US gulf sale bidders key off deepwater fields, discoveries

Gas PipelinesAlmost 60% of the tracts that drew bids in US Western Gulf of Mexico Lease Sale 177 in late August were on the shelf, but bidders showed high interest in deepwater areas, especially Garden Banks.

Kerr-McGee Oil & Gas Corp. paced the sale with 24 total bids, 22 of which were high bids, and Shell Offshore Inc. made 24 offers, 20 of them high. Canadian Occidental Petroleum Ltd.'s CXY Energy Offshore Inc. was high bidder with all 20 of its offers.

Fifty-two companies made 266 bids for 226 blocks, fewer than 6% of the tracts offered. Minerals Management Service called the sale "moderately strong," the fifth largest Western Gulf sale in the last 10 years.

MMS received bids on 1.3 million acres in four deepwater areas off Louisiana and 16 planning areas off Texas. The sum of high bids was $153.66 million, up 62% from the last western gulf lease sale a year ago. All bids require MMS approval.

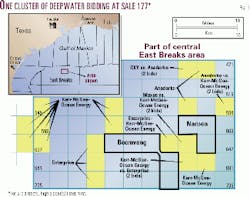

Garden Banks focus

The 40 tracts bid in Garden Banks exceeded the number of tracts bid in any other planning area.

The sale-high bid (Table 1) for Garden Banks 624 won Kerr-McGee and CXY acreage just north of the Gunnison oil discovery. Kerr-McGee, CXY, and a unit of Cal Dive International are partners in Gunnison, on blocks 667, 668, and 669. Kerr-McGee and CXY also bid high on Garden Banks 621-624, 666, and 711, north, west, and south of Gunnison.

Seven blocks drew bids in Garden Banks southwest of Shell's Auger field and west of Shell's Macaroni field on Garden Banks 602 and the Oregano and Serrano discoveries. High bidders in this area were the Murphy Exploration & Production Co.-Spinnaker Exploration Co. LLC combine for Block 465, Anadarko Petroleum Corp. and Devon Energy Production Co. LP for 511 and 513, Amerada Hess Corp.-Devon for 556, 600, and 601, and Amerada Hess alone for 600.

Murphy-Callon Petroleum Operating Co. bid high on Garden Banks 738, and Vastar Resources Inc.-Callon bid high on Garden Banks 653, both north of Vastar/Callon's Entrada discovery on Garden Banks 782.

Two days before the sale, Kerr-McGee announced acquisition of Statoil Exploration (U.S.) Inc.'s leasehold interests in 93 deepwater blocks. With the purchase, Kerr-McGee got interests in 33 new leases and boosted its existing working interests to 662/3% from 331/3% in 60 blocks. The acquired blocks are in 1,700 ft to more than 9,500 ft of water in the Alaminos Canyon, Atwater Valley, Ewing Bank, Garden Banks, Green Canyon, Keathley Canyon, and Walker Ridge areas.

East Breaks activity

Kerr-McGee noted that the blocks for which it bid are "in proven, high-potential trends near our recent discoveries of the Nansen, Boomvang and Gunnison fields."

All three fields are in the East Breaks area (Fig. 1). Water depths are 3,150 ft at Gunnison and 3,700 ft at Boomvang-Nansen.

Kerr-McGee said it will operate 16 of the 22 high-bid blocks and has a 50% average working interest. If they are awarded, the company would hold interests in 540 gulf blocks, more than 300 of which are in the deepwater trend.

Award of the 22 new blocks would increase the company's total gulf leaseholding by 126,720 gross acres to more than 2.8 million gross acres.

Ocean Energy Inc. and partners were apparent high bidders on 11 blocks, 10 of them in 3,200-4,000 ft of water in the East Breaks area near Boomvang and Nansen.

Other deepwater bidding

South of Garden Banks, another cluster of tracts in the Keathley Canyon area drew bids.

The blocks are 4-25 miles south of the only two wells drilled thus far in the Keathley Canyon planning area. Amerada Hess bid high on blocks 383, 384, 427, and 428. Phillips Petroleum Co. bid high on 424, 425, 426, and 470. And Conoco Inc. bid on Block 467.

TotalFinaElf's Elf Exploration Inc. unit, CXY, and Burlington Resources Offshore bid on eight adjacent tracts in the southern part of two planning areas. They are Alaminos 701, 744, 745, 788, and 789 and Keathley Canyon 661, 705, and 749. These blocks are some 60 miles southeast of Exxon Mobil's Hoover-Diana oil and gas fields, the first development in Alaminos Canyon to be placed on production.

