OGJ Newsletter

Market Movement

OPEC hike unlikely to correct oil prices buoyed by hype

Despite few changes in market fundamentals since early August lows, oil prices have increased $7-8/bbl, and OPEC's recently proposed output hike has not eased market jitters, says Purvin & Gertz.

"Market psychology is a more prominent feature in today's market than we have seen in years," the analyst said. "Prices have oscillated over a $10/bbl range for short periods twice this year already, with little or no perceptible change in real fundamentals."

Purvin & Gertz contends there is adequate crude in the market.

"Most of the hype that is agitating the market is simply false. We believe that refiners are only running at levels consistent with their desire to supply the markets with products without building excess stocks. Thus, prices are not currently due to an actual shortage of available supply.

"It will take a more significant move by OPEC to turn market sentiment, at which point prices will probably come down sharply. Unless competition is transparently increased, we do not see much downward potential in this market environment," the analyst said, adding that WTI is likely to remain above $30/bbl into next year before correcting considerably by the end of winter (see chart).

PDVSA to offer heating oil storage

Venezuela's state oil company is offering some respite in the US heating oil supply crunch.

PDVSA is offering to let the US use its Freeport, Bahamas, terminal to store heating oil against possible supply shortfalls this winter. The firm said in April it plans to sell the facility (OGJ Online, Apr. 17, 2000).

PDVSA Pres. Hector Ciavaldini visited Washington, DC, and New York last week to discuss opportunities for cooperation between Venezuela and the US. He plans to meet with DOE to discuss the main technical aspects of this initiative, including investments needed to prepare the BORCO facilities. "We want to contribute in minimizing the possible negative impact that an eventual shortage of heating oil could have on the US community this coming winter," he said.

BORCO operates a terminal with a 20 million bbl storage capacity. PDVSA said 10.2 million bbl is in use, of which 4 million is crude storage, 4.7 million fuel oil, and 1.5 million distillates and gasoline.

Gas faces price crisis, not shortage

High US natural gas prices this winter could spawn a renewed call from federal regulators or Congress for price controls or even a windfall profits tax-measures that would only exacerbate a bad situation, some participants warned last week at the Governors Natural Gas Summit sponsored by the Interstate Oil & Gas Conservation Commission.

Yet the present market represents a crisis of prices-not supply, participants said. The market is working, and gas producers are responding to the higher prices by beefing up drilling programs, they said. For the week ended Sept. 15, there were 816 rigs drilling for gas in the US and Canada, up 246 over the same period a year ago. Gas prices are expected to increase this winter in most of the northern US states, delegates were told. Residential gas customers can expect price hikes of 20-40%, and industrial users will be hit with 100% or higher jumps in their bills.

Gas supply outlook troubling

Whether it's called a crisis or not, there is too little new North American gas supply coming on stream to meet rapidly growing demand, Dain Rauscher Wessels analysts said last week at their annual energy conference in Houston.

Despite a sharp increase in US gas drilling since last year, Lower 48 gas production remained flat through July, said Dain Rauscher's Ray Deacon.

While the total gas reserve replacement rate will be "well in excess of 100% this year," Deacon said, "we won't see a real increase in supplies, because most of the drilling is in areas where additional pipeline [capacity] is currently or soon will be needed."

He predicts Lower 48 production will grow by 0.5-1 bcfd in 2001, primarily as new coalbed methane and Gulf Coast production offset continued declines in the Gulf of Mexico. US imports of Canadian gas also should grow by 200-500 MMcfd next year.

But new drilling in the deepwater gulf and other frontier regions, along with renewed interest in Gulf Coast exploration, will not provide a significant supply boost over the next year, Deacon predicted. He said the US appears to be headed into winter with gas inventories of less than 2.585 tcf-"the lowest ever," down 140 bcf, or 5%, from the previous low in fall 1996.

