Pipeline capacity key to gas-price market stability in northeastern US and Canada

Natural gas markets in northeastern North America will undergo significant fluctuations during the coming decade, says the Canadian Energy Research Institute, and pipeline capacity will play a key role in determining gas prices within that region.

CERI's conclusions follow an in-depth market analysis that focused on the area's market potential for natural gas, the impact of gas supplies from the Sable Island gas fields development off Nova Scotia, and the corresponding pricing and basis relationships that will develop among the major (existing and potential) market centers within the area.

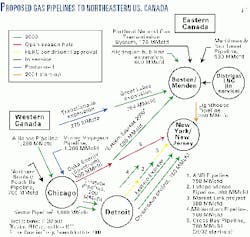

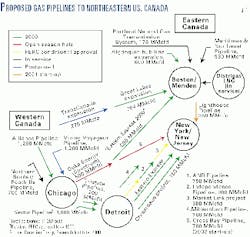

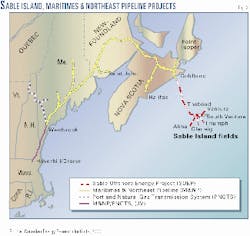

As natural gas demand grows, the Northeast region will have an unprecedented access to gas from an increased network of pipeline facilities to serve the Northeast (Fig. 1) and from a new supply source-the Sable Island Offshore Energy Project (Fig.2).

Factors affecting the differential between prices in one area and another ("basis") include the introduction of these gas supplies and the extraordinary growth in gas-fired electric power generation in Atlantic Canada and northern New England as well as in other potential residential, commercial, and industrial gas markets in the area, CERI says.

These elements, along with such traditionally unpredictable factors as weather, transportation constraints, supply disruptions, and power plant outages, all contribute to current uncertainty of future gas-price relationships in the area.

Atlantic Canada demand

One of the areas CERI studied, Atlantic Canada, consists of Nova Scotia and New Brunswick, and to a lesser degree, Newfoundland, Labrador, and Prince Edward Island. The whole of the Atlantic Canada area has a population of only 2.4 million, and its economic growth has generally trailed the rest of Canada.

This area traditionally has relied on hydroelectric power (61%), residual fuel oil (18 %), and coal (12%) to meet its energy needs. The economic growth prospects of this area were altered, however, in the 1990s with the discovery of the Hibernia oil and gas reserves off Newfoundland and with the Sable Island discovery off Nova Scotia (Fig. 2).

Gas demand is now expected to grow rapidly in Atlantic Canada, to 320 MMcfd (equal to 10% of the gas used in New England) by 2010 from less than 100 MMcfd in 2000. Distribution franchises have already been awarded to Gas New Brunswick and Sempra Gas Atlantic in Nova Scotia.

Roughly two-thirds of the gas consumption in the region will be used for power generation. By 2005, however, natural gas will begin to make inroads into the industrial sector-the second largest share of expected gas demand in Atlantic Canada and a market expected to grow rapidly.

As gas becomes increasingly available, it will displace 20% of existing fuel sources, taking market shares of 30% from coal, 50% from fuel oil, and 20% from diesel. Any new power-generating capacity to be installed during this period will also be gas-fired.

Gas for residential heat and water heating currently represents less than 3% of demand, which may present a challenge to distributors supplying areas that have no significant commercial, industrial, or electric power generation loads.

Construction of an extensive gas distribution system may not be financially feasible in Atlantic Canada if it would serve only small and widely dispersed residential, commercial, and industrial markets outside major metropolitan areas.

Northeastern US demand

For purposes of this study, the northeastern US area includes New England (Connecticut, Massachusetts, Rhode Island, Maine, New Hampshire, and Vermont), Middle Atlantic (New York, Pennsylvania, and New Jersey), and the East North Central (Ohio, Michigan, Illinois, Indiana, and Wisconsin).

Gas demand in the US is measured, for the most part, according to population in census regions. The three US census regions in the Northeast are the East North Central, the Mid-Atlantic, and the New England census regions. These, in turn, are divided into N-S or E-W (Fig. 3) for purposes of determining regional demand.

