STAR partners cutting methane emissions via cost-effective management

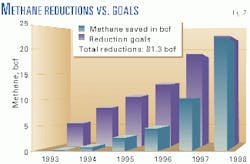

The US oil and gas industry has reduced emissions from unit operations and equipment leaks by 110 bcf during the past 7 years by implementing management practices endorsed by the US Environmental Protection Agency's Natural Gas STAR program during the past 7 years.

These gas savings, valued at over $220 million,1 have helped companies increase efficiency, enhance revenues, and maximize competitive advantage.

More than 70 companies in the natural gas production, processing, transmission, and distribution sectors of the industry have joined the STAR program.

Eleven major trade associations endorse the program.2 It is a voluntary partnership between EPA and the oil and gas industry to find cost-effective ways of reducing emissions of methane, a significant greenhouse gas.

In 1999 alone, the program's partners collectively reduced methane emissions by over 28 bcf, saving $56 million. Savings continue to increase each year, as more companies join the program and participating companies discover new opportunities to reduce gas losses.

This article describes the experiences of three Natural Gas STAR partner companies-Enron Gas Pipeline Group, Unocal Corp.'s Spirit Energy 76 unit, and BP Amoco-in reducing gas losses through management practices and technologies recommended or recognized by the STAR program. Enron's work centers on leak detection and repair, while both Spirit Energy and BP Amoco have found ways to reduce or eliminate emissions from pneumatic devices.

STAR program goals

The goal of the STAR program is to encourage the natural gas industry to reduce methane emissions through market-based, voluntary activities that are both profitable for industry partners and beneficial to the environment.

The program focuses on methane because of its high potential for cost-effective emissions reduction. Although methane is a more potent greenhouse gas than carbon dioxide, it breaks down much faster in the atmosphere; so relatively small reductions in methane emissions could have a significant impact on climate change.

EPA works with partners and industry associations to identify cost-effective methods for minimizing equipment leaks, reducing methane releases from unit operations, and improving equipment efficiency.

Partners agree to assess these methods-called best management practices (BMPs)-and implement only those that make economic sense for their specific operations. Partners also agree to report annually on their progress and results.

The STAR program recommends two BMPs for production companies, three for transmission companies, and two for distribution companies (Table 1). The program also encourages partners to identify and implement additional practices and technologies that can profitably reduce methane emissions from their systems.

Partners have identified over 50 of these additional practices-called partner-reported opportunities (PROs)-since the program began. PROs now account for well over half of all methane reductions reported by partners.

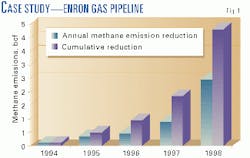

Enron Gas Pipeline

Since joining the STAR program in 1994, Enron Gas Pipeline Group has developed an emissions-reduction program that incorporates the three transmission BMPs and nearly 20 PROs.

This case study describes the company's efforts to test and implement a new device, the Hi-Flow Sampler, that allows maintenance personnel accurately to measure methane leaks during directed inspection and maintenance (DI&M) surveys of compressor stations.

Compressor stations can have as many as 2,500 components, many of which eventually develop leaks. Gas Research Institute (GRI, now Gas Technology Institute) and STAR research have shown that 95% of methane emissions from compressor stations come from just 20% of the components. Identifying and preventing or containing these leaks can result in significant savings and more gas available for delivery to market.

In 1994, Enron began conducting DI&M as a pilot project at a limited number of compressor stations, using a four-step methodology recommended by the STAR program:

- Screen and measure leaks.

- Evaluate results to identify the largest.

- Prioritize and repair them.

- Develop a focused survey plan for the continuous monitoring of the leak-prone components.

As Enron soon discovered, leak measurement is the most critical of these steps. Without accurate information on leak rates, maintenance personnel cannot make informed decisions about which leaks are profitable to repair. As a result, costly repairs may be made to treat relatively small leaks.

