E&P strategy prepares producers for 21st century

The exploration and production industry has bred a set of established rules for success over the past several decades. Although many of the same challenges remain, the rules for addressing them may be changing. In fact, today's challenges differ little from those faced by the industry 50 years ago. Then, as now, economics were challenged by increasing gas-oil ratios, increasing water production, declining production rates per well, and escalating infrastructure costs for entering new areas.

These challenges, inherent in an industry where the best resources tend to be developed first, will remain as long as there is an oil industry.

What is new, however, is a method for addressing these challenges. That method may be found in the choice of business model, which affects virtually every part of the company, including: organization structure, capital structure, resource allocation, measures of success, and compensation.

The business model also affects technology strategy in terms of which technologies are used, their source and economic justification, and their risk profile. There is now emerging an alternative model to the traditional model that has served the industry well. Either model can be executed successfully-but mixing models is almost certainly a losing strategy.

Two models-Prospector and Processor

The two models are built from the perspective of the market offering different sets of investment opportunities:

- Prospectors believe that the best way to address E&P challenges is to find new resources to lower the company's aggregate development and production costs.

- In contrast, Processors believe that these same challenges can best be met by improving the economics of "known" resources, either through increases in scale or outright operational enhancements.

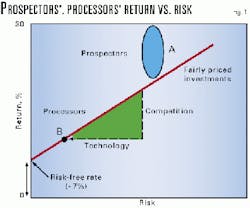

In economic terms, these two opportunity sets lie on different parts of the capital-asset pricing model (points A and B in Fig. 1).

Due to huge up-front costs in petroleum exploration and the lengthy time of development, Prospector investments must have substantial upside potential. The development of the North Sea, Alaskan North Slope, and deepwater Gulf of Mexico are representative of this type of investment. In each case, early movers (Royal Dutch/Shell and Exxon Corp., ARCO, and Shell Oil Co., respectively) proved the concept of these provinces and locked up sufficient assets to profit from their initial investments.

While there may be great risk in individual investments (for example, the Mukluk prospect in Alaska's Beaufort Sea in the 1980s), Prospectors pool enough of this type of investment to achieve superior returns on their portfolios overall.

This strategy has led to the unprecedented globalization of the oil industry, in which progressively lower-cost resources were found, developed, and depleted and a low-cost trading infrastructure to connect these sources with markets was created.

The economics were compelling for seeking these lower-cost resources instead of further developing existing assets; it was cheaper to find new oil than to recover incremental production from older fields. As a result, the framework of "Explore-Develop-Operate" is deeply ingrained in the business processes, organization structures, career paths, and cultures of most companies.

The alternative point (B on Fig. 1) reflects an altogether different type of E&P investment opportunity.

Where the existence of resources is not in doubt, but the extent and quality are, assets tend to trade at higher prices per barrel. Both expected return on these investments and associated risk tend to be lower. For example, companies bid very aggressively for Venezuelan concessions in the mid-1990s due to the track record and data available on those assets.

While the upside potential of these investments is relatively limited, committing large sums of capital for a predictable return can lead to a valuable portfolio as well.

The critical issue is to not overpay for access to these assets, because the margins are relatively thin. This business strategy requires consistency in approach and execution-hence, the name "Processors."

The earning potential of the Processor model can be enhanced as long as consistency is maintained. The Processor's lower returns can be increased by financial leverage, which is more feasible due to lower investment risk but also accentuates the need for consistency, as successful Processors must deliver on time and on budget.

Current environment suitability

The Processor model is appropriate when significant opportunities exist to seek low-cost reserves in unexplored areas. But there are few large-scale "unproven concepts" left. It would be difficult for a major oil company to construct a global exploration program with sufficient "new-concept" opportunities to fill a multi-year portfolio. While limited opportunities may exist in spot locations, a true Prospector model is unavailable to many companies.

Opportunities today are mostly in developing relatively well-known resources-more a game of delineation and development than identification. The competition in areas such as Venezuela, the Middle East, West Africa, and the former Soviet Union is in gaining access to resources without overpaying for the privilege of developing them.

"Exploration" is still required to fully delineate these resources, but little effort is required in terms of proving concepts. Therefore, the price of entry for these areas is relatively high, and returns are bid down to fairly low levels.