Industry Scoreboard

null

null

Industry Trends

The anticipated rebound in the baker hughes international rig count (the world excluding the US and Canada) materialized last month as the total reached 705, up 6% from the 662 counted in July 2000, and a rise of 27% vs. the 556 counted a year ago.

Baker Hughes also reported that the international offshore rig count for August 2000 was 208, up 5% from July 2000 and 48% from August 1999. Worldwide, the rig count for August was 2,011, up 99 from July and 546 from August 1999.

Latin America experienced the biggest increase in working rigs vs. other regions-249, up 16 from July and up 65 from August 1999.

Drilling activity also climbed in the Asia-Pacific region, where the combined onshore and offshore count rose 13 to 152 vs. 139 rigs working in July and 121 in August 1999.

In the US, bullish gas and oil prices kept producers busy drilling on and offshore, pushing the US count for August to 987, up 45 from July and 348 from August 1999. The Canadian rig count for August was 319, up 11 from July and 49 from August 1999, crimped by bad weather inhibiting rig movement.

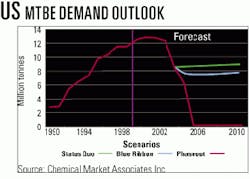

Will demand for mtbe in the US evaporate because of growing political oppositiion?

MTBE continues to come under political fire. Already, a number of states have opted to either restrict or eliminate use of MTBE, thus adding to the uncertainty over its use in US gasoline.

Purvin & Gertz and Chemical Market Associates Inc., in a joint study, have created three potential scenarios for MTBE demand (see chart). The first , dubbed Phaseout, entails a complete ban on MTBE across the US by 2005; the second, Status Quo, holds to the current situation, in which California bans MTBE by yearend 2002, but with no change in federal regulations and oxygenate use in the US; the third scenario, Blue Ribbon, calls for a ban in California with a 1 wt % MTBE cap in the rest of the US. The latter two scenarios have a relatively modest impact on global refining and petrochemical markets, but a total phaseout will drive up the cost of octane alternatives, particularly aromatics, in the US. That, in turn, could make it more difficult for US petrochemical producers to compete, and US refiners will be faced with new capital outlays for expanding other facilities and higher operating costs.

Government Developments

MMS has proposed new regulations to ensure continuation of royalty relief.

MMS announced a proposed rule to continue, but limit, deepwater Gulf of Mexico royalty relief.

The Deepwater Royalty Relief Act's mandatory requirement for royalty suspensions expires Nov. 28, but the law allows MMS to continue the suspensions, if warranted. The agency proposes to provide relief, as needed, for leases issued after November 2000.

In its presale notices, MMS would specify automatic royalty suspension volumes by water depths, along with applicable oil and gas price thresholds below which relief would apply. Once established, the royalty suspension volumes would be in place for about 3 years.

Royalty relief, if provided, will be issued to individual leases-not fields-and the volumes would not be affected by the status of the fields to which the leases may be assigned.

MMS said the new leases would be issued with an extended "rental fee" provision that applies during the period of royalty suspension. It will establish a process to let lessees apply for additional royalty relief on new leases when they think the automatic royalty suspension is insufficient for development.

MMS Director Walt Rosenbusch said, "These new regulations will provide the framework to ensure the continuation of royalty relief that may be needed as an incentive in the deepwater areas of the Gulf of Mexico.

Philippine refiners seek to postpone second phase of clean air rules.

Refiners in the Philippines have asked the government to defer the second phase of that country's Clean Air Act, slated to take effect in 2003.

The firms, many of which have suffered losses due to higher crude prices and a resulting squeeze on margins in domestic petroleum products markets, say they cannot afford to invest in new equipment to reduce the aromatics and benzene content in motor fuels, as mandated under the act.

The legislation calls for reduction of the aromatics content in unleaded gasoline to 35% from 45-50% and reduction of gasoline benzene to 2% from 4-5%, both by 2003. It also calls for reduction of diesel sulfur to 0.3 wt % by 2001 and to 0.05 wt % by 2004, from the current 0.5%.

