OGJ Newsletter

Market Movement

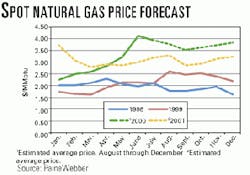

Natural gas prices-new floor at $3?

US natural gas prices are expected to sustain their current strong levels. In fact, industry can expect to see gas prices hover above a new floor throughout 2000 and into 2001, says PaineWebber (see chart).

The analyst noted, "With continued triple-digit temperatures in the South- west and the on- slaught of humid conditions in the Northeast, natural gas prices moved higher last week."

Beyond the spike in cooling load, other factors supporting the spot gas market are rallying crude prices, unplanned nuclear outages in the Northeast, the threat to Gulf of Mexico supplies from hurricane activity, and weaker hydroelectric generation, Paine Webber explained: "This will likely result in the next reported composite spot price coming in near $4.00/MMbtuellipsegiven the long-awaited arrival of more-normal conditions in the key markets, we are growing more comfortable with our August spot price prediction of $3.80/MMbtu and our overall 2000 composite spot price assumption of $3.35/MMbtu."

IEA revises forecast

IEA has revised its forecasts of oil supply and demand for 2000, calling its new demand projection "conservative" and its supply prediction "optimistic." IEA's latest report pegs 2000 oil demand at an average 75.8 million b/d vs. its first forecast for 2000 of 77.1 million b/d, made a year ago. IEA attributes the lowered estimate largely to declining consumption in the FSU and slowing economic growth in Western Europe. A downward revision of its 1999 demand estimate also contributed to the softer 2000 forecast.

On the supply side, IEA boosted its global crude output estimate for 2000 by 600,000 b/d, based mainly on growth in FSU production. There, higher oil prices have favored investment in fields previously considered marginal, said the agency, and "increased industry cash flows [have] contributed dramatically" to the industry rebound, especially in the areas of field maintenance, development drilling, and oil field equipment.

But, warned IEA, "It is unlikely this increase can be repeated or is sustainable over the medium term." Average 2000 oil supply, including stockdraws, is now estimated at 75.8 million b/d-about equal to demand, vs. earlier projections of 77.1 million b/d for demand and 77.0 million b/d for supply.

US refiners picking up slack

API reports that US refineries in July "picked up the slack in supplying the nation with petroleum products," while operating at 96% capacity-the highest utilization rate since August 1998.

In fact, US refineries set a record for July, API said, processing 15.898 million b/d of mostly crude, about 2.9% higher than a year ago. Production of gasoline, distillate fuel oil, kerojet, and resid all marked gains vs. a year ago.

Reflecting a still-tight market, inventories of crude and products reached their highest level since last October but were still 6% below July 1999-crude stocks alone were 14.6% lower.

However, in a sign that high gasoline prices are making a dent in consumption, July gasoline deliveries were 4.7% less than a year ago.

Crude production rose as well for the Lower 48, API said, reaching 4.891 million b/d, or 1.7% higher than production in July a year ago. Alaskan production, however, dropped to its lowest output in 20 years, API said, reaching 921,000 b/d.

null

null

null

Industry Trends

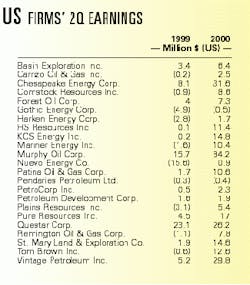

US independents' second quarter earnings released in late July and early August echoed big gains reported here earlier (OGJ, Aug. 14, 2000, p. 22). Many smaller E&P firms reporting big earnings increases cite increased production and the dramatic recovery of oil and gas prices for their gains (see table).

Aubrey McClendon, chairman and CEO of Oklahoma City-based Chesapeake Energy said, "Current natural gas prices, although down from their 15-year highs reached last month, are still nearly double what they were in the second quarter of 1999 and reflect the compelling supply and demand fundamentals that should have a profoundly positive impact on our business in the years ahead."

European firms fared equally well. Mark Moody-Stuart, chairman of Royal Dutch/ Shell, unveiled record second quarter profits of more than $3.2 billion, crediting soaring oil prices and $500 million in cost reductions.

On an estimated current-cost basis, excluding special items, Shell's ad- justed earnings for the quarter came close to doubling the figures reported for the same period last year, jumping from over $1.6 billion to $3.15 billion. E&P led the charge with earnings of over $2.1 billion, a 159% rise from second quarter 1999.

Moody-Stuart acknowledged "a lot of [this increase] is [due to] price," but stressed the contribution made by "serious" cost reductions "in every [Shell] business" over the last 12 months.

Lasmo announced record earnings of £126 million for first half 2000, with Chairman Anthony Hitchens crediting "adherence to disciplined capital management."

