Coming to terms with risk in Caspian region yields more realistic production, investment outlook

This is the second of Wood Mackenzie's two-part review of the upstream Caspian Sea region. In the first part, the authors analyzed the reserves and production potential in Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan and ranks companies' positions in those countries (OGJ, July 24, 2000, p. 38). In this article, the authors analyze the level of investment required to develop the reserves and meet the ambitious production targets.

The Caspian Sea region is entering an exciting new phase as key exploration and development projects move into critical stages.

For years, the large resources of the Caspian remained undeveloped, as Soviet governments refused access to foreign investors.

Following the break-up of the Soviet Union, governments in Central Asia and the Caucasus have opened their doors to western companies in an attempt to attract foreign investment and transform the economies of the region.

In this analysis, Wood Mackenzie assesses the foreign oil company investment in the region over the past 10 years and looks at the potential level of investment required to meet the optimistic production potential profiles. Due to the complex geopolitics of the Caspian, distance to international markets, relatively high levels of risk and availability of financing, these optimistic production potential figures are unlikely to be achieved in the timeframe indicated in the unrisked cases.

In this second of a two-part series, Wood Mackenzie analyzes 32 key projects (29 E&D plus 3 pipeline projects) in the Caspian region to develop more realistic production and future investment profiles by applying risk factors to the main parameters for each project.

The analysis shows that with a potential total investment-including capital expenditures (capex), operational expenditures (opex), and transportation) of $180 billion over 30 years and associated potential production of 18 billion bbl, average costs for the region will be around $10/bbl.

Production potential

Wood Mackenzie analysis indicates that three Caspian littoral countries-Azer baijan, Kazakhstan, and Turkmenistan-have the potential to produce almost 4 million b/d of oil by 2015 (Fig. 1).

Almost 60% of this potential comes from Kazakhstan, where the success of several key projects (Tengiz, Kara chaganak, and Kashagan) remains critical to achieving the production profile. As the South Caspian basin starts to look increasingly gas-prone, Azerbaijan's future liquids production becomes ever dependent on a few key fields, namely the Azeri-Chirag-Gunesh* (ACG) complex and Shah Deniz.

Given the uncertain nature of developing fields in the Caspian region and the risks associated with transportation, exploration, political instability, and availability of financing, the profile shown in Fig. 1 is considered an optimistic scenario.

Wood Mackenzie has analyzed 32 key Caspian projects in Azerbaijan, Turkmenistan, and Kazakhstan in order to create a more realistic risked production profile, which takes into account project uncertainty.

The analysis excludes Lukoil's recent discovery (estimated to contain 2 billion bbl) in the Russian sector of the Caspian and exploration potential of Iran's Caspian Sea shelf.

While it is beyond the scope of this analysis to assess all projects that form the basis for the optimistic Caspian oil profile, future production from the chosen 29 projects represents a significant proportion of it (generally >75%).

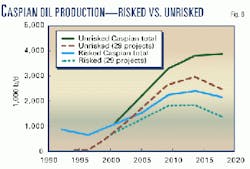

The liquids production profile shown in Fig. 2 highlights the significance of the 29 key projects in relation to the overall Caspian liquid potential.

Investment

Using Wood Mackenzie's portfolio of Caspian project cash flows generated with the Global Economic Model (GEM), it has been possible to assess the level of investment required to meet the unrisked production profile for the 32 key projects.

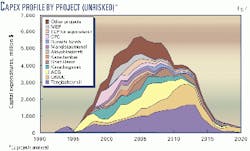

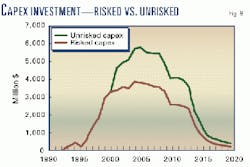

The capex profile shown in Fig. 3 is based on Wood Mackenzie's current understanding of the costs and timing associated with each project. Of the 32 projects analyzed, 3 are regional pipeline projects (Caspian Pipeline Consortium, Main Export Pipeline [MEP], and Trans-Caspian [or equivalent project]), and 29 are E&D projects (Azerbaijan 9, Kazakhstan 18, and Turkmenistan 2).