Unquestionably, investments in these areas will generate revenues. The issue is whether the revenues will justify the initial investments, i.e., "Can we stick to the business plan?" This is where a Processor approach to the business can be invaluable-applying rigorous, consistent processes to develop and operate these assets in order to meet a set plan.

Trends in the equity capital markets further support the Processor model. Equity investors expect rates of return in the double digits, so either model has to be oriented toward adding value at these kinds of rates.

Prospectors mainly add value by finding more resources, but with world oil production rates growing by only a few percentage points annually, sustained 10% reserve growth rates will soon be impossible to maintain.

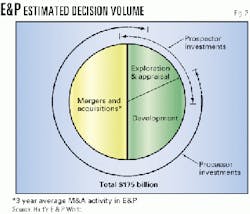

In contrast, the Processor model is more of a capabilities play than a resource play, so it should be less sensitive to market growth. And the vast majority of E&P investment occurs in development of existing resources or in asset sales, providing a larger market in which Processors can compete (Fig. 2). The double-digit return expectations coupled with low, single-digit growth in production and reserves virtually dictate that companies will aggressively bid for each other's assets in the foreseeable future-whether it be in equity takeovers or for access in countries with nationalized resource bases. Clearly, many more opportunities exist around point B in Fig. 1 than around point A.

Bidding for known assets

Cost position is king in this environment. There will be few private deals to gain access to resources at bargain prices. Instead, access will be gained by paying more than other contenders pay at auction. The way to grow while bidding in this market is for the assets to appear to be relatively inexpensive to you. This requires consistent development and operation of assets-at lower costs than those of the other bidders.

The petroleum refining industry, which also faces flat or declining profit margins and low growth (leading to heavy asset turnover), provides a similar illustration of this rule of asset auctions.

The standard benchmarking study of that industry, conducted by Solomon Associates, allows the operation of each refinery to be placed in an operating cost quartile with some precision (e.g., by indexing for plant configuration through "complexity barrels"). No equivalently rigorous study exists for E&P.

In theory, efficient operators would pay more for refineries, because they can earn more from the same asset than a less-efficient operator. The diagonal line on Fig. 3 shows this relationship quantitatively, indicating that first-quartile operators could afford to pay almost double for assets relative to fourth-quartile operators.

When the prices of actual transactions are plotted on the same chart, the conclusion is clear: actual trading prices for refineries reflect first quartile operating economics. It is difficult to buy refineries at fourth-quartile prices, because efficient operators know that they can improve asset performance, so they bid more. Low-cost players thrive while the rest of the industry cedes assets to the point of extinction.

As a result, cost position for Processors drives both near-term profitability and long-term growth potential. This is straightforward. However, cost position driving long-term growth potential gets to the heart of winning in today's E&P business environment, because companies reach growth goals only through acquiring assets. Low unit operating costs make acquisitions possible at a profit and therefore become central to corporate strategy.

Prospectors vs. Processors

Clearly then, the way to address oil industry challenges is changing. Consistency in bidding and operating are now of prime competitive importance. The next step, reasonably, is to say, "So what?" In fact, the shift in emphasis from Prospector to Processor has a number of implications, most of which are beyond the scope of this article (Table 1).

These differences demonstrate the incompatibility between the Prospector and Processor business models. Either column in the table provides a consistent model, but blurring the models by mixing and matching components will decrease competitiveness (e.g., a highly leveraged exploration program is unlikely to work due to volatility of results).

One model is designed to add value by proving geologic concepts, and the other does so by careful valuation and operation of known resources. The choice depends on the view of opportunities presented by the marketplace.

Some companies try to run both models in parallel in different divisions, but there are likely to be leakage and compromise, e.g.:

- Despite the best cost accounting efforts, cost-oriented divisions will still bear allocations that reflect Prospector costs.

- Each division can receive a different cost of capital, but these are likely to be drawn toward the corporate average.

- Compensation schemes would undervalue true Prospectors (as an analogy, many oil companies have had difficulty keeping their best traders).