The refiners say they have been saddled with huge losses due to the imbalance between petroleum prices in the domestic market and those in international markets.

New investments in upgrading the refineries are not possible with a weaker balance sheet, said the local refiners, which include units of Royal Dutch/Shell and Caltex, as well as state-owned Petron.

Shell is again embroiled in a human rights controversy in Nigeria.

A Second Circuit US Court of Appeals ruling will allow to be heard a lawsuit claiming Shell aided and abetted the 1995 torture and murder of Nigerian activists who opposed industry operations in their region, said a report by Mark Hamblett in the New York Law Journal.

The case, filed under the Alien Tort Claims Act, alleges violations of international human rights law, said Hamblett.

The appellate court reversed a lower court finding that the US Southern District of New York was an "inconvenient forum" to hear the suit, saying the court failed to give consideration to the choice of a US forum by US resident plaintiffs and to the interests of the US in providing a forum for the adjudication of claims alleging international human rights abuses. x

Quick Takes

Mitchell Energy & Development completed two pipeline system expansion projects in North Texas.

The company added looping to 13.5 miles of a main gathering line serving the Bridgeport processing plant, plus 3,000 hp of compression.

The additions raised gathering capacity along this line to more than 40 MMcfd. Gross gas production in this area jumped about 30 MMcfd a week after the project was completed.

NGL output also has increased, by about 1,000 b/d. When fully loaded, the Bridgeport plant expansion should add another 7,000 b/d of NGL output.

In other pipeline action, Texas Railroad Commissioner Tony Garza proposed legislative and administrative changes to an earlier proposal aimed at strengthening the state's pipeline disruption notification program. Garza also urged the US House to approve a Senate-passed bill that would maintain TRC's role in interstate pipeline inspections. Early this summer, he urged Congress to eliminate restrictions on state agencies in pipeline inspections in the Federal Pipeline Safety Act (S 2438). In a June 13 letter to Sen. John McCain (R-Ariz.)-chairman of the US Senate committee on commerce, science, and transportation-regarding S 2438, Garza asked the Senate to provide flexibility for state programs to participate in interstate inspection activities. In its original form, S 2438 would have removed the option for states to request status to conduct field inspections and would have limited state participation to accident investigations and new construction activities.

Crosstex Energy Services acquired Western Gas Resources' natural gas gathering and compression units in the Arkoma basin in Oklahoma. The 74-mile system gathers gas from more than 110 wells and provides compression services into a mainline owned by Reliant Energy affiliate Reliant Energy Gas Transmission.

A cloud has appeared over a proposed GTL-based methanol plant in Darwin, Australia, following the federal government's assurances that LNG would not be subject to national greenhouse gas abatement measures.

Methanex-the company behind plans for a $1.76 billion methanol plant using feedstock from the yet-to-be-developed Woodside Energy-Royal Dutch/Shell Sunrise-Troubadour-Sunset-Evans Shoals gas fields in the northeastern Timor Sea-wants to have specific promises before committing investment to Australia. It will now make a decision by the end of the year on whether to locate the plant in Australia or take it to an alternative location in Qatar.

The company wants the Australian government to clarify any future abatement measures it intends to introduce. It also wanted to know what expectations for greenhouse gas emissions reductions would apply to the proposed GTL-based methanol plant, which will emit about 2 million tonnes/year of CO2.

In other gas processing news, partners in an LNG plant in Trinidad and Tobago have again turned to Phillips Petroleum's LNG technology for use on two trains to be added to the plant, said Phillips. Atlantic LNG operates the facility, in which BG, BP, and Repsol-YPF are the three major shareholders. The original LNG train at the complex also uses Phillips LNG technology. Train 1 produces 3 million tonnes/year of LNG, while Trains 2 and 3 will produce 3.3 million tonnes/year each.

PemePlans to drill five deepwater wildcats during the next 7-10 years in the Gulf of Mexico in 600-1,400 m of water, a company official indicated at a Houston conference.

