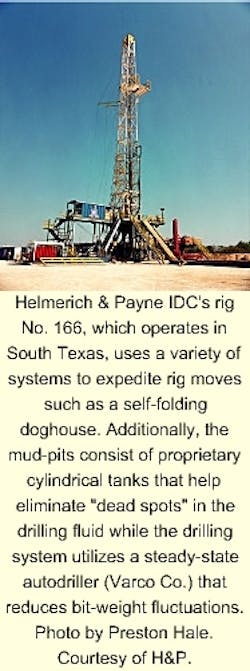

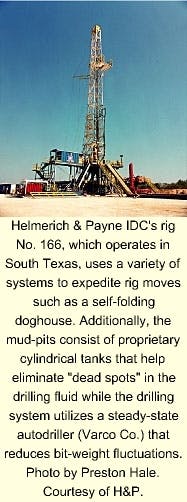

Helmerich & Payne IDC (H&P), another company that did not cut wages in the downturn, has also given out pay raises. Currently, in Oklahoma, H&P drillers earn $17.50/hr, up 26%, while floorhands make about $14.50/hr, up 42%.

Yet wages for even the best paying companies remain depressed due to low day rates over the past 15 years. "I did a calculation based on 1982 wages and carried it forward at 3%/year," said John Lindsay, vice-president for H&P. With this in mind, "a driller should be making $24/hr today." Thus, the problem remains: "We're still not competing for people from other industries; we're just passing people back and forth."

Consolidation and valuation

The merger and acquisition frenzy that occurred through the mid-to-late 1990s has apparently slowed in the US land market. And where this activity is taking place, there is mostly consolidation among the smaller players.

Recent announcements include the purchase of Gary Drilling Co. in California and Ashby Drilling Co. in Colorado by the Ensign Resources Group of Canada. Additionally, UTI Energy Corp. bought Phelps Drilling in Canada, South Texas Drilling & Exploration has agreed to purchase Pioneer Drilling Co. in South Texas, and Nabors purchased Pool late last year.

Another important merger this year involves National Oilwell Inc. and IRI International Corp. that took place June 27, 2000. This move essentially expands National Oilwell's ability to build shallower, mobile drilling units while providing equipment and services for downhole drilling and fishing tools.

According to Mason, stock market valuations for publicly held land drilling contractors "are at, or exceed, 1997 peak values even though the companies themselves are just now showing positive earnings momentum after a disastrous 1999. No doubt about it: These companies have leaner cost structures this time around, and that promises even greater potential valuations."

On the other hand, he warns that buying into the drilling industry based on the possibility of day rates approaching rig replacement costs should be conducted with extreme caution. "This is an event that happens once a generation or so."

Gas, directional wells

The big story in the US continues to be the rising need for natural gas drilling to meet domestic US demand. According to Baker Hughes, 79% of the fleet drilled for gas on Aug. 11, 2000, as compared to 5 years ago when only 55% of the fleet was dedicated to this work (Fig. 7). As of July 28, 2000, US gas operators drilled 6.83 million ft, while oil operators drilled 2.5 million ft (Table 5).

According to Smith Bits (Smith International Inc.), Houston, as of Aug. 25, 2000, operators drilled 622 vertical (70%), 201 directional (23%), and 64 horizontal (7%) wells in 2000. This places directional and horizontal activity up 42% and 52% from a year ago, respectively.

Canada

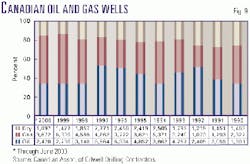

Tim Paul, coordinator of economic analysis for the Canadian Association of Oilwell Drillers (CAODC) expects a record year for Canadian drillers, anticipating 16,566 well completions. As of Aug. 22, 2000, 368 rigs were operating in Western Canada, up 54 units from last year (Fig. 8). While last year's gas sector was particularly strong with 70% of all wells drilling for gas, this year Paul expects the ratio will be 55% gas and 45% oil (Fig. 9).

For the coming drilling season in winter, CAODC expects a very busy year with near full utilization. "With 601 available rigs, crew availability will depend on how fast the winter season picks up," Paul said. To entice seasonal workers to return, Canadian rig personnel have received pay increases by about 6%. According to recommended CAODC guidelines, a driller makes $22.30/hr (Can.) and "can expect another pay hike later this year."

Like the US industry, mergers and acquisitions have also quieted down. In the first quarter 2000, Precision Drilling Ltd. purchased Fleet XL.

Concerning the technology end of the business, coiled tubing continues to have a strong impact on the shallower gas well market (less than 1,500 m), Paul added. "They can drill a well in a day with penetration rates approaching 300 m/hr."