"Lasmo is keeping capital expenditure under strict control, and we remain cautious over the direction of commodity prices," Hitchens said.

Energy E-commerce consolidation gathers momentum.

After what would seem like an endless barrage of announcements by internet-based business-to-business start-up companies touting a quick fix for the oil and gas industry, a new trend has emerged among these B2B ventures-namely consolidation.

Application service provider WellBid Inc. and workflow management firm eNersection announced an agreement to merge, thus joining efforts in providing online software to the upstream energy sector.

The combined company, to be known as Wellogix Inc. and based in Houston, will provide "tools for expediting intercompany exchange of enterprise data, streamlining workflow and collaboration, and transacting complex, engineered services via the internet," the companies said.

Government Developments

Hoping to increase his country's solidarity with fellow OPEC member countries while rallying their interest in a heads-of-state summit in Caracas late next month, Venezuelan Pres. Hugo Chávez called on the heads of OPEC during a recent tour of their countries.

Of all the stops, Chávez's Aug. 10 visit to Iraq to meet with Pres. Saddam Hussein-the most controversial leg of his trip-has caused much US handwringing.

The US State Department's Richard Boucher was quoted by the Associated Press as saying that Chávez's Iraqi visit "bestows an aura of respectability upon Saddam Hussein, which he clearly does not deserve."

The Venezuelan president's trip to Iraq was the first by a foreign head of government since the UN imposed sanctions against Iraq after its invasion of Kuwait a decade ago. "We are doing all we can to maintain [oil] prices as they are today," Chávez told reporters.

An FPSO IN THE GULF OF MEXICO HAS NO GREATER OIL SPILL RISK than that posed by other deepwater development systems.

So concludes MMS in its draft environmental impact statement (DEIS) on the possible effects of using FPSO systems in deepwater gulf fields. The DEIS concludes that the potential site-specific effects of using FPSOs are essentially the same as with other deepwater development systems.

MMS says storing oil in FPSOs until it can be moved to shore via tankers or barges can allow the industry to operate in waters that exceed the capabilities of current production techniques and transportation systems. The DEIS found that the main oil spill risk associated with FPSO use is from shuttle tankers, not FPSOs themselves; that FPSO risks are comparable to those from other deepwater systems and from pipelines; and that excluding FPSOs would not reduce cumulative environmental impacts because other systems would be used instead.

MMS will be accepting comments on the DEIS until Oct. 10 to formulate a final EIS and thus decide whether to allow use of FPSOs in the gulf.

Hearings are slated Sept. 18 in Mobile, Ala.; Sept. 19 in New Orleans; Sept. 21 in Lake Charles, La.; and Sept. 20 in Houston.

The US EPA and the Army Corps of Engineers proposed a regulation that, if passed, would make it more difficult for oil and gas operators to conduct activity on US wetlands.

The proposed rule would change the definition of dredged materials to afford broader protection for wetlands. The agencies say the proposed rule would close a loophole in Clean Water Act regulations by clarifying the types of activities that can harm wetlands.

EPA said that, since the late 1700s, more than half of the nation's wetlands have been lost to development and other activities. Seven states have lost more than 80% of their original wetlands.

The proposed rule would broaden coverage of environmentally destructive earth-moving activities (such as mechanized land clearing, ditching, channelization, and in-stream mining) associated with draining wetlands.

Quick Takes

STATOIL'S AMBITIOUS Karstø GAS PLANT EXPANSION will soon be ready to receive gas from giant Asgard field in the Norwegian Sea. - Karstø treatment plant. Photo by Arvid Steen, courtesy of Statoil.

Aastein Austerheim, manager for commissioning and operation of the Åsgard facility at Karstø (see photo), north of Stavanger, said some 10% of system testing remains to be carried out, while start-up activities are 50% complete.

The 10.4 billion kroner project is designed to double gas reception and treatment capacity at the plant, which can handle roughly 64 million cu m/day.

The expansion project also incorporates a fractionation plant, a 600,000 tonne/year ethane separation and treatment plant, and two large rock caverns able to store more than 250,000 cu m of LPG at a temperature of -42° C.

Updates on plant explosions top refining news.

Police in Indonesia have determined that the crippling refinery explosion at Balikpapan earlier this month was not the result of sabotage, as suspected earlier (OGJ Online, Aug. 8, 2000). Rather, the incident has been ruled an accident.

Pertamina official F.F. Welan said the explosion occurred because of a leak that developed in piping in a hydroskimming unit.

The hydroskimmer, where the explosion occurred, was commissioned in 1984. Pertamina says it checks the unit's condition every 2 years.

The refinery reportedly has resumed operation, although at 65% of capacity.