Total capex for the 32 projects amounts to $80 billion (this and other dollar amounts in this article are expressed in 2000 US dollars) during 1990-2020. Of this, more than 59% of the capex is expected to be invested in Kazakhstan, 27% in Azerbaijan, 12% in regional pipelines, and the remaining 2% in Turkmenistan.

The capex profile by project highlights the high level of investment expected in a few key projects in the region (Fig. 4). In particular, the Tengiz consortium is expected to invest almost $20 billion of capex in the Kazakhstan project duirng 1993-2020, about 25% of the total investment and roughly the same level of investment as all the Azeri projects combined.

The Offshore Kazakhstan International Operating Co.'s Kashagan discovery also represents a significant overall proportion (14%) of the total capex for the 32 projects.

Wood Mackenzie has based its OKIOC-Kashagan analysis on a 6.4 billion bbl oil field development, which could prove to be conservative given the huge potential of the structure. The 20 projects, which combine to form "other projects," represent only 13%, or $10.5 billion, of the regional capex investment.

Based on the Caspian projects analyzed, capex investment could peak in 2005 at around $5.8 billion and tail off to around $1.4 billion by 2015. However, as additional projects arise in the future, one could reasonably expect peak capex investment to be pushed out well beyond the current estimate of 2005.

History tells us that it is commonly the largest prospects and hence the key development projects that are identified during the early stages of basin exploration. This implies that as the Caspian province matures, a larger number of smaller projects will replace the "giant" field developments such as Tengiz, ACG, and Shah Deniz.

The capital investment associated with the larger number of smaller fields may go some way to extending the capex plateau but, over the longer term, is unlikely to match the huge investments associated with the early development of the giant fields.

In an unrestricted market, one could expect capex investment to be in decline by 2015. However, in practice, some key projects will slip, and the massive revenue generated from the key projects will allow the financing of large exploration programs in an attempt to maintain production levels.

As a result, the post-2010 decline is unlikely to be as sharp as indicated on the plot.

If the South Caspian proves predominantly a gas province, then the level of future investment in the region will, to a certain extent, be driven by market demand for gas rather than exploration success.

This in itself will influence the number of active projects at any one time and might restrict future spending.

While Caspian oil projects are not dependent on the market to the same degree as gas field developments, the landlocked nature of the region means that pipeline capacity and availability will, to a large extent, influence the timing of oil developments.

The ACG project is an example of an oil development that has been delayed due to insufficient export capacity. Smaller oil projects in the future may not be large enough to warrant their own export facilities and may therefore have to wait for the giant fields to come off plateau before export capacity becomes available and production can be phased in.

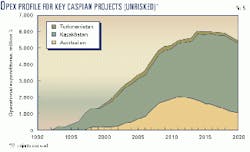

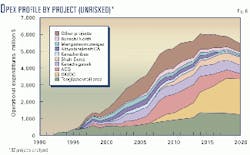

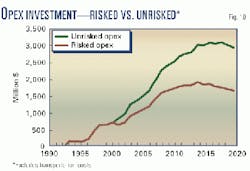

Operational expenditures for the 32 analyzed projects during 1990-2020 total $100 billion. Kazakhstan E&D projects account for 71% of the total opex, Azerbaijan 25%, and Turkmenistan the remaining 4% (Fig. 5).

Operating costs for the 3 pipeline projects are excluded from the opex profile, as these are incorporated into the individual field analysis through tariffing.

Transportation limitations continue to be the key factor, restricting project development and investment in the region. The lack of pipeline infrastructure and the large distances to world markets make regional transportation costs high and, as a result, they form a significant part of any project investment.

Wood Mackenzie has broken out transportation costs from opex for the 32 projects analyzed, to provide an estimate of the proportion of investment allocated to transportation. Of the projected $100 billion of opex during 1990-2020, 51% will be spent on transportation, through tariff payments.