During 1994-96, Enron used organic vapor analyzers (OVAs) to identify and measure methane leaks at compressor stations along the company's 30,000 miles of pipeline. OVAs measure methane concentrations in parts per million in the area around a leak; they do not measure leak rates.

To convert ppm readings to volume estimates, Enron used EPA Method 21 correlation equations. However, the accuracy of the resulting leak-volume estimates had a variability of 3-4 orders of magnitude, and the estimates also tended to understate the size of the largest leaks.

As a result, the company found that a DI&M program based solely on OVA measurements was not cost-effective.

During 1994-96, Enron spent $55,957 conducting roughly 70 DI&M surveys at 48 stations and another $41,223 repairing leaks. Yet the company could only calculate gas savings worth about $9,500. The actual amount of gas saved-probably much greater-could not be accurately determined due to the nature of the OVA measurements.

Piloting Hi-Flow Sampler

A major turnaround for Enron's DI&M program came in 1996 when GRI asked the company to participate in a study to test the Hi-Flow Sampler.

The sampler differs from OVAs and other measurement tools in that it provides a direct volumetric measurement of methane flowing from a leak. It is also faster to use and much more accurate.

The study, funded by GRI and the Pipeline Research Committee, took place at a compressor station operated by Enron Transportation & Storage (ET&S), one of Enron Gas Pipeline's three operating units.

By providing accurate data on actual gas loss, the sampler allowed them to create a database of leak rates and repair costs. This helped them focus their repair efforts on the most costly leaks, thus making the leak-repair process profitable.

Based on the study results, Enron expanded and reorganized its DI&M program to make extensive use of the Hi-Flow Sampler. In 1997, the company used the sampler to survey 117 compressor stations, most of them serving ET&S pipelines. In 1998, another 57 stations were surveyed, most within the Gulf Coast operations unit.

During this 2-year period, Enron Gas Pipeline spent $233,000 on DI&M surveys and another $363,000 on leak repairs and other projects to reduce gas emissions identified through the surveys. The DI&M program reduced methane emissions by 356 MMcf in 1997 and 523 MMcf in 1998.

These gas savings were valued at more than $1.7 million, resulting in a 2-year net savings of over $1.1 million.

Continuous implementation plan

Enron now uses the Hi-Flow Sampler for DI&M surveys company-wide. By analyzing survey results, the company has been able to focus efforts on the largest methane emission sources.

These analyses have also revealed significant trends, enabling Enron to pinpoint the compressor stations with the highest emission rates-generally the larger and older stations, although good maintenance may well play a role in minimizing gas loss.

Enron also found that certain components, including unit valves, compressor blowdown valves, compressor relief valves, and compressor rod packings, tend to leak more frequently than others.

Using this type of detailed knowledge about trends, Enron is refining the frequency of its continuing DI&M surveys to maximize cost-effectiveness. Although EPA initially believed that companies should conduct multiple surveys in the first year to determine leak-development patterns, Enron's experience indicates that a lower frequency is more appropriate once leak patterns have been determined.

The company surveyed some stations quarterly at the start of its DI&M pilot project but found that significant leaks do not develop that quickly. Enron currently surveys its compressor stations on a 2-year rotation.

By analyzing data from these surveys, the company hopes to identify an optimum frequency for DI&M surveys. EPA will then consider using these findings in its recommendations to other STAR partners.

With more data and experience, Enron hopes to focus its surveys better. By concentrating on components and facilities most likely to leak and by excluding those with negligible emissions, the company can further reduce survey costs and increase the overall profitability of the DI&M program.

For example, Enron chose to exclude some turbine engines from DI&M surveys because a survey conducted at a representative turbine found negligible emissions. This decision has allowed Enron to exclude the entire pipeline system of its Northern Plains Natural Gas unit because each of its compressor stations is operated by a single turbine.

Enron is also installing turbines at new compressor stations and when retiring reciprocating engines, a practice endorsed by the STAR program. In the future, the company hopes to exclude other facilities and component classes from its surveys.