This almost inevitable compromise would make each division less competitive against its respective "pure play" model. So, true Processors will tend to be better bidders and lower-cost operators than the "Processor Division" of a major company, and similar advantages will go to true Prospectors. Successfully segregating these models will be the exception rather than the rule.

There are also substantial cultural differences between the Prospector and Processor models. Prospectors are accustomed to blue-chip cost structures as they "roll the dice in the big leagues."

In contrast, Processors drive down the unit cost of developing and operating assets, applying their "system" to as many assets as possible. "Cost position" is not an attractive term to a Prospector. An industry condemned to squeezing out incremental efficiencies would seem to be less glamorous than an industry in which a single well could make or break a company.

Simply put, Prospecting sounds like more fun than Processing. In fact, the romance of the Processor model is its relentless execution. A Processor's existence can be exciting in terms of growth and profitability, even if it lacks some of the traditional glitter associated with the wildcatter.

Beyond these basic structural differences between Prospectors and Processors, there are significant differences in the approach to technology, in particular which technologies are used, the role of technology in uncertainty assessment, and the impact of technology on decision-making. This difference in technology strategy makes up the remainder of this article.

Technology strategy for Processors

The application of technology is central to Processor strategy. As established in a recent Landmark white paper1 and in a recent study by Cambridge Energy Research Associates,2 technology is the primary factor in driving down E&P development and operating costs. For Processors then, the basis of competition becomes the ability to apply technology to lower costs faster than a field of sophisticated competitors.

At the same time, technology spending is not a cure-all. Processor technology strategy is not simply increasing technology budgets, nor is it championing technology development or technology in the market, with Processors declaring themselves "technology companies."

Instead, technology strategy for Processors is much more about execution than concept. The following are aspects of true Processor technology strategy:

- Technology's application is prized above development of the technology.

- The asset base is limited to a few segments to minimize fixed costs.

- Within these segments, technology application is aggressive.

- Technology is used to measure and manage uncertainty, to ensure that investments do not stray to the right of point B on Fig.1.

- Technology investments are made to achieve targeted cost positions that matter in terms of business strategy.

Each of these aspects is described in the following sections, followed by some practical first steps to implement these ideas.

Application > development

Given the importance of technology to Processor success, the first issue is the origin of the technology. While the impact on operating economics is felt in technology's application, the technology itself could be developed either internally or brought in from outside. The answer to this question could vary by type of technology:

- Broad, horizontal technologies that can be applied to E&P (communications, supercomputing, office systems).

- Specific technologies with narrow application to E&P (completions, seismic interpretation).

- Systems of integrated technologies based on the above technologies.

The types of investments made by Processors tend to favor application of technology over development.

First, attempting to develop horizontal technologies does not seem appropriate-when has an E&P company developed a technology with broad applications outside the industry?

There are specific technologies that must be developed within the E&P industry because they will not be elsewhere, but the issues these technologies address tend to be shared by multiple companies. This is particularly true of Processors, which tend to work in established areas.

Finally, there are some systems that must be integrated to work within a particular asset, but they tend to be linked components that are fairly large pieces (e.g., a production-data gathering, analysis, and volume-accounting system).

So there is little need for outright technology development for a Processor to meet his business objectives. The application of technology to lower operating and development costs fully covers the strategic need.

There is an important distinction between Prospectors and Processors within this component of technology strategy, however. Like Processors, Prospectors would likely not develop horizontal technology. However, due to the perceived uniqueness of challenges based on the Prospector model (going into unexplored areas to prove concepts), there is the potential for greater emphasis on technology development for E&P-specific technologies. This makes sense for Prospectors when these proprietary technologies aid in proving geologic concepts but tends to result in unwanted overhead for Proces- sors.

Consistent asset base

A consistent asset base allows Proces- sors to improve economics by minimizing fixed costs. There are several distinct producing segments in E&P, each of which presents unique challenges (see Table 2 for a simple, summary example).

Gearing up to address these challenges efficiently requires some fixed investment in technology. For example, development of massive carbonate reservoirs in the Middle East requires a major investment in reservoir characterization, complex flow modeling, reservoir simulation, and completion technologies.

The full cost of this cannot be applied to other segments; these costs are largely segment-specific. The issue is one of leverage: how much resource can be developed from a segment-specific investment base? Minimizing fixed costs implies limiting the number of segments in which a company operates.