As with capital investment, the same key projects dominate the opex profile: Tengiz, OKIOC-Kashagan, ACG, and Karachaganak (Fig. 6). The four projects in combination account for more than 62% of the potential Caspian opex.

Tengiz operating costs are expected to reach almost $22 billion (22% of the total opex) duirng 1993-2020. The opex profile closely reflects the unrisked production profile as expected, with maximum operating costs for the region of around $6 billion coinciding with peak oil around 2015.

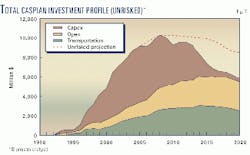

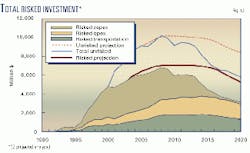

The combined unrisked capex, opex, and transportation costs for the Caspian region amount to $180 billion during 1990-2020. Peak investment occurs in 2008 at around $10 billion and tails off to around $6 billion in 2020.

While the capex investment is heavily weighted in the early years, exploration and identification of additional projects over time will result in further investment during 2010-20. This could help maintain the investment plateau at around $8.5-10 billion/year out beyond 2012 (Fig. 7).

Based on a potential production of 18 billion bbl over the 30-year period, capex averages $4.44/bbl, opex averages $2.72/bbl, and average transportation costs are $2.78/bbl. The total foreign company investment during 1990-2020, for this unrisked scenario, is $180 billion, giving an overall cost of around $9.94/bbl.

Risking

The production and investment profiles previously highlighted here are based on Wood Mackenzie's current understanding of the individual projects and the region as a whole.

While the unrisked profiles provide a useful guide to the levels of potential production and investment in the region, due to the complex geopolitics of the Caspian, distances to world markets, lack of infrastructure, relatively high levels of risk, and availability of financing, these unrisked profiles are unlikely to be achieved in the timeframe given.

Caspian projects have a history of delays. The ACG project, for example, is currently expected to reach a peak production of around 800,000 b/d in 2008-09, or 8 years from now.

In 1997, Azerbaijan International Oil Co. projected that peak production would occur in 2005, also 8 years away. The reality is that the ACG project will continue to slip all the time that the MEP remains on hold, unless an alternative transportation route is found. ACG is only one of many projects that will face similar delays in the future.

In an attempt to generate more realistic production and investment profiles, which take into account the possibility of delays or project failure, Wood Mackenzie has created an overall risk for each project that measures the likelihood of the project developing according to the existing plan. The overall project risk comprises individual risk values placed on each of the following parameters:

- Exploration risk. For exploration projects, the chance of economic success has been estimated.

- Transportation-markets risk. A risk factor is applied to each project, based on available transportation (pipeline, rail, or tanker) and the location of the project in relation to the market.

- Development risk. A risk placed on the likelihood of development delays either through technical, logistical (e.g., rig availability) or economic-financing difficulties.

The three risk factors were applied to give an overall risk for each project. Each annual production or cost (capex, opex, etc.) figure after 2000 has been risked for each project and combined to provide the new risked profiles.

While the risking process is, by its nature, subjective, the resulting risked production and investment profiles represent a more realistic projection of the Caspian region in the future.

Risked production

The risked production profile for the 29 projects suggests a peak production of just under 2 million b/d in 2010-15 compared with the unrisked peak of around 3 million b/d in 2015 (a reduction of about a third).

Total risked Caspian production over the 30-year period is 12.3 billion bbl compared with the unrisked total of 18 billion bbl. Wood Mackenzie has made the assumption that the 29 Caspian projects analyzed here are representative (in terms of risk) of the Caspian projects that have not been addressed individually in the analysis.

This same combined level of risk has been applied to the overall Caspian liquid production potential to provide a risked profile. The overall Caspian profile has a risked peak production of 2.4 million b/d in 2015 compared with almost 4 million b/d in the unrisked case.