PemeAlso designated a Gulf of Mexico "B" project to explore an area designated as its southwestern marine region-a 228,000 sq km horseshoe enclosing the smaller northeastern marine region that wraps around the Yucatan Peninsula. Its outside boundary abuts the international border line. That region has an estimated undiscovered potential of 50.3 billion boe, "mostly in Tertiary locations," said Rafael Navarro III, a petroleum engineer for Pemex Exploration & Production.

Elsewhere in the exploration world, Talisman Energy UK made a new oil discovery not far from its Clyde field. The North Leven prospect, spudded from the Clyde platform via the 30/17b-A32 extended-reach well, flowed 12,080 b/d of 39° crude on test. The well is currently producing some 10,000 b/d through the Clyde facilities. North Leven is expected to bring an additional 4 million bbl of oil reserves on stream, with a potential for another 4 million bbl through "further development drilling," said Talisman. Fletcher Challenge Energy (FCE), a unit of Fletcher Challenge Group, said that it will farm out to Australia's Origin Energy a 20% share in the PEP 38718 license area containing the Tuihu prospect in New Zealand's onshore Taranaki basin. The agreement also gives Origin Energy the option to earn a 25% participating interest in the adjacent license, PEP 38730. Operator FCE will hold the remaining 70% interest in PEP 38718. It currently holds a 100% interest in PEP 38730.

Singapore will test Petroleos de Venezuela's trademark Orimulsion boiler fuel at a power station starting next month.

The test is part of the island city-state's search for alternative energy resources and fuels. About 40,000 tonnes of Orimulsion will be delivered for a 1-month trial, said Shum. Siew Keong, managing director of power of Seraya, a state power generating company.

Shum said the experiment would determine how much boiler modification would be necessary.

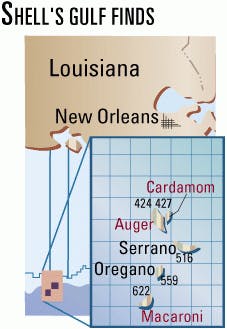

Shell is on the verge of developing two deepwater discoveries in the Gulf of Mexico.

Shell Exploration & Production plans to develop its deepwater Gulf of Mexico discoveries Oregano and Serrano via a subsea production system tied back to the Auger TLP.

Total development costs for the two projects are $250 million, excluding lease costs. In each field, Shell plans to initially complete two wells, set a flowline sled, and install a single 6-in. within 10-in. pipe-in-pipe insulated flowline, which will tie back to Shell's Auger TLP.

Oregano, which holds mostly oil reserves, is in 3,400 ft of water on Garden Banks Block 559. Serrano, which holds mostly gas, is in 3,400 ft of water on Garden Banks Block 516. The Auger TLP is in 2,860 ft of water on Garden Banks Block 426. Shell expects to recover 50 million boe from each field.

Production is slated to begin at Serrano in September 2001 and at Oregano in December 2001. Peak production rates from Serrano and Oregano are expected to reach 150 MMcfd of gas and 20,000 b/d of oil, respectively.

Elsewhere on the development front, China National Offshore Oil Corp. has nailed down a plan for developing a major natural gas find in the South China Sea. The company plans to start commercial production at the Dongfang 1-1 gas field Sept. 15, 2003, with initial flow of 1.6 billion cu m (bcm)/year, expandable to 2.4 bcm/year. The field is 113 km off Dongfang city in Hainan Province. Discovered in 1992, the 287.7 sq km field holds estimated natural gas reserves of 99.68 bcm. The field development plan calls for CNOOC to build one central offshore platform and three production platforms. CNOOC will use the gas for fertilizer production and power generation in Hainan Province.