Bidding off Texas

A gas discovery by Spinnaker on Block A7 drew heavy bidding to the north-central part of the High Island Area (OGJ Online, Apr. 30, 2000).

Shell bid alone for High Island 203, and Dominion Exploration & Production USA Inc.-Pioneer Natural Resources USA Inc. outbid Shell-Houston Exploration Co. for Block 199. Behind Spinnaker's high bid for High Island 197 were Westport Resources Corp., Forest Oil Corp.-Petroquest Energy One LLC, Unocal, and Dominion-Pioneer.

PanCanadian Gulf of Mexico Inc. made 16 total bids. It bid high for 8 tracts in Brazos South Addition 50-60 miles off Matagorda Bay. Shell bid high on 4 blocks there and Devon on 1.

In the Mustang Island Area 30 miles off Corpus Christi Bay, Anadarko bid high on 3 blocks, Samedan Oil Corp. and Pioneer 2 each, and Cockrell Oil & Gas LP 1.

Callon alone bid for Galveston 271 and 284, Matagorda 710, North Padre Island 913, and Mustang Island 872 and 873.

Houston Exploration bid high on 7 blocks: Matagorda A5, 714, and 715, Galveston 390, High Island A4 and A591, and Sabine Pass 40.

The tracts are in or near existing operations. For instance, the company hopes to start producing gas in November from the Matagorda 704 No. 4 and 5 wells from 10,200 ft and 13,000 ft, respectively, through a platform that was being installed in August 2000. It operates the block with 28% net working interest.

Overall statistics

Gulf of Mexico OCS Regional Director Chris Oynes of the MMS noted the dominance of independents. Four independents-Unocal, Kerr-McGee, Amerada Hess, and CXY-posted $63 million of the $153.6 million in high bids, he said.

The sale-high bid, Kerr-McGee and CXY's $10,540,800 sum for Garden Banks 624, was the only offer submitted for that block.

High Island 197 received the most bids, 5, with Spinnaker's $1,155,000 on top.

One tract received four bids: High Island 539. Six blocks received three bids each.

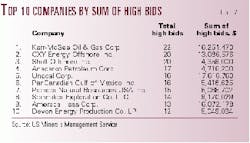

Top 10 participants

Kerr-McGee's apparent winning bids, submitted alone and with partners, totaled $16,251,470 for 22 blocks (Table 2). Kerr-McGee also submitted the largest number of high bids at the last western gulf sale, totaling $33,211,289 on 36 blocks.

Following Kerr-McGee this year was CXY, whose sum of high bids totaled $13,086,576 on 20 blocks. Shell was third with a total of $4,359,000 for 20 blocks.

CXY parent Occidental Petroleum Corp. had just closed the sale of its gulf interests to Apache.

Also among the top 10 high bidders were Anadarko, Unocal, PanCanadian, Pioneer, Spinnaker, Amerada Hess, and Devon.

Unocal had the highest total dollar amount of high bids, at $17,616,760, and it led in exposure at $18,792,640 on 22 bids.

Still in deep water

Blocks in more than 800 m of water drew the highest amount of total bids. The deepest block receiving a bid was Keathley Canyon 671 in 2,747 m of water. Texaco Exploration & Production Inc. bid $1,371,456 for that block.

In 0-400 m of water, where royalty is 162/3%, 129 blocks in 0-200 m of water received bids, and 6 blocks in 200-400 m of water received bids.

The sum of high bids for the 0-200 m category was $46,475,259. The sum of high bids for the 201-400 m category was $1,601,229.

In 400 m of water or more, where block royalties are 121/2%, 10 blocks in 400-800 m of water received bids, and 81 blocks in more than 800 m of water received bids.

The sum of high bids for the 401-800 m category was $9,337,674. The sum of high bids for the 800+ category was $96,245,869.

There were 17 bids on 14 8(g) tracts. The 8(g) zone is a 3-mile-wide band that borders Texas' jurisdictional waters where the state and federal governments share royalties.

Companies risked $5,333,818 on those tracts. The sum of high bids was $4,537,251.

Most tracts cover about 9 sq miles.

The 1999 Western Gulf of Mexico Lease Sale 174 drew 177 bids from 41 companies bidding jointly or alone on 153 tracts of a total of 3,747 blocks on offer. In that sale, the bidders exposed a total of $104,211,708, and the total of high bids was $94,649,044.