The growth of gas demand in the northeastern area will be strong during 2000-10 and will represent the fundamental driver for price differentials in the region. Demand in the Mid-Atlantic and New England regions, in particular, will increase substantially more than the US average. Gas-fired power generation will be the dominant driver of this demand.

Demand in the New England area, for example, will rise to more than 1.2 tcf in 2020, from 630 bcf in 1998, and then it will level off, according to CERI. Markets for residential, commercial, and industrial service in New England during this period will remain flat to 2020, when more than one half of total demand will be for power generation requirements.

In the Mid-Atlantic, gas demand will be almost four times the level of gas demand in New England. It is projected to increase to 4,123 bcf by 2020 from 2,407 bcf in 1998. Power generation, again, will cause most of the increase in this region after 2005.

Growth will be more moderate than in New England, but by 2020, gas demand for power generation will represent about 40% of total demand. Power generation projects totaling 5,480 Mw are projected for communities in the New England Power Pool area and 10,004 Mw for those in the New York Power Pool area.

Plans for electricity-generating facilities producing approximately 28,199 Mw also are in place for the PJM Interconnection LLC (Pennsylvania-New Jersey-Maryland Power Pool) area.

Gas demand in the East North Central states will exceed the combined demand of New England and the Middle Atlantic states. But growth will occur at a slower rate, and most of the demand will be for residential and industrial use.

Supply sources

"Other than the introduction of the new supply source from Sable Island, all other adjustments to the Northeast region's supply mix [will be] fairly gradual," CERI says.

Gas from new fields off Eastern Canada and from LNG delivered to the Everett, Mass., receiving terminal will satisfy some of the increased demand.

The growth in gas flows to meet the additional demand in the Northeast will strain available pipeline capacity, and numerous new gas pipeline projects have been proposed to meet requisite deliveries (Fig. 1).

New England will depend entirely on pipelines to supply its gas requirements, as it has no indigenous sources of natural gas. Pipeline companies are planning new delivery systems with a combined capacity of 11.287 bcfd to serve the area. Some of the lines will terminate near New York City, and others will extend farther north to New England.

Recent plans include the expansion of the existing Algonquin, Tennessee Gas Pipeline (TGP), and Iroquois systems delivering gas from western Canada and the southwestern US. The new Portland Natural Gas Transportation System (PNGTS) will bring in gas from western Canada, and the Maritimes & Northeast Pipeline (M&NP) will transport gas from the Sable Island area.

In addition, TransCanada PipeLines Ltd., Union Gas Ltd., and Trans-Quebec & Maritimes (TQM) are expanding their capacities to take supply from existing upstream pipelines to support these projects. Pipelines also will deliver additional gas volumes from the Distrigas LNG regasification plant at Everett, Mass., which will receive LNG from Trinidad and Tobago.

The LNG plants at Cove Point, Md., and Elba Island, Ga., scheduled to be back on stream in 2002, as well, will boost US imports an additional 52 bcf/year.

Projected total US imports of LNG will be 271 bcf/year in 2005 and 292 bcf/year in 2010, according to CERI estimates. That compares with US Energy Information Administration estimates of 270 bcf/year in 2005 and 290 bcf/year in 2010.

Despite the construction of new pipeline facilities, throughput on most pipeline routes to these areas will rise noticeably during 2000-10 to meet increasing demand. Running lines at near-capacity will raise average transportation costs by decreasing toll discounting to customers during the year.

Delivery hubs

Pricing points exist at key delivery hubs where gas arrives from various producing areas with different routes or transportation rates.

Pricing points in Atlantic Canada will include the Sable Island beach terminal at Goldboro, NS, and other existing hubs at St. Stephen, NB; Dawn, Ont.; and Parkway-Niagara, NY.

Gas supply hubs considered significant for gas purchase and sales transactions in the northeastern US are Dawn; Henry Hub near Erath, La.; AECO-C, adjacent the Nova Gas Transmission Ltd. mainline in southeast Alberta; and TETCO M3 and Transco Z6 in the New York-New Jersey area.