While the risked profiles model the projected production ramp-up (2000-10) and expected plateau level, the graph does not necessarily show a realistic production decline.

The area between the risked and unrisked sections of the graph represents a volume of delayed production and a volume of lost production either through exploration risk or project failure.

In Fig. 8, the delayed production has been lost from the profile due to the methodology used in the analysis; however, in reality, the delayed production will help produce a flatter profile, with a longer plateau period and will ultimately help reduce the production decline rate in future years.

The addition of future projects, which are as yet unidentified, will also help maintain the production plateau out beyond 2020.

Historic analysis of hydrocarbon basins worldwide shows that, as technology and reservoir management improves over time, the production decline in a basin is nearly always less than initially projected. Wood Mackenzie expects the same to be true of the Caspian region.

With the Caspian production profile being so dependent on a few large developments, the risked profiles are extremely sensitive to the risk values placed on the key projects.

In particular, the ACG and Tengiz developments are crucial to the region's future liquids production. There is essentially no exploration risk associated with these two projects, and, given the large western companies involved, little financing risk.

The key risks to both projects are the availability of pipeline capacity, economic climate (i.e., oil price), and the political and technical risks associated with project development. In nearly all cases, these risks would only serve to delay production.

Risked investment

The level of investment required to meet the new risked production profile will clearly be less than that required for the unrisked production. The following capex, opex, and transportation cost profiles have been risked by project using the same method, to generate the more realistic investment profiles (Figs, 8-10).

During 1990-2020, risked capex is estimated to account for $56 billion of regional investment compared with an unrisked value of $80 billion. Risked opex and transportation costs are expected to amount to $32.6 billion and $33.8 billion, respectively, over the same period.

The combined risked opex and transportation costs total $66.4 billion, which compares with an unrisked figure of $100 billion. These risked figures combine to produce an overall Caspian investment during 1990-2020 of $122.4 billion compared with unrisked figures of $180 billion.

As in the unrisked case, the average cost (capex, opex, and transportation) averages out at $10/bbl.

The risked investment profiles provide a more realistic projected future investment in the Caspian region.

While the risked profiles for capex, opex and transportation costs reasonably model a less optimistic ramp-up and investment plateau, they do not fully reflect the likely investment decline in future years. As with the production profiles, one can expect future and delayed projects to add to the profile in later years, pushing the investment plateau out beyond the current estimate.

In essence, the process of risking the production and investment figures serves to flatten and extend the overall profile (Fig. 11).

Ultimately, the actual production and investment profiles will be shaped by many factors, including the economic climate, oil and gas prices, availability of financing, market requirements, exploration success, and export availability.

The outcome of several key projects (ACG, Tengiz, OKIOC-Kashagan, and Shah Deniz) will remain critical to the future Caspian production and investment profiles out to 2020.

The OKIOC-Kashagan exploration license in particular could have a dramatic effect on the risked profiles presented here.

Future production and investment in the Caspian is heavily weighted in favor of only a few key projects, with the upshot that any changes to the schedules of these projects will ultimately influence the profiles dramatically.

Financing

While the risking process significantly reduces the projected level of Caspian investment, the risked figure of $122.4 billion remains impressive for a region where the political risks are high.

So, will there be a willingness to finance these projects? With the "supermajors" all pursuing strategically important projects in the region in an attempt to provide corporate growth, raising the required finances is unlikely to prove problematic for these large companies, providing the economic climate and response by the Organization of Petroleum Exporting Countries to the incremental production remains favorable.

For many of the smaller investors, however, finding the required finance could prove more difficult. Lasmo Oil PLC recently withdrew from the Azerbaijan Inam license, citing the need for a "big player" in the project.

Other smaller investors in the region may struggle to raise the required finances in the future, particularly if economic and market conditions decline.

According to Edmund Glentworth, director of project finance, Deutsche Bank, if the political and legal risks in the region can be seen to reduce, lenders will be prepared once more to finance large up stream projects, although there will be a marked preference for those countries that respect their legal obligations, are more democratic, closer to international markets, and have experience of international operators.