Since 1994, Enron Gas Pipeline has achieved cumulative methane-emission reductions of 1.1 bcf through its DI&M program. These gas savings, valued at $2.2 million, have increased the company's profit margin and allowed Enron to reduce some rates charged to its customers.

The program also has helped Enron reduce the amount of "unaccounted for" gas in its transmission systems. Based on the success of the DI&M surveys in the US, Enron is considering implementing a DI&M program at its pipelines in other countries as well.

Spirit Energy 76

Spirit Energy 76 is a Unocal business unit responsible for exploration and production in the Gulf of Mexico and onshore Texas, Louisiana, and Alabama.

Spirit Energy joined the STAR program in 1998, with an interest in improving efficiency and saving money from its production operations. As a large independent producer, the company takes a conservative approach to methane-emissions reduction, using pilot projects to determine the cost-effectiveness of specific practices before implementing them on a larger scale.

In July 1996, Spirit Energy began a pilot project to test the use of an instrument air system at its Fresh Water Bayou production facility in Vermilion Parish, La. The project involved converting the facility's natural gas-powered pneumatic instrument system to a compressed air-powered system.

To avoid categorization of the facility as a major source of VOCs by the state, Spirit Energy sought to reduce VOC emissions there by cutting the facility's overall gas losses.

To effect the reduction, the company opted for the second of two options: install a vapor recovery system on the facility's storage tanks or control emissions from its pneumatic instrument system.

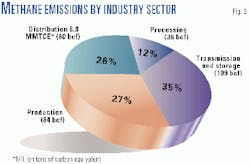

Most natural gas producers use natural gas in order to power pneumatic controllers because an inexpensive supply of high-pressure gas is readily available. However, the constant and intermittent bleed of gas from these controllers during normal operations is one of the single largest sources of methane emissions, estimated at about 35 bcf/year in the production sector alone.

Due to the high VOC content in some field gas, pneumatics can also be a significant source of VOC emissions.

Several STAR partners have reported that air-based instrument systems can be a cost-effective alternative to natural gas-powered systems and can eliminate methane and VOC emissions entirely. However, installation and operating costs vary for instrument air systems, and the systems are not cost-effective at all sites.

EPA and other STAR partners use a four-step analysis to evaluate the cost-effectiveness of conversion to instrument air at specific facilities:

- Establish the technical feasibility of an instrument air system.

- Estimate the costs involved.

- Estimate the savings.

- Evaluate the economics.

Spirit Energy conducted a similar analysis before deciding to use instrument air at Fresh Water Bayou.

Technical feasibility

Three main factors determine whether instrument air will be feasible and cost-effective at a particular facility:

- Facility layout. The layout of a natural gas facility can significantly affect equipment and installation costs for an instrument air system.

For example, conversion to instrument air may not be cost-effective at decentralized facilities where tank batteries are remote or widely scattered.

In general, instrument air is most appropriate when used at facilities where pneumatics are consolidated within a relatively small area.

- Available power supply. While major facilities often have an existing power supply or their own power generation system, many smaller and remote facilities do not.

For these facilities, the cost of power generation generally makes the use of instrument air unprofitable. In other cases, existing generators may not have enough available capacity to support an air compression system, and the cost of a generator upgrade can be prohibitive.

- Number of pneumatics. The more pneumatic controllers converted to instrument air, the greater the potential for reduced emissions and increased company savings.

The STAR program typically recommends conversion to instrument air only if a company is planning a facility-wide change.

Based on these factors, Spirit Energy found that the Fresh Water Bayou site was a good candidate for instrument air. First, it is a consolidated wetlands facility. Although its wells are spread over a wide area, all processing takes place at a central facility appropriate for instrument air.

In addition, there are onsite generators with available capacity to provide an adequate power supply at no additional cost.

Finally, Spirit Energy planned to convert all pneumatics at Fresh Water Bayou, thereby maximizing the resulting emission reductions and cost savings.