Similarly, there are segment-specific costs tied to participation in each stage of the oil field life cycle, leading to further incentive to specialize. For example, the challenges of mid-cycle operation differ from late-cycle operation, with relatively less technology needed in "stripper" operations. This implies that there are distinct cost structures for mid and late-cycle operations.

As noted, it is difficult to keep these cost bases fully segregated in a company-the stripper division still may get an overhead charge from the corporate division, for example. As a result, focus is on gearing up to be efficient in particular producing segments and life cycle phases and maximizing the asset base within these constraints.

Here again, there is a significant difference between the Prospector and Processor models. Prospectors are oriented toward volume growth and tend to overlook increased fixed-cost requirements for serving incremental segments as "small change" (when was the last time an exploration vice-president was fired for finding reserves in the wrong place?).

On the other hand, Processors want an asset portfolio of lookalikes, where knowledge, people, operating procedures, and technology can be shared and therefore minimized on a unit cost basis across the company.

Risk profile of new technology

New technology application always has the potential to create windows of opportunity (the question is: "for how long?"). This is because, as the primary driver of development and operating economics, technological innovation lowers unit costs.

The impact of these innovations eventually shows up in asset prices. For example, all bidders today would value a North Sea opportunity assuming extended-reach horizontal drilling and multilateral wells. However, there is a period where asset prices do not yet reflect new technology. It takes critical mass to move the auction price; if only one or two bidders are "in the know," then asset prices still reflect old technology. During this time, innovative, risk-taking companies can earn high returns.

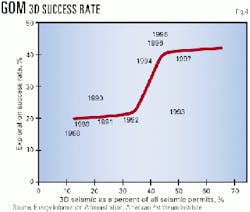

A good example occurred in the US Gulf of Mexico (GOM) with the adoption of 3D seismic. Fig. 4 plots the exploration success rate in the GOM against the penetration of 3D seismic for the past decade.

Use of 3D started to penetrate the market in the late 1980s and early 1990s, but it wasn't until the mid-1990s that overall exploration success rates started to reflect the new technology. The early adopters in this market had the opportunity to acquire assets at prices that looked relatively cheap to them.

Although this may seem counter-intuitive, one of the central points of the Processor model is that risk-taking is required. Rather than betting on the existence of resources as a Prospector would, the Processor is betting that technological improvements will impact the economics of assets under management. This requires a certain amount of daring and a keen eye for emerging technological impact. Going along with the herd may be less risky, but it is a sure path to mediocrity. There is nothing dull about being a Processor!

Technology used to manage risk

Ironically, explicitly measuring uncertainty and managing risk are more important for a Processor than for a Prospector.

The irony stems from the "less risky" investments pursued by Processors. Yet, the relatively narrow margins in Processor investments make it critical that risk is measured accurately to ensure that too much risk is not taken for the relatively lower returns that Processor investments allow.

Companies with investments straying to the right of point B on Fig. 1 will find themselves with low, volatile earnings-arguably a place where much of the industry is today.

The traditional industry model (Prospector) recognizes many kinds of risk in E&P investments:

- Political turmoil (delay and added cost).

- Expropriation (loss of assets).

- Change in concession terms (loss of value).

- Lack of market information (loss of value).

- Commodity price (loss of revenue).

- Asset-related, above-ground risk (added cost).

- Asset-related, below-ground risk (delay, loss of asset, or added cost).

The total system risk across all these elements has declined, especially in established areas.

Countries are competing for capital and recognize that inconsistency or threat of expropriation limits development.

Market information has improved tremendously, and it is fairly easy to get information about major investment commitments or divestments, infrastructure additions, etc.

Price risk remains, although with steadily improving hedging alternatives. Moreover, some concession contracts move much of the price risk to the host country rather than to the operator. The decline of these other factors makes asset-specific risks relatively much more important to total system risk.

The increasing importance of asset risk to total system risk makes risk far more explicitly measurable. Combining the many types of risk in the traditional model was mostly a matter of intuition.

In contrast, asset-specific uncertainties (e.g., structure, reservoir properties, capital costs, and operating costs) are far more measurable due to advances in technology.