Sable Island development

Sable Island has an estimated 5.8 tcf of marketable gas reserves in 22 fields off Nova Scotia. The shallow-water fields can be developed with conventional technology similar to that used in the Gulf of Mexico.

These fields represent only a portion of the estimated 18 tcf of identified natural gas reserves on the Scotian shelf. Six fields are targeted for development by 2007.

In the first phase of development, operators already are producing from three of the six fields-Thebaud, Venture and North Triumph (Fig. 2). The Sable Offshore Energy Project (SOEP) began regular operations in late December 1999, and the fields were delivering 200 MMcfd by February 2000 via a 129-mile, 26-in. gas line to the SOEP processing plant ashore at Goldboro (OGJ, Aug. 7, 2000, p. 00).

The 354-mile, 30-in. M&NP delivers Sable Island gas to markets in Atlantic Canada and the US Northeast. The M&NP line has a peak capacity of 530 MMcfd that could be increased to deliveries of 800 MMcfd with additional compression.

Following additional field development during the year, pipeline throughput is to reach 450-530 MMcfd by fall 2000. The other three fields, South Venture, Glenelg, and Alma, will be developed during 2004-07.

Sable Island impact

CERI found that the impact of transmission costs on delivered gas prices would not be lessened initially by the introduction of Sable Island gas to Northeast markets. These gas supplies will be absorbed, for the most part, by demand growth.

Even though this gas supply is closer to Northeast markets, the cost of the new pipeline relative to its initial throughput will result in a higher transmission cost than gas arriving from either Western Canada or the Gulf Coast.

With higher transportation costs, Sable Island gas will be unable to undercut existing gas prices in the Northeast. Therefore, at least in early phases of production, "Sable Island gas [will be] more of a price-taker than a price-setter in the Boston market," CERI says.

Higher levels of production from Sable Island, however, would greatly benefit both Sable producers and Northeast consumers. Doubling production will "substantially improve pipeline economics, resulting in lower prices for Northeast consumers and higher prices for Sable producers," CERI says.

Gas from Sable Island initially will compete with other sources of energy, primarily fuel oil and coal. In addition, it must compete, unfavorably at first, with gas from the other producing regions of Canada and the US and from the increased imports of LNG.

Gas, price relationships

Changes in basis in the Northeast will be influenced more by transmission costs than by gas prices at the wellhead, CERI notes. The basis between Northeast city gates and the major producing areas is likely to increase significantly as demand increases during 1999-2010, CERI says.

During that period, the increase in basis in major Northeast markets will range from 10¢/Mcf, at New York-Henry Hub, to 32¢/Mcf at Boston-Henry Hub-a 26-76% increase (Fig. 4).

Rise in basis is primarily attributable to growth in gas demand. When increased gas demand raises pipeline utilization, it results in fewer periods when pipeline tolls are discounted to maintain flows.

But "gas demand in excess of expectations poses little additional basis risk," CERI says. "With expectations for gas demand growth in the Northeast already so high, further increases in gas demand present only minor additional basis risk."

Areas with slower demand growth and excessive pipeline capacity, such as the Chicago area, have very stable basis conditions. Areas having higher growth rates that necessitate an increase in pipeline capacity experience wider increases in basis.

As demand grows, pipeline capacity will become increasingly scarce, and the gas will command higher prices on the secondary market.

Basis will increase with the rise in transportation costs. This will occur in the Northeast in the short term until the pipeline systems reach capacity. The rate of cost increases for transportation in the Northeast will eventually slow as pipelines begin to operate at higher capacity and achieve greater efficiency gains with the higher loads.

At the same time, increased Canadian East Coast gas production will reduce the growth of basis and provide Sable Island producers with a higher price for their gas through improved transmission economics.

If enough new pipeline capacity can be installed to keep pace with or exceed demand growth, basis will drop or increase to a far lesser extent. As long as there is enough excess pipeline capacity, toll discounting on the secondary market will keep gas transmission costs in check, CERI says.