Fresh Water Bayou costs

With no electricity costs to consider at Fresh Water Bayou, the main costs of conversion to instrument air would be the purchase and installation of equipment.

Knowing that their air supply needs required a compressor package that could deliver a high volume of air at high pressure, facility personnel solicited bids for a package that employed two Quincy rotary screw-type air compressors.

After gathering additional price information for a dehydration system, piping, and labor costs, Spirit Energy projected an initial capital outlay of $60,000 for the pilot.

Fresh Water Bayou savings

To determine the gas savings achievable through conversion to instrument air, Fresh Water Bayou personnel used a turbine meter at the system inlet to measure the volume of natural gas used to feed the pneumatic instruments, which included bleeding controllers, chemical pumps, generators, and saltwater pump starters.

The turbine meter made it unnecessary to measure bleed rates from individual devices.

Metering showed an average consumption of 190 Mcfd, none of which was routed back to a sales or recovery line. Thus, Spirit Energy estimated that conversion to instrument air could reduce natural gas emissions from the site by 69,350 Mcf/year, worth $138,700.

Because the VOC content of the produced field gas is roughly 2.25%, the pilot project would also result in VOC emission reductions of about 1,560 Mcf/year.

Spirit Energy evaluation

Based on their estimates of capital costs and potential savings, Fresh Water Bayou personnel calculated that the pilot project would have a rapid payback.

Although the annual maintenance costs for the two air compressors were expected to average about $2,000 each, the extra revenue generated by the increased gas sales would far outweigh these costs.

The company also expected additional cost savings because instrument air systems protect delicate pneumatics from potential corrosion caused by trace amounts of corrosive gases in field gas.

In a cost-benefit analysis for the instrument air pilot project over a 5-year period, Spirit Energy found that its savings in the first year would more than double the initial investment. Return on investment over a 5-year period was expected to total 600%.

Results

Spirit Energy completed installation of the Fresh Water Bayou instrument air system in July 1996. This conversion achieved forecast reductions in natural gas use and in VOC emissions and cut methane emissions by 62,415 Mcf (assuming a 90% methane content in the field gas).

By reducing VOC emissions, Spirit Energy achieved its original goal of avoiding "major source" classification for Fresh Water Bayou.

At Spirit Energy's average actual 1996 gas price of $2.30/Mcf, payback of the initial $60,000 capital outlay was actually achieved in under 5 months, and cumulative gas savings from the project continued to grow through 1999.

Spirit Energy management now sees instrument air projects as "value-added" projects, and the company has begun to consider similar initiatives at other facilities.

As in the Fresh Water Bayou example, methane is not always the driving factor in conversion to instrument air. Spirit Energy has recently completed two instrument air installations in the offshore Mobile, Ala., area in order to help control hydrogen sulfide emissions.

However, the economics for these projects have been so attractive that management is now considering new projects based solely on the potential methane savings.

BP Amoco

In 1998 BP Amoco announced a commitment to cut its total greenhouse gas emissions to 10% below 1990 levels by 2010.

To achieve this goal, the company has launched an internal greenhouse gas emissions trading system focused on carbon dioxide and methane. Under this system, the company has placed a binding cap on company-wide emissions and grants individual business units a set number of emissions allowances, in CO2 equivalents, under the cap.

Any business unit that reduces emissions may sell unused allowances for a given year to another unit. In contrast, a business unit with fewer options for cost-effective emissions reductions may find that purchasing additional allowances is the most economic means of meeting its obligations.

The trading system has stimulated a flurry of greenhouse gas-related projects, as business units anticipate the value of emissions reductions. This next case study examines the efforts of one business unit-BP Amoco's Western Gas Business Unit (WGBU)-to reduce emissions under the internal trading system by identifying and replacing high-bleed pneumatic devices, a STAR program BMP.

Opportunities for reductions

In 1998, BP Amoco conducted a company-wide emissions inventory to establish a baseline for its initial emissions allowances. When WGBU management examined the inventory results, it discovered that one of the unit's largest sources of methane emissions was continuous-bleed, pneumatic level controllers used to regulate methane, water, and hydrocarbon condensate levels in separators.