Of the three countries assessed here, Azerbaijan is well-positioned to benefit from western financing in the near future.

World markets

The unrisked production profiles demonstrate that the Caspian region could be producing up to 4 million b/d by 2010-15.

A small fraction of this volume will be sold on domestic markets in the region, with the majority making its way to world markets.

So how will world markets react to this additional production? With the sudden addition of 1.5-3 million b/d on world markets, one might expect the destabilization of oil prices as a result of growing world oil stocks and an adverse reaction from OPEC if it were to lose a significant share of the market.

World economic growth rates will ultimately influence the level of oil demand between now and 2010. However, given that average world demand has annually increased by 0.8 million b/d over the past 7 years, it appears unlikely that an influx of 1.5-3 million b/d of Caspian crude alone will cause oil prices to fall dramatically.

Indeed, a number of other non-OPEC producing regions will be in decline by 2010-15, so the overall impact to world prices is unlikely to be severe.

With non-OPEC producing regions becoming less important to world production in 2010-15, OPEC is likely to control a greater share of the market and as a result should be able to accommodate the rise in Caspian production and manage oil price fluctuations.

Conclusions

The Caspian region has the potential to produce almost 4 million b/d by 2015; however, given the complex geopolitics, distances to world markets and availability of financing, this figure is optimistic.

Risking the production profile to account for exploration failure and project delays generates a more realistic production plateau of around 2.4 million b/d.

Delayed projects effectively flatten the production profile by reducing peak production, extending the plateau period and reducing the future decline.

The single most important factor, which will dictate the future oil production profile in the Caspian, is transportation (export capacity). However, the outcome of key projects such as ACG, Shah Deniz, Tengiz, and OKIOC-Kashagan will remain critical to the profile in the shorter term.

Total unrisked investment for the Caspian during 1990-2020 is estimated at $180 billion for the 32 E&D and pipeline projects analyzed. This consists of $80 billion for capex, $49 billion for opex, and $51 billion for transportation costs.

By applying risk factors based on the likelihood of each project progressing according to plan, total risked investment of $122.4 billion is estimated for the same 30-year period.

The risked profile consists of $56 billion for capex, $32.6 billion for opex, and $33.8 billion for transportation costs. The importance of key projects to the region is highlighted by the fact that more than 50% of the unrisked investment is tied up in only three Caspian projects: ACG, OKIOC-Kashagan, and Tengiz.

Financing the required $122-180 billion in such a politically risky region could prove problematic for the smaller investor, particularly if governments fail to stabilize the fiscal and legal regimes within their countries.

If the political risks can be seen to reduce, then lenders will be more willing to finance those upstream projects in countries that respect their legal obligations and that are closest to international markets. Of the three countries assessed here, Azerbaijan is well-positioned to benefit from western financing in the near future.

Risking the production and investment profiles is a useful process in as much as it provides a more realistic planning scenario. However, the Caspian region is so dependent on so few key projects that any delays or deviations from the project plans could have a huge effect on both the production and investment profiles.

The potential of the Caspian region is not in doubt. The rate of investment however, which is primarily determined by the perceived risk in the region, is, to a greater extent, in the hands of the host governments.

Ultimately the level of governmental cooperation, political stability, and incentives will determine future risk in the Caspian and as a result dictate the level of foreign investment.

The authors

Hilary McCutcheon has worked at Wood Mackenzie for 4 years since graduating with an MA degree in Russian interpreting and translating. She has been involved in coverage of various parts of the former Soviet Union (Central Asia, Caucasus, and Timan-Pechora) and now focuses on commercial analysis of Central Asia.

Richard Osbon has a BSc degree in geochemistry from the University of Manchester and an MSc degree in basin evolution and dynamics at the University of London. He worked for ARCO British Ltd. as an exploration geologist working the UK North Sea before joining Wood Mackenize in January 2000, where he now works as a research consultant on the Former Soviet Union team.