As a result, total system risk for Processors is far more measurable than for Prospectors. And because of the competitive intensity in the market, it is critical to understand these risks to avoid overpaying or missing investment opportunities.

The use of technology for explicit risk assessment changes the nature of how technology feeds management decision-making.

Technical analysis traditionally was viewed as a way to improve point estimates (of recovery factor, pay thickness, etc.) and improvements such as 3D seismic have actually done just that.

However, technical analysis not only improves the quality of point estimates, it can also improve the certainty with which these point estimates are made. For example, volume interpretation of 3D seismic might help in improving a point estimate of average reservoir thickness of 90-100 ft. It also helps in determining the confidence in this new estimate. So, the situation before and after the survey is run and interpreted is as follows:

- Before-We estimate average reservoir thickness of 90 ft. Because we do not have an explicit measurement of the uncertainty in this estimate, we tend to ignore its uncertainty and implicitly assume that 90 ft is simply "right."

- After-We estimate average reservoir thickness of 100 ft. In addition, the technology tells us that we are 80% certain that thickness is 80-110 ft.

Returning to the "after" case yields better insight into how much risk is being taken. Technology has both changed the expected vertical position on Fig. 1 (based on the new 100-ft estimate) and the expected horizontal position (based on the explicit assessment of uncertainty).

Over many decisions on many assets, the company approaching decision-making using the "after" case approach is most likely to come out ahead.

Invest to a target-cost position

Processors must be constantly aware of their relative cost position by segment, as that is their source of business advantage. Relative cost position conveys both the potential for near-term profitability and the feasibility of growth.

With technology being the primary driver of cost position, Processors need to assess their ability to drive technology into their operations. A good example of this is in deepwater drilling. The learning curve has been so rapid for deepwater drilling and competition so fierce for assets that an advantageous cost position has the potential to be fleeting.

This can lead to companies acquiring assets with the intent of driving costs lower through the application of technology. Some Canadian operators, for example, have set target-cost positions for development and operation of bitumen resources, telling their asset teams to refine their project designs to meet these figures or quit the ventures.

In these instances, the ability to meet specified targets drives project design, scope of development, data requirements, and timing of investment. This is not breakthrough thinking but rather methodical problem-solving to achieve a business result.

Adopting Processor strategy

Becoming a Processor that uses technology strategy will be challenging for companies with a strong Prospector heritage. Concepts such as minimizing fixed costs are straightforward, but changing actual business practices in a traditional company will be difficult.

One problem is that most companies simply do not capture data such as fixed costs, segmentation of producing assets, or portfolio risk. Just finding this information would be difficult for many companies. Beyond the data availability is a cultural barrier: Prospectors are disdainful of concepts such as championing plodding technology application over breakthrough development or of selling off assets to rationalize producing segments. Changing business models is not easy, but that in itself should give a successful Processor an even greater advantage.

The following rules are intended to provide a few practical steps toward considering a Processor approach.

- Understand asset scatter.

Be clear about which segments your technology strategy supports. Break your asset base into segments with similar technology demands, in terms of type of technologies required and up-front capital intensity (geography is less important than operating characteristics).

Once the asset classification has been set, collect for each such relevant information as reserves, production, and net present value.

How are your assets distributed? Is there sufficient focus to confine technology investments to a few, large areas with good leverage?

Asset positions are not fixed; they are changing around the industry with every deal. Which changes would make your overall position much more consistent?

- Include technology in business plans.

The choice of assets and producing segments should not be made independent of technology. Nor should technology dictate which assets the company should own. Instead, aim for an iterative approach, where business assets and technology play off each other to arrive at a consistent, integrated plan.

For example, assess your current asset position and consider the impact of current and future technology on asset economics. Second, develop the desired asset position and your technology strategy. Then build the asset development plan.

Many companies would argue that they do this, but technology is most often an "order-taker" for operating units. Often, business units simply inform technology units of their asset plans and tell them to plan accordingly.

Again, asset positions are changeable, so explicitly reviewing their positions in light of technical capabilities is common sense. It is easier to justify the purchase price of assets where you have an established low-cost position with strong operating practices and technology to bring to bear.

- 3. Work process as much as nodes.