The inventory identified 4,900 continuous-bleed controllers operating at over 4,000 wells in the Green River, Wyo., and San Juan, Colo., basins.

Altogether, these controllers were venting 1.5 bcf/year of field gas, an average of 840 scfd/controller.

Pneumatic devices powered by pressurized natural gas are used widely in the natural gas industry to assist in process control. Continuous-bleed level controllers are float-activated, pneumatic devices that utilize gas pressure to activate a liquid dump valve and maintain an appropriate liquid level within the separator.

The controllers constantly bleed gas, even in the closed cycle of the dump valve stroke, making them a significant source of methane emissions.

Through BP Amoco's participation in the STAR program, WGBU management knew that other STAR partners had achieved significant methane emission reductions and cost savings by replacing continuous-bleed controllers with nonbleed devices that vent gas only during the open stroke of the dump valve.

WGBU management decided to evaluate the feasibility and cost-effectiveness of such a conversion, using a three-step decision process recommended by EPA and other STAR partners:

- Locate and identify the continuous-bleed devices (something WGBU had already done).

- Establish the technical feasibility and cost of alternatives.

- Evaluate the project economics.

WGBU project feasibility

WGBU personnel investigated several alternative solutions before settling on conversion to nonbleed controllers. Possible alternatives included modifying the controllers, retrofitting them from continuous to nonbleed, or installing instrument air systems at some, or all, of the 4,000 well sites.

Instrument air was ruled out due to the remoteness of most of the well sites and the lack of an appropriate power supply to run electric air compressors.

Retrofitting was also ruled out as an option for widespread application. Although most manufacturers offer retrofit kits, WGBU personnel found them to be costly and difficult to use, and thus more appropriate for special circumstances than for mass conversions.

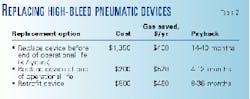

The third alternative involved modifying the existing controllers to reduce emissions. In a series of tests, WGBU personnel found that they could reduce a controller's emissions by up to 70% by inverting the controller head so that the unit vented gas only during the open cycle of the dump stroke. However, the emissions reduction of the modified controllers varied, and WGBU personnel felt that they could achieve more consistent and significant reductions by replacing the continuous-bleed devices outright (Table 2).

WGBU project cost

WGBU personnel identified nonbleed, displacement-type level controllers that would work for all 4,000 wells. Using vendor date, they calculated that the average emissions from these nonbleed, snap-acting controllers would be only 12 scfd of field gas-a reduction of over 98% on the average emissions from the continuous-bleed controllers. They estimated the cost of converting to nonbleed controllers at less than $400/controller, using a vendor for installation. WGBU also determined that no significant production would be lost during installation.

Although many of the wells would require shut-in during equipment conversion, the shut-in time per well would be only 1-1.5 hr, with no appreciable production foregone. Based on these predictions, WGBU anticipated a net capital outlay of $1.7 million.

WGBU economic evaluation

WGBU personnel calculated that conversion to nonbleed controllers would reduce methane emissions by an average of 0.8 Mcfd/controller (to 12 scfd/controller from 840 scfd). Thus, the total methane emissions reduction for the 4,900 controllers would be 1.43 bcf/year, worth $2.86 million.

A cost-benefit analysis of the proposed project showed that BP Amoco could expect payback of the initial $1.7 million capital outlay in less than 1 year.

Savings over 5 years were projected to total over $9 million, with a projected return on investment over that period of 530%. In addition, WGBU expected a slight decrease in maintenance costs after conversion to nonbleed controllers.

Based on these highly favorable projections, the company made plans to proceed with replacement of all 4,900 continuous bleed controllers.

WGBU results

WGBU completed replacement of 70% of the continuous-bleed controllers in 1999 and is replacing the remainder in 2000.