Agip Energy & Natural Resources agreed to develop fields in a license area owned by the Nigerian Petroleum Development Co. (NPDC), a unit of Nigerian National Petroleum Corp., according to an NNPC official. Last December, NNPC invited national and international companies to submit tenders as NPDC's partner for the development of the two oil fields-Okpono and Okono-on Oil Prospecting License 91 off Nigeria. The two offshore oil finds are in 100 m of water. NNPC Group Managing Director Jackson Gaius-Obaseki said the two fields have combined estimated reserves of 2.5 billion bbl. NNPC spokesman Ndu Ughamadu said that, under the terms of the agreement, development and operation of the lease would be jointly managed by NPDC and Agip, "with NPDC taking full control after 5 years."

Kerr-McGee approved a development plan that involves a FPSO for Leadon field and satellites Birse and Glassel in the UK North Sea. The three fields will be developed with subsea horizontal wells tied back to the FPSO. Operator Kerr-McGee said further "major" contracts for the three-field development-to cost $600-700 million-would be awarded "over the coming months, involving Scotland, UK, and internationally based companies."

US DOE will help fund three projects to capture coal mine methane gas emissions.

The National Energy Technology Laboratory, DOE's chief field site for its fossil energy research program, cites Mine Safety and Health Administration data estimating that 400 US mines emit nearly 250 MMcfd of methane when coal is mined.

The private sector participant will contribute at least half the costs of the 3-year projects.

Appalachian-Pacific Coal Mine Methane Power will work with West Virginia University Research and Invitation Energy to convert coal mine methane from mines in Marion County, W.Va., and surrounding areas into LNG to fuel heavy trucks.

Northwest Fuel Development will build a combination gas processing-power generation system at a West Virginia coal mine to produce 500 MMcfd of gas and 1.2 Mw of electric power. Fuel Cell Energy will field-test a fuel cell power plant that would produce 250 kw of electricity by capturing and using coal mine methane emissions from a mine in Cadiz, Ohio.

In other news on environmental issues, the Synthetic Organic Chemical Manufacturers Association (SOCMA) last month urged US EPA to refine the proposed database that will be used to select chemicals for EPA's Endocrine Disruptor Screening Program (EDSP). EPA, through the 2-year old EDSP program, is testing the potential effect of various chemicals on the human endocrine system. It will use data from its findings to construct the database, which could generate toxicity information for more than 2,000 chemicals. Jim Cooper, manager of government relations at SOCMA, said EPA hopes to begin in 2001 picking chemicals to be entered into the database and plans to begin the screening and testing program in 2003. A prototype of the database is currently available.

Government opposition to unocal's gasoline patent grows.

California Atty. Gen. Bill Lockyer told the US Supreme Court that Unocal should not be allowed to "hijack and distort" the state regulatory process by claiming a patent on reformulated gasoline (RFG) formulas developed in cooperation with the government. In a friend-of-the-court brief supported by 33 other states, Lockyer followed the lead set by seven members of US Congress and urged the Supreme Court to overturn lower court rulings that require six major oil companies in California to pay patent royalties to Unocal for RFG (OGJ Online, Sept. 18, 2000).

He said Unocal patent's value stems from its similarity to California's cleaner-burning gasoline regulations, developed to improve air quality. Unocal's inventors have admitted that they modified the patent to resemble California's regulations.

CHINA'S PETROCHEMICAL BOOM CONTINUES APACE.

Uni-President Enterprises said it will enter into a JV with Hsianglu Chemical & Fiber to build a purified terephthalic acid plant at Xiamen, Fujian, China.

Uni-President, through its affiliate, President International Development, will supply $12 million of the project's initial paid-in capital of $40 million.

Details of the project have not yet been released.

Meanwhile, Grand Pacific Petrochemical plans to spend $12 million to expand production capacity at its Zhenjiang acrylonitrile butadiene styrene resin plant. The first production line began commercial operations in 1998 with a capacity of 40,000 tonnes/year. A second 40,000 tonne/year production line came on stream in February of this year. The new investment is intended to add another 40,000 tonnes of capacity in first quarter 2002.

Despite their often secondary consideration, process-control improvements can generate substantial benefits with little or no investment. - Despite their often secondary consideration, process-control improvements can generate substantial benefits with little or no investment.