Offshore markets

According to Offshore Data Service (ODS), Houston, 546 rigs held contracts on Aug. 25, 2000, 2 fewer than the previous week but 83 more than a year ago. "The biggest impact this time around has come from operator budgets," said Tom Marsh, an analyst with ODS. "What we've already seen is companies of all sizes boosting their budgets. However, the majors have not moved in a similar increase (as compared to the independents), even though there are high oil prices and high revenues."

Over the next few years, Marsh expects natural gas issues and oil supply "drawdowns" to push operators to expand exploration and field development activity.

"The utilization in all of our markets is coming on strong except second and third-generation semis that operate in mid water depths," said Paul Bragg, CEO of Pride International Inc., Houston. "These rig prices are not reflecting increases as seen for other types of assets where higher utilization has occurred."

On the other hand, the shallow jack up and deepwater drillship-semisubmersible markets have undergone a strong increase in demand. Much of this rise has been tied to the Gulf of Mexico (GOM), accounting for two-thirds of the worldwide increase.

"The GOM is a low-cost gas province with lots of infrastructure," said Jon Marshall, executive vice-president and COO of Global Marine Inc., Houston. "The North Sea, however, has high operating costs and will probably be the last market to recover."

In fact, "past markets typically have not moved up together," Marsh noted. "Instead, the 1995-98 cycle was an anomalous situation."

Manpower issues

Bragg feels the offshore and onshore industry will be able to "handle the manpower issues," but everyone will have to continue to train new employees and occasionally hire from one another." Pride International, with a fleet of 260 land rigs and 60 offshore rigs, has a unique perspective of this issue as it operates drilling units across the entire spectrum, ranging from small onshore mechanical rigs to deepwater drillships.

"We've been able to crew up, but the level of experience isn't always what we prefer," he said. "The hardest place is the GOM due to the increase in jack up rigs working there. In most of the foreign (onshore) markets, however, the effects induced by labor shortages shouldn't be quite as pronounced since we didn't have the collapse or broad swings we've had elsewhere." Additionally, we have had to retrain employees to operate technically advanced deepwater rigs operating in international markets.

Marshall says that the offshore industry will require more technically competent personnel. "Today, we have PLCs [programmable logic circuits] embedded in nearly all of our equipment."

Offshore drillers, like their onshore counterparts, have also been giving out pay raises, which should continue for the near future. For example, based on a rotational schedule of 14 days on, 14 days off, Global Marine roughnecks make about $35,000/year while drillers make between $54,000 and $64,000/year, depending on experience and rig type.

"We have given pay raises this year to our US and UK-based employees," Marshall said, averaging 8% for most positions, "although some positions received 15%."

He feels that the labor market will remain tight because of the US economy."

Offshore dayrates

Marsh says that dayrates for the offshore market depend on the vessel type and water depth.

In July 1999, a typical 300-ft GOM jack up dayrate bottomed out at $12,000 to $17,000/day. As of Aug. 30, 2000, however, dayrates had increased to $38,000 to $50,000/day.

The dayrates for jack ups, however, are subject to short-term contracts, whereas deepwater vessels utilize long-term commitments. For example, a fourth-generation semisubmersible received anywhere from $65,000 to $130,000/day in July 1999. In late August of this year, however, the dayrates remain in the same range of $49,000 to $139,000/day.

Marsh says that it is difficult to make a comparison with drillships because they mostly work on long-term contract as well. "When it peaked in late 1998, before oil prices fell, contractors received $175,000 to $206,000/day. There have been no recent contracts for purposes of comparison."

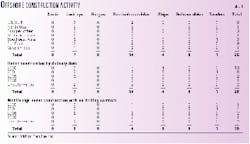

Offshore construction

This year, 14 semisubmersibles, 7 barges, and 4 drillships are being built, or have been proposed, with 13 of these vessels to be finished by the end of 2000 (Table 6). In 2001, the construction cycle, which began in the mid-1990s, should, for all practical purposes, be complete with the delivery of 8 more vessels.

Out of the 26 offshore rigs under construction, 9 units will go to work in Southeast Asia and 8 in the Gulf of Mexico. Marsh believes that because the jack up fleet is aging, there will have to be "some serious replacement construction between 2005-2010."

Drillships may be affected as well because they are designed for both drilling and production phases. Essentially, if they are used for the latter activity, they could be taken out of the drilling fleet for a long period of time.

Also certain to affect drillship demand is the question of whether deepwater discoveries off Africa, Brazil, and GOM will continue.

Offshore consolidation

This year, offshore consolidation continues, but only between two major players, Transocean Sedco Forex Inc. and R&B Falcon Corp. The total transaction value for the combined company is estimated at $8.8 billion and should be completed first quarter 2001.

According to Victor Grijalva, chairman of the board for Transocean Sedco Forex, the company will employ about 15,000 people worldwide. "R&B Falcon's 139 mobile offshore drilling units and marine barges [will] complement the 72-rig Transocean Sedco Forex offshore fleet. Between the two companies, they will have delivered 17 new offshore vessels by the end of 2001." F

null