However, site-specific factors prevented WGBU from replacing all 4,900 controllers with the single, snap-acting model that had been selected. Some wells produced dirty fluids that tended to foul the controller orifice; other wells produced a crude too light to trigger the controller's liquid dump valve.

In these cases, WGBU personnel selected alternative nonbleed controllers. In other cases, where the displacement-type device was inappropriate for the separator in question, they were able to modify the controller to meet design challenges or use retrofit kits to reduce bleed rates on existing controllers.

Once the project is complete, WGBU personnel will have replaced 4,860 of the 4,900 continuous-bleed controllers with nonbleed devices, using the snap-acting, displacement-type controller at about 1,300 of 4,000 wells.

The final cost of the project is expected to total only $1.43 million-$280,000 less than had been projected.

Because of small delays in the installation timetable for some controllers, emissions reductions and associated cost savings for the first year were slightly lower than projected. Nevertheless, through this project alone, WGBU has reduced total CO2-equivalent emissions enough to sell unused emissions allowances for this year to other BP Amoco business units.

Overall, WGBU and the other BP Amoco gas production units are finding that they are well-positioned to take advantage of opportunities for cost-effective emission reductions under the internal emissions trading system.

With the success of the pneumatics conversion project, WGBU is examining additional initiatives for greenhouse gas reductions, including a planned CO2 sequestration pilot project at a Colorado amine and compression facility that has the potential to withdraw more than 130,000 tonnes/year of CO2 from BP Amoco's emissions inventory.

Results

Enron Gas Pipeline Group, Spirit Energy 76, and BP Amoco are each achieving significant emission reductions and cost savings by implementing management practices and technologies recommended by the STAR program. These companies view the STAR program as a valuable forum for learning about cost-effective greenhouse gas reduction practices from their industry peers.

By sharing technical information through the STAR program's workshops, technical documents, and other technology transfer mechanisms, EPA and industry partners have cut implementation costs and shortened payback periods for many of the program's BMPs and PROs.

As these three case studies show, each STAR partner has its own motivation for participating in the program. Yet the STAR program benefits all partners in the same key ways: It helps them save money and achieve their environmental goals; it promotes their achievements within and outside the industry; and it documents their emissions in a manner that may help them gain credit for their actions in the future.

References

- Unless otherwise noted, all gas value estimates in this article are based on a market price of $2/Mcf.

- American Gas Association, American Petroleum Institute, Domestic Petroleum Council, Gas Processors Association, Gas Research Institute (since merged with the Institute of Gas Technology as the Gas Technology Institute), International Center for Gas Technology Information, Interstate Natural Gas Association of America, National Association of Regulatory Utility Commissioners, Natural Gas Supply Association, New York State Energy Research and Development, and Southern Gas Association.

The authors-

James Frederick is a senior environmental specialist with Unocal's Spirit Energy 76 unit. He is responsible for Unocal's air quality programs in the Gulf Coast area and the Gulf of Mexico. He has been a Unocal employee for 25 years and holds a BS in industrial technology from the University of Louisiana-Lafayette.

Marc Phillips is manager of regulatory technical analysis for Enron Corp. He has been with the company for 9 years and has over 20 years' experience in the environmental field. He has a master's in environmental engineering and is a registered engineer in Texas.

Gordon Reid Smith is a senior environmental specialist with BP Amoco's Western Gas Business Unit operating in the intermountain states. He holds the lead health, safety, and environment role in the business unit's greenhouse gas and emissions-reduction programs. With 20 years of worldwide environmental experience in the upstream oil and gas industry, he has extensive air quality background and experience and holds BS degrees from Utah State University.

Carolyn Henderson is program manager for the US EPA's Natural Gas STAR program. From her base in Washington, DC, she works closely with oil and gas companies and trade associations. She holds a BA from Stanford University and an MCP (environmental management) from the University of California-Berkeley.

Ben Carlisle is a writer at Eastern Research Group Inc., an environmental consulting firm in Lexington, Mass. He has a master's in journalism from Boston University.