Much of the information technology developed for E&P is built around individual productivity (e.g., reservoir simulation or seismic interpretation), belying our Prospector heritage.

The specificity of these investments is somewhat comforting ("If we spend $80,000 on an interpreter's desktop technology, we can expect more maps").

For Processors, it is necessary to think in terms of business outcomes, which can include whole processes with multiple technology "nodes." For example, a well-location process might include reprocessing seismic, depth migration, geologic-model integration, volume calculation, and digital well-planning.

Each of these nodes may be subject to innovation, but the impact of each is felt only in the context of the process as a whole. If meaningful measures occur only at the full process level, use that as the benchmark, as the Canadian bitumen operators did.

This is comforting because the normal process measures are familiar: for example, development cost per barrel; lifting cost per barrel; drilling cost per foot. It is the aggregate impact of all technology applications on these processes that will determine whether a company is competitive.

- Set targets.

Meaningful targets can be set once segments and processes are defined (process costs are segment-specific).

- The first issue is determining current process costs on a fixed and variable basis, being sure to hold non-cash charges such as depreciation, depletion, and amortization separate.

- Next is to understand the trend in these costs: how are they changing over time for the industry and for your company?

- If there has been a substantial amount of asset turnover in the segment, it may be possible to infer the market level of process costs being used to generate bids. These may be seen as "point estimates" or "future estimates," depending on how others are betting the trends.

Alternatively, you may be able to use informal networks or other industry sources to infer the process costs of others in the market, keeping in mind that there has been relatively little rigorous benchmarking of E&P costs.

- Assess how technology is affecting process costs in this segment. This is as much about the future as the past. Which upcoming technologies could substantially impact process costs? On which of those are you comfortable taking a risk?

- Set targets for process costs. This includes a level, a time frame, and investment required for technology application. The target should reflect a level required either to defend or to acquire assets (Fig. 5).

- Use technology to manage risk.

Although many companies claim to do risk analysis, the industry's roughly 7% return on assets over the past decade contradicts the assertion. To determine how much "poorly estimated uncertainty" is costing your company, go back over prior investments and the risk estimates used. If estimates are either systematically high or low, or results are more or less "extreme" (positively or negatively), consider a more formal application of risk analysis.

The goal of the risk measurement system is not just to make better point estimates. There is tremendous, potentially company-saving value in implementing a process that results in unbiased estimates with an accurate level of uncertainty.

There is little here that is "technology for technology's sake." Instead, the focus is on harnessing technology to meet business objectives. While there may be high-impact technology nodes (an example would be digital analysis of shear waves to improve reservoir characterization), the value of the technology is derived from integrating it into systems that lower the cost of doing business.

Conclusion

Pilot Processor models have been implemented, formally or informally, but the model has yet to be adopted widely in the industry. Companies cut costs, but seldom use competitive cost position as a platform for growth because of the difficulty of abandoning Prospector thinking.

Beyond the already-noted challenges of tradition, data availability and culture, there are two counter-intuitive aspects of the Processor model that make it harder to accept:

- As technology becomes more important, we need to perform less of it ourselves.

- As investments become less risky, we need to do more risk management.

Companies having the vision and courage to become Processors must convince themselves and the markets that this capabilities-based approach creates greater value.

Changing the way technology is managed will be only one of the challenges faced by the move from Prospecting to Processing. Yet, as the primary lever in reducing unit costs, it is a good place to start.

And a targeted, aggressive technology program would make being a Processor more palatable internally and externally. Playing offense is more interesting and would be refreshing for most companies.

References

- "Getting Ahead of the Curve: How Technology is Driving the Economics of E&P," Landmark White Paper, 1999.

- "The Technology Revolution and Upstream Costs," Cambridge Energy Research Associates, 1998.

The author

Al Escher is vice-president of services for Landmark Graphics Corp. His responsibilities include Landmark's global integrated field services, global telephone support, consulting business, and key client relationships. Prior to joining Landmark, he was a vice-president in the energy practice of Booz-Allen & Hamilton Inc. Previously, Escher held a variety of engineering roles at Texaco Inc. He holds a BS from Princeton University, an MS from the University of Southern California, and an MBA from Northwestern University's Kellogg School.