Meanwhile, Hub Oil has been charged in connection with an explosion at its Calgary used-oil recycling plant a year ago that killed two workers (OGJ, Aug. 16, 1999, p. 36).

The company could face fines up to $150,000 (Can.) for the charges, which allege it failed to maintain equipment. Hub Oil refused comment on the charges because the matter is before the courts.

Calgary police and the Alberta Department of the Environment are still conducting an investigation into the explosion.

In other refining news, La Samir, a subsidiary of Sweden-based Saudi Coral Group, plans to invest $600 million over the next 4 years to expand the Al Muhammadiyah refinery in Morocco. The subsidiary will contribute half of the investment from its own capital and borrow the remainder from international markets. The expansion would add 2.5 million tonnes/year of processing capacity. La Samir reportedly is to issue tenders in September to build four new units at the plant.

API and NPRA, in written comments to US EPA, warn that a pending rule to reduce the sulfur content in US diesel fuel could cause shortages of the fuel. EPA has proposed to cut sulfur content in diesel fuel from the current 500 ppm to 15 ppm by 2006 (OGJ Online, May 17, 2000). A final rule is expected in December. API says the proposed rule does not adequately estimate the costs on industry, the potential for supply shortages, or the effects on consumers. The refiners' group urges EPA to reconsider both the level and timing of the diesel sulfur regulation, noting that refinery operations already are strained. It says the rule could result in a diesel supply shortfall of 10-20% in 2006 "because many refineries, importers, and fuel distributors may find it impossible to comply."

HS RESOURCES IS TO PAY A $700,000 PENALTY FOR ILLEGALLY DESTROYING 20 ACRES OF LOUISIANA WETLANDS, says the US Department of Justice.

Also, in the settlement filed in federal court, HS Resources agreed to spend $500,000 acquiring wetlands in the Calcasieu River watershed and will convey that acreage to the nonprofit Nature Conservancy for preservation.

Under the settlement, within 2 weeks, HS Resources must apply for an after-the-fact permit for its drilling activities.

If the corps issues a permit, HS Resources would have to mitigate the environmental effects of past drilling. If it denies the permit, the company would have to restore the drilling sites.

Phillips's Maureen platform may be refloated.

Norway's Aker Maritime has clinched a further £7 million contract connected to Phillips Petroleum's decommissioning plans for Maureen platform in the UK North Sea.

The new deal to tow the giant steel gravity base to the Aker Stord facility, clean its three storage tanks, and carry out a "thorough inspection" of the platform, builds on a 500 million kroner contract awarded last year to the Norwegian company to engineer the structure's refloating.

Should Phillips fail to find the "reuse opportunity" for the Maureen platform, Aker also has been provisionally contracted to dismantle the structure. The installation is scheduled to be refloated next summer.

In other production news, Amenam oil field in Nigeria's deep offshore frontier will double TotalFinaElf unit Elf Petroleum Nigeria's current crude production to about 300,000 b/d when it comes on stream in 2003, said Alain Roux, the firm's executive general manager, oil and gas. The merger of TotalFina and Elf brought the new firm operatorship of deepwater exploration blocks off Nigeria, Angola, Congo, Gabon, Equatorial Guinea, Brazil, and Indonesia, and in the US Gulf of Mexico and the West of Shetland area, noted Roux.

The controversial and much-hyped West African Gas Pipeline project will not be cost-effective, said Michael Choi, a Conoco senior engineer, at an SPE conference in Abuja earlier this month.

Choi proposed shipping the gas as LNG by tanker instead, saying it would be faster and less expensive.

Choi noted that the transnational gas pipeline network project is bedeviled by "unresolved issues relating to right-of-way, national agreements, and transit charges."

He maintains that the pipeline network also would be open to loss of control, which could introduce other risks associated with sabotage and political disputes.

In other pipeline action, Coastal Liquids Partners is expanding its Rio Grande Valley refined products distribution system by 30%. Work has already started on that expansion, which will provide additional gasoline and diesel supplies for the fast-growing market along the Texas-Mexico border. A truck-loading terminal at Edinburg, Tex., will be expanded, and horsepower will be added at three pump stations along a pipeline system that originates in Corpus Christi. That pipeline will continue to carry all grades of gasoline and diesel from Corpus Christi refineries to the Edinburg terminal. The expansion should be completed by yearend. F The Albanian-Macedonian-Bulgarian Oil Pipeline (AMBO) and the governments of Bulgaria, Macedonia, and Albania said that a US-sponsored feasibility study of the proposed Trans-Balkan Oil Pipeline project has been completed and delivered to the contracting parties. The report provides a "commercially compelling proposition" to the major oil companies that are developing oil fields in the Caspian Sea and that have chosen the Black Sea export route to the Mediterranean Sea, said Gligor Tashkovich, executive vice-president of AMBO. The $1 million study updated and enlarged the project's original feasibility study of 1996.

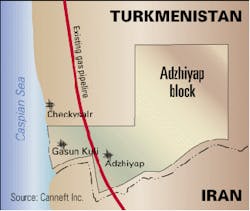

Exploration of Turkmenistan's Adzhiyap territory is on tap.

Calgary independent Canneft signed an agreement with Turkmengeology in Ashgabat, Turkmenistan, to evaluate the Adzhiyap oil and natural gas territory, a 2,000 sq km block along the Caspian Sea coast in southwest Turk- menistan on the border with Iran (see map).

Canneft and Turkmengeology will conduct a joint technical evaluation of the Ad-zhiyap territory over the next 6 months. At the same time, the companies will negotiate for an exploration license.

The technical evaluation will concentrate on the reprocessing of 2,500 km of existing 2D seismic, detailed geologic investigation, and infrastructure evaluation. The company postulates reserves potential on the block at 1-3 tcf of gas.

In further exploration news, South Korea's Daewoo signed a PSC with state-owned Myanma Oil & Gas Enterprise for Block A-1 off Myanmar. This 960,000-acre block is off northwestern Myanmar near the border with Bangladesh in the Bay of Bengal. Daewoo has a 100% working interest in this block and will reprocess existing seismic data during the first period of exploration. F South Africa's Sasol opened an online data room for divesting its interest in Marine Block X off Congo. "Marine X permit is an exploration block in the prolific Lower Congo basin, where a recent 3D seismic survey has better-defined some old marginal discoveries and revealed additional deeper potential," said Geoff Jackson, Sasol's manager for West Africa. "Presalt exploration plays can be combined with multiple postsalt prospective levels in an area close to existing infrastructure and with water depths of around 100 m." OilExchange, Denver, will host the data room. F TGS-NOPEC Geophysical began its acquisition of seismic in a new, nonexclusive 2D survey program off Sierra Leone. This 2,500-km program is a joint effort of TGS-NOPEC and the Ministry of Mineral Resources of Sierra Leone. The survey will cover the Sierra Leone portion of the Liberia basin in preparation for a bid round scheduled in 2001. The data set will be available by yearend. F Petro-Canada has completed drilling three exploratory wells in the Jeanne d'Arc basin off eastern Canada. Results from the Hebron M-04 and White Rose H-20 delineation wells are currently being evaluated. The Riverhead N-18 wildcat was plugged and abandoned after encountering minor hydrocarbon shows in the targeted structure. No further drilling is expected on the license. Petro-Canada also is currently participating in the Cape Race N-68 wildcat, about 12 miles west of White Rose. Husky Oil is operator. Petro-Canada and partners have also begun shooting 1,738 sq miles of 3D seismic in the deepwater Flemish Pass basin and 772 sq miles of 3D seismic on the Scotian shelf.

Topping development news, Talisman Energy reports that two wells it's drilled this year in the Monkman, BC, area are prolific producers.

The first well, Talisman Poco Highhat c-42-K/93-P5, flowed 18 MMcfd of gas. Drilled to 13,629 ft TD, the well encountered 656 ft of net pay in the Triassic and proved a new structure in the Highhat area. The well is now on stream, and production from the Highhat area totals 35 MMcfd, restricted by compressor capacity.

The latest well, Talisman Poco W. Bullmoose d-7-E/93-P-3, flowed 39 MMcfd of gas. The well was drilled to 13,661 ft TD and encountered 820 ft of net pay in the Triassic. The well is currently on stream. Talisman holds a 50% interest in each well.

Conoco Energy Nigeria started negotiations to participate in the development of NPDC's two oil fields in the Niger Delta, said Conoco Managing Director Paul Warwick. Conoco is producing 22,280 b/d from its Ukpokiti marginal oil field on OPL 74 in the Niger Delta. The field, located 24 km off the coast in 88 ft of water, has estimated reserves of 30 million bbl. Warwick said Conoco submitted a bid of $164 million on OPL 249 in March when the Nigerian government offered 22 oil blocks for open competitive bidding. The bids were opened last month, and block winners are to be announced in the fourth quarter (OGJ Online, July 10, 2000).

Statoil is sketching out plans to develop the midsized Svale discovery as a satellite to its nearby Norne field floating production vessel. Statoil currently favors a subsea installation for the Norwegian Sea development, with four production and two injection wells tied back 10 km to the floater and first flow in 2003. Continuing appraisal, however, might reschedule submission of a Svale development plan to Norwegian authorities to sometime "around the New Year," said Statoil. Svale is thought to contain 100 million bbl of reserves and would help extend plateau production from the Norne vessel to 2005. Norne has reserves of around 510 million bbl of oil and is being produced at a rate of 220,000 b/d of oil.